Volkswagen Case Defeat Devices

Questions 1: Why did VW’s leadership decide to use defeat devices? What was its impact on the share price?

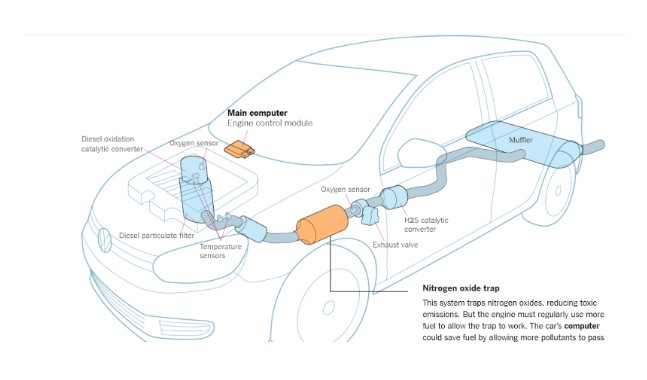

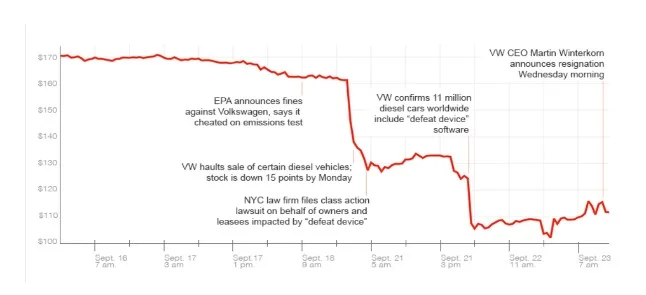

The scandal that rocked Volkswagen (VW) vehicle manufacturer involved including a software into its vehicles primary auto functions such as steering wheel positioning, speed, barometer pressure, and duration of engine operations. With data from these functions, a computerised system would detect whether the car was being tested for emission then adjust the equipment down reducing emissions to required limit (Hakim, 2021). During normal operations, the system would turn the equipment down to mostly likely to improve the car’s acceleration, torque, and save fuel (illustrated in Appendix I). The wildly argument held is that in an increasingly competitive automobile industry where consumers demand for fuel efficient, low emission, environmentally friendly, and high performing vehicles, the companies in the industry are forced to adopt innovative measures to remain competitive which is said to be a crucial aspect discussed in the business dissertation help (Contag et al., 2017; Castille, and Fultz, 2018). For this, the decision by VW’s leadership to cheat on emission regulations came in attempt to balance between beating competitors in the market and being within regulated limit of emission. As pointed by Jung and Sharon (2019), the stringent regulation introduced by the United States Environmental Protection Agency (EPA) that include reducing Nitrogen Oxide emission by 94% meant the vehicles companies faced unprecedented engineering challenges in meeting the requirements while seeing growth in the sales. Before the admission of guilty, the company’s sale and shares had seen a steady growth to 235 EUR in 2015 and then it saw its shares plummeting to approximately 100 EUR after the scandal was made public (Snyder and Jones, 2015).

Questions 2: Describe the various Stakeholders and their individual interest in VW. Whose interest dominated in the decision to pursue the defeat device strategy? How does this compare to the Shareholder situation? (Discuss)

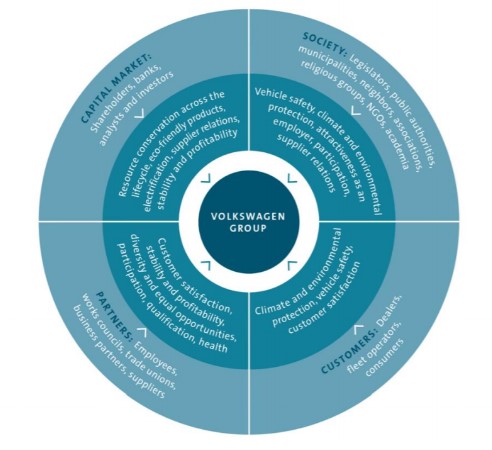

The Board of Management, currently comprising of eight members and chaired by Dr. Herbert Diess, oversees different operations such as procurement, brand (premium and sport & luxury), human resources, technology, finance, and integrity. Just below the management, there is a supervisory board comprising of 20 members who in monitors the management and approve key corporate decisions as well as appointing the board of management members (Volkswagen AG, 2021). The Porsche & Piëch family owns majority of the company (31.4%) while Qatar Investment Authority (QIA) have a 14.6% of equity and State of Lower Saxony (11.8%). Additionally, the company is publicly trade and primary listed on Frankfurt Stack Exchange trading ordinary shares. Although it was delisted from the London Stock Exchange, the company still trade in the US. Depending on the shares held, the shareholders have voting rights but the three majority owners control 90% of the rights. Other stakeholders in the company include dealerships, which are independent entities given exclusive rights by the company to sell the products in addition to allowing it navigate the local laws and culture (Sapozhnikov, 2018). Employees and buyers are other group of people directly involved with the company, although at two distinct ends. For employees, they are involved directly in design, manufacturing, operations, and coordinating the functions of the company, and fundamentally key in performance and direction of a company. Whereas customers purchases and use the products. Arguably, with direct interaction with the products, the consumers are on the receiving end of functionality, quality, and any defects (Zhang et al., 2021). The regulators that include governments and control bodies such as EPA and CARB are there to ensure the business entities, in this case VW, follows established guidelines and regulations aimed at protecting consumers, public, environment, and other businesses.

The scandal saw the company navigate around the set limit on pollutant emission in which it present a significant engineering challenges of cutting emission by approximately 94%. Arguably, in order for the company to continue producing cars while retaining its consumers’ preferences of fuel efficiency, high performance, and cheap while holding perception of meeting regulatory requirements, it had to cut corners. From this, it is clear the company interest was rooted on continuing its sales and growth. However, in its aftermath where shares plummeted, cars were recalled, reputation and public trust damaged, and penalties levelled against it, the shareholders capital markets (shareholders, investors, financers, and banking institution), and customers including dealers and buyers were severely affected. The findings by Bachmann et al. (2017) and Che et al. (2020), show that the sales and market share of the company as well as public perception is yet to recover more than five years later. The negative reputation, the company being labelled as a cheat by media, has remained despite its recent gradual growth in revenues. As pointed by Jacobs and Singhal (2020), the trust and respect bestowed on Germany engineering and automobile industry ‘German machine’ incurred reputational damage that ultimately affected the country’s automobile industry.

In addition to losing more than $30 billion in damages, fines, recalls, and private settlement, the company brand equity particularly reputation suffered a significant unknown loss. In addition to class action filed against the company’s CEO was indicted of federal charges of fraud, in the USA. Although the engineers and lower level management and employees were not directly affected, losing their jobs, the management including the CEO left the company. In comparison to the company loss in revenues and financial damages paid, the impact to other shareholders particularly investors and employees not just employed directly by the company but across the German automobile sector particularly considering that one-in-five cars globally is German made (Forbes, 2015). The long-term implication of the scandal to the stakeholders can been perceive from the reputation, capital market, and sales.

Dig deeper into Volkswagen's Supply Chain and Strategic Partnerships in the Global Market with our selection of articles.

Question 3: How did VW react to the discovery of its deceit? Do you think this was the proper crisis management response? What would you recommend that they do differently – next time? Is this an agency problem, why?

Initially, the company had tried to cover up the scandal but later admitting to foul plan after the findings were made public. The then CEO Markin Winterkorn had been fully briefed on the plans by the engineers and later authorised the cover up. It shows the extended to which the scandal ran up the company’s management structures. The handling of the crises followed replacing then CEO with Hans Dieter Poetsch. Additionally, the company issued a statement assuring the customers on the safety and drivability of the vehicles while going further to highlight high emission. The action plan adopted by the company involved admitting the problems, replacing the management, recall the affected cars, pay penalties, and compensate damages caused.

As argued by Booth (2015), in time of a business crisis, it is crucial to inform the consumers and have a regular assuring messaging to all stakeholders in general on the cause of the problems, current solution, and future solution plan. Importantly, in addition to being assuring, this communication need to be timely, informative, and inclusive. Essentially, putting all stakeholders in an informed loop. Arguably, by admitting publicly and swiftly the wrong doing as well as stating the extent of the problems, the company managed to prevent further plummeting of stock prices cause by public panicking, and cushioning more negative reputation. In taking responsibility from the top management, admitting guilty and leaving the company, the company restored a small remaining perception of honesty and integrity held by customers and other stakeholders. By retaining the engineers who designed and implemented the device showed the blame was on the employees but rather leadership and management for authorised it use.

References

Bachmann, R., Ehrlich, G. and Ruzic, D., 2017. Firms and collective reputation: The Volkswagen emission scandal as a case study (No. 6805). CESifo Working Paper.

BBC News, 2016. How VW tried to cover up the emissions scandal. [online] BBC News. Available at:

Bloomberg, 2021. Bloomberg - Volkswagen AGCOMPANY INFO. [online] Bloomberg.com. Available at:

Booth, S.A., 2015. Crisis management strategy: Competition and change in modern enterprises. Routledge.

Castille, C. and Fultz, A., 2018, January. How does collaborative cheating emerge? A case study of the Volkswagen emissions scandal. In Proceedings of the 51st Hawaii International Conference on System Sciences.

Che, X., Katayama, H. and Lee, P., 2020. Willingness to Pay for Brand Reputation: Lessons from the Volkswagen Diesel Emissions Scandal.

Contag, M., Li, G., Pawlowski, A., Domke, F., Levchenko, K., Holz, T. and Savage, S., 2017, May. How they did it: An analysis of emission defeat devices in modern automobiles. In 2017 IEEE Symposium on Security and Privacy (SP) (pp. 231-250). IEEE.

Forbes, 2015. The Domino Effect Of Volkswagen's Emissions Scandal. [online] Forbes. Available at:

Gates, G., Ewing, J., Russell, K. and Watkins, D., 2017. How Volkswagen’s ‘Defeat Devices’ Worked. [online] Nytimes.com. Available at:

Hakim, D., 2016. VW’s Crisis Strategy: Forward, Reverse, U-Turn (Published 2016). [online] Nytimes.com. Available at:

Jacobs, B.W. and Singhal, V.R., 2020. Shareholder value effects of the Volkswagen emissions scandal on the automotive ecosystem. Production and Operations Management, 29(10), pp.2230-2251.

Jung, J.C. and Sharon, E., 2019. The Volkswagen emissions scandal and its aftermath. Global Business and Organizational Excellence, 38(4), pp.6-15.

Sapozhnikov, R., 2018. Stakeholder Relationships in International Crisis (Doctoral dissertation, Zurich University of Applied Sciences).

Snyder, B. and Jones, S., 2015. Here’s a Timeline of Volkswagen’s Tanking Stock Price. [online] Fortune. Available at:

Volkswagen AG, 2021. Executive Bodies | Volkswagen Group. [online] Volkswagenag.com. Available at:

Zhang, M., Atwal, G. and Kaiser, M., 2021. Corporate social irresponsibility and stakeholder ecosystems: The case of Volkswagen Dieselgate scandal. Strategic Change, 30(1), pp.79-85.

Appendix

Take a deeper dive into Using Data for Business with our additional resources.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts