Globalization and Strategic Expansion

1.0 Introduction

The retail market is growing at a rapid rate in such an era of globalisation, where the retail firms are operating in the market efficiently to serve the customers worldwide (Haugen, 2018). The study is efficient to analyse the internal and external market for the organisations operating in the retail, industry. Through this paper, it is also possible to analyse the strategic planning of the organisations to sustain in the market and identify the future opportunities and threats. LVMH is the French luxury retail manufacturing organisation focusing on the products including clothing, cosmetics, fashion, accessories, Jeweller, perfume, spirit and watches. The organisation is efficient to generate high revenue which was €53.7 billion in 2019 by running their business through the retail network over 4910 stores worldwide. The company is as successful to hire the employees over 163000 and the staff members are efficient to run the business activities across the globe. The organisation decided to acquire Tiffany which is an American Luxury jewellery and speciality sector. LVMH has created £12.6 billion and buy the jewellery brand which is also efficient to design high end jewellery and luxury items as per the market trend and customer’s preferences (LVMH, 2020). If you need a business dissertation help, understanding these dynamics and strategies can provide valuable insights.

2.0 External Analysis

2.1 Macro-Environment analysis of the grocery and food industry

2.1.1 Political

The incident of Brexit is considered as threat where it raises uncertainty in the market of fashion and jewellery where the customer’s purchasing intension for luxury products is deteriorating over time. On the other hand, the political stability at the UK and USA as well as inter country relationship and international trade are considered to be positive factors that influence the business of LVMH to sustain in the market and expand it successfully (Gopalakrishnan and Matthews, 2018).

2.1.2 Economic

The economic growth across different counties is an influential factor where it affects the firm’s growth positively. The countries like UK and USA as well as other western countries and emerging economies like China, India are growing at a rapid rate with high GDP, National Income and purchasing power parity. The customer’s purchasing power is increasing as well as there is high employment due to industrialisation and thus these factors are major opportunities for LVMH to establish their business sustainably. The countries are also efficient to minimise the inflation rate for avoiding inflationary growth and for which the market is stable where the business firms can operate efficiently.

2.1.3 Social

Social development is also another major opportunity for the organisation, where the people are educated and they find latest technological innovation and latest goods and services for maximising their quality of life. Apart from that, corporate social responsibility practice is increasing due to high concerned among the individuals about the environmental green footprint and it is also another opportunity for LVMH to sustain in the market and provide green environmental footprint. However, structural change is another threat where the buying behaviour, pattern and choice and preferences of the customers are changing over time which is unpredictable by the organisations.

2.1.4 Technological

Technological advancement in the fashion and jewellery sector is considered to be a major opportunity where the firm can establish the infrastructure and implement the latest technology like ERP system, ICT and CRM for managing their stakeholders and maximising organisational excellence. In addition to this, he rise in e-commerce activities is another opportunity in the market, where the firm can utilise the online activities and strengthen their customer’s base by providing high quality product and efficient services (Bansal, 2019). The retail fashion and jewellery firms in the market can operate properly by utilising online website and mobile application to retain the long run customers and establishing the business successfully.

2.1.5 Environmental

Environmental sustainability management is the core strategy of the business in the recent era of globalisation, where the people and the ent6reprneours are concerned about managing the green environmental footprint. Though it is beneficial for the social communities and environment as a whole, it becomes difficult for the organisation to manage sustainability and thus it is considered as threat. It is difficult to reduce the emission of greenhouse gas, toxic by products, energy waste and plastic usage (Goswami and Goswami, 2017). This is challenging for the organisation to manage the factors for environmental sustainability as well as cost of the operations lower at the same time. LVMH needs to focus on managing sustainability of the business by reducing waste, improving the use of renewable resources, reducing greenhouse gas emission by production management and using electric cars for supply and distribution network management and utilising paper packaging system.

2.2 Industry analysis using Porters

2.2.1 The threat of potential new entrants

The threat of new entrant for LVMH is low, as the company is also successful to gain high competitive advantage and establish the brand efficiently with latest innovative and luxury products. Additionally, the company is also successful to have culture and brand image where it is difficult for the new entrants to gain such market share initially (Moraes et al., 2017).

2.2.2 The threat of substitutes

The threat of substitute products is high for LVMH due presence of the substitute products in the market. The competitive brand sin the jewellery and fashion industry are also successful on present variety of fashionable product which may attract the customers across the international markets and thus LVMH face high threat of substitute products.

2.2.3 The extent of competitive rivalry

There is strong competitive in the market where LVMH face high threat due to presence of the competitive brand such as Companies Financière Richemont, PPR, Valentino Fashion Group, Christian Dior, Mulberry, Salvatore Ferragamo, Hermes, Burberry, Giorgio Armani, Chanel, Coach, Dolce & Gabbana, Jimmy Choo, and Polo Ralph Lauren, and the companies are also efficient to design innovative jewelleries and accessories for attracting the audiences across the international markets. The strategy of acquiring Tiffany is effective for LVMH to sustain in the market and compete with other competitive business for gaining high competitive advantage in log run (Dauriz and Tochtermann, 2017).

2.2.4 The bargaining power of suppliers

The bargaining power of the suppliers is moderate in the industry, where the company LVMH is also successful to have strong supplier’s base and distributors in the market. The suppliers and the distributors are satisfied with the organisational policies and practice and they can earn higher through incentives and rewards program. Thus the company is successful to retain the experienced suppliers and distributors in long run. However, the industry is highly competitive and there are other competitive brand operating in the market for which the suppliers have the chance to switch their choices towards another brand for which the power of the suppliers to bargain is moderate.

2.2.5 The bargaining power of buyers

The bargaining power of the customers is considered to be moderate, as there are alternative competitive firs available in the market, from where the customers have the option to choose the best products at affordable price. LVMH charges high price for their luxury items and it further influence the customer to switch their brand preferences due to availability of other substitute products in the market. The organisation is facing high bargaining power of the buyers due to low switching cost of the consumers in the market (Antomarioni et al., 2017).

3.0 Internal Analysis

3.1 Resource analysis

As per the resources analysis, the major resources of the firm LVMH are strong brand name and culture, strong employee base, technological advancement, product portfolio, customer base, sustainably. The organisation LVMH is efficient to gain high market share by expanding their business across the international countries. In this regard, the organisation is also efficient to strengthen their customer’s base by providing the best quality products and services to each customers across the globe, where LVMH focuses on managing strong product portfolio and serve a huge variety of products and services to them. For creating the values for the customers, it is one of the effective strategies to fulfil their needs and preferences and establish the business efficiently in long run. The other resources are technological advancement and the strong employee base. The acquisition of Tiffany is one of the best strategies LVMH to sustain in the market and utilising heir resources in long run.

The firm’s infrastructural development and the production and manufacturing units are effective resources which further contribute to manage their operations efficiently. On the other hand, in the recent era of digitalisation, the company LVMH is also successful to implement the technology of ERP, ICT and CRM model to manage their operations and maintain strong stakeholder’s base in long run. Hereby, brand name and culture as well as strong employee base and technological advancement are the major strengths of LVMH. Additionally, the distribution network is also other resources which are considered to be a major strengthen to sustain in such recent competitive market (Al Amin and Islam, 2017). As per the resource analysis, the firm charges high price for the products and luxury goods which is considered to be a major weakness of the business and it further deteriorate firm’s performance in the market as due to high price, LVMH is unable to target the customers based and retain the long run consumers across the international markets.

3.2 Competences Analysis

3.2.1 Value Chain

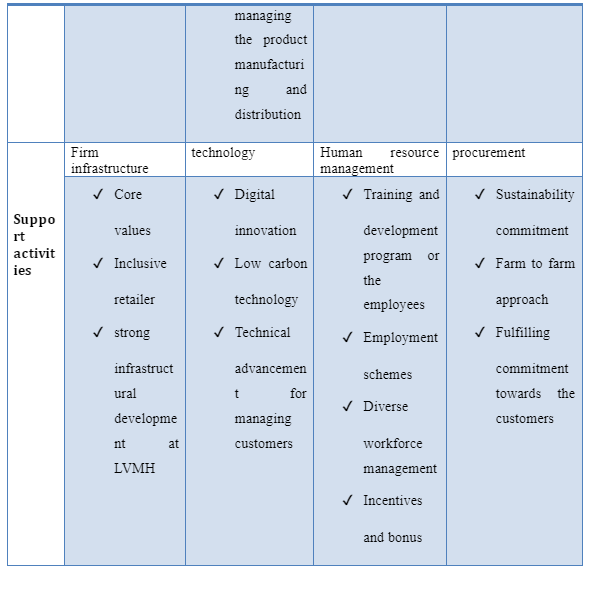

As per the competency analysis, the organisation LVMH is efficient to manage is primary activities as per the value chain evaluation. The company is successful to have strong employee base, where LVMH provides proper opportunity to ensure work life balance and meet the requirements of the employees by providing hem monetary and non-monetary incentives and rewards. The technological advancement is another success factor, which improves the operational efficiency as well as organisational excellence in long run, where ERP and ICT technology further enhance the organisational performance. As per the service and marketing and sales, the company is also successful to manage their service efficiency for creating values for the customers where the e-commerce activities, 24*7 services and support to each customer improve customer’s loyalty and trust in the market.

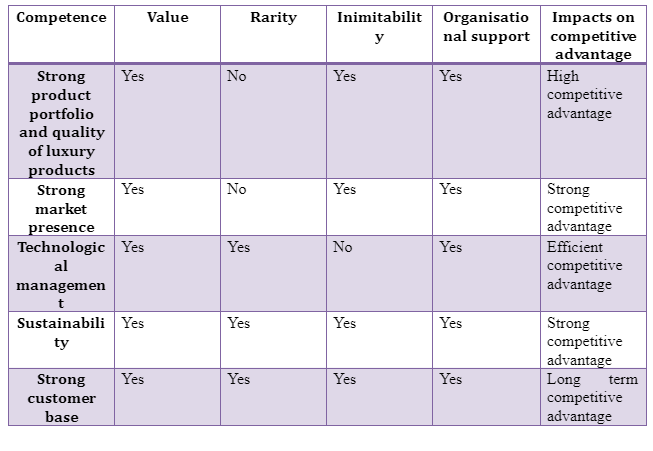

3.2.2 VRIO analysis

The major competencies of the organisation LVMH are product portfolio, strong market presence, technological advancement, and the strategy of acquiring Tiffany as well as strong customer service which help the firm to secure future sustainable development by gaining high competitive advantage as compared to the other competitive firms in the market.

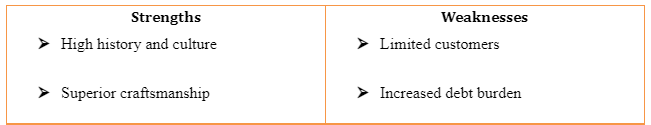

3.2.3 SWOT Matrix

The major strengths of the company LVMH are strong brand values and history, where the company is successful to create a culture and maintain high quality products and services. The company also has strong customer base in the market due to high end products and luxury brands associated with LVMH. The other strengths are superior craftsmanship and strong presence in the market. Though these are the major strengths, there are some weaknesses for which the bard cannot increase their performance in the luxury good and retail market across the international countries. The weaknesses are such as high price of the products, low customer base and increasing debt burden. The major threats are such as intense competition in the market, structural changes and lack of management of the corporate social responsibility as well as the incident of Brexit (Serdiuk, Votchenko and Bogdashev, 2019). On the other hand, the major opportunities are such as rise of ecommerce activities, management of the CSR practice and growing market for luxury products, continuous innovation and product creativity or brand performance maximisation. The company needs to focus on developing proper strategic planning in order to mitigate the upcoming threats in the market for enjoying the market opportunities.

4.0 Strategy evaluation

4.1 TOWS Matrix for suitability

As per the analysis above, the major threats of the company LVMH are the incident of Brexit, which raises the cost of operations of LVMH and reduce the customers base, due to high price of the products, due to Brexit, there is negative impact on the customers base where the purchasing power parity of the consumers is deteriorating after the incident of Brexit for which the company starts losing their loyal customers in long run. Additionally, intense competition in the jewellery and luxury market is another threat where the major competitors of LVMH are Companies Financière Richemont, PPR, Valentino Fashion Group, Christian Dior, Mulberry, Salvatore Ferragamo, Hermes, Burberry, Giorgio Armani, Chanel, Coach, Dolce & Gabbana, Jimmy Choo, and Polo Ralph Lauren. LVMH is efficient to establish brand in the jewellery and fashion industry across the globe, where it has the capability of strengthening their position in the market. The organisation must utilise their financial position and reinvest their asset for more research and development of the products so that LVMH would be able to establish their operations in the global fashion industry. In order to sustain the business in long run, the opportunities in the market must be utilised well, where the company should focus on the technological innovating and utilising the ecommerce activities for long run retention of the customers, so that their profitability and sale volume can be maximised well in near future.

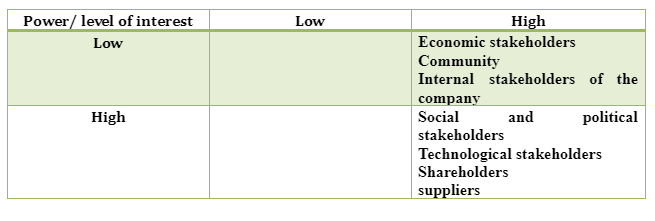

4.2 Power/Interest Matrix for acceptability

4.2.1 Shareholders

The shareholders of the company LVMH have the high power and interest where they are efficient to influence the business strategies of LVMH. The shareholders invest a strong capital and finance in the business of LVMH and thus the CEO is efficient to manage them and maximise their interest in order to mitigate the issue of conflicting interest between the organisation and shareholders. The cooperation and communication with the shareholders of LVMH further helps the CEO and the management team to make effective decision and maximise the organisational profitability in long run (SOUZA PENAFORTE, 2018).

4.2.2 Suppliers

The suppliers are also playing crucial role in managing the business activities, where the supplier try to influence the organisational decision and they are well acknowledged about the market growth, customer’s preferences and demand which further helps the organisation LVMH to identify the market scenario and develop the products successfully to meet the customer’s requirement. The suppliers of LVMH and Tiffany have strong supplier base, where the supplier are efficient enough to strengthen their distribution network and supply the quality jewellery and other accessories and fashion related products to the customers successfully.

4.2.3 Customers

The customers are one of the major stakeholders of the business of LVMH where the customers also have the power and interest in the organisation. The CEO and the management team aim at developing the brand by creating strong customers base where they are trying to create values for the customers and satisfying them with high quality products and services in long run. The design of the products are unique as well as the quality is at its best which further attract the customers and the acquisition strategy of LVMH is successful where tiffany is a strong brand designing quality and innovative luxury jewellery and it would be possible for LVMH to retain the customer’s base of Tiffany and establish the business sustainably in the market.

4.2.4 Employees

The technological stakeholders are important and they have the power and high interest in the business of LVMH where the employees and the technical staff are collaborating and performing with high communication for achieving future success. For creating organisational values, the technical tem as well as the staff at stores, production and manufacturing sites try to perform efficiently and develop new strategy to serve the customers uniquely. In this regard, CEO of LVMH focuses on creating values or them by providing high return on investment, encouraging their creativity at the workplace and managing them successful by proper support and giving direction which further motivate the employees to contribute positively in the business and achieve future success.

4.3 Feasibility

Tiffany is worn by Lady Gaga and the company LVMH is successful to make the deal of acquisition with Tiffany. The $135 per share offer represents significant improvement on the $120 originally put in LVMH. Both the company’s board of members as well as the shareholders accept the deal for better management and running the business collaboratively to gain high competitive advantage. It further influence the purchasing decision making behaviour of the buyers where LVMH is successful to utilise the strong brand Tiffany’s market share as well as their product base to retain the long run customers worldwide. It is also a great deal to sustain in the US market and gain high competitive advantage in near future (Dailymail, 2019).

Take a deeper dive into Geothermal Power Plant Earthquake Crisis with our additional resources.

Reference List

- Al Amin, M. and Islam, M., 2017. Factors Leading to Market Segmentation of Fashion House Business Based on Customer Behavior: Evidence from Bangladeshi Fashion Industry. International Journal of Business and Technopreneurship, 7(3), pp.251-272.

- Antomarioni, S., Bevilacqua, M., Ciarapica, F.E. and Marcucci, G., 2017. Resilience in the Fashion Industry Supply Chain: State of the Art Literature Review. In Workshop on Business Models and ICT Technologies for the Fashion Supply Chain (pp. 95-108). Springer, Cham.

- Bansal, K., 2019. Analysis of Online Shopper Behaviour and Identification of Choice Drivers for Women’s Wear.

- Dauriz, L. and Tochtermann, T., 2017. Jewelry 2020–On the Heels of Apparel. In Luxusmarkenmanagement (pp. 201-212). Springer Gabler, Wiesbaden.

- Gopalakrishnan, S. and Matthews, D., 2018. Collaborative consumption: a business model analysis of second-hand fashion. Journal of Fashion Marketing and Management: An International Journal.

- Goswami, K. and Goswami, G., 2017. An Analysis of growth of Fashion Retailing in Guwahati city. Journal of Marketing Vistas, 7(1), pp.12-18.

- Haugen, H.Ø., 2018. Petty commodities, serious business: the governance of fashion jewellery chains between China and Ghana. Global Networks, 18(2), pp.307-325.

- Moraes, C., Carrigan, M., Bosangit, C., Ferreira, C. and McGrath, M., 2017. Understanding ethical luxury consumption through practice theories: A study of fine jewellery purchases. Journal of Business Ethics, 145(3), pp.525-543.

- Serdiuk, A.V., Votchenko, E.S. and Bogdashev, I.V., 2019. THE MARKET VALUE OF BRANDS ON AN INTERNATIONAL SCALE: CONSIDERING THE EXAMPLE OF JEWELRY INDUSTRY. Sciences of Europe, (39-3 (39)).

- SOUZA PENAFORTE, L.U.C.I.A.N.A., 2018. E-couture. Renewable jewelry: an alternative perspective for handcraft accessories.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts