Islamic Finance and Ethical Investment

1. INTRODUCTION

Islamic financial system in particular Islamic banking is a relatively new concept in the western countries. The broader aim of Islamic banking is much more than a mere prohibition of interest. It clearly and with justification indicates that the finance could be linked to ethical behaviour that could better serve the society in which we live. The whole idea behind the Islamic Financial System is to eradicate social injustice through fairer wealth distribution.

The close relationship of the Islamic Financial System with the Islamic faith might cause doubts among non-Muslims perhaps more out of fear for the not known. Due to increasing Internationalisation and Globalisation, today’s society especially in Arab countries and its financial systems get closer to us and need to be understood to appreciate it.

When Islamic finance appears for the first time, and its ethical values were introduced, most regarded it as a utopian dream by the financial systems of the globe. However, the attitudes of people have been changing gradually and rapidly in the past 10-15 years the conventional banking system has slowly but surely started to trouble the conscience of an increasing number of people both Muslims and non-Muslims. There is a general feeling that the people are reluctant to offer their funds to large financial co-operation, which will invest in businesses associated with immoral and socially harmful business activities.

This section of the study explores the background of Islamic financial systems with particular reference to banking in the UK as well as in the world in general. Islamic banks and institutions, which have been set up based on shariah, the Islamic law. Shariah has been in existence for a long time, but the Islamic financial system came into operation together with the principle of profit and loss share investment by the Bank of Egypt. Since then Islamic financial institutions have spread to banking, mortgages, asset management and more recently into Trading debts and Insurance. The estimated annual growth in this new industry is 15-20%. According to Steward (2008), real growth in this sector started in the late 1970s with product development and investment techniques. Bank of Dubai was the first Islamic bank that was established in 1975. It offers a variety of banking services to name few personal, auto and home finance to cater to the need of Muslims, which is by Shariah.

Looking for further insights on Globalization's Impact on Employment Relations? Click here.

1.1 History of Islamic Banking

Modern conventional financial and banking institutions were introduced to the Muslim world at a time when they were underdeveloped, in the mid part of the 1900’s. The home countries central banks of the imperial superpowers promoted and started local subsidiaries in the capital of the subject countries. The main focus was on import and export requirements of overseas parent companies. These branches/subsidiaries were mainly located in capital cities and rural population were largely untouched by these banks. The local population avoided and ignored these overseas financial institutions for religious as well as nationalistic reasons. However, with the lapse of time, it became unattainable to engage in commercial activities without involving the banks especially for commercial transactions. Even then most people restricted their involvement to transaction activities, for an examples of money transfers and maintaining current accounts. Hence depositing and borrowing from the bank were avoided with a view of keeping away from dealing with interest that is prohibited by Shariah.

As a result of economic and other socio changes around the globe, it became almost inevitable to altogether avoid the involvement of banks in pursuit of economic and financial advancement. Consequently, local banks were established in conjunction with interest-bearing overseas banks want of new system, and they started to expand rapidly within the country bringing this new system to the local community. Engagement of banking activities became inevitable and necessary as the countries became independent. Hence the governments, businesses and public at large started to deal with banks regardless of whether they like it or not. This drew the attention of Islamic scholars and intellectuals. This is where the interest-free or shariah compliant financial system began. I will investigate in the following paragraphs how successfully their concerns were addressed.

Continue your exploration of Investment Strategies for CFOs with our related content.

Broadly the history of shariah complaint Islamic Financial System could be divided mainly into two parts. Firstly, when it was just remained as an idea, secondly when the idea became a reality by law in some countries and by private initiatives in others. Hence it would make sense for me to discuss these two periods separately. It should be noted that over the last 30 years there has been a decline in the establishment of Islamic financial institutions in particular banks and the banks already existed have failed to cater the needs of Muslims who wanted to live by their Islamic teaching to avoid interest being paid or received. The writing of the period starts with evaluations and ends with attempts of searching means and ways of overcoming the issues and problems faced by the existing Islamic banks.

Origin of interest-free banking is relatively new to the banking world. The oldest references to the establishment of banks based on profit and loss sharing as opposed to interest are found in Anwar Qureshi (1946), Naiem Siddiqi (1948) and Mahmud Admad (1952) in the mid forties. This was followed by more details works by Mawdudi (1950), Muhammad Hamidullah 1955, 1957 and 1962 workings should include in this section. The common among all these scholars was the recognition of the need for commercial banks and adverse effects of interest for the businesses that operate in society. They have promoted a banking system based on the sharing of risks and rewards between the bank and its customers.

During the 1950’s the concept of shariah complaint banking system attracted a substantial number of people as a result of political interest it created in a county like Pakistan and partly because of the emergence of talented Islamic scholars. Studies focus on this subject started to appear during this period. One such study was that of Muhammad Uzair (1955). This was followed and enhanced in the sixties and seventies. Abdullah Araby (1967), Nejatullah Siddiqi (1961 – 1969), Al Najar (1971) and Baqir Al-Sadr (1961, 1974) were the main contributors.

Institutional involvement began in the early seventies. In 1970 there was a significant conference organised in Karachi, Pakistan, In 1972 Egyptian study, in 1976 the first International conference on Islamic economics, In 1977 Economic conference in London were the outcome of such association. The most significant breakthrough came as a consequence of government and private institutions participation, which led to the theory being applied in practice and resulted in the formation of the first interest-free financial institutions such as banks. Consequently, the Islamic Development Bank was established in 1975 was the product of this process.

During the eighties the subject matter of public conferences has dramatically changed from the concept of interest-free banking to performance evaluation of their significance on the local economy and world at large. Their intense discussion of this subject and the locations are proof of worldwide interest on this subject. Seminars & speeches on Islamic finance’, its influence on world financial systems held on September 1984 in London, In 1986 workshop on Financial activities of Islamic banks held in Vienna, In 1986 International conference held in Tehran, In 1986 International Conference on Islamic banking held in the USA. However, the most important one is the conference on the elimination of Interest from the economy, which was held in 1992 in Pakistan.

This was the period in which there was a substantial amount of literature written such as documentaries, articles and books. The work of M. Akram Khan on annotated bibliographies of all circulated and some un-circulated works on Islamic Economics sine 1940 and before should be given special consideration. It was useful to those who are new to this subject of Islamic banking, due to the inclusion of both Urdu and English (1980, 1988).

All interest-free banks on the basic principles commonly accepted it. However, its application by individual banks may differ. There were several reasons for this such as laws of the country in which banks were operated, the difference in objectives of banks as well as their experiences, the circumstances under which they operate etc. Another important reason was the requirement for Islamic banks to communicate with interest-based banks.

Since the start of Islamic Bank in 1975, over 300 shariah complain financial institutions have come into existence in more than 70 countries all over the world. The fundamental difference between Islamic Banks and conventional ones are that are based on interest, Islamic banks operate by sharing risk and rewards. Islamic Banking dominated the whole banking industry in Iran, Sudan and to some extent in Pakistan. Other countries like Malaysia, Jordan and Bangladesh where the provision of Islamic Banking services through individual windows/counters of interest based banking system. To take advantage of this rapidly growing market, some large conventional banks in the UK such as HSBC, Lloyd’s group, city group etc have introduced Islamic divisions. This shows that there is a considerable interest in the western world in particular in USA & UK. Currently, there is one central bank in the UK which provide shariah complaint day to day banking activities such as current and deposit account, personal and home purchase finance etc that are compliance with Islamic law.

Interest is banned and prohibited by Shariah due to its adverse impact on the society at large as unequal distribution of wealth which leads to social unrest, poverty, credit crisis currently faced by the word, decrease in earning and purchasing power etc. The one of the famous scholar by the name of Usmani (2006) said the most significant disadvantage in riba or interest-based banking and finance is the lenders have no involvement and do not bother when they lend loan that is subject to interest to their client. However, according to shariah complaint arrangements of funds are not given to their clients. Instead, the banks acquire the asset and pass it on to the clients, and hence profits and loss would be shared between both parties based on pre arranged terms and conditions. He emphasised this method of financing in Islamic financial system making a real difference and supporting the economy as proper check and balances are in place to ensure that will lead to prosperity in the society.

As evident in the above paragraphs, the concept of shariah complaint financial systems not just for Muslims because it provided an ethical and moral dimension of investment and financing that would benefit the society as a whole. This is why Islamic Banking is gathering popularity among all communities worldwide and in the UK too. It also has some challenges in the UK as a result of the framework in which the system of finance favours the conventional banking system. This is not to say that there are no opportunities. There are opportunities and potential for growth because in less than 15 years it has established a prominent position within the UK banking industry.

1.2 Research Questions

According to National Statistics in the UK, 2 million Muslims living in the UK. It was acknowledged that the Muslim population is one of the fastest growing minorities in the UK. There were no real alternatives to Muslims before 2000 to conduct their financial matters by their religious faith. As stated previously Islam prohibits interest. However, the Muslims need to be involved in banking activities such as current and deposit accounts, mortgages, credit cards etc that comply with their religious belief. The UK as a non Islamic country which favours conventional banking system in terms of regulations made the demand and pressure grew from Muslims to establish a banking & financial system which is capable of meeting their religious belief. To respond to this growing demand an Islamic bank was established in the UK in 2003. Since 2003 to 2013 there was a significant development in the Islamic banking sector. As a result, presently there are two conventional high street banks and one Islamic bank that is entirely compliant with Shariah law catering in the banking industry. Islamic banking is an infant in the banking industry and is at the introduction to growth stage which faces a tremendous obstacle in the face of well established conventional banking systems competition together with the framework and regulations that favour them — also the western communities who are comfortable and closely connected socially and economically with conventional banks. That being so there is a need to find the opportunities to develop and grow this infant Islamic banking sector as well as to come up with innovative products and services that will not only comply with Shariah but also the requirement of banking regulations and financial services authority.

2 LITERATURE REVIEW

A literature review of this section focus on to demonstrate the scope & concepts of Shariah-compliant banking system internationally and specific consideration in the UK. Islamic financial system is a global concept; practically many Islamic products being offered by the UK well-established banks such as HSBC, Lloyds and IBB banks to name a few. I made a specific effort in reviewing published materials such as articles written by Islamic scholars and non-Islamic scholars, Journals, books, business magazines, newspapers, Online articles, Websites etc about Islamic banking in general and their impact on the UK specifically. Also, I did try to emphasise the consequence of the implementation of shariah law in relations to banking and finance in the UK. It should be mentioned that over the last 10-15 years, Islamic banking has provided a positive contribution to its customers in the UK economy.

2.1 Principles of Islamic Banking

Although Islamic banking system seems to be prominent in the world at large for about 40 years, truthfully principles of shariah financial system have been adopted throughout the world for centuries. Principles of Shariah have existed in Islamic countries in different shapes and forms based on the situation at the time. In essence, Islamic banking has all the necessary characteristics and elements to fulfil the requirement of society, country and the world at large if implemented strictly by the principle s of shariah. It can be argued that Islamic banking system is one of the fastest and expanding sectors with diversity in different spectrum and segments. It has the ability and the willingness to cater to Muslims as well as non-Muslim communities. It is a system that is appealing to any individuals or communities regardless of their religious belief who seek ethical and moral financial solutions. According to OIC (Organization for Islamic Conference), Islamic Banking could be defined as System of Finance whose rules, statues and procedures mention its engagement to ban the receipt and payments of interest that complies with the principles of Shariah. This is a clear indication that the interest in any form is prohibited according to Islamic Law due to its adverse impact on individuals as well as on the society and economy as a whole.

2.2 Comparison of Islamic banking and Conventional Banking

Frankly, mentioning system of Islamic banking is not clashing from the conventional system as they are discharging the same practices that are to maintain current and deposit account, personal and corporate financing, home financing etc. However, the fundamental difference is its objectives and practices. The primary objective of strictly run Islamic Bank is the equal distribution of wealth through profit and loss sharing and decreasing the poverty through ethical banking and increasing investment opportunities to all not just a section of society. According to www.islamicbanking, it claims despite western media’s suggestion that the Islamic Banking is a recent phenomenon; its basic principles and practices can be traced back to the seventh century. This statement is a testimony that the shariah compliant financial system is not a new concept. Its root could be traced to the early days of Islam. Islamic financial system progressively developed and generally accepted and followed by not only Muslims but also non-Muslims in western countries especially those living in the UK, USA, France & Canada. Despite Islamic Banks popularity among Islamic and non- Islamic countries that provide comprehensive financial and economic solutions to its customers it is still a system, which is not organised or developed well compared to its traditional rivals. Islamic Banking lacks proper supervisory bodies, Inconsistencies in fatwa’s issued from jurisdiction to jurisdictions, uniformity in accounting standards, the difference in local regulations etc. Upon reviewing different elements of Islamic banking and Finance, It is evident that the UK could be the hub for Islamic banking in Europe and its conventional financial institutions which offer Islamic products make a significant contribution towards the development of this infant industry. Islamic Banking system has a great potential to grow as a result of a large concentration of Muslims from around the globe that are based in the UK. It also faced with an unprecedented challenge as a result of lack of awareness of its existence and problems regarding regulations and the structure of Shariah boards and their implementations.

2.3 Islamic Bank’s Competitive Advantage

As a relatively new entrant Islamic banks poised to take advantages of their developed conventional competitors infrastructure. Although Islamic banking system is new, it has its competitive advantages when compared with well-established interest-based banks. A useful way of analysing Islamic banks position within the banking industry is in the context of the BCG matrix it falls to specific position depending on the market it operates and competes in. For example, Islamic Bank of Jeddah’s strategic position is not restricted to UAE but open to competition on a global scale due to its capability and size that allowed it to compete globally. According to BCG Matrix due to its vast financial resources as a result of Oil revenue is a cash cow. This gives the strength for it to promote its products aggressively in any parts of the world mainly focusing on Asia. In contrast, if we looked at Islamic Bank of Britain, which was set up in early 2000, it is competing in a mature market against well-established global giants such as HSBC, Lloyds, City group etc. Also, it is a tough challenge for it to convince a society which is well versed and comfortable with more established banks to use its services; it will be a daunting challenge for Islamic Bank of Britain to compete successfully. Hence the bank can be considered a dog in the matrix due to its low market share with relatively low growth in a mature market. Therefore it is essential for the bank to maintain its liquidity position via good cash flow, as revenue is restricted at this early stage of the bank and could lead to liquidity problems if they are not careful with its working capital management. Banks that operate in an environment in which Muslims are a minority such as in the USA, European countries would fall into the category of a question mark. This is a market where Islamic financial product and services are growing but struggling to capture market shares, for an example in the USA post 9/11 event. This issue has been magnified by the growing and strict regulatory requirements in the USA that make it even harder for Islamic Banking to grow or even compete fairly. The bank of Brunei that has been established in a country that is considered to be one of the wealthiest nations due to its vast gas and oil revenue could be considered as a star. This state is rigorously promoting Islamic financial institutions in every opportunity it comes across with a view of making Brunei as the international hub for Islamic banking and finance. It occupies substantial market share and a brand that is so popular among its citizens. However, as a result of the size of its economy, it is inevitable that the maturity of this small market is much faster and activities of lending getting saturated soon as well.

Although generally banking is highly competitive, Islamic banks have survived due to their protective legislation where they have been established, example countries like Sudan, Some Middle East countries as well as Pakistan and Brunei. Islamic Financial Institutions over the past few decades have managed to create and maintain a competitive advantage in the industry. According to Michael Porter any organisation, which is operating in industry, needs to make strategic choices, which will enable it to adapt to the market it is operating. As a result of Islamic banks using the same platform as their conventional competitors, they need to be stand out from the crowd. The sensible approach is to offer product differentiations with a view of gaining market share through increased customer base it to attract new depositors as well as investors and individuals to the bank with them. Porter pointed out in 1997 that in general, all banks lack to implement a strategy of differentiation in order to enhance their market share and become more profitable. He claims that consolidation through merger and acquisition is not a strategy for competition. Instead it will destroy values of the entity concerned as these new entrants will be met with strategies which are not evident in the mid to long run (www.bai.org). As an infant in this industry, Islamic banking learning walks to develop experience and skills that will be practised with a view of becoming different from the rest of the players in the industry. So Islamic banks should develop abilities and competences to create and offer new values that will be their competitive advantages. Muslims are considered to be a close community, which is an advantage, they gather at least once a week such as the Friday prayers that could be used in circulating, promoting as well as discussing information regarding Islamic banking products and services. On the other hand in western communities, they lack this close-knit community gatherings and feelings which may be a drawback for their banking promotions. Hence they decided to invest heavily on expensive and lucrative that is considered to be very aggressive campaign such as adverts on TV, Billboards, or even making personal visits/calls etc to prospective clients. Initially, the idea of Islamic banking was using the traditional form of marketing, i.e. word of mouth to introduce and spread its message. With the lapse of time and technological development, it uses modern marketing and promotions tools similar to conventional banks. The banking industry is approaching its maturity stage as evident by the slow growth, and hence there is a growing requirement to develop new product and services to kick start the industry as a whole. Due to the Muslim population of 1.6 billion, there are great opportunities on a global level for Islamic banking as the majority of this growing population look for a banking system that conforms to their religious belief. These opportunities broadly can be categorised into four segments such as Investment, corporate, commercial and consumer. There was a detailed study conducted in the UK to investigate the potential for Islamic financial products in particular mortgage business. The highlight of the study was the significant differences between Islamic and conventional mortgages are the concept of Murabaha and Ijara meaning they are based on equity where the customer and bank share the ownership of the asset hence sharing risk and rewards, whereas the conventional banks use interest which is prohibited according to Islamic Law. Islamic banks survived in Islamic countries mainly due to protectionism by those countries through regulations that will make it very hard for the overseas bank to enter into the industry. It is a sensible approach to protect this infant industry from well-established global giants.

According to Mishkin (2005), the presence of international banks will provide and promote much-needed stability in the financial system which will enable to create an efficient system of the bank in those countries which try to restrict the entrance of these global established conventional banks. He continued to claim the presence of these overseas banks in developing countries would act as a protector for any unknown shocks. There is a truth in this argument because banks need to be convinced to face the competition on a global scale regardless of what banking system they are subject to. It is true that the current banking environment is not only restricted to domestic players, but it goes beyond the borders due to globalisation.

2.4 Competition in the Banking Industry

The main competition is focused on loan products and deposits. This is because Business communities, Individuals and large corporation are in a way inseparable from the banks in many countries, which lead to their bank deposits, and other financial products and services are closely linked with the bank. The demand & supply for banking product and services are directly influenced by the pricing of those products and services that is subject to the level of competition in the sector. Shaffer (2003) explains that due a large number of banks in the market, which may create an unfavourable selection of lenders. I support this argument when few customers are chased by the banks, and it is possible to end up with a single organisation has many borrowings from a small number of banks that in future it is likely to create more loss on loans for banks involved. In order to achieve budgeted targets the banks in a highly concentrated market, they peruse a strategy of aggressive marketing to get more customers or to sell other related products. Because banks often met with asymmetric information issue, clients of these banks prompted to obtain more loans with the anticipation of the proposed investment will be able to pay back the loans borrowed. The primary tool the banks used, a a weapon to beat competition was the pricing of their products and services mostly personal and commercial loans and deposits. Charges of the banks depend on how many players are in the market, the power of supply according to Porters five forces, fewer means they could charge higher interests on loans and offer lower interest on deposits. The competition of the banks was more felt to smaller firms than larger corporations. Because there are fewer findings made available to smaller firms as a result of greater asymmetric information, also it should be noted that just because there is an increase in competition between banks does not mean there will be an increase in credit supply as it is dependent on asymmetric information of the customer. In a relatively small economy where there is a high level of market concentration, the rates of Loans tend to be higher while the rates on deposits are likely to be lower than the interest rate in a less concentrated banking market. The main reason was that the high dependency of businesses and individual who are situated within the proximity of their homes and businesses. This was the main attraction for banks to reach out to their clients by opening new branches in some strategic locations with a view of getting closer to potential customers. Despite the advancement of technology especially use of internet-based banking, expansion through new branches make commercial sense in attracting and capturing larger share of the market that will contribute towards the enhancement of overall performance of the banks. Credit should be given to HSBC in taking a prominent role in localisation strategy, which needs to be followed by other banks, as it was a success story. A study showed that the rates for any accounts were the same in their branches. This is an example of a perfect market competition where the clients aware of the prices charged by every bank of the identical product and services. The early stage of banking systems, main competition strategy was the establishment of branches and identification of strategic locations are the key elements in maximising their market share. Banks which have maintained branches tend to take an aggressive stance when comes to competition than banks that do not have many branches as they can invest their funds elsewhere which cost-effective and less risky. About pricing, these banks maintain more similar pricing policies as opposed to the local banks that need to customise their products and services to accommodate local demand and supply. Based on Bandt and Davis (2000) study, the impact of single currency such as the Economic of Monitory Union has a different approach on the competition. They claimed that the international competition likely to increase causing the profitability to fall of the banks. In this scenario, the competition for loans and other products and services will become intense in the banking sector. This was supported by the work of Llewellyn’s (1996) who says the main reason for the decline of traditional banks were due to aggressive approach by more traditional big banks to follow an off-balance sheet activities.

Due to smaller banks ability to offer product and services to suit local needs, they tend to monopolise the local market whereas the larger banks adopt a strategy of direct competition with other similar big banks for other products and services such as the provision of funding for large projects which smaller banks are unable to serve. Market structure and level of market concentration will determine the level of competition according to the study made by Case and Girardone (http:www.essex.ac.ukAFMfinance-discussion-papersDP05-02.PDF). Their claims were in a highly concentrated market; the banks would enjoy monopolistic positions due to the elimination of competition. They also claim that more efficient banks have less or even no competition between them in a way it is common in the banking industry. The strategy to increase its market share would be mergers and acquisitions as this strategy would enable the banks involved to achieve economies of scope and scale through the combination of their management capabilities and competencies as well as vast common other resources such as technological advancement, Human and financial recourses etc. Consequently these combined banks have enhanced their existing capabilities to take advantage of their market by adopting measures of process improvement and cutting cost hence serving their customers more efficiently. This study is consistent with the earlier study on competition of banks. As a result of the deregulation of banks, it has opened up to a new kind of competition like international competition over the borders as never seen before. This had a direct impact on the way Islamic banks compete by following their conventional competitor’s strategy due to globalisation. Another useful action taken by the Islamic bank was to capitalise on already available banking infrastructure created by the existing conventional banks and adjust it to be in compliance with shariah law such as the use of Dow Jones Islamic index that was initially developed for conventional banking for the purpose of investment that has been restructured to comply with Islamic law. The Asia Pacific is the main focus for Islamic banking sectors growth. According to Deloitte, Asia Pacific would be ideal for potential cross border investment. Countries such as Malaysia, China, Thailand and India due to economic growth, the consumers demand new and refined financial product and services in an environment, which is rapidly changing. Surprisingly Muslim population in these countries are significant and could become the focused clientele for those Islamic banks wishing to enter this growing and expanding economies. Many countries such as Brunei and Thailand have responded by establishing Islamic banks in these countries, which is partly financed by respective governments (http://www.muslimnews.co.uk/news). In India, several Islamic financial companies have been established which are not recognised as Banks but is a first initiative to cater to Muslim populations financial and banking needs in that country. It is a possibility in the future that the banking regulation would be amended to comply with Islamic laws in particular pressure from international regulators and demand from international investors, corporations etc. Due to the majority of Muslims live in a remote part of China yet to capitalise the potential of Islamic banking and finance.

2.5 Islamic Perspective of Competition

Based on Tilva & Tuli (www.globawebpost.com) discusses Islamic banks impact of growth and the way it has changed the nature of competitiveness to the conventional banks. The driving force of the competition in the Islamic banking sector is due to increasing development of shariah compliant financial products and services which lead a vast amount of funds to be transferred from Conventional banking systems. Another factor was the availability of Islamic financial instruments on the International stock exchanges such as FTSE Global Islamic Index in the UK and Dow Jones Islamic Index in the USA that made way for both Muslims and non-Muslims who involved in Islamic Banking for ethical reasons. This was supported by Brown, K stating that although Islamic banking is not profitable as conventional banks it is a viable alternative. It is challenging to penetrate into Islamic Banking industries where it is protected by the governments in countries such as Pakistan, Iran, and Sudan etc. In Malaysia, the regulation permits the conventional banks to have Islamic Banking windows, and hence banks like HSBC have opened its Islamic divisions called HSBC Amana Finance & Citibank that has branches in the Middle Eastern countries. This prompted other established conventional banks to follow in and compete for the provision of the loan, attract depositors etc in that part of the world. According to Kahf, M. (2002), the creation of new and sophisticated financial products developed by the partnership between the banks and Islamic scholars were one of the main reasons successful developments of the Islamic banking sector which lead the way to become a global player without being restricted only to domestic market. This partnership also created a revolution in the study of Islamic banking and finance. This is evident by the fact that most of the scholars in Europe and the USA are not Muslims. The attraction to Islamic finance mainly due to the appreciation of its ethical and moral stance. The various factors, which created an impact on the world of finance in particular on the conventional banking, the conventional bankers, scholars as well as authorities in many countries especially the financial regulators commonly, acknowledge the threat posed by Islamic banking. Richard Duncan who is the head of Islamic Finance at ANZ International predicts ‘’Islamic Finance would become very prominent and established player over the next five years’’. This is a strong view from a banker who practices Islamic Finance which would make a concern to well established conventional competitors. In the last 30 years, there has been a rapid transformation of shariah complaint Islamic finances. Banks such as Citi group has been heavily focused on developing its Islamic banking arm concentrating specifically on investment banking where it has a competitive edge as opposed to other banks in the Middle Eastern countries. Lley & Megalli (2002) analysed that in the last 30 years there has been a significant interest by established western banks to attract and lure Muslim customers with an anticipation of penetrating in to the multi-billion investment opportunity, they quote the giant UBS has initiated several such approaches by being one of the largest banks in the world have used their Noribal bank to attract their international Muslim clientele by the use of their competence and well experienced workforce.

This fact was insisted by Martin, J, (1997) due to the recognition of Islamic instruments and increasing demand from both Muslims and non-Muslims corporations such as IBM, Xerox & GM. This new revolutionary ethical approach to banking and finance is no longer limited only to Islamic countries and Muslims but also expanded to countries such as USA, Europe etc. However the smart move by the conventional bank to have both conventional & Islamic banking system posse a fierce competition for the relatively new entrant Islamic banking which exist to serve only Islamic banking. As a result they do not enjoy the economies of scale that is enjoyed by their competitors. In 1996 Llewellyn, D.T suggested due to the pressure of competition there has been a marked decrease in competitive advantage in the banking industry in general. The banks that had enjoyed monopolistic position previously have been taken away by deregulations and changes in governments policies. Since the advancement of technology has a significant impact on how banks are operated any changes do have a profound effect on the way banks operate. This factor has a collective impact on both Islamic and conventional banks in a similar way though both operate in a different system. As the Islamic banking system is sharing the same infrastructure as conventional banking, whatever changes taking place in general banking would have a direct impact on them too. Due to generally slow down in conventional banking has opened up a new opportunity for an Islamic bank to capitalise in this lucrative industry. Similarly, due to intense competition in the conventional banking sector, the introduction of the Islamic banking system has opened opportunities for them to penetrate into this system. It was estimated that asset worth the US $800 billion in 2010 globally for Islamic banking and it is growing at a rapid rate of 10% - 15% annually (www.invesoroffshore, com), which is materially significant when compared to 1970s first introduced Islamic banking in the world. However when compared to world’s Muslim population of 1.6 billion it may not be significant, but potential contribution of Muslims in the world is something, which cannot be underestimated and hence cannot be ignored. Large part of this Muslim population resided in Muslim countries whose primary revenue is from gas & oil which prices are on the rise hence it is not surprising the additional funds generated from Gas & Oil are primarily from Muslim countries, and they wanted to conduct banking activities in a way that is allowable according to Islamic law, Shariah. The emergence of Islamic bank not only added the much-needed capacity but also intensify the existing competition on the global level as such Islamic finance is an international where people around the world wanted to take advantage of this new system that is looking for an alternative to the existing conventional banking system. The protectionism exercised by many Islamic countries should reconsider their position based on the merits of opening up their market and allowing overseas players to compete in the domestic market. Surely there will be risks associated with the globalisation of financial activities, but potential merits may outweigh the risks as defended by Schmukmler, S. L (2004). There is a number of distinct advantages such as Clients have many choices when it comes to borrowing and depositing without having to rely only on domestic finance as well as increased competition between banks would ultimately benefit the customers, the flow of overseas funds into local economy is better for country’s financial system etc. This argument was recognised and appreciated by Mishkin (2005) because existence of robust and effective legal system will allow Transparency & good corporate governance to flourish as a country with such a system always promote and uphold good ethics & avoid ethical dilemma issues which are common in any given financial system.

Changes are inevitable in Banking and financial sectors the same as with any other type of businesses. What is essential for the industry is the time it takes to meet the demand of its customers. According to Khan. M. F (1999) there is a number of factors, which determine this speed:

Constant and rapid customer change for Investments

Increase in efficiency through cost reduction

Different market structures due to the potential existence of new market

New product & Services due to the advancement of technology

Pressure for modernisation through the changes in regulation

The above factors are equally applied to both conventional and Islamic Banking. Regardless of the banking systems being used, both banks require competing on the same playing field, and the field sooner or later will be saturated. Also increasing regulatory requirements put Islamic Banks under increased pressure in terms of competition when compared to conventional banks. Changes in regulation like the relaxation of Glass Steagall Act (1933), during 1990s US regulations are restrictive in relations to banking activities specifically the design of products & services, as well as they, are barred from taking part in security market which included the prohibition on the sale of mutual funds. However, following the relaxation the law and regulations the conventional banks are now allowed to participate in all these activities previously either prohibited or restricted including investment banking which is primarily the Islamic banks focused on. The issue was these banks have been engaged in Islamic Banking activities through setting up subsidiaries outside the USA and fiercely competing against newly established Islamic banks. As the conventional banks could operate under both system and Islamic Banks can not function under conventional system, the competition seems to be unfair as one sided and hence some countries imposed sanctions or restrictive measures on new entrants with a view of protecting their domestic Islamic banks. Taylor’s (2003) argues in the USA due to the restrictions imposed on commercial banks to own properties this could be considered as a severe restriction on Islamic bank’s ability to operate and expand. This is particularly disadvantages in the area of a product such as Murabaha which is effectively commercial lending to acquire assets. Ijara, which is leasing will not be affected, as it is a fundamental feature of any commercial bank in the USA. Consequently, there is no Islamic commercial bank exist in the USA. However due to increased demand for Shariah complaint product by the Muslims. As a result in 1987 LARIBA institution was born in California. Since then it has expanded its operation throughout the state except for in New York. It focuses on providing funds to purchase homes, Ijara to small businesses and funding under Musharakah (http://www.lariba.com/company/index.htm). Other banks such as HSBC also started their operations in the US with a view of expanding their market share of Muslims who wanted a banking system without interest. With this competition between Conventional banks & Islamic banks are not only in Muslim countries but also in western countries that will increase pressure on existing established conventional banks. Conventional banks are busy with trying to find ways to comply with regulations, which apply to Islamic Banks in the Muslim world. Countries such as Malaysia & Pakistan have been working tirelessly to create a stable environment in which Islamic banking could successfully compete against their conventional competitors on an international level. According to Dr Zeta Akhtar, Governor of Central bank of Malaysia told world Islamic economic forum in Malaysia in 2005, her country working towards becoming the international hub for Islamic banking. She also claimed that Islamic finance attracted not only Muslims but also non-Muslims due to its ethical value embedded in the system. Malaysia has since relaxed its regulation inviting overseas Islamic banks to operate in Malaysia. This approach is co-inside with the argument produced by Mishkin previously that due to overseas banks capability on the management of risk as well technological advancement stability in a financial system in the country could be expected in the event of sudden economic shock that may happen in the future.

Regulatory systems in countries may be differ from each other. The expectation that 40%-50% of savings of the Muslim population globally may be attracted by Islamic banks, the massive global players such as Citibank, UBS, BNP etc are already established their Islamic branches in potential countries (Hawary et al., 2004). This study is consistent with Khan’s previous argument that the conventional overseas banks are penetrating into Islamic banking in Muslim countries. Credit should be given to his forward-thinking ability, which has been proven in the last 30 years. HSBC is the most prominent bank, which has a strong presence in Middle Eastern countries, Asia, America & western countries with 20 presences just in OIC members (http://hsbcamanah,com). Another example would be the City bank that has been known as the largest Islamic investment bank in the world. It is evident from the above that this new phenomenon are attracting both Muslim as well as non-Muslims alike around the globe. It is high time for Islamic banking to reconsider how well it could position itself in the light of ever-increasing competition from conventional banks internationally and locally as well as how best it could serve the banking and financial needs of Muslims efficiently and effectively while marinating its competitive edge.

2.6 Customers Acceptance of Islamic Banks

The marketing approach will determine the level of customer acceptance of its products & services. Generally, Islamic banking needs to compete with conventional banks as they offer similar product and services. The only difference is the concept of Shariah compliance that could be used to differentiate its offerings from conventional competitors and hence all other offerings are subject to common promotional strategy to retain and attract customers. It is true that its main focus/finish is Muslim customers because its products and services are by Islamic teaching. However, it is important to note that all countries where Islamic banks operates do not have Muslim as majority; hence there are no- Muslim who could be potential customers. So more or less competition is on a level playing field and winning or losing customers is up to individual banks ability, which could be influenced by its marketing and operational strategy as well as its ability to deliver a high standard of services efficiently.

Research by Haron et al. (1994) on customers of Islamic banks in Malaysia has used the following:

Banking Preferences of Muslims and Non -Muslims

Factors that influence their selection criteria

Awareness of the merits of service provided

The research concluded, no significant difference found in both set’s criteria selection and hence the belief that Islamic banking may have advantages to attract Muslims customers cannot rely upon to convince new customer into the bank. New customers may have reasons other than the bank being Islamic to become a customer such as the speed or sound quality of services, especially among the young & working class. Heron & Ahmad (2002) conducted a study on Islamic banking & products used by corporate clients’ show a similar result to that of Haron’s above. Most corporations make business decisions on economics and not religious ground. Hence the selection of a bank would be based on potential cost savings. The the quality of services followed by the reputation of the bank as well as its size. This means the corporations are primarily focused on what benefit will accrue to shareholders as well as how future performance of the corporation would be enhanced increasing efficiency through cost-cutting. The influence of purchase and quality of service delivery generally will influence customer behaviour towards Banks. Most customers nowadays are aware of the basic features of banking products and services; hence banks involvement in promoting those are minimal. Also, loyal customers of the bank will be passive users in that they repeat their bank dealing over and over again without having them to be chased by the banks for business. The main reason for customer loyalty would be the recommendation by family and friends as existing happy and satisfied customers as well as the closeness of the banks to their customers. Another reason for customer loyalty to be the hassle and the costs involved in switching a bank, in particular, the elderly customers wanted to stay with their chosen bank regardless. Product and service differentiation could be another reason for customers who do not want to switch. Historically customers are reluctant to build a new relationship with new unknown banks hence decided to stay with the existing one. Based on the finding by Crow et al. (2006) has concluded that introduction of new offerings such as credit & debit cards and convenience such as internet banking may influence customers a choice in selecting a bank. This is not to say that customers still cautious about the speed of service a bank could provide and hence efficient discharge of banking facilities will also play an essential role in selecting a bank. In the UK the use of Debit & Credit cards & Internet has become a norm of in providing banking services. The success of any bank is its ability to understand customer needs in advance & be able to influence their behaviour in banks favour, which is very important for the survival of banks, and stay ahead of the competition. An interesting study by Zainuddin et al. explains why there are differences in perception towards Islamic banking between users and non-users of Islamic banking in Malaysia. This study was much appreciated by Islamic banks as it helped in developing a marketing strategy to target existing as well as potential customers of the banks. Mainly it was beneficial in retaining the existing customer with the bank. The study concluded that the awareness of Islamic banking is high among married people than the unmarried. Also, the study concluded that customers’ decision to select banks is influenced by the recommendation of family and friends, which is consistent with the previous study conducted by many scholars. Due to the close-knit community connection, it is highly likely in Malaysia and in Asian countries to listen and convinced by the recommendations made by family members and friends.

Education of the population in a country plays a vital role in the Islamic banking system. Metawa & Almossawi (1998) researched two prominent Islamic banks in the country of Bahrain and concluded that majority of their banking customers are educated with 50% having a degree and 40% having diplomas. This is an indication that the customer of these two banks is educated as well as capable of earning decent salaries. Hence the understanding of the concept of Islamic banking is immensely helped by education. This finding would help banks to organise their marketing strategy to target these segments effectively. It was revealed that being an Islamic country about 30% of the population is unaware of Islamic banking and their offerings, which is considered to be relatively low. This is a clear indication that only religion will not bring customers into Islamic banks, but it needs to be combined with education regarding the merits and ethical stance that it will uphold for the betterment of the society at large not just serving the privileged segment of society. An awareness programme needs to be conducted by the banks to promote these good values to its existing as well as potential customers so that they would become familiarise themselves the product and services that are offered.

3. RESEARCH METHODOLOGY

Islamic banking and Finance is a subject that has become an area of increasing interest in the western world precisely in the UK. About 2 million Muslims are living in the UK who would like to conduct their day-to-day lives by their religious belief. The government of UK has appreciated this community’s contribution to the UK economy by way of giving importance to the Islamic Banking sector. The government initiatives are promoting and encouraging London to become a hub for Islamic financial institutions. Consequently, some of the big banks are now offering shariah complaints products & services backed and endorsed by a panel of Islamic scholars through their Islamic divisions. The increasing demand for Islamic products provides not only great opportunities for existing players operating in the sector but also attracting new entrants into this largely untapped segment. However, it also provides challenges and obstacles in the western world. The purpose of my study now to research and find out as well as analyse the potential growth and opportunities in the UK for Islamic banks. In the field of research, there are two paradigms: Positive & Phenomenological. Alternative terms are Qualitative research for Phenomenological & Quantitative research for positivistic. The positivist paradigm has been used by natural science to research natural world and tends to establish facts. Phenomenological paradigm has been used in social sciences to accommodate and help researchers in studying and analysing social-cultural observation, and the approach is experimental and inductive. Paradigm provides a direction to researchers on a correct path and correct methodology to be used. According to Collis & Hussy, It is essential to take account of all the elements and make sure that there are no contradictions or deficiencies in the methodology used by researcher regardless of the paradigm used. I chose the Phenomenological study, as the focus will be on the production of qualitative and not quantitative data. The Quantitative research is objective, not subjective because it analyses numerical data by the use of various sampling & statistical tests. However, the use of Qualitative study is highly subjective due to its association in developing theories that could be generalised when trying understanding the potential challenges & opportunities presented by Islamic financial institutions in the UK.

Qualitative techniques widely used are:

Detailed interview

Creating a focus group

Scenario/Case study approach

Observation

Role play & simulation

Researching published materials such as Internet, Newspapers, business journals, books etc

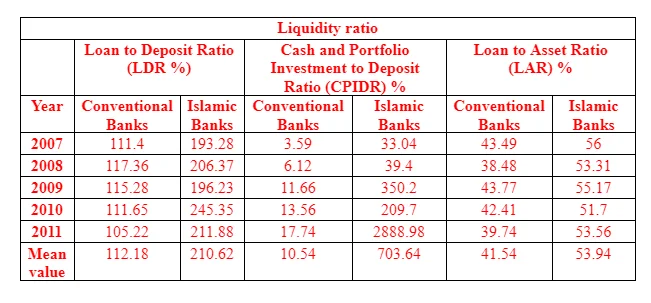

My research and study primarily based on the secondary data in the form of Qualitative research that was collected using various appropriate literature. Extensive reading of published materials of recognised Muslim as well as non Muslim scholars who have written valuable books, internet blogs, journals etc on the subject of Islamic banking and financial institutions. There is clear evidence of obtaining some merits by the use of Qualitative data as oppose to Quantitative data such as it is relatively straightforward to go in to in-depth of the subject matter chosen than Quantitative approach as well as relatively cheaper due to the fact it does not require to be involved so many participants and no need for highly sophisticated software’s to analyse & interpret results. It also convenient about lactations & timing as long as the researcher has access to internet and printed materials such as Books, Journals, newspapers, articles etc. There are obvious drawbacks associated with Qualitative research due to difficulty in producing the correct amount, which shows the number of people in the society who understood what is being the subject matter and what they like and dislike. Analysis of data in Qualitative study is complicated due to the data being collected could be massive and reaching a conclusion would very time-consuming. In this study quantitative comparative analysis of the Islamic vs conventional banks. A thorough ratio analysis also has been carried out in this research. It entails liquidity ratios, profitability ratios, risk and solvency ratios, and efficiency ratios.

4 DISCUSSIONS AND RESULTS

The aim is to investigate the challenges, the opportunities for growth & developments faced by the Islamic and financial institution in general with specific reference to the situation in the UK. The primary aim source of collecting data has been through readings to match with different opinions expressed by many scholars in the field of Islamic Banking & Finance. My reading also extended to the different opinions of the community members mainly through view expressed, questions & answers published regarding the scope and the potential future in the UK for the Islamic banking system. According to my plan of research, I have reviewed the remarks, opinion and view expressed by various Islamic & non-Islamic scholars who represent a different part of the community like customers and non-customers of Islamic banks. As a result of extensive reading and research secondary data collected is to be linked with views expressed by various members of the community concerning the future of Islamic Financial institution in the UK as well as results obtained have been matched with the objectives of the study. Discussion section aims to present the prevailing position of Islamic banking, Opportunities and its drawbacks as well as its practices.

4.1 Understandings the Basics of Islamic Banking

Checking the understanding of Muslims and the institutions associated with the provision of Islamic banking is essential in order for a sufficient discharge of their services.

4.1.1 Concept of Islamic Banking

In order to obtain the needed outcome regarding the basic concept of Islamic banking, I did review views expressed as opinions, remarks, Q&A etc published on the internet, newspapers, business journals, official publications etc on Islamic financial system including but not restricted to Islamic banking, avoidance of Riba, shariah complaints financing and its religious dimensions as well as ethical consideration. Some responds were presented below: Based on HSBC, “the Islamic Banking is a financial system based on shariah law, and it is interest-free system”. Based on Lloyds, “the concept is based interest-free because Riba is prohibited in Islam”. Based on Islamic Bank of Britain, “Islamic banking is a system by which interest is prohibited as receiving & paying interest is strictly prohibited in Islam, which will lead to clean & pure banking system”. Based on the above responses by well-known banks, it could be concluded that they all agree on two essential factors: Shariah is the base for this financial and banking system and free from Interest. It is essential to understand, why the interest has been prohibited in Islam, and the adverse effect of it is on the society as a whole. Lloyds TSB states, “No interest is made from the funds deposited by the customers”. HSBC says,” interest has a negative impact on people as it reduced the capacity of earning, purchasing power and undue expenditure”. IBB states, “Availability of interest is common & easy to obtain. As a result people enjoy spending ignoring their level of earnings. At the end of the day, the loan needs to be rapid which will be difficult for the borrowers. This is the same with the economy as well, and the financial crisis is one tiny example of the interest-based economy”. According to Lloyds TSB, “The credit crunch is the best example of adverse effects as a result of having an interest-based economy”. Based on the above observations it was suggested that interest would hurt loan borrowers as well as the society at large. Non-Islamic bank customers to agree on the detrimental effect of interest on people and the economy. According to HSBC, “Islamic banking is consistent with shariah, which is approved by the shariah central committee”. Lloyds TSB claims, “All financial products offered by Islamic banking system are subject to the approval of Muslim scholars who have deep knowledge of Islamic Financial System”. “Islamic banking system is religious as well as provides moral & ethical banking system” according to HSBC IBB Claims that “Initially the introduction of the Islamic banking system to fulfil the religious need of Muslims. However, it turned out to be more ethical and moral than conventional banking system”. Customers regardless of their banking arrangements do tend to agree that the system of Islamic banking is moral and ethical than conventional banks where the system tries to have an equal distribution of wealth within individuals & society.

4.1.2 Difference between Islamic and Conventional Banks

The purpose of this study is to understand whether the Muslims could differentiate Islamic bank from a conventional bank. It is fundamentally essential for Islamic banking to understand whether Muslims can differentiate these two banking systems in order to develop and grow the Islamic banking system. If they do not appreciate the difference and the Islamic benefit bank offers then regardless of whether they are Muslims or not would not be able to take advantages of this ethical banking. According to Lloyds TSB, “Islamic banking based on the concept of profit & loss sharing according to a predetermined agreement between parties while conventional banking is entirely based on interest”. According to HSBC “both system similar to each other, only difference the interest, which we will not charge, or payable under any circumstances”. So it could be concluded that only difference in both systems is the interest that will be charged or paid by conventional banks whereas Islamic banks do not involve in interest that will not make the society prosper. Lloyds TSB states that “money never be lent by Islamic banks without the transfer of risk & reward. Whereas Conventional banking, the whole economy is based on interest, and hence any transaction initiated by the bank will be settled via either receipts or payments of interest”. According to HSBC Amanah, “while Islamic banking promotes sharing of risk & reward, the conventional bank based all their transaction on interest would not take the risk of loss. Also, it says that both systems are not dissimilar to each other. The only difference in the practice of risk & reward”. It could be concluded that two factors distinguishes these two financial systems: Sharing of risk & reward the involvement of interest. It should be noted that the treatment of savings & consumer finance by conventional banks is different from Islamic banking in that Savings of the customers will be invested in a project that complies with shariah and risk & rewards will be shared between both parties in an Islamic bank by previously agreed ratios. In the case of consumer finances/credits, the bank play an intermediary role, i.e. it acquire the asset from the open market and pass on to its customers who will invest in labour and profit & loss will be shared between the bank & the customer in accordance with predetermined ratios hence bank too bear the risk.

4.1.3 Shariah Compliance

The aim is to identify the validity of Islamic banking claims that their activities are by Islamic shariah and the contribution made by Islamic scholars in developing it. It extended to carry out research to establish whether Islamic banking at its present state is carrying out its activities that comply with Shariah and how successful in addressing the needs of Muslim communities who wanted to conduct their banking that complies with Islamic teaching. Following are some of the reviews: HSBC claims, “Islamic banking is created based on Shariah, which is fulfilling its obligation as expected as all the products & services are subject to strict quality control and are approved by a panel of Islamic scholars known as shariah committee”. Islamic banking is highly regulated by a scholarly committee consist of qualified Islamic scholars. Providing financial solutions that comply with shariah Islamic banking is fulfilling its obligation to the Muslim community as it a requirement that every bank need to establish a shariah committee that approves the products to be launched. Islamic scholars are equipped with the required knowledge that can play an essential role in the development of this infant system to great heights. An Amana customer believes “that their decision is based on Islamic Law”. A Lloyd’s customer claims, “They based their decision on Quran and Sunnah”. An HSBC customer says, “That as a bank, which provides both Islamic & conventional banking would be able, provide 100% pure Islamic finance”. An IBB customer claims that “shariah committee is working according to Islamic law and they were from Quran and Sunnah”. From the above responses, it is clear that people tend to think decisions made by shariah committee are by Islamic law as they base their decisions on Quran & Sunnah. Some customers agreed Islamic banking is based on Shariah while one person disagrees saying it would be challenging to provide 100% Islamic banking by conventional banks as there would be a confusion between 2 systems.

4.2 GROWTH & DEVELOPMENT

The focus is to identify the opportunities for growth and development for Islamic Banking in the UK. It could be argued that the UK could be considered the hub for Islamic Banking and finance in Europe. This claim can be justified by the steady in the growth of the Muslim population in the UK. As a result of the high birth rate of Muslims and the immigration predominantly from Asian countries such as India, Pakistan & Bangladesh have to lead to around 0.45 million (Appendix 7.2) increase in Muslim population in the last ten years.

4.2.1 Product Development

The aim is to identify the level of customer satisfaction due to new offerings of new product & services through products innovations/development. The primary purpose of this is to find out given the severe competition from well experienced and established conventional banks which enjoy a monopoly in the banking sector that can introduce new products & services quite often, what are the chances of Islamic baking’s position to provide adequate services to fulfil customer’s financial need. HBSC claims, “It is offering various Islamic products such as current accounts, corporate finances, Assets finance to cater the needs of Muslims. Also claims it is the pioneer in the introduction of home finance as it is one of the main concerns of Muslims in the UK”. Lloyds TSB is offering various shariah complaints products such as current, graduate & student accounts, Baby accounts as well as business and corporate accounts. In the UK the Islamic banking started in 2003, within a short space of time in banking industry it introduced several financial products that are whole in compliance with the teachings of Islam to name a few Current and deposit accounts, Home and vehicle finance, Islamic bonds etc. It is true that comparatively, rates for home purchases are more expensive than conventional banks for apparent reason being a new entrant in the banking sector as well as limitation in raising finance to lend for borrowers. This situation may change over time with increasing popularity among the people who sought ethical financial solutions. A customer of HSBC,” Islamic banking is capable of fulfilling my banking requirement”. An IBB Customer,” I have home through IBB and am enjoying easy and simple shariah complaint mortgage.” According to individuals who are not customers of Islamic Banking yet, claimed that Islamic banking would be successful if it could offer services that are similar to conventional banking as in a developed country like in the UK its really inconvenient without having access to banking facilities as most of the daily activities are linked with banks such as debit/credit cards, salaries & wages paid in to banks etc.

4.2.2 Development of Markets/Institutions and Customers

The aim is to establish whether the Islamic banking system has the potential to discharge a prominent or at least a meaningful role in the UK’s banking system. The success of the banking system depends on its ability to provide market development and the level of strengths/influence it has in industry. It must be said that generally, Islamic banking is quite successful in the area of product development. However, it would be useful to see how effective the Islamic banking in product and market development in the UK as opposed to other countries such as France and Germany. Hence my focused was to analyse reviews expressed on the development and the rate of growth in the UK. HSBC says “within a short space of time, we were managed to introduce financial services products in almost all the areas in most of our branches in order to fulfil the needs of Islamic banking customers”. Lloyds TSB “In few years the bank has successfully introduced various product and services in the UK that cater the Islamic banking customers in particular through Islamic banking window in our high street branches.” UK significant banks started to provide Islamic banking services somewhere in 2003. Before this, there was inadequate service provision of the Islamic banking sector. However currently there are many banks such as HSBC, Lloyds etc all have Islamic banking windows. IBB provide wholly shariah complaints of products and services. According to HSBC “within a decade which is a short time in the banking industry, Islamic banking has achieved the acceptance and the recommendation of the Islamic community. Presently Islamic banking enjoys a prominent place in the banking sector in the UK”. Lloyds Says, ” before 2000 there were no banks, which provide Islamic banking facility, but currently there are many financial institutions that provide Islamic banking facilities”. IBB claims, “Within ten years on its introduction it has achieved a prominent place in the UK banking industry such as HSBC and Lloyds having opened Islamic banking windows through their high street branches”. As a financial hub for the global banking industry, London has the ability and infrastructure to develop this infant Islamic banking sector more than other western countries such as France or Germany, although France has the largest Muslim population in Europe. When compared the Islamic products and services provided by the UK, Germany and France are behind. In the UK there are about 8-10 Islamic financial institutions compared to France and Germany, which have about 1, & 2 financial institutions respectively.

4.2.3 Enhancement of Investment

The aim is to investigate the Islamic Banking system’s ability to attract investment opportunities and its significance to the UK economy. The Muslim population in the UK is approximately 2 million (3.3%), and they are closely connected with Islamic banking for their day-to-day activities. The history of Muslims in the UK can be traced back to South Asia, the Middle East as well as Africa where they have a religious and economic position. Muslims in the UK are playing an essential active role in the financial market such as involved in small, medium and sole businesses. The purpose of this study is to analyse the Islamic banking system’s ability to enhance the businesses and investment opportunities especially for Muslims and in general for other communities. I did review some of the responses to the role of Islamic Finance and its development in the UK. According to HSBC “Islamic Banking is playing a vital role for the growth of the UK economy as Muslim can now invest their money according to their religious belief”. According to Lloyds TSB “Islamic financial solution arguably the timely solution at the time of financial crises and credit crunch.” According to the Islamic Bank of Britain “There is considerable Muslim population who engaged in various businesses who are playing a vital role in the development of the UK economy. However the majority of Muslims in general feeling that the conventional banking system is unable to fulfil their religious obligation. Hence the introduction of Islamic financial system would enable to invest in permissible business activities that help grow the UK economy”. From the above reviews it could be established that there is a collective agreement among significant banks that Islamic banking is playing a vital role and contribution to the UK economy, promotion of investments in particular real estate, personal finance, Insurance to name a few. ”Islamic financial system will enhance the investment of Non-Muslim as well as Muslims” according to HSBC customer. “UK is positively impacted by the Islamic banking system as it will promote investment in general” according to Lloyds customer. As Islamic Banking and Finance provide profit and loss sharing schemes, Investors are encouraged to make investments. Also, Muslims, in particular, are motivated to take part in business activities not feeling any burden of interest.

4.2.4 FSA and UK Government Regulatory Authorities

The aim is to concentrate on the environment of the UK in terms of the influence of political, social and geographical for the development and growth of Islamic Banking. An industry is affected by the state of the environment of a country on growth and development. Hence it is evident for me to review specific comments made regarding the role of FSA and the UK government to see whether they provide a positive environment for Islamic Banking System to thrive. “As long as Islamic Banking provide activities according to law, all their products are approved by the FSA” according to HSBC. ” Since FSA’s approval of Islamic Bank of Britain in 2004, there were no restrictions on any Islamic banking products/services as long as they are not against UK law” according to IBB. It should be noted that the treatment by FSA is standard for both Islamic and conventional banks as long as they are in compliant with the law. “There is no difference it is just like they are promoting the other conventional banking” according to Islamic Bank of Britain.

4.3 Challenges for Islamic Banking System in the UK

Challenges faced by Islamic banking are my third area of research. The UK being a non-Muslim country there are obstacles that Islamic banking needs to overcome, mainly the rules and regulations that have been established in favour of conventional banking. Relatively Islamic banking system is an infant system compared to the conventional banking system in all areas such as investment, fund management, information system as well as market & product developments. Consequently, I decided to focus on the problems presently faced by the Islamic banking system in the area of Globalisation, competition, awareness, supervisory and legal as well as an institutional framework.

4.3.1 The Institutional and Legal Framework

The main aim to investigate the effectiveness of institutional and legal framework on Islamic banking in the UK. In order to develop and prosper any industry, it is essential to have well-defined institutions and legal system. Being an infant in a highly competitive market, Islamic banking can only be effective if all related parties in the industry work collectively to establish a strong foundation. I made review comments made by some concerning the present position of the Islamic banking system about the regulatory framework. “Like conventional Islamic banking has not got an established institution and legal system. They follow the conventional platform with some amendments to comply with shariah. They need to develop their Accounting Standards and Policies” according to HSBC. ”The major challenge for Islamic baking is to overcome institutional and legal barriers while operating in the non-Islamic country. Because the system in this country is more compatible with the conventional system” according to Lloyds TSB. ”Legal requirements of western countries are the major barrier for Islamic banking as they based on Islamic Law” according to IBB. Based on reviewed comments it is clear that Islamic Banking lacks a sound legal and institutional framework. Also, major high street bank such as HSBC, Lloyds that have a secure network agree that Islamic banking is experiencing the obstacles of lack of accounting standards and policies in the financial industry.

4.3.2 The Supervisory Framework

The aim is to establish the issues faced by Islamic banking in the UK about scholarly committee and supervision as its development and growth is mostly depending on the effectiveness of this committee and their role. The goals of Islamic Banks can be achieved through following Islamic law, as the aim of Islam is to provide fair financial solutions to individuals and society at large. It is vital to consider whether these committees are working on Islamic principles and can make timely decisions. I reviewed some of the comments in this area giving preference to the availability of Islamic scholars and their role in effectively developing the Islamic Banking System. ” Customers are confused regarding the calculation of profit sharing ratio due to lack of Islamic banking supervisory framework which is present within the conventional system” according to Lloyd TSB. “Product development for Islamic Banking is a major problem due to lack of supervisory framework” according to Islamic Bank of Britain. During my research it was discovered that Lloyds has 4, IBB and HSBC have three supervisory committee members who are responsible for developing new product and services to the market, investment decisions as well as profit sharing ratios. As a result of this analysis, it was revealed that Islamic Banking lacks a proper supervisory system in place to support this infant industry. It potentially will have a vast market that requires a network of strong supervisions but unfortunately currently have three or four members in their committee.

4.3.3 Awareness of Islamic Banking System