Understanding Rental Housing Market

Introduction

The supply can demand forces are playing crucial role in the market and economies to identify equilibrium process for the particular basket of goods and services. The policy makers and the economists try to analyse the demand for the products and supply of the particular products in the market to assess the actual price level. Supply, and demand is hereby related and it indicates the involvement between the quantity of commodities that produces wish to sell at various prices and quality that the consumers wish to buy (Mulheirn, 2019). Through supply, and demand analysis, it is possible to analyse the price of the basket of products and services in the market economics. The aim of the study is to analyse the demand and supply, of the rental houses at the UK, and identify right the factors influencing the price of rental houses in the country. The second part of the study is related to acknowledging the government or the economic policies and practice in the economy, to stabilise the rental housing market in the UK and influence the price of the rental houses across the UK.

Analysis of determining the price of private rental housing in the UK

There are several factors that influencing the prices of the commodities in the economy, and the demand and supply are the major factors that initially affects the price range of the products and services.

Demand and supply:

Demand in the economics, is the customer’s willingness and ability to consume a basket of goods and services. There is inverse relationship between the price and the demand in which if the prices of the commodities are increasing, the demand of the customers for that particular basket of goods and services will decrease. Hereby, there is adverse relationship between the demand and price level of the products. In this c0onbtext, it can be stated that, in the recant years, the rental housing price is increasing which deteriorates he demand of the customers for the rental house. Due to high price, the demand of the consumers for renting the houses at the UK will decrease over the time. On the other hand, the supply is another major factor influencing the price of the products and services at the market. As per the supply considers, it refers to the total amount of goods and services available at the market for the consumers, where the suppliers are able to supply he commodity baskets in the market. The supply, of the products and services also include the price level of the commodities positively or negatively. There is positive relationship between the supply, and price of the products and services, which indicates that if the supply is high, the price range will increase and if the supply for the particular commodity is low, the price will decrease (Wu and Lux, 2018). Hereby, high price of the private renting houses at the UK will encourage the suppliers of the houses to increase supply in the economy. On the other hand, if the price is low, the suppliers are not willing to increase supply of the house at lower price. Hereby, the demand curve in economics is downward sloping and the supply curve is upward sloping. This further determines the equilibrium point where the supply cuts the demand curve. At the equilibrium punt, there is equilibrium price at which the customers can purchase the products or the services in the economy.

In this equilibrium point, the equilibrium price can be determined ad it is mainly the market price at which the quantity of demand and quantity of supply of the good are equal. In this context, the equilibrium price of the private rental houses at the UK is also determined by the demand and supply of the houses at the economy. The market price or the equilibrium price is determined through the demand of the customers for the houses and the supply that the suppliers wish to supply the houses at the economy (Hilber, and Vermeulen, 2016). The figure above indicates the equilibrium price and quantity, where the customer demand of the private rental houses and the supplier’s supply amount is equal. In this regard, there are shifts of the demand curve toward right and left as per the increase and decrees of the demand among the consumers at the UK for the rental houses. If the customer’s demand is increasing, the demand curve will shift rightward and this further increases the price and quantity of the products. As per the figure 2, it is evaluated that, there is increased price and quantity due to demand shift toward right with supply curve constant where the customer’s demand for the private rental houses will be increasing. The customers in this situation may make the decision of renting house at high price as the supply of the renting house is constant, but there is high demand of the customers (Economics Online, 2020).

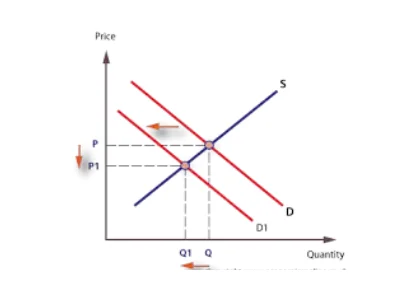

As per the figure 3, there is backward shift of the demand curve, where the customer’s demand will decrease in the renting house market of the UK. This further decreases the price and quantity of the houses with constant supply curve. Due to decrease and, there is excess supply and this further deteriorates the price for the renting house at the market and will also decrease the equilibrium quantity (Economics Online, 2020).

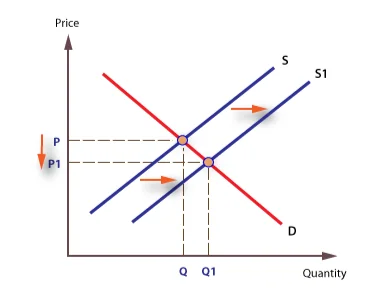

Like the shifting demand, the supply curve is also shifting towards forward and backward due to changing in the supply of the renting houses at the UK economy. In this regard, the supply shifts forward with the high supply of the renting house and it further decreases the equilibrium price due to excess supply of the products as the demand of the customers is constant at its previous point. Hence, if the supply of renting house is increasing with no chances in demand for the houses, the equilibrium price decreases and equilibrium quantity will be boosting due to lower price.

As per the figure 5 below, there is shifting supply towards left and this is due to decrease in the supply of the renting house at the economy. With backward movement of the supply, the price will increase and the equilibrium quantity will decrease due to highly price. If the supply of the houses in the UK economy is decreeing over the period of time, it will deteriorate the equilibrium price due to constant demand and lack of potential supply (Desmond, 2018). This situation boosts the price of the renting houses and it further affects the equilibrium quantity negatively, where it becomes lower due to high price at the market in which the customers cannot afford higher price of the products (Economics Online, 2020).

Hereby, the demand and supply is the major instrument in the economy to affect the equilibrium price and quantity of the private renting house at the UK economy. There are other factors influencing the price of the UK rental housing industry which are,

Population:

Population is another factor influencing the price and quantity of the rental houses and in this regard, if the population of the UK is increasing, the demand for the rental houses will also increase and it will influence the price of the houses. Apart from that, there is huge migration of labourer at the UK economy, which further boosts the demand for the renting houses and the price range becomes high with the high demand, where the suppliers think to boost the supply to meet the equilibrium price and quantity at high level (Economics Online, 2020).

Interest rates:

The interest rate is playing crucial role on the price of the renting house, where if the interest rate is higher, the customers become willing to pay high price and the supplies in this condition set high price for the housing at high interest rate (Duffy, Kelleher and Hughes, 2017).

Taxation:

Taxation is also another factor influencing the price of the private renting houses and in this regard high corporate tax increases the price of the house and there is positive relationship between the rent and taxation.

House building:

Another crucial factor is quality of housing building and also the supply of the rented houses which indicates the price of the private houses. If the quality of the renting houses is good, the suppliers may charge high price for that and apart from that, if there is high supply of the housing apartments with high demand, it will boosts the equilibrium price and quantity.

Income effect:

Income effect is another crucial factor influencing the price of the renting houses, which indicates that if the price falls with the constant nominal income of the consumers, the buyers can make better purchase decision with high quality of goods and services. Thus, if the purchasing power parity of the consumers in the UK increasing, the supplies may charge high price as the affordability of the customers will increase with personal income and constant nominal income (Economics Online, 2020).

Substitutes:

Presence of substitute products available at the market will decrease the price of the renting houses, where the suppliers try to set competitive price to retain the customers. Hereby, if the customers may access the alternative accommodation to live, the price of the private renting house will decrease.

Policies influencing the demand for private rental housing in the UK

There is high government intervention in the UK to influence the price of the private rental housing of the country, where the government plays a crucial role to strategise the sector and influence the activities to boost the demand and maintain equilibrium price and quantity for retaining the customers for long run.

Government actions:

Government focuses on improving quantity and quality of the private houses in the UK by allowing flexibility on waiting list, and develop tenancy agreement properly. Supporting the tenants is another strategy of the UK where the government is supportive and manage the accommodation so that it is possible to retain the customers. The government also encourages more investment in the private rented sector of the UK through different schemes such as building rent fund and new loan guarantees, which influence the price of the rented houses (Gov.UK, 2015).

Regulation:

The Homes and Communities Agency (HCA) provide proper guidelines where it is effective for nation lousing and regeneration agency for England. It is non-departmental government body which is working with the partners to create homes, economic growth and jobs in the private renting sector, and thus it further influences the price of the houses. Investment planning is also effective where HCA influences the price of the private houses and additionally, economic regulations of housing association is concerned to safeguard £43 billion of taxpayer investment in the sector to help the consumers to invest more for affordable housing. The HCA is also playing crucial role to influence the private house suppliers to follow the regulations and deliver high value for money (Orford, 2017). Protecting the reputation of the private suppliers as well as enabling the landlords to invest more to boost the supply of private housing is also effective where the landlords try to maintain the quantity and quality of the private housing and it further boosts the price of the houses in the economy (Gov.UK, 2015).

Economic standard:

The government and the HCA play crucial role together to manage the economic standard and also the standard for the consumers in the economy by providing proper accommodation and private housing. The government focuses on managing economic standard by providing high value for money, rent standard and governance and financial viability. Apart from that, the private investors on housing industry are influenced with the regulatory framework of the UK government and HCA to maximise customers standard, where the quality of the home needs to be ensured, there is proper tenancy agreement, enhancing neighbourhood and community involvement and tenant involvement and empowerment, so that the customers can be engaged with the landlord and make effective decision for retain the private houses. Hereby, the government rules and regulations increases the standard at the private rental housing industry and it further boosts the price range of the houses. Tenancy agreement and the empowerment of the tenants are mandatory, where the government is also efficient to improve the tenant empowerment program in the country to involve the tenants and influence their purchase intention for the private rented houses in the country (Gov.UK, 2015).

Interest rates:

There is no such string relationship between the interest rate and the housing price in the UK. However, if the mortgage price will rise; it has significant effects on the housing price. When the price of mortgage is high, the economy is growing and job market is also growing with rising wages. Meanwhile, the inventory and cost of the housing obstruction will rise further and this will influence the price of housing to boost in future. In the starting of 2020, the private rented houses in the UK are growing with high price where there is 2% increase in the price of the private rental houses in the country (Gallent and Tewdwr-Jones, 2018). Hence, higher interest rate makes the property less affordable and the demand for the rental houses will shift leftward.

Taxation:

If the property taxation is increasing over the years, it influence the price of the private rental houses, where the tenants need to pay higher due to high property tax, provided by the landlords. Hereby, the government may regulate the taxation rate as well as interest rate to influence the price for the private rental houses in the UK (Blaseio and Jones, 2019).

Social housing policies:

The UK government focuses on increasing the social housing amounts in the market to increase affordability of the consumers. There is huge numbers of social housing and the government influences the investors to invest on social housing to boost the industry and influence the customers to make purchase decision for the social housing. This will also affect the price of the private housing in the UK. Here is proper accommodation as well as the government is successfully to manage the quantity and quality of the social housing complex which may influence the price of the private rented houses in the market.

Conclusion

It can be stated that, the private rental house industry is growing in the UK with high price, flexibility and proper management, where the private landlords try to manage the quantity and quality of the accommodation to influence the demand of the consumers in the market. There are certain factors which are playing curial role in influencing the price of the private rented houses which are demand of the customers, supply of the rented houses, as well as taxation and interest rate, building quality, income effects, subsidies of the government in the UK social housings industry and government intervention.

Reference List

Blaseio, B. and Jones, C., 2019. Regional economic divergence and house prices: a comparison of Germany and the UK. International Journal of Housing Markets and Analysis.

Desmond, M., 2018. Heavy is the house: Rent burden among the American urban poor. International Journal of Urban and Regional Research, 42(1), pp.160-170.

Duffy, D., Kelleher, C. and Hughes, A., 2017. Landlord attitudes to the private rented sector in Ireland: survey results. Housing Studies, 32(6), pp.778-792.

Gallent, N. and Tewdwr-Jones, M., 2018. Rural second homes in Europe: Examining housing supply and planning control. London: Routledge.

Gallent, N., Mace, A. and Tewdwr-Jones, M., 2017. Second homes: European perspectives and UK policies. London: Routledge.

Hilber, C.A. and Vermeulen, W., 2016. The impact of supply constraints on house prices in England. The Economic Journal, 126(591), pp.358-405.

Mulheirn, I., 2019. Tackling the UK housing crisis: is supply the answer. UK Collaborative Centre for Housing Evidence.

Orford, S., 2017. Valuing the built environment: GIS and house price analysis. London: Routledge.

Owusu-Ansah, A., Ohemeng-Mensah, D., Abdulai, R.T. and Obeng-Odoom, F., 2018. Public choice theory and rental housing: an examination of rental housing contracts in Ghana. Housing Studies, 33(6), pp.938-959.

Wu, Y. and Lux, N., 2018. UK house prices: Bubbles or market efficiency? evidence from regional analysis. Journal of Risk and Financial Management, 11(3), p.54.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts