Impact of Directors’ Share Purchases

Introduction

Event study is undertaken to assess the effect of certain events occurring in 2014 and 2015 on the returns of a few particular stocks. Such studies are undertaken to determine the impact of a particular event on the returns of a security or an asset. These events, in this case, are essentially directors buying shares of their own companies, and can be listed as follows:

Market model is applied on the stock market data to estimate normal returns, with estimation period of 43 days prior to the event in each stock. Using the market model, the intercept and the slope values as well as the standard error values are calculated and normal returns are predicted each security. Them, abnormal returns and Cumulative abnormal returns are calculated based on 3 distinct event windows; 3 days before and after the event, 5 days before and after the event, and lastly 10 days before and after the event. This gives useful insights on the effect of each particular event on each particular stock. T test is conducted to detect if the results are significant, taking 1.96 as the critical value at 95% confidence level. If the calculated t value is less than 1.96, then the results are said to be insignificant and vice versa.

Results and Findings

INTUP

AR(0) describes the immediate effect of the event on the stock returns of INTUP, whereas AR(1), AR(2) and AR(3) describe the mean abnormal return in 3 days before and after, 5 days before and after and 10 days before and after time windows effect of the event. It is evident that the event caused a negative effect on the stock returns, since both the average cumulative abnormal returns as well as average abnormal returns turned out to be negative for all events. The event caused an immediate drop in the returns over the market returns by 0.9%. The t test showed that most of the results were insignificant, except for the 10 day before and after average cumulative abnormal return, which was a negative 3% return. Thus, it can be concluded that the event led to an overall negative effect, but not big enough to be statistically significant.

BP

Similar to the previous case, the event caused a negative effect on the returns of BP, as all the average abnormal returns as well as average cumulative abnormal returns turned out to be negative. There was an immediate negative effect of 1.28% on the abnormal stock returns due to the event. While the average abnormal returns were insignificant, the cumulative returns turned out to be significant, since the calculated T statistic was greater than 1.96. Overall, there were more mean negative abnormal returns and cumulative abnormal returns than positive. Thus, it can be concluded that the event affected the above normal returns of the stock in a negative manner.

OML

For the stock ‘OML’, it is difficult to deduce whether the event had a negative or positive effect on the stock returns. The immediate effect of the event is just a 0.56% drop in the abnormal return. Similarly, the abnormal returns of all the other event windows were significantly low. The cumulative abnormal returns were also significantly low. The number of average negative returns were more than the number of positive returns for all cumulative as well as abnormal returns. However, the T test for each of the abnormal returns for different event windows as well as the cumulative abnormal returns showed that the results were insignificant, since all T values calculated were less than the critical value of T. Thus, it can be concluded that there was an overall negative effect on the above normal returns of the stock, but the effect was not big enough to be statistically significant.

VOD

Similar to the previous case, it is not possible to extract concrete results from the table above. The immediate effect of the event turns out to be a 0.47% drop in the above normal returns of the stock, however, the rest of the mean abnormal returns show a low but positive effect. Similarly, the mean cumulative returns show a low positive effect. Overall, there were more positive returns than negative returns in all time event windows. Conducting T test shows that all results are statistically insignificant, since the calculated T statistics are significantly lower than the critical value. Thus, it is evident that there was a positive effect of the event on the above normal stock returns, however, the effect was not big enough to be statistically significant.

MRW

Similar to the previous case, it is not possible to determine clear cut conclusions for this particular stock. The value of AR(0) shows that the event caused an extremely low negative effect on the above normal returns of the stock, immediately after the event occurred. The mean abnormal return values of all the other time windows show similar results, with a low value of effect on the returns of the stock. The low value shows that the event did not cause any major change in the returns of the stock. Similarly, the average cumulative abnormal return values were also very low. There were more positive returns than negative returns in all time windows. Thus, the event caused a very low positive effect. However, conducting T test reveals that the results for abnormal returns and cumulative abnormal returns are insignificant, since the calculated T statistics are less than that of the critical value (1.96). Thus, it is evident that the event did not cause a change big enough to be statistically significant.

STAN

It is evident that the event affected the stock returns in a negative manner. The AR(0) value suggests that there was a temporary rise in the above normal return of the stock by 0.63%, which lasted for a day. The mean abnormal return values for all other time windows suggest a negative effect of the same. The mean cumulative abnormal returns for all time windows were extremely high, and negative. There were more negative returns in the time periods than positive. Conducting T test shows that only cumulative abnormal returns are significant, since the calculated T statistics are significantly greater than 1.96. Thus, it is evident that the event caused a very high negative effect on the above normal returns of the stock, which were statistically significant.

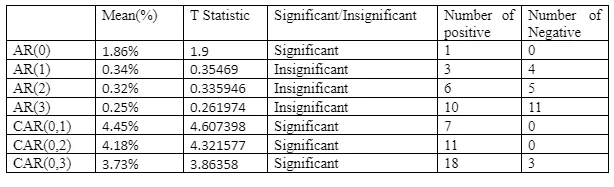

CNA

It is evident from the positive average AR and CAR that the event had a positive impact on the stock returns. The day of the event itself, the stock price outperformed the market by 1.86%. Thus, the event caused an immediate positive rise in the above normal returns of the stock by 1.86%. As for the mean abnormal returns of all other time periods, the effect was low but positive. When it comes to cumulative abnormal returns, the values were significantly high, and validates the positive effect explained using abnormal returns. Conducting T test, the immediate effect as well as all cumulative abnormal returns turn out to be significant, since the calculated T statistics of these were much greater than 1.96. Thus, it can be concluded that the event had a high positive impact on the above normal returns of the stock, and these results were statistically significant.

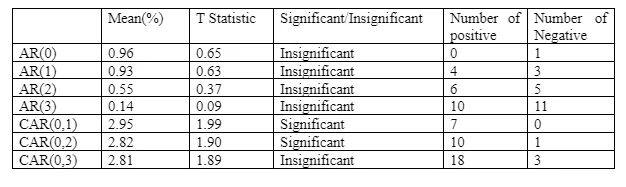

GFS

Similar to the previous case, the event had a positive impact on the above normal returns of the stock ‘GFS’. There was an immediate rise in the abnormal returns of the stock by 0.96%, while the mean abnormal returns of all other time periods also remained positive. The mean cumulative abnormal returns were very high, which shows a high positive effect of the event. On average, there were more positive returns than negative in all time periods. Conducting T test shows that only the cumulative abnormal returns of 3 days before and after and 5 days before and after were significant. Thus, the event caused a positive effect on the above normal returns of the stock, and the results were significant.

ITRK

The event caused the stock the outperform the market, with positive AR and CAR values, and higher number of positive returns. The value of AR(0) of 0.37% shows that there was an immediate rise of the abnormal returns of the stock by 0.37%. The average abnormal returns of all other time windows show similar results. However, the AR(2) value of 0 suggests that the temporary rise was neutralized in 5 days. Similarly, the cumulative abnormal returns were positive and high, validating the fact that the event caused a positive effect on the stock. Conducting T test, it shows that the cumulative abnormal returns were statistically significant, since the calculated T values were much greater than the critical value. Thus, the event caused a positive effect on the above normal returns of the stock, big enough to be statistically significant.

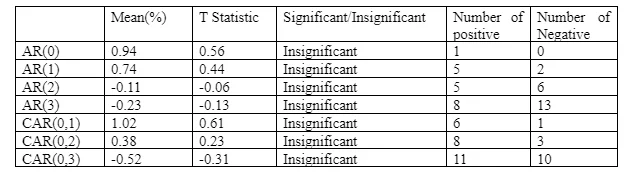

KGF

It is not possible to draw concrete results from the table above. The immediate effect of the event was positive, with a 0.94% rise in the abnormal returns of the stock. However, as we shift to different event time windows, the positive effect turns into a negative effect. Thus, it is difficult to determine whether there was a positive or negative effect. The cumulative abnormal returns showed a similar pattern, with a positive effect in a 3 day window, but a negative effect in a 10 day window. The positive and negative returns were at par in all time periods. Conducting T test shows that all abnormal returns and cumulative abnormal returns were statistically insignificant, since the calculated T values were less than 1.96. Thus, it is not possible to extract concrete results from the table.

MGGT

The event caused a negative effect on the above normal returns of the stock. On the event day, the stock returns outperformed the market returns by approximately 3%, thus showing a positive impact of director buying its own shares. But this effect was only temporary, as the abnormal returns of other time periods shows that the effect was more negative than positive. Similarly, the cumulative abnormal returns of each time period show a very high negative impact on the stock abnormal returns, on average. The T test shows that the cumulative abnormal returns of 3 day and 5 day time windows were statistically significant. Thus, the event led to a negative effect on the above normal returns of the stock.

LLOY

It is not possible to draw significant and concrete results from the above table. The value of AR(0) shows an immediate rise in the above normal returns of the stock by 0.79%. This effect is only temporary, as all other abnormal return values show a negative effect. Similarly, the cumulative abnormal return values show a low negative impact of the event on the returns of the stock for all time windows. There were more negative returns than positive returns, on average. T test shows that none of the abnormal returns or cumulative abnormal returns are statistically significant. Thus, the event caused a negative effect on the above normal returns of the stock, but the effect was not big enough to be statistically significant.

Conclusion

The above report provided useful insights from the event study on whether directors buying stocks of their companies have any affect on stock prices as compared to the market. While some events had little to no effect on the stock’s performance, and turned out to be insignificant, most events had either a positive or negative impact. Directors buying stocks in companies like BP and STAN caused the stock to underperform as compared to the market, whereas CNA, GFS, ITRK and MGGT outperformed the market significantly with positive returns. Thus, the event study helped yield concrete results. On average, there was an overall positive effect of the directors buying shares of their own companies, since most of the stocks outperformed the market after the event. Thus, UK firms do enjoy the benefit of their directors announcing the purchase of shares of his/her own company.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts