Personal taxation

Case Study 1

Critical Evaluation

Taxation served as the main source of government finance and used for economic, social and political stabilities as well as for the well-being of the nation. In the modern society, the political and economic structure has turned complex. Alongside, government responsibilities have also risen which means taxation serves for far wider purposes.

It has been seen that a major proportion of UK individual and entities pay their tax as and when they are due. The difference between the revenues that as per HRMRC (Her Majesty’s revenue and Customs) should be derived and the actual total collected by HMRC is recognised as “Tax Gap”. Taxation gap is increasingly being widened as businesses, and the individual is entering into practices of tax avoidance (legal, however morally incorrect) and tax evasion (illegal, widespread). Tax avoidance is highly a controversial topic, and the lords have not been able to prove its justification (Slemrod and Yitzhaki, 2002). If you are looking for assistance with your HRM dissertation, then consider seeking HRM dissertation help as it is the most reputable source.

As per Graham Aaronson, QC tax avoidance is nothing but tax dodging in a deliberate sense. Though tax professional have set the clear demarcation between tax avoidance and tax evasion but in a broader sense, both are means of deviation from what is “ought” to be paid. Tax reform is complex and involving changes in tax rate cuts is a base-broadening process. Margaret Hodge MP made use of her position as House of Common’s Public Accountant Committee (PAC) to put forth strict action on tax avoidance activities of MNC, on HMRC for not taking actions effectively out on the problem of corporate tax avoidance. The viewpoint of Graham Aaronson had been mixed, and he wholly justified to it, as he believed HMRC could equip itself to combat tax avoidance more effectively. Jimmy Carr’s uses K2 scheme a legitimate tax avoidance, and his strong statement made that “I pay what I have to, not a penny more” boomed within the wider public. As per the government, taxation policies influence the economic choices, but on an ex-ante basis, it can be observed that tax rate cuts will lead to a more prosperous and larger economy (Fuest and Riedel, 2009). The significance of above statement can be help in deriving the implication of:

- Tax’s central role in revenue generation,

- Impact on the income distribution, and

- Effect on the wide economic activities.

Opinion on Graham Aaronson article

Graham Aaronson is a specialised person in the field of commercial taxation. His advice is represented most of the major corporation conducting their business in the UK. He has suggested tax regime by being a representation in leading council that deals with corporation tax. According to him, UK should introduce into their tax legislations a General Anti-Avoidance rule (GAAR).

I partly disagree to Graham Aaronson verdicts on tax avoidance. The key purpose behind introducing tax is to generate revenue for the government. But nonetheless, the high tax rate shall create a huge inducement, which is far enough to motivate taxpayers to pay less tax. The high taxes encourage a man to handle its affairs in a manner to attract the least tax (Tax journal., 2016). I believe tax avoidance is a matter driven by high tax rates having acceptable measures will help in reducing this practice. Taxes are means to revenue generation for economic prosperities, but tax rates will reduce the capacity of individual to function, save and invest the same this shall reduce the economic activity. It has been seen that with this the high taxation rates should be discouraged to end this game of tax avoidance.

Government economic policies role in framing taxpayer behaviour

It is important to cover the loopholes within the government economic policies as they do play a significant role in determining the taxpayer’s behaviour. The attitudes of taxpayers vary considerably as taxation policies affect the overall business cost. Most of the administrative policies framed are done to influence the behaviour of the taxpayer. Tax administration is wide and complex an improved understanding the government on understanding the taxpayer behaviour can help in developing a strong and effective compliance treatment (Cobham, 2005). Auditing behaviour of tax is an expensive measure by the government but influencing the behaviour shall offer effective rather less expensive option for compliance by the taxpayers. It is important to recognise the reason for resistance of taxpayer’s to ensure their voluntary participation in a declaration of his income.

The taxpayer will comply voluntarily to pay taxes and not choose the method of evasion or avoidance only if they agree that it is the right thing to do. The desire to pay is linked with the behavioural norm of a taxpayer who presumes the working of administration rightly in favour for the long-term. This means it is important to guide a taxpayer’s posture in favour of tax administration, which is a difficult task to influence. In the situation, if the belief is admitted that the outcome derived from government policies is fair and true to the taxpayer then only they will opt out of practices of tax avoidance and tax evasion.

In any case, where the taxpayer is not convinced by the tax administration, it is motivated to take steps for evading taxes. Therefore, it can be seen that Norms and motivation are equally influenced by the government policies and fairness in tax administration. In the case of Google, it has been seen that it found ways by lowering its payments to make tax avoidance and claiming it as capitalism (Kumar and Wrigh, 2013). Tax arrangements are permitted under law and cutting the tax bills is just considered a part of capitalism by the Google. In order to resolve crises of capitalism issue, it is important that fair taxes are derived from the taxpayers.

If the government continues to keep such stringent policies the taxpayer will find other ways to liberalise their taxed income. Whereas on the other if government draws some leniency in their policies then they will be able to avoid tax blunders made by the taxpayer. Thus, it can be observed that problem of tax evasion and avoidance can be eradicated only through the mutual approach of government as well as the taxpayer.

Tax haven popularity among tax avoiders

Yes, tax haven countries like Panama have gained growing popularity among wealthy individuals, as investing money in such countries is not illegal and good prospect to evade or avoid taxation in the host country (Dyreng, Hanlon and Maydew, 2008). The investment made in tax haven countries is entirely legal and encouraged as it helps in bending the rules than opposing them. Not all approaches of tax avoidance are condoned but the loopholes in law have helped the taxpayer in minimising their tax bills.

Moral and ethical justification

Tax evasion is failing to file a tax return whereas tax avoidance is ascertaining the loopholes within the tax administration to avoid tax. Both tax avoidance and on a serious scale tax evasion come under morally and ethically wrong categories. Tax avoidance and evasion undermines the rule of law and contributes to unequal economic reality (Christensen and Murphy, 2004). It is morally wrong as it is not fair for the hardworking people who do the right thing and pay off their taxes. It is further also wrong as it directly deprives other of the services, which are much needed in the present than ever.

G8 Summit and General Anti-Abuse Rule (GAAR)

In the year 2013, G8 summit hosted by David Cameron, Prime Minister of UK who has particularly stated that a special attention shall be placed on tax dodging. The summit had been issued against the practices the rich undertake to take benefits by avoiding tax and does not pay proper cooperation tax. The issue raised by Britain in its G8 summit pays strong emphasis on the investigation to be made by the Organisation for Economic Co-operation and Development (OECD). It was also done to equalise between the rich and ordinary to stop the tricks used by MNC’s to not effectively contribute their fair share (Effects of Income Tax Changes on Economic Growth, 2014). The taxation authorities were directed to make up a template to state wherein they can make profits and determine a new tool for tax avoidance against the multinational cooperations. At this summit also a fresh agreement was signed that established on automatic exchanging of information between the taxing authorities. HMRC had been emphasised on to undertake steps to enhance their expertise skills and deal with the offshore evasion. Graham Aaronson article has identified the prominent measures that were taken to stop tax avoidance. One of them was the General anti-abuse rule (GAAR) established in the year 2013 which gave power to HMRC to override existing tax legislation in case of counteracting of abusive tax avoidance which carries a penalty of 60% as of in 2016, of the planned tax savings (Tax journal., 2016). As per UK law, it has undertaken this measure to counteract against tax avoidance scheme adopted by taxpayer aggressively. The use of anti-avoidance has helped in influencing the behaviour of taxpayer’s and kerbing the activities of those adopting avoidance schemes.

Case study 2

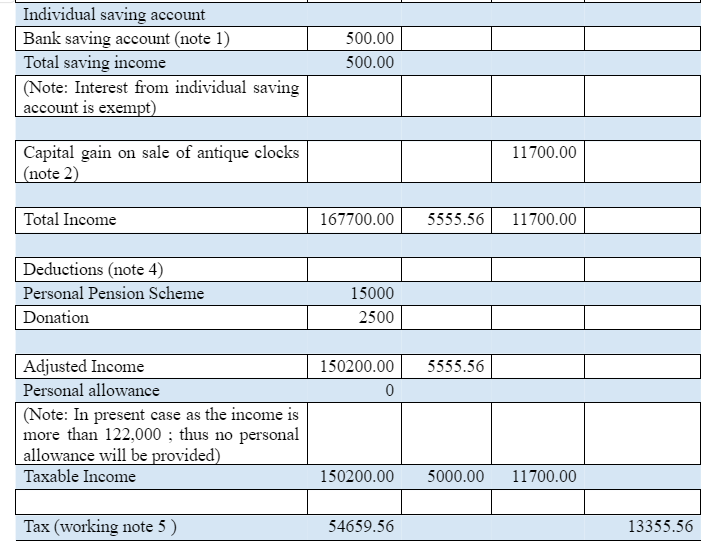

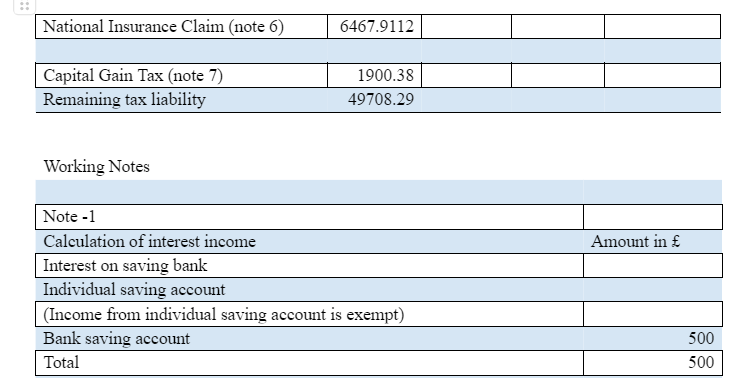

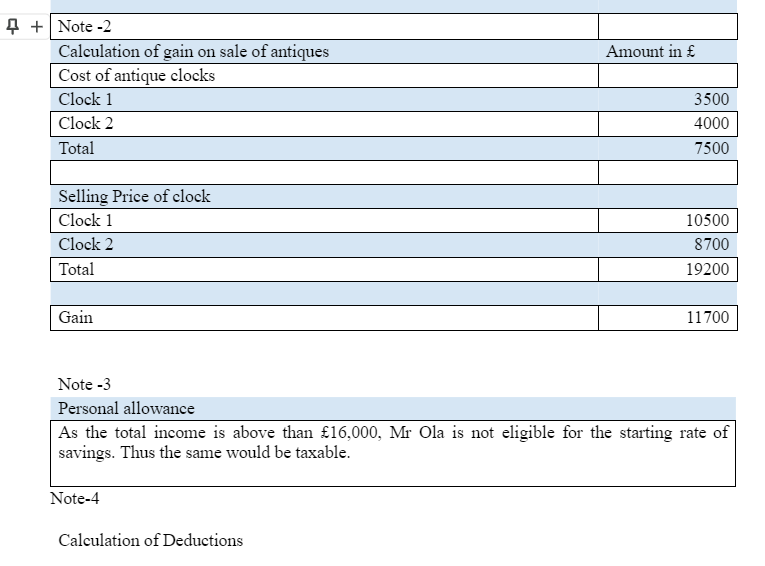

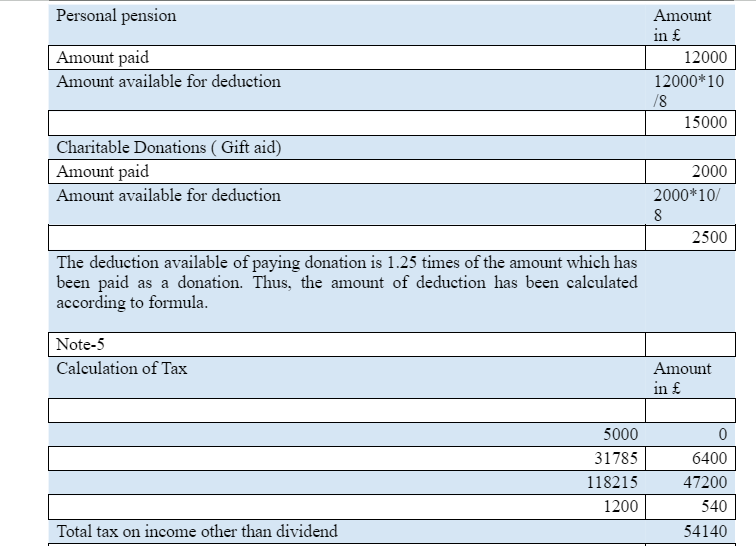

Income of Mr. Ola Alina from various sources:

Recommendations for tax planning

Tax planning is the most appropriate way of reducing tax liability. In the present case, as Mr Ola knows that income is going to be increased in the coming year; thus the deductions should be accelerated through higher charitable contributions to offset the higher income. The following alternatives are available for reducing the tax liability:

- Individual Saving account: ISA is tax efficient saving and investment accounts (Becker, Reimer and Rust, 2015.). The assessee is not obligatory to pay any tax on interest or dividend which has been earned from this account. The other benefit which can be claimed is that the profit from investments is free from Capital gain tax i.e. no tax is payable on money is withdrawn from the scheme either. The funds in this account is restricted for used for a loan but the same can be a useful tool for retirement planning as well.

- Pension Saving: The payment which is made as the pension is received as tax reliefs from HM Revenue & Customs. According to Brownlee (2016), the tax relief is overtime considerable i.e. the tax benefit is dependent on the quantum of the amount which is deposited in this account. It is the easiest way of reducing tax liability because tax relief can be claimed for every penny which has been deposited in this account.

- Premium Bonds: A premium bond refers to an efficient loan to government, and the benefit is that all the returns from the bond are exempt from tax (Wallace, 2015). These bonds are issued by NS &I and each bond are worth £1. Along with interest owner of the bond is entered into a prize drawn. The winner is chosen on a random basis, and each bond is having an equal chance of being chosen. The value of the bond is not increased with the time thus in inflation period the value is eroded. The best return from high-interest rate is presently 7%. The probability of winning is very low, but as the scheme is backed up with government scheme, it is a safe investment and tax savvy. Charity: If money is donated and Gift Aid declaration is signed than an individual can claim the basic rate of tax which has been already paid on the amount paid as a donation. It means that if £1 is donated than the deduction for £1.25 can be taken (Kalotay, 2016).

REFERENCES

Becker, J., Reimer, E. and Rust, A., 2015. Klaus Vogel on Double Taxation Conventions. Kluwer Law International.

Brownlee, W.E., 2016. Federal Taxation in America. Cambridge University Press. Christensen, J. and Murphy, R., 2004. The social irresponsibility of corporate tax avoidance: Taking CSR to the bottom line. Development, 47(3), pp.37-44.

Cobham, A., 2005. Tax evasion, tax avoidance and development finance. Queen Elizabeth House, Série documents de travail, 129.

Dyreng, S.D., Hanlon, M. and Maydew, E.L., 2008. Long-run corporate tax avoidance. The Accounting Review, 83(1), pp.61-82.

Effects of Income Tax Changes on Economic Growth, 2014. [PDF] Available at

Fuest, C. and Riedel, N., 2009. Tax evasion, tax avoidance and tax expenditures in developing countries: A review of the literature. Report prepared for the UK Department for International Development (DFID), pp.1-69.

Kalotay, A., 2016. Optimal Municipal Bond Portfolios for Dynamic Tax Management. The Journal of Investment Management, 14(1), Pp.87-99.

Kumar, N. and Wrigh, O., 2013. Google boss: I'm very proud of our tax avoidance scheme. [Online] Available at

Slemrod, J. and Yitzhaki, S., 2002. Tax avoidance, evasion, and administration. Handbook of public economics, 3, pp.1423-1470.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts