Performance Measurements

Introduction and Context

The performance measurement is an important task that is helpful for identifying the actual outcome and production of individual and overall organization. The organizations are using the different tools and methods for analyzing the performance such as financial and non-financial. According to analysis, the financial performance is providing the information related to the general well-being of the firm based on the economic health of the organization. For those who are seeking insight into this particular area, data analysis dissertation help can provide the most valuable guidance. The financial performance analysis involves the balance sheet, income statement and statement of cash flow (Jackson et al., 2020). Moreover, for the financial analysis of the organization quantifiable metrics is used. Apart from this, the Key Performance Indicators (KPIs) for the financial performance measurement are involving the gross profit, net income, working capital, operating cash flow and current ratio. The non-financial performance measurement metrics involve the consideration of the company’s reputation, customer influence and value, competitiveness and innovation. In addition to this, the non-financial KPIs are involving the brand preference, customer retention, customer experience, market share and innovative approach that used by the organization to maintain the standards services and product quality. The proper knowledge and implementation of these indicators is helpful for analyzing the performance of the organization (Taouab & Issor, 2019). The current study will aim to analyze the performance of St Thomas NHS foundation based on the financial and non-financial metrics.

Literature Review

Performance measurement is process of collecting, analyzing and reporting the information regarding the performance of the individual, group, organization or a system. The consideration of this process is helpful for the management to identify the areas of strengths and weakness and development of the strategies that could help in managing the issues and maintaining the standards in performance of the company (Al-Ahdal et al., 2020). According to Awaysheh et al., (2020), the performance measurement is having significant impact on the planning and decision making process of the organization and identification of the issues that creating the barriers in achievement of the goals and objectives. The framework for analyzing the performance is including the balanced scorecard and Key Performance Indicators. In the current scenario, the use of financial and non-financial measures for analyzing the performance is helpful for the organizations. According to Ukko et al., (2019), the use of the financial performance metrics for identifying the performance is based on the subjective matter that provide the information about the utilization of the assets for generating the revenue. It used for analyzing the general financial health of the organization and provide the comparative analysis of company within the industry. There are various aspects used for analyzing the financial performance of organization that include the balance sheet that provide the information about the management of assets and liabilities. Income statement that offers information about the summary of entire year operation based on the sales and revenue. In addition to this, the evaluation of cash flow statement helps to understand the flow of the cash in operation, investment and financing. Apart from this, the financial performance analysis is useful for examine the specific areas of the organization like working capital, financial structure and activity (Grewal, Riedl & Serafeim, 2019). The proper investigation of these can be useful for financial performance measurements of the organization. According to Ali et al, (2020) the non-financial performance is used for identifying the effectiveness of the organization in maintaining the customer satisfaction, market share, innovation and brand reputation of the company. The analysis of the performance based on the impact of the organization on the stakeholders and society can provide the deep insight into the working of the business and planning of the actions to improve the internal performance. As per the views of Xie, Huo & Zou, (2019), the non-financial performance analysis involve the indicators like brand preference that provide the information related to the position of the company in the market considering the quality of the services and products. Moreover, the customer satisfaction and retention is also considered for analyzing the performance of the organization and brand value of the company. Apart from this, the analysis of Battiston, Dafermos & Monasterolo, (2021) has suggested that market share and innovative approach of the organization is also having the significant role in non-financial analysis of the organization. The innovative approach of organization is playing a critical role in maintaining the success and achievement of the goals and objective. The proper evaluation of advancement in utilization of technology and planning of the operations using the market trends is helping to improve the performance and maintaining the standards process for attracting and retaining the customers. Therefore, analysis of the performance of organization using the financial and non-financial performance metrics is helpful for evaluating the success and key areas that might have a significant impact on the progress of the company and planning of the actions to meet the business objectives. In addition to this, the yearly analysis of performance using the both performance measurements is helpful for the organization to understand the competitiveness and make the effective utilization of the resources.

Continue your journey with our comprehensive guide to Red Zone's Mobile Market Performance.

Methodology

The study is aiming to measure the performance of St Thomas NHS foundation based on the financial and non-financial metrics and indicators. Therefore, the approach of study will be mixed that involve both qualitative and quantitative data of company for understanding the effectiveness of the company. The study will collect the financial data of NHS foundation for 2020-21 and 2021-22. Moreover, the non-financial analysis data will be collect and analyze using the literature and information available on the different database. Apart from this, the analysis of the financial data will be done using the ratio analysis. In addition to this, the comparison of both data will help to understand the effectiveness of the both financial and non-financial performance measurements and identifying the impact on the NHS foundation. The strengths of study involve the proper examination of financial data of company using the annual reports. However, the limitations of study involve the lack of time for collecting the information related to non-financial performance of NHS foundation and limited access of the data related to the working capital and investment

Analysis

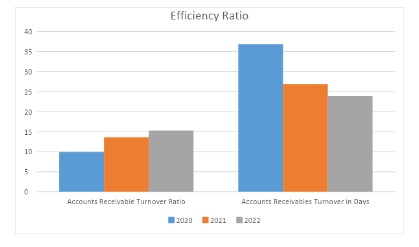

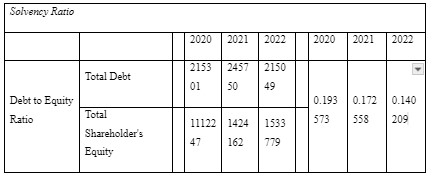

Non-financial analysisThe non-financial analysis of St Thomas NHS foundation has suggested that organization is having a good reputation among the customers and maintaining the higher quality in services of health care. The proper understanding and analysis of the individual KPIs and performance is helping the NHS management to improve the quality of the services and planning of the action such as training and development as well as improvement in the numbers of the staff to improve the performance. In addition to this, the management of company is using the innovative approach for managing the operations and implementing the new technologies and tools to improve the customer satisfaction by proper identification of disease and treatment accordingly. The management and staff members are having the good knowledge of the needs of the patients and maintaining the services standards following the international and UK regulations for the health care services. In addition to this, the customers are also giving the preference to services of NHS for maintaining the health and gaining the knowledge about the prevention from the disease. Apart from this, the market share of NHS foundation is increasing and showing that the performance of organization is good and helping to generate the higher revenue as well as attracting the patients to get the treatment. Market share is a primary measure for both the company and marketing’s success. An increase in market share has a number of benefits, including better operating margins, one of those financial metrics company’s often track. Ratio analysis The liquidity ratio tells about the company’s ability and capacity to meet its short term obligations. Ideally, the current ratio of 2 and quick ratio of 1 is considered to be a good performance. If a company maintains this ratio, it means it will be able to meet its short term obligations. In the given scenario, both current and quick ratio of the company was less than the ideal requirement. This shows that the company does not have enough liquidity to meet its short term obligations (Appendix 1). In fact, as per the analysis, current liability of the company is more as compared to its assets, showing its inability to meet any unforeseen situation in the near future. Profitability ratio shows whether the company is making profits or loss. In the present scenario, all the profitability ratios of the company are showing negative results. It shows that company is in losses. Thus, it can be said that either the company is not making enough sales, or its operating expenses are very high. This is not a good for the company’s prospective. Although in 2021 company showed positive returns, but in succeeding year again its returns were negative (Appendix 2). It means, it has not employed its capital and assets adequately to generate profits. Efficiency ratio tells about how effectively and efficiently the company is utilizing its resources. As per company’s account receivable turnover in days, the company is able to reduce this gradually from 37 days in 2020 to 24 days in 2022. This is a good indication for the company as it will ensure that the company has adequate working capital and it does not have to rely much on its everyday operations (Appendix 3). However, it needs to further work on it credit management policy as this ratio in health care sector is very competitive. Riskiness of any company can be determined through its solvency or debt equity ratio. A company will debt equity ratio of less than 1 is considered to be safe as in that company the owners have put their money so they are likely to put genuine and science efforts to make it profitable (Appendix 4). In this case, the debt equity ratio for the company is small, showing that owners have injected enough equity and thus making this stock a safe bet. Thus, overall it can be said that the company’s financial position is not good as presently its making losses and it has not employed its resources adequately for generating higher sales. It is essential for the company to put efforts and deploy its resources adequately so that it can generate profits.

Discussion

From the analysis, it has been considered that both financial and non financial analysis approaches for performance measurements is playing a significant role in understanding the overall effectiveness of the organization. According to the analysis of current study, it has been carried out that the management of St Thomas NHS foundation is using the innovative approach for managing the operations and implementing the new technologies and tools to improve the customer satisfaction by proper identification of disease and treatment accordingly (Grewal, Riedl & Serafeim, 2019). Moreover, as per the ratio analysis, current liability of the company is more as compared to its assets, showing its inability to meet any unforeseen situation in the near future. Apart from this, in the present scenario, all the profitability ratios of the company are showing negative results. It shows that company is in losses. Thus, it can be said that either the company is not making enough sales, or its operating expenses are very high. As per company’s account receivable turnover in days, the company is able to reduce this gradually from 37 days in 2020 to 24 days in 2022.

References

Al-Ahdal, W. M., Alsamhi, M. H., Tabash, M. I., & Farhan, N. H. (2020). The impact of corporate governance on financial performance of Indian and GCC listed firms: An empirical investigation. Research in International Business and Finance, 51, 101083.

Ali, H. Y., Danish, R. Q., & Asrar‐ul‐Haq, M. (2020). How corporate social responsibility boosts firm financial performance: The mediating role of corporate image and customer satisfaction. Corporate Social Responsibility and Environmental Management, 27(1), 166-177.

Awaysheh, A., Heron, R. A., Perry, T., & Wilson, J. I. (2020). On the relation between corporate social responsibility and financial performance. Strategic Management Journal, 41(6), 965-987.

Battiston, S., Dafermos, Y., & Monasterolo, I. (2021). Climate risks and financial stability. Journal of Financial Stability, 54, 100867.

Grewal, J., Riedl, E. J., & Serafeim, G. (2019). Market reaction to mandatory nonfinancial disclosure. Management Science, 65(7), 3061-3084.

Jackson, G., Bartosch, J., Avetisyan, E., Kinderman, D., & Knudsen, J. S. (2020). Mandatory non-financial disclosure and its influence on CSR: An international comparison. Journal of Business Ethics, 162, 323-342.

Taouab, O., & Issor, Z. (2019). Firm performance: Definition and measurement models. European Scientific Journal, 15(1), 93-106.

Ukko, J., Nasiri, M., Saunila, M., & Rantala, T. (2019). Sustainability strategy as a moderator in the relationship between digital business strategy and financial performance. Journal of Cleaner Production, 236, 117626.

Xie, X., Huo, J., & Zou, H. (2019). Green process innovation, green product innovation, and corporate financial performance: A content analysis method. Journal of business research, 101, 697-706.

Appendix

Appendix 1 Liquidity Ratio

Appendix 2

Profitability Ratio

Appendix 4

Looking for further insights on PepsiCo Inc Suitability Focus? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts