A Case Study on Drax Power Station Project In

Project finance involves the course of financing a particular commercial unit that the funders establish, creditors, share more of the project’s business risk and capital is attained only for the project. Project financing establishes worth by decreasing the cost of funding, sustaining the sponsor's financial elasticity, growing the leverage ratio, reducing corporate levies, limiting the necessary costs that are linked with market deficiencies. Nonetheless, project finance dealings are multifaceted activities, which involve higher costs of lending as equated to conventional financing and the conciliation of the financing and operating contracts take much time. In this regard, this paper will look at the Drax Power Station Project in the United Kingdom For students who are grappling with such intricate concepts, seeking UK dissertation help can provide the best support.

Summary of the Project The Drax Power Station started in two significant phases, that is in 1974 and 1986, and is among the most significant power generators in the United Kingdom, providing enough electricity to meet the electricity demands of six million households. According to its purpose, the Drax Power Station is a strategically significant power asset not only for the Yorkshire region but to the broader United Kingdom. The project was conducted after decades of research and developed by the Drax Group to enhance the Yorkshire power station into a predominantly biomass-fuelled generator. By 2016, the project has been concluded reducing the plant's dependence on coal and expanding the renewable energy section. The project involved complex modification of the power plant and the development of the whole infrastructure to manufacture and deliver the wood pellet fuels to the site in Selby (Nelson et al. 2018, p. 662). The initial owners of the project, National power was mandated to deprive some of its production capability when it bought the distribution business of Midlands Electricity, which is among the regional firms dealing in electricity production. Later, a USA based organisation (AES Corporation)

acquired the Plant for 3 billion USD, which was a more significant value than the anticipated, and later financed the plant with significant leverage (Davis 1996, p. 171). The electricity price protection is among the facets that were used to justify the leverage from a hedging contract with its subsidiary in the United Kingdom. The financing framework, the purpose of the study, the risk involved and the possible lesson learnt on this study, makes it a suitable project for analysis, since various aspects of the project highlight the fundamental practises of project finance, such as debt management, debt ratios, policy analysis and risk analysis, which is useful for both professional and learning objectives. Background Before 2001 electric power in England was traded between the power plant and contractors via a day-ahead market referred to as the pool, managed by the National Grid Company Plc. The pool is applied in determining the generators that ought to be dispatched to satisfy the demand for electricity. The pool system was criticised for resulting in high power prices and was subjected to gaming by the biggest generators, that could withdraw capacity to keep the price of electricity high.

Continue your exploration of The Relationship Between GDP and Consumer Purchasing Power with our related content.

In 2001 the government implemented the NETA system that replaced the pool system and created a competitive market. Instead of selling the Pool, companies that generated electricity were required to find clients and arrange a bilateral contract with them. This system exposed generating companies to dispatch risks to the extent that they generated the electricity they could not sell or sold power that they could not generate (Simshauser 2014, p. 201). In the previous arrangement, the operator assumed this risk. In the new system, a short-term balancing mechanism referred to as the UK Power Exchange sets the price for electricity sold from four hours to two days ahead. In this framework participation is voluntary. Project Financing The project was financed in two phases; the first phase involved a £1.3 billion bank financing at the time of purchase in 1999, and a second bond financial in 2000. Banking Financing

Looking for further insights on World Bank Financing? Click here.

The lead planners for the initial bank financing were Chase Manhattan, who was the book managers, rating counselors, and financial modeling bank. The Deutsche Bank acted as a loan documentation bank and facility representative. On the other hand, the Industrial Bank of Japan acted project documentation and insurance bank. The leading planners faced three challenges, which are the size of the financing was not expected, the electricity plant was partly exposed to merchant power risk, and the project had high control. The co-planners earned an underwriting fee of 35 bps for commitments of US $50 million or more, where the Abbey National Bank of Scotland, Bank of Tokyo Mitsubishi, Rabobank, National Australia Bank, Fortis Bank and Rabobank (Nelson and Simshauser 2013, p. 306.). Among the elements that justified the Drax’s project high leverage was 15- year prevaricating contract, a financial instrument that has the result of a power purchase agreement (PPA), which provided for a fixed stream of capacity costs. These contracts protect approximately 60% of the electricity plant forecasted revenue until 2007, and then the percentage of revenue protected was to decrease over time, such that throughout the contract, approximately 40% of plant revenue would be protected. Drax ratified the hedging agreement with Texas Utilities (TXU), who are the owners of Eastern Electric. Before TXU purchased eastern Electric company, East Electric company was

Dig deeper into Small and Medium-Sized Enterprises (SMEs) and Funding Issues in Glasgow with our selection of articles.

among the most significant regional producers of electricity. At the same time, TXU was among the significant power distributors of electricity on the eastern side in England (Simshauser and Laochumnanvanit 2012, p. 66). When the directors of AES negotiated the agreement, they knew that TXU had strong desires to own Drax, but that was subject to various limitation because it had a large share of the electricity generation market. Both of the principles could have thought of raising the electric production through this agreement but were afraid that if the percentage could be too high, the treaty would appear to the regulators to be a de facto acquisition of the production plan by TXU (Simshauser 2014, p. 555).

The outcome of the hedging contract reinforced the credit of the project by giving, on the one hand, a steady revenue stream, while on the contrary leaving a considerable amount of prediction revenue subject to merchant risk. AES was confident on its capability to trade and manage this risk, but merchant risk could be a crucial issue for various financial institutions involved in loaning the project (Simshauser and Ariyaratnam 2014, p. 157). In respect to the loans involved and the magnitude of the deal, the bank under-writers wanted a credit rating for the loan and worked with AES to ensure that the rating would be investment grade. Financing the Bond In 2000 AES, Drax Holding Ltd gave £400 million corresponding senior secure bonds in 2020 and 2025 to reimburse part of the £ 1.3 billion bank financing for InPower Ltd. Besides, AES Drax energy Ltd gave £250 million equal high-yield, profoundly subordinate notes to refine a bridge loan of a similar amount made to AES at the time the plant was purchased. inPower Ltd is a specialised agency, while AES Drax Holding Ltd and AES Drax Energy Ltd were indirect companies of AES Corporation (Sathaye et al. 2001, p. 351). Dividend dispersals tune the subsidiary debt after working expenditures, senior debt service and full backing of essential

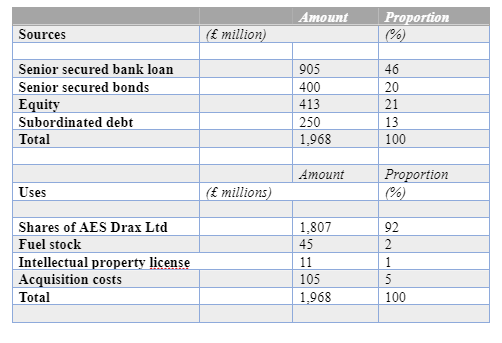

fall-back accounts. These dispersals are subjects to different tests and come before distributions to the primary entity, which are subjected to 1.5-time semi-annual debt service coverage ratio assessment on both a one year historical and forward-looking two-year foundation. The high-yield debt broadened the expected life of Drax’s whole debt financing from about 11 to 17 years and provided an uplift to the sponsor’s returns. Even so, it hypothetically increased the risk of senior debt and could not have been issued devoid of the agreement of senior lenders to weaken their protection against junior debt (Ye and Liu 2008, p. 96). The most prominent lenders were specifically concerned that the high-yield debt is extremely subordinated not to expose the investment-grade credit rating on the senior debt. Sources and Uses of funds The funding of this project after the bond funding is replicated in the sources and uses of the fund as shown in the table below.

The primary Senior Debt Service Reserve Account had to be greater of six months of debt service or above £50 million. That value increases in equivalent semi-annual stages to the greater of 12 month’s debt service or £100 million on the 15th semi-annual repayment date. It is then decreased in equivalent steps to the original balance on the 20th repayment date, given that the adjusted debt service coverage ratio over the next ten repayment dates is more than the ratio between 1.45 and 1.75 times, the precise level dependent on the level of hedged capacity. The total levels of Debt Service Reserve Account are reduced by intended prepayment of the senior debt. As depicted in the table below, the distribution test contains the tree ratio thresholds; these are the one-year historic average debt service coverage ratio, the two-year projected and the five-year projected.

After giving senior bonds and low notes, the bondholders and creditors were subjected to various risks such as; volatile and low-priced electricity, the uncertainties on the effect of NETA, which could have negatively affected the company’s competitive advantage, and merchant risk. Besides, the electricity generation market was changing because of regulatory and politically driven changes, which unbalanced various fuel sources, which were mainly the coal-generating units.

Lesson Learnt

Three valuable lessons can be drawn from the Drax project. First, the impacts of the NETA were not correctly examined, and the results turn out unexpected. Besides, the leverage rate of Drax was too high, and therefore, it could not withstand the deterioration in wholesale electricity prices and the associated upheaval in the United Kingdom market (Piterou et al. 2008, p. 2050). Lastly, the high growth, high-leverage company, AES was exposed to the combination of a global reduction in the wholesale price of electricity, economic recessions in South America and the trickle-down effects of the Enron bankruptcy.

The success of AES in restructuring its debt management and increase project financing is mainly determined by its success to execute assets sales as soon as possible. Besides, AES had earlier committed to selling as much as 1 billion USD of surplus assets. The rating agency revealed that the rating on the prospective senior secure bonds and bank credit facilities was allocated to the senior implied level since the guarantee was majorly stock in a subsidiary, rather than a entitlement on the basic physical assets. The newly acquired bond and a loan from the bank at the holding company level can be organisationally subordinated to a more substantial sum of debt at the secondary level, like in the case of Drax.

References

- Davis, H.A., 1996. Project finance: Practical case studies. London: Euromoney Publications. Nelson, J. and Simshauser, P., 2013. Is the merchant power producer a broken model?. Energy Policy, 53, pp.298-310.

- Nelson, T., Orton, F., and Chappel, T., 2018. Decarbonisation and wholesale electricity market design. Australian Journal of Agricultural and Resource Economics, 62(4), pp.654-675.

- Piterou, A., Shackley, S. and Upham, P., 2008. Project ARBRE: Lessons for bio-energy developers and policy-makers. Energy Policy, 36(6), pp.2044-2050.

- 2001. Barriers, opportunities, and market potential of technologies and practicSathaye, J., Bouille,Simshauser, P. and Ariyaratnam, J., 2014. What is the normal profit for power generL., Peszko, G. and Verbruggen, A.ation?. Journal of Finan D., Biswas, D., Crabbe, P., Geng, L., Hall, D., Imura, H., Jaffe, A., Michaelis, es. Climate change, pp.345-398.

- cial Economic Policy, 6(2), pp.152-178. Simshauser, P. and Laochumnanvanit, K., 2012. The political economy of regulating retail electricity price caps in a rising cost environment. The Electricity Journal, 25(9), pp.48-66.

- Simshauser, P., 2014. From First Place to Last: The National Electricity Market's Policy‐Induced ‘Energy Market Death Spiral.’ Australian Economic Review, 47(4), pp.540-562. Simshauser, P., 2014. The cost of capital for power generation in atypical capital market conditions. Economic Analysis and Policy, 44(2), pp.184-201.

- Ye, S. and Liu, Y., 2008. Study on development patterns of infrastructure projects. Journal of Construction Engineering and Management, 134(2), pp.94-10.

Dig deeper into World Bank Financing with our selection of articles.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts