Navigating Change for Business Success

Introduction

With the rapid development of information technology, the business environment has become more competitive with organisations facing more changes that are difficult to predict. In this era, strategic business and change management is core to increased organisational performance (Yang 2019). Companies are increasingly searching for sustained competitive advantage which is intended to act as a strategic concept for long-lasting optimal performance. However, this is not always the case as change continues to be disruptive, with uncertainty and volatility leading to short periods of competitive advantage before change occurs (Elahi 2013). Nonetheless, some organisations have successfully used strategic business and change management concepts to turn disruption into new business areas resulting in sustained competitive advantage for longer periods (Teece et al, 2016). In the same vein, Alkhafaji and Nelson (2013) write that in the dynamic changing environment, keeping up with changes in the environment and quickly adjusting strategies to match the changes can result in sustained competitive advantage. On the contrary, Li and Liu (2014) state that in reality, many well-established organisations have failed to perform in changes environments or in new markets despite adjusting their strategies. On the other hand, Lengnick-Hall and Beck (2016) state that some businesses adapt to change when it is too late thus they end up losing their market share; for example, Kodak was slow to implement its strategic change thus lost the opportunity to enter the digital market resulting in its bankruptcy. Thus, lack of strategic business and change management as well as slow strategic change result in business failure.

Company Profile

SSE is an energy company that was formed in 1998. The company provides energy and related services in the UK and Ireland while developing, owning, and operating energy and related infrastructure (SSE 2019). Today, SSE has investments and operations across the UK and Ireland and is involved in generation, distribution, transmission, and supply of electricity, production, storage, distribution and supply of gas, and in the provision of energy related services. The company operates at the wholesale, network and retail business levels (See table 1).

Section 1

1.1 Benefits of strategic planning to SSE

Strategic planning can be defined as the process of systematically identifying, analysing, assessing and managing internal and external business environments while considering factors in the industry environment in order to identify the strengths and weaknesses of a company’s capabilities and internal resources and to recognise the opportunities and threats facing the organisation (Grant 2016). VRIO is commonly used in internal analysis, PESTLE in external analysis and Porter’s Five Forces in industry analysis (Campbell et al. 2011). Through strategic planning, an organisation is able to assess the impact of known and unknown variables relating to the internal and external environment which affects its performance. Existing literature provides benefits of strategic planning that in this case affect financial and non-financial performance of SSE. Strategic planning will help SSE identify the strengths and weaknesses of its internal capabilities and resources as well as identify threats and opportunities for its operations in the future (Helms & Nixon 2010). According to Teece (2010), strategic planning helps an organisation to devise plans effective in overcoming threats and harnessing opportunities for higher performance in the future. Further, Campbell et al. (2011) note that strategic planning helps a firm gain and maintain competitive advantage and economies of scale. Still, strategic planning helps an organisation to create distinctive position in the industry it operates. Finally, Grant (2016) posit that strategic planning helps a company attain long-term sustainability. SSE will acquire these benefits through strategic planning. However, Treece (2010) state that strategic planning is costly in the short run but beneficial in the long run. This implies that SSE should invest in strategic planning with an aim of attaining its long-term goals.

1.2 Environmental Analysis

Environmental analysis refers to the process of identifying, assessing, and analysing the internal and external environment of a firm (Powell & Bromley 2013). In this process, SMART goals, and objectives are defined, strategic actions developed, and the most effective strategy in meeting the goals selected (Voiculet et al. 2010). Environmental analysis has a key role in strategic planning; internal environmental analysis leads to identification of organisational strengths and weaknesses while external environment analysis facilitates identification of potential opportunities and threats (Wilson & Gilligan 2012). Additionally, environmental analysis helps in definition of targets and strategic KPIs as well as in development of contingency plans to address key risks (Hollensen 2010).

1.3 SSE’s PESTLE Analysis

1.3.1 Political Factors

Brexit and geo-political uncertainty: The continuing uncertainty that the UK could leave the EU countries inclines SSE to financial losses (Cumming & Zahra 2016). In addition, the government’s decision to phase out power generation threatens the performance of SSE. EU and national policies such as EU package of climate protection further threaten the operational efficiency of SSE (Ziv) et al. 2018. Specifically, the intervention policies and changes in regulation such as price reduction, additional taxes, and price cessation are likely to negatively affect the operation of SSE. The specific effects include decline in net income, decreased market capitalisation, and strategic KPIs in relation to price cap and variable staffs.

1.3.2 Economic factors

Interest rate: The interest rate has been significantly increasing, which adversely affects SSE (Swanson and Williams 2014). For example, higher interest rates result in lower security prices, which implies that SSE will sell its shares at a lower price. Additionally, an increase in financial cost results in higher interest rates further threatening the success of SSE; for instance, the average value of cash flow risk was about 12 million in 2018 (SSE 2019).

Weaker economic growth: PwC (2018) state that the global economy is likely to grow at 2.5% in 2020, which is a slower rate compared to previous years. If Brexit is not avoided, Schoof et al. (2015) state that the UK economic growth will be as low as 1.5%. This slow rate of economic growth will negatively affect SSE’s financial performance and it might not be able to meet its financial targets.

1.3.3 Social factors

Changing consumer behaviour: the technology-driven business world, information influx, changes in consumer attitude, and ageing population affect an organisation’s financial results (Rani 2014). SSE will have to develop new products to keep meeting the changing expectations of its customers while maintaining its competitive advantage. The increase in ageing population will require SSE to change its pricing policy given the low purchasing power of ageing population (PwC 2018).

Take a deeper dive into Business Challenges with Strategy with our additional resources.

1.3.4 Technological Factors

Artificial intelligence and advanced technology: technology plays an integral role in the energy sector and the importance of artificial intelligence has increased in this sector. According to Ungureanu et al. (2016), artificial intelligence, machine-based learning and automation are a source of competitive advantage for firms in the energy sector. Big data analytics and Al-based solutions have promoted the operational efficiency of SSE (Böttcher. and Müller 2016). In addition, High Voltage Direct Current technology has allowed SSE to develop high power capabilities and voltage and cover linger distances. Further, digitisation and the growth of internet-connected and smart devices are creating an opportunity for SSE to better serve its customers (SSE 2019).

1.3.5 Environmental and legal factors

Decarbonisation: Decarbonisation has posed as both a challenge and an opportunity for SSE. The government requires organisations in the energy sector to source power more from renewable sources and networks to support this shift have been established (Tang & Demeritt 2018). Carbon pricing continues to drive emissions reductions forcing SSE to focus more on renewable sources (Connor et al. 2014). SSE is also forced to develop transmission and distribution networks to support low-carbon generation that not only meets legal requirements but also new demands from customers.

1.4 Summary of SSE’s PESTLE Analysis

The success of SSE depends on its ability to adapt to the changes in the external environment. The changes in energy policy, transition to low carbon economy, Brexit, economic slowdown are quite a challenge for SSE but it can turn them even to a bigger opportunity. Coupling these opportunities with technological advancement and increase in government subsidiary, SSE should be able to maintain its competitive advantage.

1.5 Porter’s Five Forces

1.5.1 Threat of new entrants

The threat of new entrant is low given several factors that hinder new business from entering the energy industry. These major barriers to entry include large capital requirements, patents, economies of scale, ownership of resources, and governmental regulations (Hokroh 2014). This implies that SSE is not threatened by new capacity and loss of market shares that come with new entrants.

1.5.2 Threat of substitutes

The decarbonisation policy is influencing firms in the energy sector to consider alternative sources of energy and renewable sources in particular (Hokroh 2014). Consumers are also exerting pressure for renewable energy sources forcing SSE to focus more on renewable sources (Lobianco 2016). Failure of SSE to develop low-carbon generation implies that it will lose its customers and experience a decline in its market share.

1.5.3 Bargaining power of suppliers

SSE works with around 8,000 suppliers and contractors with whom it has built a strong relationship (SSE 2019). This strong relationship and the large number limits the power of suppliers thus giving SSE a voice over suppliers (Beck and Martinot 2016). However, SSE relies on this supply chain to deliver its objectives thus it has to consider the concerns and needs of suppliers. Therefore, SSE shares power with its suppliers, which helps it maximise cost efficiencies.

1.5.4 Bargaining power of buyers

Buyers have a high bargaining power thus SSE has to continually develop its products and services to meet the changing consumer needs. Currently, customers prefer renewable sources of energy to non-renewable sources (Böttcher and Müller 2016). SSE has been able to respond to these changes and in 2019, the company’s operating profit was derived majorly from regulated energy networks and renewable sources of energy (SSE 2019). However, SSE has more to do in this decarbonisation period.

1.5.5 Existing level of rivalry

The UK energy and gas industry is dominated by the big six, British Gas, EDF Energy, E. ON, npower, Scottish Power, and SSE. SSE faces stiff competition from these firms as shown in figure 4. The figure shows that in 2019, SSE ranked number 2 in supplying electricity in GB with a percentage score of 13% (Ofgem 2019). It was closely followed by E. ON (12%) while British Gas led with 19% (Ofgem 2019).

1.6 Summary of Five Forces

The low level of entry is an opportunity for SSE to serve a large customer base in the energy sector. The threat posed by preference of renewable sources is an opportunity for SSE to focus more on low-carbon generation. The shared power with suppliers is an opportunity for SSE to acquire resources at a price that promotes its sustainability. However, the high power of buyers and high level of competition among the big six threaten the financial performance of SSE.

Section 2

2.1 OT Analysis

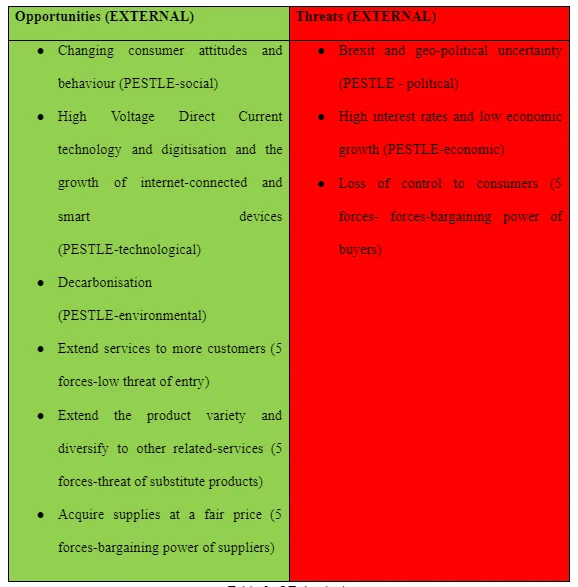

Table 2 presents an evaluation of external environment to identify the opportunities and threats the SSE

2.2 Summary of OT analysis

The OT analysis that SSE has more opportunities than threats thus in a stable position to realise its vision of a better world of energy. Nonetheless, SSE should develop a local strategy to help it overcome the challenges of Brexit and maintain its profit margin despite the low economic growth in the UK. Further, the analysis shows that consumers have high power thus SSE should always adjust its strategy to reflect the needs of consumers.

Section 3

3.1 Critical justification of Porter’s Generic Strategies

To gain and maintain a competitive advantage, an organisation should adopt one of the two generic competitive strategies identified by Porter – low cost or differentiation (Brenes et al. 2014). Whichever the selected generic competitive strategy, the organisation should combine it with the scope of activities it is seeking to achieve thus have either a broad or a narrow focus (Tanwar 2013). In Britain’s energy market, suppliers compete on price and service in order to attract customers (Ofgem 2019). In setting prices, suppliers seek to cover their costs and make a profit but they face the risk of keeping their prices and costs low failure to which they lose customers to rivals (Banker et al. 2014). From SSE’s 2019 financial year report, the company reported an operating profit of £1,137.6m which is a decline compared to 2018’s £1,453.2m (SSE 2019). This shows that SSE is experiencing a decline in profits thus cost leadership will not be an effective strategy. However, the company should ensure its sells its products within the market price to avoid losing its customers to its rivals. Differentiation as a competitive strategy renders an organisation’s products more attractive by making it different and more valuable that the products offered by competitors (Zehir et al. 2017). SSE’s 2019 financial report shows that the company’s revenue is majorly generated from regulated energy networks and renewable energy (SSE 2019). SSE aspires to be known as the dominant source of renewable energy and considers renewable energy the primary route to achieving decarbonisation (SSE 2019). This implies that SSE should compete on the basis of differentiation by exploring and exploiting various sources of renewable energy. Currently, SSE has three sources of renewable energy namely onshore wind, offshore wind and hydro-electricity which are complemented by flexible thermal generation (SSE 2019). Given that SSE is already reaping the benefits of low-carbon generation (for example; Beatrice offshore wind contributes to SSE share by 40% making SSE to have the largest renewable energy capacity in UK (SSE 2019)) the company should compete on the basis of green-energy.

3.2 Evaluation of renewable energy sources in relation to SSE KPIs

Differentiation will directly contribute to SSE’s economic KIPs and environmental KPIs and indirectly to social KPIs. According to Böttcher and Müller (2016), consumers in the energy market are preferring renewable energy to non-renewable sources, which implies that by focussing in renewable energy, SSE will obtain higher financial performance. In addition, decarbonisation has gained increased attention requiring companies in the energy sector to commit to low-carbon generation (Oxburgh 2016). Renewable energy will help SSE meet the decarbonisation requirements. Socially, SSE will be able to promote the health and safety of its employees by focussing on renewable energy as it poses minimal health hazards. Nonetheless, the company should secure its renewable energy plants to ensure they are not a threat to the safety of community members.

Section 4

4.1 Kotter’s 8 step change model

Differentiation will entail equipping employees with more skills so they can effectively generate energy from renewable sources. This reflects a change in management and in order to lower and overcome employees’ resistance to change, Kotter’s 8-stage model of change management will be used. Kotter portrays the change management process as a series of 8 steps including establishing a sense of urgency, creating a guiding coalition, developing a vision and strategy, communicating the change vision, empowering broad-based action, generating short-term wins, consolidating gains and producing more change, and institutionalising new approaches in the culture (Tang 2019). Acting with agency should be grounded in a clear understanding of organisational needs (Mount and Anderson 2015). This implies that SSE will first have to spend quality time (not less than 3 months) listening to its shareholders, employees, teams, leaders, and diverse stakeholders in order to establish the most effective practices to attain meaningful change (Small et al. 2016). The company should emphasise on improved communication at all levels in creating a sense of urgency to help drive shared need to implement the change (Tang 2019). The management should then identify a number of employees who share the urgency, form a team, and develop the team into leading the organisational through the change (Calegari et al. 2015). Every member of the team should be asked for the change vision and together they brainstorm and agree on a shared vision. The vision should then be communicated to the rest of the employees and support needs identified to ensure every employee feels confident to undergo the change (Hornstein 2015). Short-term wins should aim at making the employee believe the vision is attainable thus keep them motivated towards the ultimate goal (BHATT 2017). Where short-term wins are missed of met partially, the team should transform the culture through changing systems and policies that oppose the vision (Galli 2018). Finally, the team should work at ensuring employees understand and embrace the relationship between new behaviour and new vision.

Conclusion

This report was designed to provide information relating to the concepts, theories and models of business strategy and practical examples through application to SSE’s case. The environmental analysis shows that Brexit uncertainties, slow economic growth, and high interest rates threaten SSE while changing preference towards renewable energy, information technology and technologies provide SSE opportunities for expansion. The report also shows that the energy market is expensive to enter which given SSE the opportunity to serve a large customer base. Similarly, low threat of substitutes and shared power with suppliers provide an opportunity for SSE. However, buyers have a higher power and there is high level of competition among the big six which is a threat for SSE. Porter’s generic strategies show that SSE should compete based on differentiation – focus more on renewable energy which is gaining preference in the energy market. Focusing on renewable energy will contribute to SSE’s economic, environmental, and social KPIs. To facilitate the change management process, the report suggests that SSE should use Kotter’s 8 stage change model.

References

- Alkhafaji, A. and Nelson, R.A., 2013. Strategic management: formulation, implementation, and control in a dynamic environment. Routledge.

- Böttcher, C. and Müller, M., 2016. Insights on the impact of energy management systems on carbon and corporate performance. An empirical analysis with data from German automotive suppliers. Journal of cleaner production, 137, pp.1449-1457.

- Brenes, E.R., Montoya, D. and Ciravegna, L., 2014. Differentiation strategies in emerging markets: The case of Latin American agribusinesses. Journal of Business Research, 67(5), pp.847-855.

- Calegari, M.F., Sibley, R.E. and Turner, M.E., 2015. A roadmap for using Kotter's organizational change model to build faculty engagement in accreditation. Academy of Educational Leadership Journal, 19(3), p.31.

- Campbell, D., Edgar, D. and Stonehouse, G., 2011. Business strategy: an introduction. Macmillan International Higher Education.

- Connor, P.M., Baker, P.E., Xenias, D., Balta-Ozkan, N., Axon, C.J. and Cipcigan, L., 2014. Policy and regulation for smart grids in the United Kingdom. Renewable and Sustainable Energy Reviews, 40, pp.269-286.

- Cumming, D.J. and Zahra, S.A., 2016. International business and entrepreneurship implications of Brexit. British Journal of Management, 27(4), pp.687-692.

- D. Banker, R., Mashruwala, R. and Tripathy, A., 2014. Does a differentiation strategy lead to more sustainable financial performance than a cost leadership strategy?. Management Decision, 52(5), pp.872-896.

- Galli, B.J., 2018. Change management models: A comparative analysis and concerns. IEEE Engineering Management Review, 46(3), pp.124-132.

- Helms, M.M. and Nixon, J., 2010. Exploring SWOT analysis–where are we now? A review of academic research from the last decade. Journal of strategy and management, 3(3), pp.215-251.

- Hornstein, H.A., 2015. The integration of project management and organizational change management is now a necessity.International Journal of Project Management, 33(2), pp.291-298.

- Lengnick-Hall, C.A. and Beck, T.E., 2016. Resilience capacity and strategic agility: Prerequisites for thriving in a dynamic environment. In Resilience Engineering Perspectives, Volume 2 (pp. 61-92). CRC Press.

- Lobianco, A., Caurla, S., Delacote, P. and Barkaoui, A., 2016. Carbon mitigation potential of the French forest sector under threat of combined physical and market impacts due to climate change. Journal of Forest Economics, 23, pp.4-26.

- Oxburgh, R., 2016. Lowest cost decarbonisation for the UK: The critical role of CCS. Report to the Secretaty of State for Business, Energy and Industrial Strategy from the Parliamentary Advisory Group on Carbon Capture and Storage (CCS).

- Powell, W.W. and Bromley, P., 2013. New institutionalism in the analysis of complex organizations. International encyclopedia of social and behavioral sciences, 2, pp.764-769.

- Rani, P., 2014. Factors influencing consumer behaviour.International journal of current research and academic review,2(9), pp.52-61.

- Small, A., Gist, D., Souza, D., Dalton, J., Magny-Normilus, C. and David, D., 2016. Using Kotter's change model for implementing bedside handoff: a quality improvement project.Journal of nursing care quality, 31(4), pp.304-309.

- Swanson, E.T. and Williams, J.C., 2014. Measuring the effect of the zero lower bound on medium-and longer-term interest rates. American Economic Review, 104(10), pp.3154-85.

- Tang, S. and Demeritt, D., 2018. Climate change and mandatory carbon reporting: Impacts on business process and performance. Business Strategy and the Environment,27(4), pp.437-455.

- Tanwar, R., 2013. Porter’s generic competitive strategies. Journal of business and management, 15(1), pp.11-17.

- Teece, D., Peteraf, M. and Leih, S., 2016. Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy. California Management Review, 58(4), pp.13-35.

- Teece, D.J., 2010. Business models, business strategy and innovation. Long range planning, 43(2-3), pp.172-194.

- Voiculet, A., Belu, N., Parpandel, D.E. and Rizea, I.C., 2010. The impact of external environment on organizational development strategy.

- Yang, P., 2019. Environmental Dynamics, Financial Flexibility and Enterprise Strategic Change. American Journal of Industrial and Business Management, 9(1), pp.124-138.

- Zehir, C., Can, E. and Karaboga, T., 2015. Linking entrepreneurial orientation to firm performance: the role of differentiation strategy and innovation performance. Procedia-Social and Behavioral Sciences, 210, pp.358-367.

- Ziv, G., Watson, E., Young, D., Howard, D.C., Larcom, S.T. and Tanentzap, A.J., 2018. The potential impact of Brexit on the energy, water and food nexus in the UK: A fuzzy cognitive mapping approach. Applied energy, 210, pp.487-498.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts