PVH Corp: Impact of Global Financial Trends

INTRODUCTION

International financial market trends play a critical role in the strategic planning process of multinational companies. PVH company is leading multinational company that owens wide range of iconic brand. Therefore, global marketing trends may have a significant impact on the faninancial performance on the business entity.It also leads to a significant impact on the financial performance of global brands (Bekaert & Hodrick, 2016). The global apparel market is reached to near $1.4 trillion until 2021 (The Size of the Global Fashion Retail Market, 2019). Therefore, PVH Corp found lots of business opportunities to increase the sales of company and company has diversified its business model to influence overall business efficiency. In the contemporary fashion industry, the role of social media and other technologies is significantly enhanced to deliver better experience to customers that influence PVH Corp for managing the long term investment in digital technologies to increase the effectiveness of web-based platforms and development of other tech-based solutions. Company is focusing on digital engagement strategy to increase online sales and build long term relationship with customers. Furthermore, business entity is trying to maximise its brand awareness through wide range of customer engagement strategies such as exhibitions, social media platforms and others (PVH Annual Report 2018, 2019). In this regard, this report determines two recent developments in the international financial environment and its impact on the performance of a leading multinational company that is called PVH Corp. It also evaluates the key elements of international financial and risk management strategy. Further investigation is aimed to evaluate the financial performance of PVH Corp. of two consecutive years with the help of a wide range of financial ratios.

PART 1

A. Critically discussing two recent developments in the international financial environment appear to have impacted on PVH Corp. recent performance and development

Bekaert & Hodrick (2016) stated that deregulation of financial markets is a significant recent development appeared in the international financial environment. In this regards, the global economy is witnessing an internationalisation of money and capital market. In traditionally, countries like US and EU offer free flow capital to attain distinct needs of companies along with investors, but Singapore and Hongkong have emerged as active financial markets and also offered a very efficient and robust banking structure to attract global traders. Jacque (2014) asserted that the importance of international financing is significantly enhanced in a globalised economy so as deregulation in financial markets influence the flow of currency, investment along with cross border financial transactions. Therefore, Multi-national enterprises like PVH Corp can raise funds from all over all the world to attain distinct business requirements. Market deregulation leads competition among different financial markets that offer low-cost financing opportunities to companies (Jacque, 2014). It would support the management of PVH Corp to attain financial needs in comparatively low cost of capital. Similarly, the financial market also influences the future expansion decisions of companies in overseas markets because a country with a proactive financial system can attain distinct financial requirements of PVH Corp in the form of debt and equity capital (Emerging Trends in International Finance, 2018). Lumby and Jone (2015) stated that the emergence of derivatives markets had played a critical role in the development and growth of global trade. In the overseas market trade, financial markets offer a wide range of tools such as forwards, futures, swaps and options that assist companies in transferring the risk the of currency exchange, interest rate and credit movement. In this regards, PVH Corp considers these tools while managing the import and export agreements at a global marketplace. In addition to that, multinational companies take a wide range of financing services in terms of export credit and handling currency exchange volatility from overseas marketers during the global trade (Lumby and Jones, 2015). These developments in the financial market environment support PVH Crop in developing a relationship with suppliers and distributors from all over the world. Furthermore, the business entity could lower the financial risk factors during the expansion decisions in new emerging markets because it would increase the effectiveness of long term strategic planning process.

Continue your exploration of International Market Integration Barriers with our related content.

B. Discussing the following critical elements of the MNE's international financial and/or risk management strategy

Sources of Finance: In the determination of capital structure, key theories of capital structure are relevancy, irrelevancy or pecking order. In the present case, pecking order theory seems most appropriate in which cost of financing increases with asymmetric information. It assists business entity in selection of most appropriate source of finance in the form of internal funds, debt and equity. In this approach, business entity will consider the approach of internal financing in the first place then debt and equity (Saunders & Allen, 2010). This approach assists companies in prioritised their financing sources as per the distinct requirements of business entity. International companies like PVH Corp acquires funds from different sources such as debt, equity and others from both domestic and international financial markets. Therefore, companies consider several risk factors in their financing decisions that include credit risk, liquidity risk, operational risk, and legal risk (Alexander and Nobes, 2016). Therefore, the risk management strategy of PVH Corp is focused on identifying volatility in financial markets to handle business operations as per the movement of stock prices, interest rates and other exchange rates. In addition to that business, entity monitors foreign exchange policies of different countries to manage the foreign exchange and capital structure. In the context of equity financing, marketing plays a crucial role to determine the stock prices and overall market capitalisation of the company (Atrill & Mc Laney, 2017). Apart from that, cost debt financing is influenced by global and domestic bank rates. In this regards, PVH Corp always focused on developing an appropriate combination of debt and equity sources of finance to minimise the risk factors in global business trends. The short term borrowings of the company are reduced to $12.8 million in 2018 as compared to $19.5 million of 2017. The value of long term debt is reduced to $2,819.4m with reference to $3,061.3m. The interest rate is floated near to 4% in both years. The total equity capital of PVH group is reached to $5,827.8m in 2018 as compared to $5,536.4m in 2017 (PVH Annual Report 2018, 2019).

Dividend Policy: The dividend policy is termed as an essential part of the financial strategy of the company. It plays a critical role in influencing the share prices. In the context of risk management, dividend policy can be termed as an essential aspect of corporate governance and economic policy of business entity so as PVH Corp has adopted cash dividend policy (Ward, 2014). It supports business entity in developing a fair image of the company among stakeholder. However, the approach of risk management alleviates the asymmetric information problem that is termed as an essential determinant of dividend policy. This is because the dividend policy influences cash flow within an organisation and could hamper the liquidity of the business entity. Therefore, an organisation can control the risk in dividend policy through signalling equilibrium in which international firms consider the true value of future cash flows that would be correlated with dividend payments and increase in the market prices of shares (Lee & Lee, 2010). In 2018 and 2017, the company has paid the dividends on common stock totalled $12 million in each year (PVH Annual Report 2018, 2019). THERE IS NO THEORY I NEED THE DIVIDEND POLICY THEORY HERE.

C. Analysis of Financial Performance of PVH Corp.

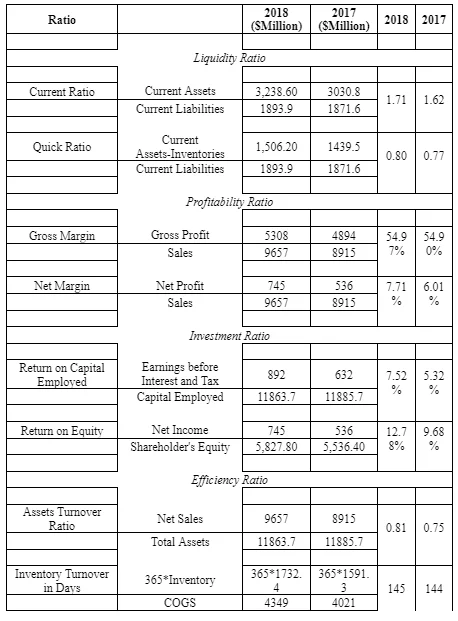

In the calculation of financial ratios, different kinds of figures related to the financial results of the company are extracted from annual report. The assessment of the financial performance of PVH Corp. is carried out below through different financial ratios:

Liquidity Ratio

Current Ratio definition: This ratio determines the relationship between the current assets and current liabilities to assess the requirements of working capital and the organisation's efficiency to manage the payment of all current liabilities. It measures the availability of current assets in the relationship with current liabilities (Saunders & Allen, 2010).

Annalysis: In this regard, the PVH Crop has recorded the current ratio for 2018 and 2017 is respectively 1.71 and 1.62. The main increase in current ratio is the increment in value of inventory and trade receivables in the current assets. However, the clothing brand has not attained the ideal current ratio of 2:1 so as it shows that the company would find some problems to handle payment of all current liabilities. Apart from that, the increase in the value of the current ratio indicates improvement in the liquidity position of the company.

Quick Ratio: It is a significant financial ratio that determines the availability of cash and equitant cash securities through which an organisation can make immediate payments of all current liabilities. In the present case of PVH Crop, a business entity has addressed positive trends in quick ratio because it is increased to 0.80 in 2018 as compared to 0.77 of 2017. However, PVH Crop has not achieved the ideal quick ratio of 1:1 in both years that could result in a shortage of cash or liquidity while conducting the payment of all dues and current liabilities. In the context of the contemporary business environment, the quick ratio assists managers in the assessment of working capital requirements as well as identification of new sources of short-term capital in the financial market to attain distinct business requirements.

Profitability Ratio

Gross Profit Margin defination: This ratio presents the percentage of gross profit as per the total sales of the company. In the present case, the consumer-driven business approach of PVH Crop has maintained the stability in sales growth that determines the steadiness in gross earnings of business entity (Ahrendsen & Katchova, 2012).

Analysis: The gross profit margin of PVH Crop is respectively 54.97% and 54.90% for 2018 and 2017. There is little improvement identified in the gross profit margin of the company in 2018. This information indicates that the business entity has enhanced its income generation capabilities through digital technologies and by offering the best experience to consumers.

Net Profit Margin definition: It is an important ratio that is considered by all stakeholders of the company. This ratio presents the percentage of net profit concerning total sales.

Analysis:The assessment of the net profit margin of PVH Crop has found that the net profit of a company is increased to 7.71% in 2018 as compared to 6.01% of 2017. Because of the growth net profit margin of the company follow a decrease in operational expenses of the business entity. Therefore, it can be stated that PVH Crop has gained significant success in controlling its administrative and operating expenses.

Investment Ratio

Return on Capital employed definition: This ratio presents the relationship between the earnings of a company before interest and tax (EBIT) and the total capital employed (Ak & et al., 2013).

Analysis:As a result of an increase in EBIT, PVH Crop has identified the increase in the value of the return on capital employed because ROCE ratio of PVH Crop is improved to 7.52% in 2018 concerning 5.32% of 2017. It shows improvement in the financial performance of the business entity, and it plays critical in attracting the investors so as the company can enhance its capital to attain business goals.

Return of Equity Ratio defination: This ratio is another investor’s ratio that assists investors in dealing with investment decisions in an organisation. It evaluates the relationship between net earnings and the value of equity capital (Saunders & Allen, 2010).

Analysis: In the context of PVH Crop, return on equity ratio of the company is increased to 12.78% in 2018 as compared to 9.68% of 2017. The main reason behind the increase in return on equity ratio is the increment in net earnings of business entity.Because of the rise in return on equity, the fashion industry like PVH crop can easily get attention from shareholders all over the world. This ratio helps investors in the evaluation of the earning capabilities of a business entity.

Efficiency Ratio

Assets Turnover Ratio definition : It is a great tool to determine the efficiency of business entity in which an organisation evaluates its sales generation capabilities regarding the total value of capital employed in total assets of the company (Culp, 2011).

Analysis: In the present case of PVH Crop, the assets turnover ratio is respectively 0.81 and 0.75 for 2018 and 2017. PVH Crop has recorded the improvement of its efficiency in sales generation. However, the sales generation capability of the business entity is not up-to-the-mark in both years. Therefore, the management of PVH Crop should have to enhance the sales volume to increase the productivity of assets.

Inventory Turnover Days: : It is an activity ratio that measures the efficiency of the company's inventories management practices. This ratio determines the time duration in which the business entity turns its inventory into sales (Ahrendsen & Katchova, 2012).

Analysis: In this regard, the inventory turnover days of PVH Crop is respectively 145 and 144 days for 2018 and 2017. This information indicates that there is no significant difference identified in the inventory turnover ratio in both years. Therefore, according to that PVH Crop has maintained appropriate efficiency for ensuring stable sales growth.

CONCLUSION

As per the above evaluation, this report has concluded that financial markets are playing outstanding in long- and short-term strategic decisions of global companies. The present investigation has found that deregulation in financial markets offers new business opportunities to raise funds from different resources at low cost. The present study has concluded that an international organisation requires to consider an appropriate strategy in managing different kinds of risk factors during the international sourcing of funds in the form of debt and equity such as debt-capital restructuring. Further assessment of financial ratios of PVH Crop has determined that the company has maintained stable growth in its profitability along with overall business efficiency.

REFERENCE

Ahrendsen, B. L., & Katchova, A. L. (2012). Financial ratio analysis using ARMS data. Agricultural Finance Review, 72(2), 262-272.

Ak, B. K., Dechow, P. M., Sun, Y., & Wang, A. Y. (2013). The use of financial ratio models to help investors predict and interpret significant corporate events. Australian journal of management, 38(3), 553-598.

Atrill, P., & Mc Laney E. (2017). Accounting and finance for non-specialists. 10th Edition. Harlow: FT Prentice Hall.

Bekaert, G. J., & Hodrick, R.J., (2016), International Financial Management. Pearson, London.

Culp, C. L. (2011). Structured finance and insurance: the ART of managing capital and risk (Vol. 339). John Wiley & Sons.

Kheradyar, S., Ibrahim, I., & Nor, F. M. (2011). Stock return predictability with financial ratios. International Journal of Trade, Economics and Finance, 2(5), 391.

Lee, C. F., & Lee, J. (Eds.). (2010). Handbook of quantitative finance and risk management. Springer Science & Business Media.

Lumby, S. and Jones, C. (2015). Corporate finance: theory and practice. 9th ed., London: Cengage.

Saunders, A., & Allen, L. (2010). Credit risk management in and out of the financial crisis: new approaches to value at risk and other paradigms (Vol. 528). John Wiley & Sons.

Ward, A. M. (2014). Finance: theory and practice. 3rd ed. Dublin: Chartered Accountants Ireland.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts