Managing Risks in Supply Chains

Introduction

Background of the Uncertainty and Mitigations in Supply Chain

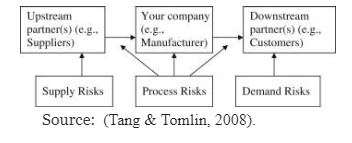

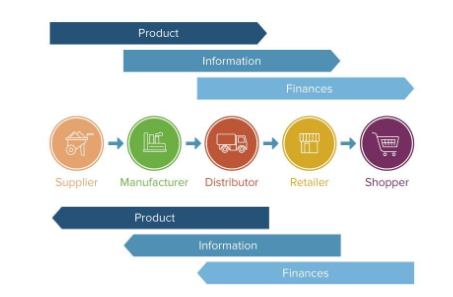

Supply chain refers to the upstream and downstream flow of products, services, finances and information and constitutes a network of companies involved in the process (Chopra & Meindl, 2016; Prajogo & Olhager, 2012). Supply chains work the most successfully when the flow of services, information and products remains unimpeded by risks that may bematerial, financial or informational in nature, as these risks could create problems within a supply chain and cause delay and disruption (Buzacott , 1971). Due to the premising of success of supply chains on risk free process, there is wide acknowledgement of the risks and uncertainties that are associated with global supply chains; the four prominent risks noted in literature being supply, demand, operational, and security risks (Christopher, 2004). Tang and Tomlin (2008) focus more on three major types of risks: supply, process, and demand, which they emphasise as being inherent to all different supply chains as depicted in Figure 1. The key aspects of risks can are: uncertain customer demand, uncertain supply, uncertain yields, uncertain lead times, and natural and man-made disasters (Boulaksil, 2016). The efficiency of supply chain modes shows how various market uncertainties might affect investment and efficiency of supply chain performance (Lai, et al., 2009). In general, supply chain risks can arise either as high-likelihood andlow-impact risks or low-likelihood and high-impact risks (Kleindorfer & Saad, 2005).Disruption caused by these types of risks and uncertainties, be these high-likelihood and low-impact risks or low-likelihood and high-impact risks, have a major influence on the flow of tangible and intangible assets in the supply chain and require preparation and precaution, otherwise it takes time for the affected system to recover (Hendricks & Singhal , 2005). Uncertainties have been observed in many areas particularly in supply chain and these need to be continuously monitored and managed (Heckmann, et al., 2015) The turbulence and uncertainty of the markets encourage the implementation of strategies to make the supply chain more risk-resistant (Christopher & Lee, 2004). The significance of risks related to the supply chain is well covered in literature, and it is accepted that urgent solutions are needed to avoid critical crises (Jüttner, et al., 2003). However, as the supply chain disruptions are generally unanticipated, and unpredictable harmful events can cause inconvenience to companies, a massive surge for mitigation strategy regarding supply chain disruptions and related issues to prevent the potential financial and economic affects in advance is mandatory (Craighead, et al., 2007).This is easier said, but is often difficult to attain because of the unpredictable nature of risks in the global business environment.

The global business environment is of a nature that risks to supply chain management are inevitable (Manuj & Mentzer, 2008). Supply chains can be disrupted with the disruptions of sustainability and continuity of the markets around the world, due to external disturbances, such as, wars, terrorist attacks, natural disasters, or internal disturbances, such as, political conflicts, supplier bankruptcy; such eventsdisrupt the flow of tangible and intangible assets in the supply chain (Chopra & Sodhi, 2004). These major disruptions are impossible to predict and reveal a lack of preparedness of developments to secure the market during these periods (Heckmann, et al., 2015). These challenges and threats can undermine the stability and security of the business and make it hard for the firm to compete (Annarelli & Nonino, 2016.). Therefore, one of the core concerns of supply chain management is to establish mitigative strategies to address risks to supply chains and potential impacts of such risks on the supply chain. A number of techniques or models have been developed in the field of supply chain management to address risk management in supply chains. The underlying purpose of developing such techniques and strategies is to develop approaches to address vulnerability to risk (Trkman & McCormack, 2009). This does not mean that such mitigative strategies can be used to completely free the supply chain from any risk as Chopra and Sodhi (2004) state:“Unfortunately, there is no silver bullet strategy for protecting organizational supply chains. Instead, managers need to know which mitigation strategy works best against a given risk” (p. 55). Proceeding from this statement, it can be said that managers need to be aware of different mitigative strategies and be aware of the strategies that are best suited to mitigating the specific risk that they are facing in a goven situation. Therefore, managers can become more proficient at resisting the obstacles of uncertainty by examining the market and deciding on the proper strategy to eliminate the consequences according to the market situation. Table 1 lists different type of risks and the proper mitigation strategies that can be used to counter the risks (Oke & Gopalakrishnan, 2009) As the analysis of relevant literature reveals, different approaches have been developed to pay attention to mitigation and contingency strategies of supply chain risks so far to secure the proper inventory, and supply and demand planning within the chain. The reliance on reducing the risk in supply chain involves exploring risk factors which may impact the market. For countering these risks, development of effective responses are a necessity for the managers. Risk mitigation and contingency response tactics are two essential plans according to Tomlin (2006);he discusses the major difference between these tactics as a mitigation plan reduces the probability of impact of the identified risk in advance of a disruption while contingency plan does not change the probability or impact of the current risk, instead it plans to control the impact as event disruption occurs (Tomlin, 2006). In some markets, it might be recommended to plan both the mitigation risk response and the contingency response as the risk factors may be high and the impacts of the risks as they occur may also be high. Zolkos (2003) mentions that successful companies are distinct in their capacity of identifying risks and developing contingency plans for the various risks that exist internally and externally to the organization. According to Chopra and Sodhi (2004), managers constructing a supply‐chain risk management strategy need to consider the following: first, the creation of the wide understanding of supply‐chain risk; and second, the determination on how to adapt the risk‐mitigation approach to the circumstances of the particular company. For instance, disruptions and delays are two common types of the supply chain risks; the identification of drivers of these risk categories and the discussion of the implication of the risk mitigation strategies can reduce one type of risk but on the other hand it might increase another type of risk (Chopra & Sodhi, 2004). Therefore, establishing the suitable strategy after addressing the risks and their potential impacts on the supply chain for the certain company in a certain market is very essential.

Research Market and Problem

The goal of any company is to obtain the highest possible return for their investments. Increased profitability is the most important goal for any company. For years, researchers have explored the ways in which markets can be enabled to achieve the greatest and highest profits possible. With the world becoming increasingly globalized, international markets and especially emerging markets, have been proven to offer investors more options to diversify and expand their investments. This has led to increased investments in countries in the developing world (Lall, 2016). For instance, there is increased investments in markets in the Middle East as this region hasbeen recognized as a region of economic growth and stability (Jones, 2003). The fast growth of the Middle East region, due to its abundant supply of resources, has led to it becoming an attractive destination for different types of businesses such as electronics and mobile phone businesses, with many brands now being represented in the region’s markets (AlGhamdi, et al., 2011; Stokes & Raphael, 2010). Academic analyses of the region’s geographic prospects have considered the following countries: Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia, Turkey, United Arab Emirates and Yemen, as part of the Middle East region (Jones, 2003). The prominent example of this study is Iraq’s market, which saw opportunist investments after the opening of the markets post the ouster of the Saddam government. Unfortunately, within the Middle East region, despite early optimistic view of economic conditions, some countries have experienced political tensions, which has dimmed the market optimism related to these countries (Chau, et al., 2014). The impact of political uncertainty and the recent turmoil in the Middle East region contributes to financial volatility in the markets of these regions leading to incapacitating of the supply flow (Chau, et al., 2014). While it is a truism that all countries of the world are prone to uncertainties, in some countries uncertainty is rather more marked, causing disruptions in the timely delivery of products, and raising the requirements for business plans that anticipate uncertainty of the market (Handfield & McCormack, 2007). In 2004, the Iraqi market started attracting foreign and local investors to make significant contributions by investing heavily in its market. In the previous years, more and more electronic and mobile phone companies have internationalized their operations and targeted the Middle East and especially Iraqi market (Bradley III, et al., 2010). The diversity of the cultural, political and economic elements make Iraq’s market an attractive and profitable space for foreign companies (Bradley III, et al., 2010). Many multinational companies invested in the Iraqi market, particularly related to oil sector (Stokes & Raphael, 2010), and telecommunications (Bradley III, et al., 2010). The motivations behind these investments have largely been driven by the desire to benefit from the current situation and demand in Iraq by entering and developing this growth market early and ahead of others (Bradley III, et al., 2010). However, foreign companies’ entry decisions in Iraq are associated with many risks, predominantly due to the political and regional tensions in the region, which can disrupt the supply flow from this region. The primary scope of this dissertation is to examine the risks to business due to the political turmoil and uncertainty in Iraq, which makes the market status impossible to predict.

The industry observers agree that potential disruptions due to war and conflicts such as in Iraq situation pressurises and interrupts the global supply chain ( Baljko, 2003). The challenges posed to supply chains within Iraq market due to a turbulent environment such as political conflicts and external influences such as terrorist attacks can be categorized as “high impact and low probability risk.” Turbulence and uncertainty of the markets, such as the kinds that are seen in the Iraqi market, make it necessary for companies and their managers to implement supply chain risk management principles to make the supply chain more risk-resistant (Christopher & Lee, 2004). In such markets, urgent solutions may be required by the managers so that they can respond to critical crises (Jüttner, et al., 2003). Managers may have to continuously monitor and manage uncertainties (Heckmann, et al., 2015). The Iraqi market has shown turbulence impacting business investments. For instance, government and political conflicts are related to major political uncertainty that impact trading within the country and cause disturbances in changing systems and instability with other countries (Rao & Goldsby, 2009). Within the context of business plans, the importance of understanding the role of political uncertainty on management stability are of great significance to investors and market inspectors (Chau, et al., 2014). Therefore, uncertainty of Iraq market cannot be neglected and requires the implementation of mitigation techniques to improve the performance to reduce the uncertainty and conflict outcomes, aiming to enhance the supply chain performance to be proactive rather than reactive.

Aims and Objectives

According to Tang and Musa (2011), disruptions from natural disaster, terrorist attacks, and crises halt the complicated supply chain network and have consequences in loss of profits, and damage of markets share which requires preparation, precaution; this inevitably increases the importance of supply chain risk management for companies investing in Iraq. The selection and development of disruption strategies must be closely related to and matching the firm’s profile and priorities. Whether it is the mitigation tactics in which the cost of the action incurs regardless of whether a disruption occurs or not or the contingent tactics which arise only when disruption happens and avoids any pre-investment on any sort of redundancy, is not relevant as disruption can occur in any of these ways (Tomlin, 2006) This dissertation was motivated by the need to respond to a specific supply risk, which occurred in Iraq, one of the strategic markets of the Middle East. Iraq is facing high supply risk due to political conflicts and unpredictable terrorist attacks which leads the companies to manage the high shortage of supply caused by unpredictable rules and regulations by the government. The focus of this dissertation is on electronics and mobile phone industry in Iraq market to derive principles of best practices and make recommendations that will ensure the reduction of losses due to the market instability as witnessed in Iraq. Business in electronics and mobile phones deals with non-perishable products, but this industry targets substantial supply chain risk strategies for avoiding shortage in stock as well as obsolesce of the stock in spite of the nature of the stock. The case study of a company which performs in Iraq is undertaken in this dissertation, which demonstrates the issues affecting supply chain management of this company. This helps the researcher to situate the research in context of the problems faced on ground by the company and considerhow it is essential to manage stock to ensure the supply of demand while keeping losses due to uncontrolled risk at a minimum due to uncertainty caused by unstable market’s circumstances.

The research methodology adopted in this research addresses the case of the Iraqi electronic companies through in-depth interviews and a case study of one of the companies that perform in Iraq market. The research methodology is aimed at gaining insights into the best practices, approaches and strategies to hedge against uncertainty of the market and its impact on the supply chain emanating from the market. There were three choices of interview methods available for this research: structured, semi-structured and in-depth interviews; structured interviews were thought to be too rigid to allow a free flow of information from the interviewees (Bryman, 2015); semi-structured interviews were also not considered appropriate because these required some level of control on the part of the researcher (Briggs, 1988); in-depth interviews were considered appropriate as these would give enough time to the researcher to uncover important experiences of the interviewees in a free flowing environment (McCracken, 1988). In-depth interviews are appropriate in research studies that require more insight or where the perception of the interviewee to the field of enquiry is important to answering research questions (Adams, McIlvain, & Lacy, 2002). The dissertation aims to contribute to knowledge in this area by addressing a key question in an actual setting based on the data gathered from in-depth interviews and the case study including:

What are the different types of mitigation strategies to manage supply risks in Iraq market?

How can the firm select the strategy? What factors are put in consideration before the selection?

What are the consequences of the selected strategies?

Literature Review

Introduction

The main purpose of the literature review section is to search and evaluate the available literature that will lead to the answering of the principal research questions raised in this dissertation. In particular, the dissertation aims to explore different types of mitigation strategies to manage supply risks in Iraq market, methods and factors used by the firms to select the strategy, and the consequences of the selected strategies for the firms. Therefore, the major aim of this dissertation is to identify the different types of mitigation strategies to manage supply risks in Iraq market, identify the criteria for the selection, and understand the consequences of the selected strategies on the firm. This literature review is undertaken to clarify the principal terms and theory that relates to this field. First, there is a need to define the different types of risk disruption that affect supply chain in Iraq market, which will help to provide the mitigation strategies required to manage these risks which are suitable for the Iraqi market. Based on the literature review, there are various risks in supply chain which can be identified as follows: material risks, and risks related to information and financial flows, which are necessary in operating a supply chain regardless of the simplicity or complication of the chain as shown in Figure 2. In this dissertation, we will focus on the material or product flow issues and risks within the supply chain.

Risks in literature

In the field of supply chain management researchers face different set of challenges to create, and keep, efficient and effective supply chain methods and solutions, understanding comprehensively the risks which must be identified and quantified in order to control and mitigate considered as additional challenge in their list. Wagner and Bode (2009) distinguished the nomenclature related to the domain of supply chain risk management: supply chain risk, supply chain disruption, supply chain risk source, and supply chain vulnerability; they illustrated how these types are connected with each other as shown in Figure 3. According to Tang (2006), the literature correlated with identifying risks is in primeval stage while the research on managing risks is moderately developed. On the other hand, Wagner and Bode (2009) discuss how several publications define supply chain risks and distinguish them as either danger and opportunity or as purely danger. Similarly, Schmitt and Singh (2012) view firms who maintain operations with higher risk levels to have higher opportunities for being competitive. Therefore, literature suggests that there is some difference in how risks can be conceptualised.Academics and practitioners have demonstrated significant interest in examining different types of supply chain risks and disruptions and the related issues along with them as shown in Table 2 (Craighead, et al., 2007). Heckmann, et al. (2015) identify core characteristics that drive the supply chain risk to the objectives that need to be accomplished by the underlying supply chain and the degree of achievement as well as the exposition towards the unexpected and uncertain developments. While Tang and Tomlin (2008) argue that the complexity of supply chains is the main reason to be more vulnerable to disruptions. In other words, Tang and Tomlin (2008) argue that simplicity of supply chain may be key to mitigating risks. Tang and Tomlin (2008) discuss three types of risks and all the associated risks along with each type. These risks are supply risks including cost, quality, and commitment; process risks including quality, time, and capacity; and demand risks, especially those related to demand uncertainty (Tang & Tomlin, 2008). On the contrary Schmitt and Singh (2012) argue that the goal of management should be to be risk informed rather than to eliminate the risks. This is supported by the assertion by Craighead, et al. (2007) that all supply chains sooner or later will experience unanticipated events that would disrupt the flow of goods. Therefore, as Schmitt and Singh (2012), little may be gained in focusing too much on how to avoid risk because risk may be unavoidable, therefore, focus should be driven by the need to manage risks as and well they arise.

Material flow risk

Material flow involves physical movement within and between supply chain elements. There are different types of inventory, which can vary from raw materials to works-in-process and finished goods, as well as maintenance, repair, and operations products (Chopra & Sodhi, 2004). In this dissertation, focus is on the third type of inventory, which is the ready to be sold products. Inventory is a fundamental measure of the strength of supply chain management (Chopra & Meindl, 2016). Inventory is considered as the capital asset for any supply chain, whether it is a global or domestic firm (Chopra & Sodhi, 2004). As part of supply chain, inventory management includes essential aspects such as controlling and overseeing products not only from suppliers’ end but also from customers’ side. Customers’ inventory needs are related to maintaining storage, controlling inventory, and order fulfillment. Hence, inventory planning and control is crucial to establishing appropriate supply to the market demand. Planning includes the amount of time, effort, money and other resources expended on inventory to ensure the sustainability and resilience of the supply (Partovi & Anandarajan, 2002). Lack of inventory management can lead to a situation where the firm is burdened with obsolete, redundant, or surplus stock which unfortunately requires extra money to manage due to the storing and controlling of the products (Partovi & Anandarajan, 2002). This scenario occurs when uncertainty is highly unpredictable and leads to shortages or surplus in stock and causes stockholding, which can cause more damage, such as, loss and deterioration of stock (Partovi & Anandarajan, 2002). Therefore, inventory management contributes to maximising value and reducing risk and uncertainty (Michalski, 2009). According to Chen, et al., (2007) the behaviour of some inventory planners amounts to risk aversion, where the main idea of the planners is to make decisions based on inventory position, on-hand inventory level and inventories in transit. Knowing the stock level in all the channels is mandatory to plan it properly from the context of averting risk to the inventory. These strategic behaviours are used to streamline inventories across the supply chain and for keeping the inventory investment and risk involved as low as possible. The risk portfolio of a firm’s inventory is a system integrated within the chain according to Manuj and Mentzer (2008), who argue that this provides the firm with a methodology to prioritise cost and risk elements to flag a risk in advance and to prevent it from occurring. Tang and Musa (2011) discuss the perspectives of risks along with the material flow as three stages, which are source, make and deliver. They acknowledg the interconnection of these flows and how one of these flows can obstruct the other ones (Tang & Musa, 2011). The sourcing stage involves different types of risks,such as, single sourcing risk, sourcing flexibility risk, supplier selection, outsourcing, supply product quality and supply capacity (Tang & Musa, 2011). However, the variation of choices and concerns in the source stage can either bring a hidden cost and managerial difficulties or reduce costs and improve responsiveness dependending on the firm’s decision. The making stage involves product and process design risk, production capacity risk, and operational disruption. These risks occur with the inability to cope with the market and technological changes, operational contingencies, natural disasters and political instability which could involve a high cost to the firm (Handfield, et al., 1999). Finally, deliver stage is significant since the risk issues are related to demand, seasonality, and excess inventory; therefore, these issues are all affected by rapid technology evolvement and customer demand changes and short product life (Tang & Musa, 2011).

Mitigations strategies:

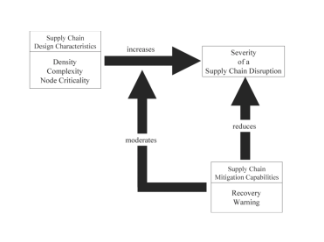

The proactive supply chain strategy against the disruptions has been the subject of significant debate and discussion since supply chain disruption can potentially be harmful and costly and often represents a significant risk to an organisation. Firms are required to build resilience strategies since supply chains are becoming more complex and the severity and frequency of disruptions within the chain is increasing exponentially. Craighead, et al. (2007) discuss how disruptions vary in severity and are unavoidable in supply chain; they encouraged the firms to consider some factors that could contribute or detain the disruption severity and its consequences before implementing any strategies or policies. The main factors of supply chain are supply chain density, complexity, and node which are related to supply chain disruption severity (Craighead, et al., 2007). Supply chain mitigation capabilities and supply chain design characteristics can interact in determining how severe a disruption would be within a supply chain and also how they can moderate the impact that supply chain density, complexity, and node criticality have on supply chain disruption severity as shown in Figure 4 (Craighead, et al., 2007). Thus, firms need to know whether to accept, avoid or limit the risks by first outweighing the cost of the disruption, then considering the possibility of disruption occurring, and finally implementing more suitable strategy of the firm and the environment surrounding. Kouvelis, et al. (2006) argue for the importance to quantify the risks via systematic approach by encouraging the firm to invest in resources. Schmitt and Singh (2012) encourage firms to be aware of its supply chain risk levels and then evaluate its investments and make decisions based on its own level of risk tolerance instead of any pre -investment in any mitigation strategies. Kamalahmadi and Parast (2017) encourage incorporation of different types of redundancy practices such as pre-positioning inventory, backup suppliers, and protected suppliers into a firm’s supply chain that is exposed to supply risk and environmental risk and adding contingency plans. These strategies can help to mitigate the impact of supply chain disruptions as well as reduce costs and risks (Kamalahmadi & Parast, 2017). However, some firms may still focus on reducing cost and increasing reward, and not pay attention to risk mitigation. Braunscheidel and Suresh (2009) argue that agility in supply chain is a valuable approach for both risk mitigation and response since the marketplace is increasingly competitive and suffers from high levels of turbulence and uncertainty. Similarly, Culp (2013) discusses the importance of adaptability and agility of the supply chain structure in response to the market conditions when the disruptive event occurs.

Different Mitigation models

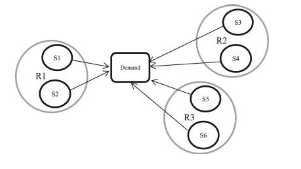

Industrial and academic aspects increase the awareness of risk management issues and raise many research questions on how to compete and enhance the supply chain to cope with all the new challenges in the field of business and environment changes. Most literature research focuses on material, cash and information flows issues in risk management; hence, risk mitigation techniques have been investigated and modeling techniques have been analyzed to examine the risks in these areas. For instance, Tang and Musa (2011) believe that improving a supply chain competence in the new business environment can be achieved by developing risk management models. They examined different flexibility strategies in the context of supply chain risk management to illustrate the power of flexibility for reducing supply chain risks (Tang & Tomlin, 2008). Their models were motivated by different degrees of flexibility to mitigate supply, process, and demand risks; some of the stylized models were based on work presented in the literature (Tang & Tomlin, 2008). In this section we will present prominent models discussed in literature and emphasize the differences among these models and some of the problems associated with them. The explanation is based in the general problem under supply and environmental disruption risks, and development of different models based on variety of circumstances. Kamalahmadi and Parast (2017) have developed a two-stage mixed integer programming as a General Model to address the problem of supply and environmental risks, where they examine the supplier selection and order allocation under supplier dependencies and risk of disruptions and develope three separate extensions of the General Model, to evaluate the expected cost of each one of three risk management mitigation strategies: pre-positioning inventory, backup suppliers, and protected suppliers. The General model as shown in figure 5 designed for the firm to minimize the total cost and the negative financial impact of disruptions; therefore, the firm needs to select the supplier and the region since it is considered a global supply chain where suppliers are spread around the world. There are h possible suppliers, H={1,…,h} the suppliers are distinguished as separate sets in region r, R={1,…,r}, where the firm has only one facility and the total demand per cycle is Q. The characteristic of the General Model’s uncertainty is independent and relevant in suppliers and regions separately or concurrently where a supplier is disrupted and /or unavailable depending on two conditions: first, an individual disruption happens to the supplier; second, an environmental disaster happens in the region in which it is located. The first stage in the General model decisions are determined through incorporating uncertainty of the future outcomes and include supplier management cost, while the second stage decisions are evaluated after the potential future outcomes are assessed and include order cost, transportation cost and loss cost. The main objective function in both stages are the minimization of all these four different types of cost.

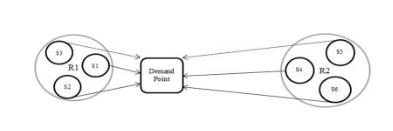

Kamalahmadi and Parast (2017) designed the Pre-positioning Inventory Model which is an extension of the General Model as shown in figure 6. They assumed the warehouses’ characteristics as following: the firm has the ability to build warehouses in different regions; there are options of location of each warehouse; and each warehouse has a specific capacity, fixed building cost, defined transportation cost and holding cost per item pre-positioned in warehouse. As shown in Figure 6 the variables R1 and R2 represent region, S1 to S6 represent suppliers and W represents the warehouses. Where the solid arrows define the delivery paths, the orange dashed arrows define the delivery paths for pre-positioning inventories prior to disruption and the black dotted arrows represent delivery paths in disruption when emergency items are transported to the demand location.

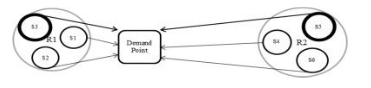

The cost associated in this model according to Kamalahmadi and Parast (2017) in first stage are: the supplier cost, warehouse building cost, emergency inventory order cost, emergency inventory transportation cost from suppliers to warehouses, and emergency inventory holding cost. Second stage contains more costs like order and transportation costs from suppliers for purchasing and transporting the normal allocation of each available supplier, and emergency inventory transportation cost from warehouses for transporting pre-positioned emergency inventory from warehouses in order to make up for disrupted suppliers’ allocations. Finally, loss cost for the items that remained unsatisfied at the end of the cycle is also included. Second model developed byKamalahmadi and Parast (2017) is the Backup Suppliers Model as shown in figure 7. The main change in this extension is division of suppliers into primary and secondary suppliers. Primary supplier is the main supplier during normal circumstances while secondary suppliers are the backup suppliers during disruption. In figure 7, the solid arrows represent flows of suppliers in normal conditions while the dotted arrows represent flows of emergency inventory from backup suppliers during disruptions periods.

Kamalahmadi and Parast (2017) mentioned the main characteristics of Backup model is prices of the product where the supplier will have two different prices during the normal situation and another price during the disruptions where the disruption price is assumed to be higher than the normal price. The decisions relate to the selection of backup suppliers, and the allocation and quantities of emergency stock in each scenario. In this model, associated costs are divided into two categories. First stage costs are supplier management cost, backup contracting cost and emergency inventory holding cost; and the second stage costs are: order cost and transportation cost emergency inventory order cost, emergency inventory transportation cost, and loss cost. Final model developed by Kamalahmadi and Parast (2017) is the Protected Suppliers Model, where the firm improves the reliability of its suppliers by investing and allocating emergency inventory to protect a supplier to minimize the disruptions as shown in figure 8. The proposed model for disruption with protected and unprotected suppliers is where the bolded arrows emphasize the protected paths to the protected suppliers. Each protected supplier has an emergency capacity and sells the emergency stock at higher than the selling price. The firm needs to determine which supplier to protect and the quantity of emergency items to avoid the disruption shortage in supply. The associated costs for each stage are similar to the Backup Model in addition for the first stage is the protected suppliers cost.

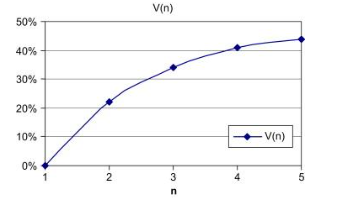

Tang and Tomlin (2008) focus on strategies that are based on the agility principle with supply, process, and demand risks. The investigated strategies are based on flexibility in order to reduce the negative implication within the chain. They present five separate models to examine a fundamental of flexibility to manage supply chain risks without the consideration of the cost for implementing additional flexibility in any of the models Tang and Tomlin (2008). In this dissertation, we will discuss the models related to the supply risk. Tang and Tomlin (2008) study the power of flexibility via multiple suppliers model which was motivated by the flexible supply strategy adopted by Intercon Japan. The circumstances of the situation are based on five suppliers with uncertain supply costs and the assumption of identical and independent cost. The supplier who offers the lowest cost is chosen where the supply flexibility level is represented by the number of qualified suppliers. Figure 9 illustrates significant savings due to the power of supply flexibility via multiple suppliers where V(n) is the percentage of savings in unit cost by ordering from n suppliers, V(n)=(UC(1)−UC(n))/UC(1). As shown in figure 9, V(n) is increasing and concave in n which is proof of the reduction of supply cost risks, and encourages firm to order from a small number of suppliers.

Tang and Tomlin (2008) discuss the supply commitment risk in this model as they illustrate the power of flexibility via a flexible supply contract as one of the strategies; this model was motivated by a supply chain network comprising the supplier Canon, the manufacturer HP, and the retailer Best Buy as shown in figure 10. The ordering process is when the retailer places the order at end of the period while the manufacturer places it at the beginning of the period from the supplier. At the beginning of period the estimated order is D=a+ε by the retailer a represents the forecasted demand ε corresponds to the uncertain market condition during period. Manufacturer orders x units at the beginning of period where x is a decision variable and would depend on the flexibility level of the supply contract engaged between the manufacturer and the supplier. u-flexible is the supply contract where the manufacturer is allowed to modify his order from x units to y units y must satisfy: x(1−u)⩽y⩽x(1+u), where u⩾0 As shown in figure 10, V(u) is increasing and concave is in u. Also, significant benefits associated with the u-flexible contract can be obtained when u is relatively small. This may explain why HP was satisfied with a flexible supply contract with Canon based on a small value of u

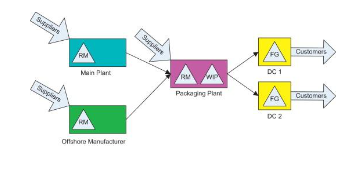

Schmitt and Singh (2012) conducted a model with the CPG firm and referred to it as company ABC in their model to study the risks in their network. As shown in figure 11, model ABC's network is an assembly distribution system, the network contains two distribution centers, one packaging plant, and two manufacturing plants. Respectively, RM, WIP, and FG stand for raw materials, work-in-process, and finished goods where WIP inventory is unpackaged product and inventory locations are represented by triangles as shown in the diagram. The operation of the model is with a base-stock level at each product level. The operation target is to accomplish one week of RM inventory, two weeks of WIP, and finally four weeks of FG.

The model developed by Schmitt and Singh (2012) shows the developed risk profiles of all parts of supply chain, and considers transportation disruptions from the offshore manufacturer in their model, since the interruption of the flow can be caused by the long lead time and customs issues. In their paper, Schmitt and Singh (2012) discussed the disruption categories for each location and how they generate them from interviews and literature. Also, they tested inventory placement based on realistic disruptions in the network and used simulation model to allow the observation of the system performance. Based on multi-echelon inventory, the disruption impact inventory placement and volumes differently in three levels of inventory storage RM, WIP and FG which held at each level of the supply chain (Schmitt & Singh, 2012). The accurate holding cost structure for ABC was studied by them in order to assess the impact of the disruption and outlined in Table 3. Their analysis demonstrates the importance of the firm to design a system that focusses on upstream and downstream locations in order to solve the optimal inventory level and be resilient to disruptions and stochastic demand. The simulation of the supply chain proofed the dynamic nature of disruption and its impact on inventory levels. The flexibility built into a system via inventory throughout the system reduce the disruptions and the impact along with minimizing inventory to reduce cost. However, this should be undertaken with careful consideration to manage both demand supply to avoid any chain risks .

Finding of different models

The most important finding by Kamalahmadi and Parast (2017) is that the three models developed by them are proofed to reduce costs and risks compared to the General Model. Each model has assisted to examine the impact of mitigation strategies in sourcing and procurement decisions. Next each model analyzes and provides insight into the selection of the proper supplier, demand and capability based on the reliability, risk, dependence and cost in order to reduce the severity of the disruptions. Finally, environmental disruptions can be mitigated by regionalizing a supply chain and reducing the impacts of the risk within the chain, thus also enhancing the understanding of the supply chain risk management. Tang and Tomlin (2008) focus on various flexibility strategies as defense and proactive mechanisms for mitigating supply chain risks for firms to compete in market. Tang and Tomlin (2008) emphasise on the needto implement the limited flexibility strategies in order to reduce supply chain risks significantly. They also examine and provide different models to illustrate the robustness of power of how low level of flexibility is enough to mitigate and reduce supply chain risk which encourage firms to build flexibility within the supply chain (Tang & Tomlin, 2008)). The finding by Schmitt and Singh (2012) suggests that the ABC model of the supply chain has multiple echelons view of system, reflects realistic disruption risks and different mitigation strategies to make inventory decisions more accurate, and provides insights to clarify the understanding of holding cost structure which help to generate the best inventory design and can be reasonably extended to more complex supply chains. The model demonstrates a systematic approach to control the downside of a disruption.

Limitation of different models

The stochastic models and experiments by Kamalahmadi and Parast (2017) have several limitations. The values for parameters may not accurately capture the dynamic nature of supply chains where the supplier and regional disruptions are the core of their study. Furthermore, Kamalahmadi and Parast (2017)neglected a time horizon in any of the three strategies. The models were assumed to be performed in a one cycle demand period without backlog. Tang and Tomlin (2008) presented different models of flexibility strategies; but there is lack of reliable data and accurate cost due to limitations of data availability. The implementation of any of these strategies or a combination of them will not eliminate the urge to structure the evaluation process such as the mitigation and contingency planning, risk assessment and identification. Schmitt and Singh (2012) mentioned the benefit of proactive planning and mitigation in transition into emergency and recovery operations within the supply chain smoothly. ABC model results indicate that mitigation strategies employed in the inventory decision help explore reduction of risk at different locations in the network; however, if the rest of the network is too vulnerable and contains weak links in the chain, then these strategies will not be enough unless an improvement is implemented to strength the weaken parts of the chain. The improvement of the overall resilience of the system cannot be done by the strategies only where the firm needs to invest time proactively so as to understand the parameters of the disruptions and minimizes the impact of it in the network.

Methodology:

Research is the foundation for knowledge, innovation and application to provide broader benefits for supply chain and inventory management in this area. The methodologies that guide and support risk inventory management evaluation vary as these depend on the approach and method preferred by the researcher and the real benefits and impacts of the different methods used by the researcher forcollecting data, and analysing it to solve a particular problem or to explore an unknown phenomenon. In addition, the methodologies can be considered as diagnosis tools that allow researchers to appraise information related to safety stock. Studies do combine quantitative and qualitative methods, in mixed methods research, which can be useful in generating data that helps the researcher to conduct a research with the benefits of both qualitative and quantitative methods (Creswell, 2013, p. 12). Mixed methods research has become common in social science research, and it supports the set of findings from one method of data collection with another method underpinned by another methodology (Creswell, 2013, p. 12).

Challenges:

There is increasing interest in SCRM within the academic and industrial environment, and there are several academic journals and resources on topics related to it (Al-Najjar, et al., 2016; AlGhamdi, et al., 2011). However, scholars researching on this area in Middle East market face many challenges in conducting research. Challenges relate to data collection, validity and reliability issues with data, language barriers and the diversity of the region, and lack of research support and infrastructure (Lages, et al., 2015). Keeping these challenges in mind, the researcher has chosen the case study approach as a useful method for exploring the areas which will enabl in‐depth understanding of a situation which is difficult to investigate using other techniques.

Data sources:

The qualitative approach of the case study involves interviews in providing more insight into the issues faced by managers and the best practices that are followed by them (Yin, 2009). Using interviews, a significant amount of data were pre-tested and supplemented with findings from interviews with senior executives managers in companies working in the Iraq market. In this study, the primary method of data collection was through interviews of key sales and logistics managers from companies work with Iraq market. Interviews were conducted by online calls using Botim application to conduct and observe the interviewee answering the questions. Botim is an webcam application which is more flexible and a way for time and cost saving, which was useful for allowing the researcher to conduct research while dealing with challenges of time constraints and costs (Bryman, 2016). The researcher participated in each interview with individual interviews lastingbetween 45 to 90 minutes. Each interview was recorded, and transcribed for data analysis. After each interview, to the researcher immediately discussed the interview observations, and coded and analyzed the data to ensure the achievement of theoretical saturation of the qualitative interview method (Bryman, 2016). The secondary data collection included supporting material and figures from the participating company such as company profile, sales figure, Iraq’s ports rules and regulations, local newspaper articles, and internal processes. These materials are essential data from the participants to allow improving the understanding of the phenomena and increasing the reliability of the study (Bryman, 2016).

Interview methodology:

The case was analytic as there were no known previous studies of supply chain risk conducted in Iraq market and focusing the case on a single company improved the investigation in developing the research through the use of the case study method (Yin, 2009). The single case study was more appropriate for generating in-depth information on a single product from a certain company to provide best practices in a company with relationto uncertainty and where the company has undergone a change of business and management structure during the period of risk to eliminate the consequences. Data were collected from 2018 onwards, to tackle the issue when it happened. Different people across different departments in sales and logistics were selected throughout the duration of the study to provide the data needed for the investigation. The advantage of this approach is to allow understanding the risk, the safety precaution and the key relationship in a setting which could reveal facets to be studied in another country within the Middle East. The company provided the research with a unique and revelatory data for the single case. The case started when the Iraqi Federal Government has imposed an international flight ban on the Kurdistan Region's airports on both the Erbil and Sulaymaniyah airports on September 29, 2017, and lasted for more than five months. The flight ban effected the lives of many people living in Kurdistan and added unnecessary complexities for the access of cargo and vital imports to Erbil and Sulaymaniyah (BCC, 2017 ).The embargo was a turbulent time for the company to maintain profits and deliver the goods to the customers in the Iraq market which proved to be a struggle during this time. Due to uncertainty, the management structures have been restructured and the business philosophy has changed dramatically as discovered during the research on the case study. This makes Iraq market an interesting case to investigate the management of risk and subsequently the issues of supply chain and how to manage the inventory and the safety stock in the channels of distribution. The level of participant observation taken was moderate to maintain a balance between participation and observation (Bryman, 2016). In this way, the researcher was able to observe and be involved with managers and retain enough information to influence the investigation of the case study and gain better insight of the risk management that was implemented by the company.

The prospect of getting close to the subjects in question was an advantage, to reduce the reluctant of information sharing, and develop trust to encourage the access of sensitive information. It also enabled the capturing of the emerging issues of risk that might prove to be invaluable or significant. In‐depth, semi‐structured and unstructured interviews were undertaken to gather detailed information (Bryman, 2016). These types of interviews allowed discussion to flow, and the conversation between the interviewer and the interviewee enabled the researcher to probe deeper and collect detailed dat

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts