Balancing Trade: A Strategic Analysis of South Korea's Economic Position in Light of Coronavirus Impact

Expected Economic Affect in Short Term

The impact of Corona virus infection in Chinese economy on South Korean economy is significant.

This is because of the trade dependence on GDP growth in South Korea, which was 70 percent in third quarter in 2019, and it is third highest ranking in global dependence on export, next to Netherlands and Germany. In dependence on import has been ranked fourth in the world (only Netherlands, Mexico, Germany show higher dependence). The high dependence would cause reducing domestic GDP growth in Korean economy by expected global Value Chain shrinking. For students who are struggling with understanding the intricacies of such economic dynamics, seeking economics dissertation help can provide the most valuable guidance.

In a short-term perspective, especially Covid-19 infection would slow down Korean productivity, causing by high mutual import and export dependence, as per the below graph. Especially parts industry dependence in Korean manufacturing would also cause reducing output.

1. Risk of US Dollar Shortage

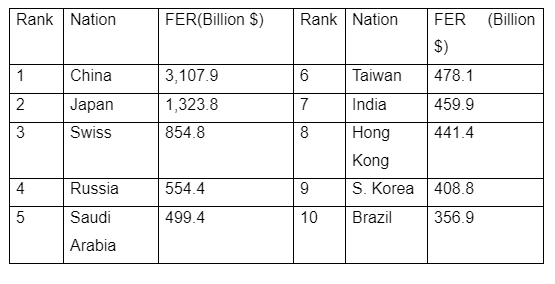

According to Bank of Korea report (2020), Foreign Exchange Reserve (FER) is US$ 409.65 Billion in January 2020, increasing US$ 840 Million compare with December 2019. Korean FER is ranking nine in the world in December 2019 point, which is described in below Graph.

Also from same source, in trend of foreign exchange reserve, proportion of securities is significantly higher than any other form of foreign reserve, which occupied 92.4 percent in January in 2020. The trend has been maintained from 2016.

1) Securities include Treasury bond, Government bond, debenture, and asset securities.

2) IMF position means exchange currency withdraw right owned by Bank of Korea, as a member of IMF

In accounting sense, total foreign reserve minus foreign debt would be net foreign reserve.

According to the Bank of Korea International Investment Balance Sheet1 (Sep, 2019), total foreign debt is US$ 458.2 Billion. It includes short term foreign debt US$ 133.8 Billion, which has been reduced 39 percentages as compared with last quarter and long term foreign debt US$ 324.4 Billion, increasing 24 percentage. From the figure, it is obvious that, in September 2019, total foreign currency that available was US$ 269.52 Billion (Total foreign currency reserve US$403.32 Billion minus Short term foreign debt US$133.8) (한겨레. 2020).

However, Kim (2015) lies that, there are three models of optimum forging currency reserves that recommend a reasonable foreign currency reserve for one country, preventing financial crisis.

From table above, in 1953, IMF suggested amount of three-month current account should be ready. The three-month currency account means (amount of US Dollar for purchasing Oil; exchange rate 1203: $1 in 27 September). From the recommendation, US$ 124 million would be the three months reserve amount. So US$ 269 Million is maintained in Bank of Korea account after less US$124 Million.

If we adopt second model, Greenspan-Guidotti model, only including short term debt, first, the available foreign currency reserve amount should be US$ 403.32 Billion and less three month account and total foreign debt-from Bank of Korea (2019) would be US$ -55.0 Billion (total debt was US$ 458.2 Billion in September 2019). But if just concern short term debt in September 2019, Which was US$ 133.8 Billion, foreign reserve currency will be US$ 269.396 Billion. So from real reserve US$ 403.320 Billion, still US$ 133.924 Billion left.

However, recently immediate capital outflow from investment market is a main reason to have a Dollar shortage. Good example would be 1998 Asian financial crisis, secondly reason was that Korean Government that could not get external Dollar, fail to contract currency swap with Bank of Japan, facing Dollar shortage, and the circumstance was a reason to accept IMF program2. But main reason was that the foreign investors removed their investment from Korean investment market (p7. Kotra FDI 현안리포트. 2008).

In that concept, BIS Model recommend to prepare foreign currency and the amount should be 33 percentage of foreign equity investment fund as a reasonable foreign currency reserve.

In September 2019, total foreign investment in both stock market division and KOSDAQ market was approximately US$ 462 Billion (e-나라지표. 2020), and 33 percentage of the amount was US$ 154 Billion.

From the BIS recommendation, reasonable foreign currency reservethat Bank OF Korea for September 2019 was US$ -20.076 billion (403.320 Billion -269.396 Billion-154 billion = -20.076 Billion). It means that if Korean Government adopts BIS model, there was Dollar shortage in September 2019.

Furthermore, Kim (2015) claimed that, even there is enough reserve; still the form of reserve could be an issue in liquidity perspective. Present foreign currency reserve formed by Treasury Bond (36%), Government Bond (21%), Debenture (14%), Asset Securitization Bond (13%), Stock (7.7%) March 2020. Kim pointed almost 30 percent of Foreign currency are high risk financial items (Debenture and Asset Securitization Bond) (MBN 매일경제. 2020).

Other additional information, 19 March Bank of Korea and Federal Reserve Board have contracted US$ 60 Billion Dollar currency swap (Border of Governors of the Federal Reserve System. 2020). Compare with September 2019 case (US$ -20.076 billion), now Bank of Korea has a reasonable foreign reserve currency, requiring by BIS standard.

But still risk of capital outflow, causing by many different entities, for example foreign investment, corporation debt repayment….so on has been left.

2. Non-financial Corporation Debt

Concern Covid-19 Infection case, if Korean corporation could not able to earn targeted profit, there would be foreign debt default in non-financial corporation section. It needs financial and business analysis for each corporation’s financial reports with risk modeling. But in macro level, in the end of 2019, Korean corporation own short-term foreign debt in US$ 9.784 Billion, which can cover by the Currency swap.

But the currency swap is not able to pay back whole amount of corporation debt, which are US$ 110.60 Billion.

Continue your journey with our comprehensive guide to Aspects of Microeconomics and Macroeconomics.

In Dollar shortage approach, there would be no problem to exchange Dollar, but still in profit generation approach, Korean corporations are able to subject matter of the debt default, if they fail to generate profit with another variables, Covid-19 infection environment, oil price…..so on.

Non-Financial Corporation Debt (US$ Million)

3. Sudden stop

From our research, there would be no dollar shortage on book value, but if we concern about liquidity it is not reasonable to argue that there are possibility to have a foreign debt default. Because there is lack of information about each foreign debt, central bank does not have obligation to publically announce.

During the 2008 Asian Crisis, Bank of Korea had an enough foreign currency (US$201.22 Billion in 2009) but could not liquidate at the right time (Bank of Korea. 2009)3. Therefore, there must be cautious to predict.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts