The Situation Analysis of Strongbow Cider

1.0 Introduction

One of the brands that have dominated the Australian market is Strongbow cider. It is also known as the dry cider, which used to be produced by the famous H.P Bulmer in 1962 in England. The name “Strongbow” emanated from the 2nd knights that reigned in the 12th century known as Richard de Clare. History has it that De Clare bore the nickname “Strongbow” was due to his reliance on the archers. The brand made its way into the Australian market in the year 1970 and the product remained the leading brand since then. SABMiller has been fronted as one of the key producers of the brand in the Australian market. In this context, the discussion will focus on the situational analysis of the brand while revisiting the impact of macro and microenvironment on the performance of the brand, as well as considering aspects such as history dissertation help.

1.1 Company Background

The dominance of the Strongbow cider brand also taps into the quality produced by the dominant companies in Australia. One of the key producers is a subsidiary of SABMiller, which has its headquarters in Woking, England (Birch, 2010). The multinational company was the second largest brewer across the world by the measures of revenue. Common brands attached to SABMiller include Pilsner Urquell, Fosters, and Miller. The origin of the multinational compositions dates back to the pre-acquisition in the era of the South African Breweries, which was found in the year 1895. In 2008, SABMiller worked together with Molson Coors forming a joint venture that produced beverages across the United States. In 2013, SABMiller worked together with other leading alcohol producers in reducing harmful drinking. In 2015, SABMiller was acquired by Anheuser-Busch InBev, which made Foster's group a direct subsidiary to the company (Forsyth, Ellaway & Davidson, 2013). SABMiller, as a key brand producer, as the key producer of Strongbow cider, concentrates more on the Apple juice for the purposes of producing a consistent flavour. The company has been producing a variety of the Strongbow cider brands and the common ones include crisp, lower carb and classic apple. The background of SABMiller remains a significant part of the analysis in realizing the behaviour of different factors in the market.

2.0 Situational Analysis

2.1 Market Analysis

The cider industry has shown a consistent performance for over the past five years. The image of cider, especially Strongbow and Magners, has been reinvented for the purposes of appealing to the interest and taste of the new generation of consumers. While alcohol seems to have encountered a falling demand, cider seems to move in the opposite direction (Chung, 2016; Fernando, 2018). According to the research conducted by VicHealth (2014), the growth of cider in the Australian market largely indicates the vital changes in terms of the alcohol tastes with time. The volume of cider supplied in the market grew by almost 30% in the year 2011. Besides, the sweetened ciders like Rekorderlig and Kopparberg are said to have recorded a growth of 300%. A demographic profile of the Australian drinkers indicates that young people are the dominant consumers of cider. Almost 30% of the consumers are said to age 30 years and below. Female drinkers are also likely to go for cider compared to other alcoholic beverages. Over 84% of the Australian drinkers believe that the consideration of cider is a dietary observation that leads to a healthy life. Most of the regular cider drinkers also have the tendency of drinking in a range of social situations while deeming cider as the convenient drink in big occasions (Lea, 2015). Notably, the Australian drinkers still drink ciders in some of the licensed premises such as pubs, clubs, and bars as well. Therefore, given the fact that cider is a social drink, aggressive marketing done by some of the companies have played a key role in solidifying the reputation (Birch, 2010). The trend has forced some of the alcohol manufacturers to focus on low-alcohol cider for purposes of meeting the corporate social responsibility, as well as meeting the consumer demand in the market (West, Ford & Ibrahim, 2015). The assertion indicates that cider is not only a brand but a wave in the Australian market.

2.2 Macro Environment analyses (PESTEL)

2.2.1 Political analysis

Australia has a liberal-capitalistic democracy where the state plays a number of roles through the parliament. For instance, the parliament imposes tax policies and environmental protection and national economy laws that have an impact on the alcoholic beverage industry (Guthrie, Cuganesan & Ward, 2008). The Australian government can intervene in significant international business by imposing quotas, export financing and subsidies on such companies like SABMiller. However, the government has strategically moved towards making the economy a free trade zone. The government has powers to control the Voluntary Export Restraints (VER). A stability of the government has made Sydney and New South Wales strong economic zones and stable markets for such products as Strongbow cider.

2.2.2 Economic analysis

Economic analysis focuses on such factors like interest rates, consumer confidence and inflation, which can either attract or scare businesses. Australia is among the largest capitalist economies across the world. The service sector is among many other potential sectors that contribute towards the country’s revenue. A continuous economic growth has made Australia to be ranked 10th in terms of the business index. With such a robust economy, such brands like Strongbow Cider can easily thrive. The Australian economy contains an open market characterized by minimal restrictions, which makes it easier for SABMiller to work on the Strongbow cider in terms of production and marketing (Smith & Marsh, 2007).

2.2.3 Social analysis

Socio-cultural factors include practices, behaviours, customs, and norms that prevail within a given population (Koe, & Majid, 2014) and Singh et al., 2017) Australia consists of diverse people with the society comprised of young people who have a growing taste towards cider drinking (Russell & Stewart, 2014). The country has no official religion. Roman Catholic constitutes 26%, Anglican 26.1%, other Christians comprise 24.3% of the religious people, non-Christians 11% and the rest tale 12.6%. Today, most Australians are highly educated and have an understanding of the market forces and consumption forces (Aktaş & Yeasmin, 2015). The assimilation rate of other cultural groups is relatively high thereby boosting diversity. Australian laws give freedom to every person to express cultural beliefs.

2.2.4 Technological Analysis

Technology initiates on such aspects like automation and R&D activity among other technical initiatives. Australia has benefited from Research funding with over $30 billion being spent on R&D in 2010 and 2011. The investment focused more on Australian businesses through commercialization of the IP. With such technical milestones, brands like Strongbow cider can thrive in such automated business environments. Permanent internet in Australia has supported businesses in embracing digital platforms, which can make Strongbow cider brand to benefit from online marketing (Guthrie, Cuganesan & Ward, 2008).

2.2.5 Environmental analysis

Australians are gradually replacing the fossil fuels with renewable sources of energy such as solar and wind. Businesses supporting the move are highly invited into the promising economy (Aaker & McLoughlin, 2010). The government has sound environmental laws said to contain the climatic change. This means that Australia is part of the global mission that looks at the climatic issues and responding to them by considering significant measures. Businesses are encouraged to support waste management and societal clean-up (Wright, & Nyberg, 2017; Peel, 2015).

2.2.6 Legal Analysis

The Australian regulatory obligations are designed to impact mandatory protection and fair competition in the market (Anderson, Meloni & Swinnen, 2018). Being a member of WTO, the Australian government has kept the tariff at friendly levels that allow businesses to trade (Lanis, McClure & Zirnsak, 2017). The Australian law also incorporates the intellectual property rights such as copyright protection, patent protection and trademark protection that protects products and businesses.

2.3 Micro Environment Analysis

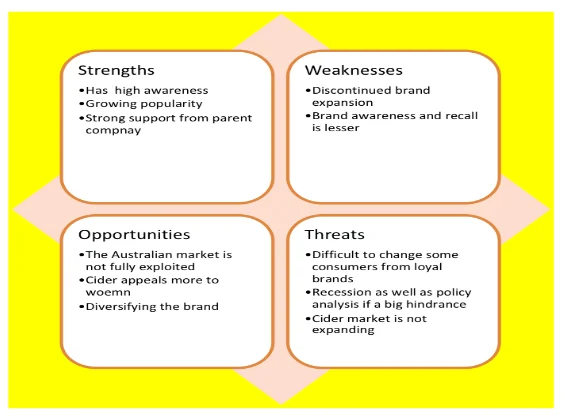

The brand has a substantial support from the parent company, SABMiller brewing Company, which makes it perform well in the global markets (Bieller & Douglas, 2014). It has a growing popularity across the world after serving as the best alternative to beer. Can be served in different tastes with some having sugars and others having none of it.

Chances of overconsumption are high due to the fact that some of the flavours are sweeter. The brand has been suffering from discontinued brand extensions with some of the trials producing negative results. Lack of awareness in some of the regions has lessened the international performance of the brand (Morey et al., 2017).

Summary of the company

SABMiller has been behind the success of Strongbow cider brand. While the entrance of the brand into the Australian market raised the expectation of the product, the long history of SABMiller bears a strong reputation to the brand.

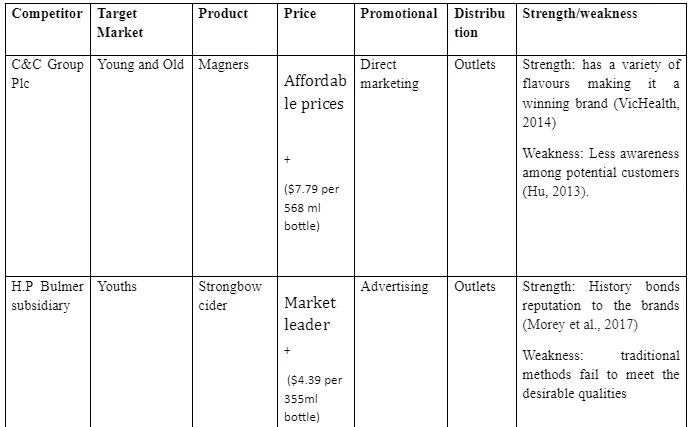

Competitor Analysis

SABMiller Strongbow cider brand has consistently been facing competition from other cider brands and beer brands in the Australian market. Key competitors include brands from C&C Group Plc., H.P Bulmer subsidiary and Kirin-owned. The three are simply part of many other companies that have taken a lead in terms of providing the alcoholic beverages to the Australian market. Across the three competitors in the larger alcoholic beverage industry, they all provide a single brand in many forms. For instance, C&C Group Plc shares a victorious history of producing Magners, which is served in form of Magners Blonde, Magners Pear and Magners Original (C&C Group Plc., 2014). SABMiller, on the other hand, shares a history of serving different flavours of Strongbow cider. Secondly, the players are essentially subsidiaries to multinational companies said to have the competencies and resources to push for the popularity of the brand. However, the three still showcase key differences in the way they develop their products, and how quality is tailored towards the market preferences. First, C&C Group Plc tailors the brands to meet the consumer taste through the provision of separate flavours served in different volumes. Magners, for example, adopts the traditional methods in serving the brand in 330ml and 568ml. The company still avails 17 varieties of the brewed Apple juice that primarily targets youngsters. On the other hand, H.P Bulmer brews its cider by use of the bitter-sweeter blend and the culinary apples (Madsen, Pedersen & Lund-Thomsen, 2011). This has made it serve 50 different varieties to young and old Australian drinkers. Besides, Kirin has consistently been dropping its market share with time leaving it with no strong brand in the market.

Consumer Analysis

Based on the research by VicHealth (2014), the dominating consumers of Strongbow cider brand include the young Australian adults aged above 30 years. The study estimates that 23% of the young adults consuming the Strongbow cider have their ages ranging from 30-39%. However, 30% of the active drinkers are aged less than 30 years, 18% of the Australian drinkers are aged 40-49 years while only 13% are aged above 50 years. The young drinkers prefer drinking the cider on big occasions as well as licensed bars, pubs and clubs in Australia (Morgan, 2016). Regular cider drinkers prefer buying the cider brand in the evenings because it has always been treated as a brand of beer that provides pleasure after working the whole day. Due to the low alcoholic content, most of the youths buy in relatively large amounts. However, for young female graduates carrying a dietary perspective, they would prefer having the drink in small bits.

SWOT analysis

Recommendations

The Australian market is quite promising in terms of the untapped potential of young who are deviating from beer to cider. Based on this trend, it is recommendable that SABMiller should enhance online marketing where majority of young retailers are shopping online. The platforms that may be used include the social media and others. Secondly, cider can be served along with other popular brands of beverages to develop the best combination that can win the expectations of the market.

Continue your journey with our comprehensive guide to The Significance of Time Management and Prioritization for Personal and Professional Developmen.

References

- Aaker, D. A., & McLoughlin, D. (2010). Strategic market management: global perspectives. John Wiley & Sons.

- Aktaş, E., & Yeasmin, N. (2015). Market Entry Strategies of Multinational Companies in Austria: An Empirical Analysis of Food and Beverage Industry. AV Akademikerverlag.

- Anderson, K., Meloni, G., & Swinnen, J. (2018). Global alcohol markets: evolving consumption patterns, regulations and industrial organizations.

- Bieller, M. B., & Douglas, E. (2014). Craft Cider in British Columbia: A Comparative Study of Regional Cider Production and Regulatory Environments.

- Birch, D. (2010). Commercial operations. Annual Report 2010: Australian Football League.

- C&C Group Plc. (2014). Magners voted best cider in Australia. Retrieved from:

- Chung, F. (2016). Alcohol consumption to hit 55-year low. [online] NewsComAu. Available at:

- Forsyth, A. J., Ellaway, A., & Davidson, N. (2013). How might the alcohol minimum unit pricing (MUP) impact upon local off-sales shops and the communities which they serve?. Alcohol and alcoholism, 49(1), 96-102.

- Gordon, R. (2011). An audit of alcohol brand websites. Drug and alcohol review, 30(6), 638-644

- Koe, W. L., & Majid, I. A. (2014). Socio-cultural factors and intention towards sustainable entrepreneurship. Eurasian Journal of Business and Economics, 7(13), 145-156.

- Fernando, G. (2018). How much is too much? Truth about alcohol in Australia. [online] NewsComAu.

- Guthrie, J., Cuganesan, S., & Ward, L. (2008, March). Industry specific social and environmental reporting: The Australian Food and Beverage Industry. In Accounting Forum (Vol. 32, No. 1, pp. 1-15). Elsevier.

- Hu, C. (2013). Opportunities for the brave: flavoured alcoholic drinks. South African Food Review, 40(8), 52-54.

- Lanis, R., McClure, R., & Zirnsak, M. (2017). Tax aggressiveness of alcohol and bottling companies in Australia. Canberra: Foundation for Alcohol Research and Education.

- Lea, A. (2015). Craft cider making. Crowood.

- Madsen, E. S., Pedersen, K., & Lund-Thomsen, L. (2011). M&A as a Driver of Global Competition in the Brewing Industry. Aarhus University, Business and Social Sciences, Department of Economics and Business, 21-24.

- Morey, Y., Eadie, D., Purves, R., Hooper, L., Gillian, R., Warren, S., ... & Tapp, A. (2017). Youth engagement with alcohol brands in the UK. Morgan, R. (2016). Somersby and Strongbow leading the cider boom. Retrieved from:

- Peel, J. (2015). Next generation environmental laws: Climate law and policy. Australian Environmental Law Digest, 2(4), 10.

- Singh, B., Verma, P., & Rao, M. K. (2017). Influence of individual and socio-cultural factors on entrepreneurial intention. In Entrepreneurship Education (pp. 149-169). Springer, Singapore.

- Russell, I., & Stewart, G. (Eds.). (2014). Whisky: technology, production and marketing. Elsevier.

- Smith, K., & Marsh, I. (2007). Wine and economic development: technological and corporate change in the Australian wine industry. International Journal of Technology and Globalisation, 3(2-3), 224-245.

- VicHealth. (2014). Attitudes of Australian cider drinkers. Preventing harm from alcohol. Retrieved from:

- West, D. C., Ford, J., & Ibrahim, E. (2015). Strategic marketing: creating competitive advantage. Oxford University Press, USA.

- Wright, C., & Nyberg, D. (2017). An inconvenient truth: How organizations translate climate change into business as usual. Academy of Management Journal, 60(5), 1633-1661.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts