Evaluating Apple's Profitability Ratios

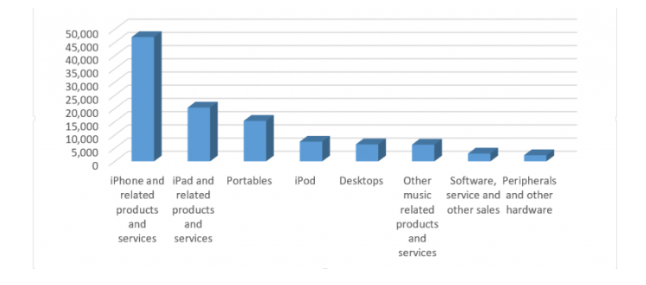

According to Khan, Alam and Alam (2015), Apple Inc. primarily manufactures, designs and markets an extensive service offering range of products consisting of mobile communication devices and personal computers along with the related software suits, accessories, services, applications and third party based digital content. Payne (2017) has highlighted the product ranges of Apple Inc. to be inclusive of iPhone, iPad, Mac, Apple Watch, AirPods, Apple TV, HomePod, iOS, macOS, watchOS and tvOS operating systems, iCloud, Apple Pay software service accessories and support offerings as well as software applications developed to meet the differential portfolios of professional and consumer necessities. According to Gardere, Sharir and Maman (2018), the financial ratios and growth trends of Apple and those of Dell, the most ardent competitor of Apple, could be utilised to analyse the macroeconomic performance of both the competing enterprises over a period of a specified number of previous years. According to Dolata (2017), the annualised percentage obtainment over specific duration from 2008 to 2012, could be highlighted through Compounded Annual Growth Rate (CAGR). The profitability ratios are utilised to evaluate the income creation by the respective companies in comparison to their competitors concerning the incurrence of expenses and various related costs. In this context, the ratios are attempted to be maintained by different companies through the highest of values. On the other hand, payment of short term debts is related to the liquidity ratios and thus, highest of numbers are required. The elements of interest based expenses incurred, standing debts, assets and equity are utilised to determine the financing procedures of any organisation such as Apple and these also outline the corporate obligations of such a company. Finally, the turnover ratios outline the replacement rates of the organisational inventories.

According to Zhao, Calantone and Voorhees (2018), the representation of growth trend is as the following:

Revenues CAGR (2008-2012):

Apple = 48.16%

Dell = 0.38%

Costs CAGR for (2008-2012):

Apple = 31.1%

Dell = 7.2%

Profits CAGR (2008-2012):

Apple = 71.4%

Dell = 7.8%

According to Heracleous and Papachroni (2016), the revenue and profit growth in the five year duration (which included the 2009 recession period) outweighed the costs for Apple. For Dell, the revenue growth was less than half a percent per annum and profit and costs expanded at a comparable measure.

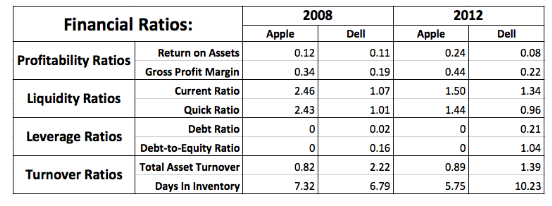

According to Chen and Ann (2016), the comparative financial ratios of Apple and Dell are as the following:

According to Kim (2018), Apple had achieved gross profit margin increment and return on assets during the above mentioned period which exemplified profitability increment. For Dell, the gross profit had increased and ROA had decreased presumably due to overhead cost increment. The sales percentage had increased which indicated to the product profitability increment. The liquidity ratios have demonstrated the reliance of Dell on inventory sales to cover liabilities which could have become detrimental if liquidation of the company could have been in progress. In case of Apple, the liquidity ratio had decreased as a response of shareholders demand to issue the necessary dividends through excess cash application. The liabilities had been covered though the company had not been in possession of excess amount of cash. According to Jeevan and Bhargav (2016), the amount of debt of Dell had increased and since the profitability had not increased accordingly, this pertained to a serious source of risk for the company. However, by the culmination of the stated period, the Debt-to-Equity ratio had been at par with the industry. On the other hand, Apple had maintained increment of profitability and revenues without having incurred any external debt. The inventory turnover for Apple had decreased by two days and this had been indicative of the efficient sales of the inventory. For Dell as well, the inventory turnover had decreased exponentially. According to annualreports.com (2018), the primary tenet of Keynesian theory is that government fiscal policies could offset the business cycles through the formulation of situations in which the application of counter cyclical strategies by companies, such as Apple, could become a paramount necessity. According to annualreports.com (2018), the effects of such theoretical principles concerning the cost vulnerabilities of and macroeconomic situational impacts on Apple are extensive. Apple is subjected to the multiplicity of foreign jurisdictions, such as at the UK and Ireland, as well as the fiscal policy changes at the USA. The effective profit earning of the company could be affected by the differing rates of statutory taxes, changes in the deferred tax asset and liability valuations and by the formulation of new taxation legislations.

Looking for further insights on Established Economy United Kingdom And An Emerging Economy India? Click here.

According to annualreports.com (2018), the cost vulnerabilities and associated profit margins are subjected to the variables such as distribution channels, products and geographic segments. The hardware product offerings based gross profit margins also vary throughout the product lines and could experience serious changes as direct outcomes of product transitions, configuration alterations and pricing strategic exigencies. Cost fluctuations such as warranty and component based cost incurrences could, also, detrimentally influence the financial outcomes of the company. Furthermore, Apple could be subjected to adverse impacts through the shifts of the products and services offerings involving the component costs increment, intense price competition from the market rivals and incurrence of higher cost structures of new products and services components. Furthermore, the primary exposure of Apple to variables in the rates of foreign currency exchanges relating to global non-U.S. dollar denomination based sales and operational cost expenses could, also, affect the profit margin accrual prospects of the company. Adverse effect could be imparted to the gross profit margins regarding the Apple services and products (based on components obtained from foreign suppliers) in the overseas countries which could be the direct outcome of the fluctuations in exchange rates. The foreign currency based sales denomination value of the company products could be adversely impacted by the weakening of the overseas currencies and this could lead towards raising of international pricing by Apple. This, directly, would, reduce the aggregate demands of Apple products. If strategic price increment is not implemented, so as to offset the strengthening of the Dollar value, then, the gross margins of the organisational income on the foreign currency denominated sales could be reduced.

Reference List

Chen, C.M. and Ann, B.Y., 2016. Efficiencies vs. importance-performance analysis for the leading smartphone brands of Apple, Samsung and HTC. Total Quality Management & Business Excellence, 27(3-4), pp.227-249.

Dolata, U., 2017. Apple, Amazon, Google, Facebook, Microsoft: Market concentration-competition-innovation strategies (No. 2017-01). Stuttgarter Beiträge zur Organisations-und Innovationsforschung, SOI Discussion Paper.

Gardere, J., Sharir, D. and Maman, Y., 2018. Consulting and Executive Coaching on Future Trends: The Need for a Long Term Vision with Apple and Samsung. International Journal of Business and Social Science, 9(3).

Heracleous, L. and Papachroni, A., 2016. Strategic Leadership and Innovation at Apple Inc. SAGE Publications Ltd.

Jaworski, J. and Czerwonka, L., 2019. Meta-study on relationship between macroeconomic and institutional environment and internal determinants of enterprises’ capital structure. Economic Research-Ekonomska Istraživanja, 32(1), pp.2614-2637.

Jeevan, P. and Bhargav, V., 2016. A Study on Green Packaging-A Case Study Approach With Reference To Dell Inc. International Educational Scientific Research Journal [IESRJ], E-ISSN No.

Khan, U.A., Alam, M.N. and Alam, S., 2015. A critical analysis of internal and external environment of Apple Inc. International Journal of Economics, Commerce and Management, 3(6), pp.955-961.

Kim, P., 2018. Integration of Management and Culture: The Culture of Dedication in Samsung Electronics and Apple Inc

Kumar, B.R., 2019. Dell’s Acquisition of EMC. In Wealth Creation in the World’s Largest Mergers and Acquisitions (pp. 191-195). Springer, Cham.

Lockamy III, A., 2017, July. An examination of external risk factors in Apple Inc.’s supply chain. In Supply Chain Forum: An International Journal (Vol. 18, No. 3, pp. 177-188). Taylor & Francis.

Payne, B., 2017. Brand Positioning and its Usefulness for Brand Management: the Case of Apple Inc. Newcastle business school student journal, 1(1), pp.51-57.

Yusoff, M. and Husnina, N., 2018. Determinants of Risks and Performance in Apple Inc. Available at SSRN 3181705.

Zhao, Y., Calantone, R.J. and Voorhees, C.M., 2018. Identity change vs. strategy change: the effects of rebranding announcements on stock returns. Journal of the Academy of Marketing Science, 46(5), pp.795-812.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts