How to Read and Understand Financial Statements Easily

Executive Summary

The report is based on financial analysis of Melmotte, which intends to seek investment for increasing the business. From the analysis, it can be stated that Melmotte would be a good investment for Grosvenor, because the company demonstrated good financial performance. Its profitability in terms of gross and operating and net profit has increased. Furthermore, the company has strong financial healthy as most of the funding is done by investors than creditors. Besides, the company has strong operational performance also, making it a good source for earning revenue by the shareholders. For students who are seeking finance dissertation help, understanding real-world financial analyses like this is going to provide them with the most valuable insights into the processes related to the investment decision-making.

Question 1 Question a Question i The descriptions have no relation with statement of profit or loss or the statement of financial position.Question ii

With respect to long term debt, it would be specifically allocated to statement of financial position

With respect to long term debt, it would be specifically allocated to statement of financial position

Question b

Statement of financial position is commonly utilised in order to evaluate the position of an organisation with respect to financial strength and possible risk. A typical financial statement is possibly to comprise a description of value of an organisational assets and liabilities. One key user of statement of financial position is lenders, who seek information about financial position of the company by looking at the assets and liabilities. On the other hand, the objective of the statement of profit and loss is to summarise the income and expenditures incurred throughout a specified time period. This statement gives information regarding whether an organisation can earn profit through increasing the revenue or controlling the costs or both. The most common user of the statement of profit or loss is shareholders, who loos for the capability to earn profit (Dhagat, 2011). Then again, the purpose of the statement of cash flows is to give information regarding cash receipts, cash payments and net variations in cash, resulting from operating, investing and financing functions of an organisation throughout the period. The key user of statement of cash flow is owners who intend to understand the liquidity position of the company.

Question c

Question i

According to IAS2, inventories should be recognised at lower of cost or net realisable value. The cost not only comprises the purchase expenses, but also the conversion expenses, which are the expenses involved in bringing inventory to the current condition.

Question ii

This rule complies with the recognition criteria in the regulatory framework by prescribing treatment for inventories. It gives guidance for determining the expenses of inventories and recording the net realisable value.

Question iii

If the inventories are out of fashion and had to be written down, this will effect on the saleable value. The out of fashion inventory will have no value or low value, and therefore will have impact on both statement of profit and loss and statement of financial position. Therefore, the value needs to be adjusted in both statements (Bose, 2011).

Question 2 Question a Question i

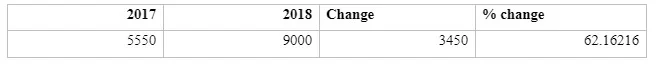

The percentage change in total revenue from 2017 to 2018 is as follows.

Question ii

The percentage of total revenue contributed by the three segments is as follows.

Question iii

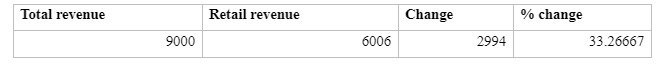

The percentage change between total revenue and revenue generated by retail operation is as follows.

Question iv

This additional information is useful for Grosvenor for taking investment decision because it helps to understand the capability of the company to earn revenue and also lucrativeness of different segments with respect to earning revenue.

Question b

Question i

From the gross profit analysis, it can be observed that the gross profit of Melmotte was £1665000 in the year 2017, which has increased to £2875000 in 2018. Thus, it can be stated that the company’s performance in terms of profitability has increased significantly.

Dig deeper into Performance Measurement Systems And Indicators In Public Sector Financial Management with our selection of articles.

Question ii

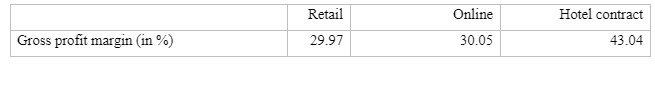

The following table demonstrates the gross profit margin ratio for every segment of the business of Melmotte.

Question iii

The gross profit margin of hotel contract is much higher than the other two segments because in contrast to the total revenue earned by this segment, the total direct expenses of hotel contract is much lower than the other two segments, hence the profitability margin has increased.

Question i

Cost of sales is regarded as the direct cost of manufacturing the products or goods by the organisation. It comprises the expenses of raw materials and labour, which is directly associated with producing the goods. On the other hand, overhead expenditures comprise on-going business expenditures, which are not directly attributed to producing a product, rather it is the expenditure incurred in order to support the business.

Question ii

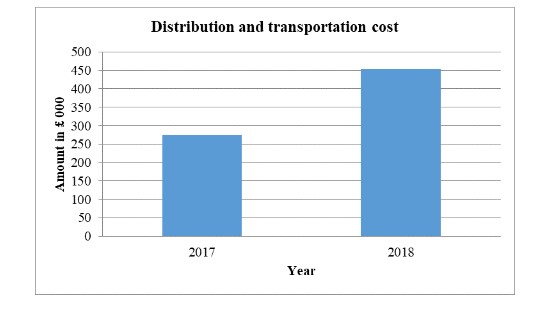

Following is the trend analysis of distribution and transportation expenses.

From the analysis, it can be observed that the distribution and transportation costs of Melmotte has increasing trend as it has increased from £275000 in 2017 to £453000 in 2018.

Question iii

Distribution cost has increased because the business of Melmotte has increased, resulting in more requirements for distributing and transporting the products. Furthermore, royalty cost has increased because the company require giving royalty for using the hotel brand’s name and this payment was realised in 2018.

Question d Question i

The operating profit of Melmotte has increased from £511000 in 2017 to £873000 in 2018, which indicates that the capability of the company to control the operational expenses has increased and the financial performance of the company is increasing.

Question ii

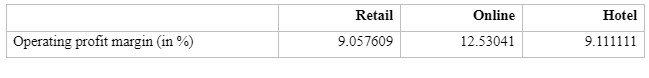

The following table demonstrates the operating profit margin for the three segments.

Question iii

The operating profit margin of online store segment is higher than the other two segments, because, running an online outlet requires low operational expenditures in comparison with running retail outlets and hotel contract.

Question 3 Question i

The property, plant and equipment and development costs are demonstrated separately for the benefits of users, so that they can understand in which way the costs are allocated and the current financial position of the business.

Question ii

The main reason for charging depreciation is to match the expenditure identification of an asset to the income earned by the asset. It helps to demonstrate the actual value of an asset throughout a definite time period. It demonstrates the financial advantage of the asset over the end of useful life. Charging depreciation can reduce the value of property, plant and equipment.

Question iii

Research cost is treated as expenses because its benefits in terms of increased revenue cannot be linked. Furthermore, its benefits with respect to revenue are uncertain. On the other hand, development cost can enhance the value of an asset directly. Therefore, it is recognised as asset (Mukherjee & Hanif, 2002).

Question b Question i

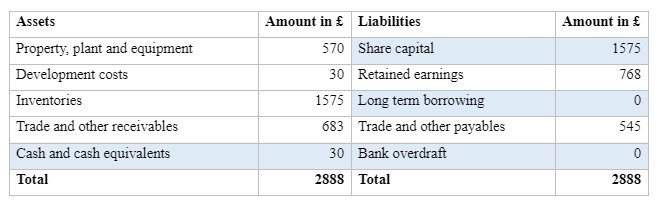

If the investment is used for paying the bank overdraft, the three figures that will be changed in statement of financial position are long term borrowing, bank overdraft and share capital. The new figures will be as follows.

Question ii

Gearing ratio help to understand how the company is funded, i.e. whether through shareholders’ fund or through creditors’ fund. If the company is funded by creditors then it signifies that it has high solvency risk, as it will require paying the debt amount in full. Then again, interest coverage ratio help to understand the capability of the company to cover the interest payment. If the company can cover the interest payment many times, it is believed to have low solvency risk. In this way, these ratios help to evaluate the organisation’s financial solvency

Question iii

Gearing ratio = (long term liabilities / capital employed) × 100 = (618 / 1575) × 100 = 39.24%.

Question iv

The company is considered less risky as a result of investment because it has strong profit margin and the company has high amount of equity than debt.

Question 4 Question a

The first reason for overall net outflow of cash is increase in inventory. The growth in inventory requires additional purchase of goods for sale, which increases cash outflow. The second reason is increase in trade and other receivables. As many sales are made in credit, cash is not realised irrespective of growth in revenue. Therefore, the amount of can inflow has reduced in comparison with the sales made. The third reason is dividend paid. The shareholders of the company were paid dividends on the earnings of the company, which has increased the level of cash outflow for the company.

Question b

The first outflow, i.e. increase in inventory was necessary otherwise, the company will not have sufficient inventory to sale the products, as from days sales in inventory it can be observed that the company requires 94 days to sell off the inventory in 2018 in comparison with 138 days in 2017. This low value means the company is quickly selling off the inventory and properly managing the inventory, therefore high amount of stock is required. Then again, the second outflow, i.e. trade and other receivables is also important to increase the sales. Furthermore, from the data, it can be observed that receivable days have reduced from 31 days in 2017 to 28 days in 2018, signifying that the company’s capability to collect the trade receivables has increased.

References

Bose, C., 2011. Fundamentals of Financial Management. Prentice Hall.

Dhagat, A. K., 2011. Financial Management. Wiley.

Mukherjee, A. & Hanif, M., 2002. Modern Accountancy. McGraw-Hill Education.

Looking for further insights on Understanding Financial Reports? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts