Financial Analysis and Management Decision-Making

Solution 01 (a): -

In the Books of Ayla King

Income Statement

For the period ending 31 December 2020

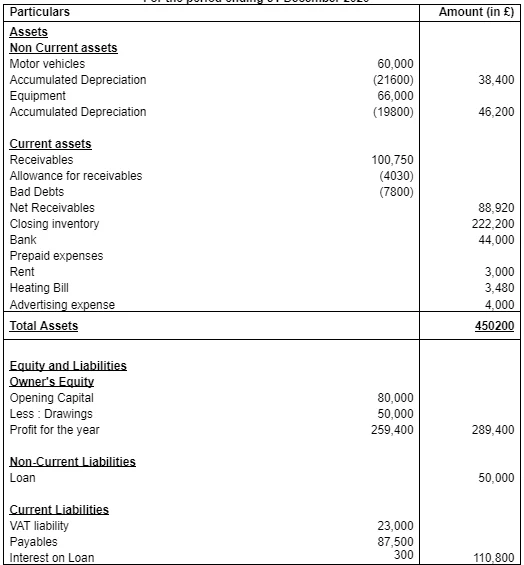

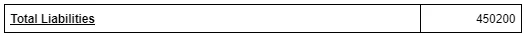

Solution 01 (b): -

In the Books of Ayla King

Balance Sheet

For the period ending 31 December 2020

Working Notes :-

1) Rent

Rent expenses includes prepaid amount of £ 3,000 hence it will not be shown in income statement as it does not belong to current Financial Year. Thus,

Rent as per Trial Balance 35,500

Less : Prepaid Expenses (3,000)

32,500

2) Heating and Lighting expenses

Heating and Lighting expenses are estimated at £ 920 for current Financial Year thus only £ 920 will be taken into consideration and rest amount will be treated as prepaid expenses and will be shown in Balance Sheet.

3) Advertising expense

Advertising expenses of £12,000 are paid for 3 months (November 2020 – January 2020) thus, £ 4,000 will be treated as Prepaid and will be shown in Balance Sheet.

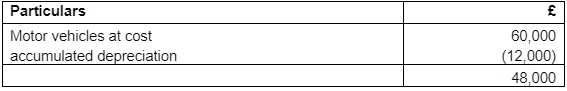

4) Depreciation on Motor Vehicle

48,000 @ 20% p.a. = 9,600/-

5) Depreciation on Equipment

66,000 @ 10% p.a. = 6,600/-

Since, here Straight Line Method has been followed; accumulated depreciation will not be deducted from cost of the asset.

6) Interest on Loan

Loan 50,000

Interest on Loan @ 6% p.a. for 10 years (3000/10) 300

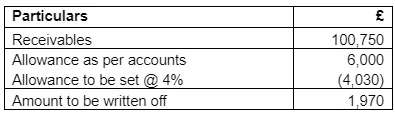

Allowance for receivables

Solution 03 –

Solution 4 (a) :-

100,800 - 80,400 = 20,400 /-

At activity lever 5,200, the fixed cost is £ 80,000 as it is in the relevant range of 3,000 to 6,000 Units. For Activity Level 2,600, the fixed cost is £ 70,000 as it below the range of 3,000. The variable cost for all activity level remains same at any level of production which is £ 4 per unit. Thus when total costs are calculated for both level of productions, it comes to £ 100,800 and £80,400 respectively.

Answer : The difference between Total Costs at an Activity Level is 20,400

Solution 4 (b) :-

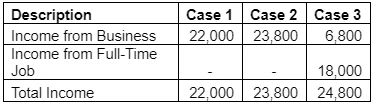

There are three alternatives before Carlos:-

Case 1 : Earn annual net profit of £ 22,000 from current business.

Case 2 : Sell the current business for £ 340,000 and invest the same amount in another business earning an annual return of 7%.

Case 3 : Sell the current business and earn an annual return of 2 % from Local Bank and get a Full-time Job earning 18,000 per annum.

If Carlos opts to sell his business for £ 340,000 and invests the same amount in another business, he will get an annual return of 7 % per annum which is £ 23,800. In this case £ 1,800 is the opportunity cost for Carlos in continuing to run his business.

If Carlos opts to sell his business for £ 340,000 and earn annual return of 2% from a local bank, and get a full time job that pays him £ 18,000 per annum, he will earn a total of £ 24,800. In this case the opportunity cost for Carlos in continuing to run his business is £ 2,800.

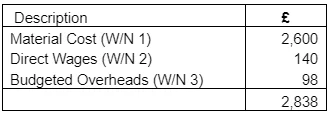

Solution 4 (c) :-

Calculation of Production cost of job AC45

Working Notes :-

1. Material Cost :

It is given that material consumed for manufacturing of AC45 is £ 2,600.

2. Direct Wages :

Direct wages for overall production department is £ 64,000. It is provided that Direct Labour Hours Worked is £ 12,800. Thus to get Direct Wages for manufacturing AC45 will be calculated as :

Labour Hour Rate = Direct Wages / Direct Labour Hour Worked

=64,000/12,800

= 5 Per Hour

Direct Wages for AC45 = Direct Labour Hour incurred x Labour Hour Rate

= 28 x 5

= 140

3. Budgeted Overheads :

Overheads for overall Production Department is £ 44,800. And it has been provided that Overheads are absorbed on the basis of Labour hours, thus, to calculation for overheads allocated to job for manufacturing AC45 are as under :-

Overheads Absorption Rate = Budgeted overheads / Direct Labour Hour Worked

= 44,800 / 12,800

= 3.5 per labour hour

Budgeted Overheads for AC45 = Overhead Absorption Rate x Direct Labour Hour Incurred

= 3.5 x 28

= 98

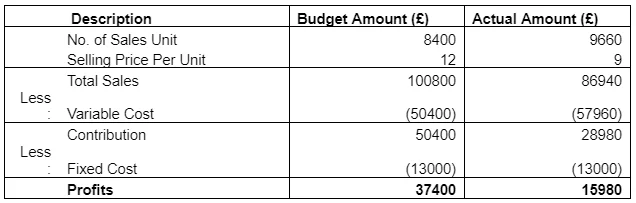

Solution 4 (d) :-

The actual profits made by Le Clerc is £ 15980.

Continue your exploration of Finance is Considered as the Life Blood with our related content.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts