Research Methodologies: Quantitative vs Qualitative

Qualitative method

In General

Shackman (2009) states that in the range of social science research methodology, there are two major different sort of research methodologies, which are quantitative method, and qualitative method. Shackman (2009) explains that “Quantitative designs approach is social phenomena through quantifiable evidence, and often rely on statistical analysis of many cases (or across intentionally designed treatments in an experiment) to create valid and reliable general claims. Related to quantity”.

On the other hand, “Qualitative designs emphasize on the understanding of social phenomena through direct observation, communication with participants, or analysis of texts, and may stress contextual subjective accuracy over generality. Related to quality” (Shackman 2009). Also there are another method add third method, which is mixed methodology (Creswell 1998).

Both methods have a more variety of difference charter. For example, role of research in both methods are different. In Quantitative research, researcher is separated with research matter and reacts as an independent entity. However, in qualitative research, researcher interconnected with research subject matter. And interact with each other. Even research language the both method show difference. Qualitative method uses more official language, and make a sentence by rule. However, explanation of qualitative method, usage of language, would be more personal, and use many word that are from the research field.

However, Creswell (1998) explains another method, which is mixed method, explaining that “with development of both qualitative and quantitative method in social science research, mixed research method employs data collection associated with both forms of data, is expanding” (p208, Creswell). The mixed method combined the two different methods by its need.

Reasons for choosing Qualitative method

The methodology of this research will adopt qualitative method for various reasons. First, this is a research project concerning Australian consumer’s personal behaviour who fail to pay back credit card debt. As a result, project should have an objective to understand Credit card debt defaulter (CCDD) in the debt defaulter’s perspective rather than the discovery of causal relation like research objectives in quantitative method. Additionally, the research uses interview and survey to study CCDDer’s psychological situation in their financial time line.

Moreover, the approaching method, interview and survey themselves are inductive rather than deductive; therefore, research ends up in hypothesis and grounded theory. besides the inductive approach would be idiographic approach for classified complexity and pattern of each research participator’s answer, that will be concluded to ground theory. In this case, the hypothesis would offer different explanation of CCDDer’s behaviour. For example, Australian consumer who fail to pay back credit card debt not because they are financial literacy or psychological confused. most defaulters do not have a financial sense about that their credit card mechanism since the card payment do not request pay credit card debt immediately, so consumer lost reality to their consumption.

Finally, sources and samples that are used for this project matches with the qualitative method. This project requested personal, and technical records for coding and analysing result. It is character of qualitative method sampling and data collection. And also tools using for the data collection is matched with category of qualitative method data collection tool, which are field note, pictures, and recorder for filing interviewee’s answers.

From the research requirement and matched qualitative method characters, research object, approach method, and data and sample collection method, it would be reasonable to choose qualitative method for this project.

Philosophical assumption

According to Creswell (1998), qualitative method has five philosophical assumptions. These philosophical assumptions consist of a stance toward the nature of reality (ontology), how the researcher knows what she or he knows (epis- temology), the role of values in the research (axiology), the language of research (rhetoric), and the methods used in the process (methodology) (Creswell 2007).

The ontological issue relates to the nature of reality and its characteristics. When researchers conduct qualitative research, they embrace the idea of multiple realities. Different researchers embrace different realities, so do the participants and the readers of a qualitative study. When studying individuals, qualitative researchers conduct a study with the intent of reporting these multiple realities. Evidence of multiple realities includes the use of multiple quotes based on the actual words of different individuals and the presentation of different perspectives from individuals. When writers compile a phenomenology, they report how individuals participating in the study view their experiences differently (Moustakas, 1994)

From Creswell (1998), epistemological assumption, conducting a qualitative study, means that researchers try to get as close as possible to the participants being studied. In practice, qualitative researchers conduct their studies in the "field," where the participants live and work which are important contexts for understanding what the participants better. The longer researchers stay in the "field" or get to know the participants, the more they "gain knowledge " from firsthand information. A good ethnography requires prolonged stay at the research site (Wolcott, 1999). In short, the researcher tries to minimize the "distance" or "objective separateness" (Guba & Lincoln, 1988, p. 94) between himself or herself and those being researched.

In the axiological assumption that characterizes qualitative research (Creswell 1998), states that, it is reasonable to ask “How do the researcher implement this assumption in practice? In a qualitative study”, the inquirers admit the value-laden nature of the study and actively report their values and biases as well as the value-laden nature of information gathered from the field as it is commonly accepted the way " it position itself" in a study. In an interpretive biography, for instance, the researcher's presence is apparent in the text, and the author admits that the stories voiced represent an interpretation and presentation of the author as the subject of the study (Denzin, 1989a).

Qualitative researchers tend to accept the rhetorical assumption that the writing needs should be personal and literary in form (Creswell 1998). For instance, they use metaphors, refer to themselves using the first-person pronoun, "I," and tells stories with a beginning, middle, and end, sometimes crafted chronologically, as in narrative research (Clandinin & Connelly, 2000). The procedures of qualitative methodology are characterized as inductive or emerging, and is shaped by the researcher's experience in collecting and analyzing the data (Creswell 1998). The logic that qualitative researcher follows is inductive i.e. from the ground up, rather than handed down entirely from a theory or from the perspectives of the inquirer. Sometimes the research questions change in the middle of the study to reflect better the types of questions needed to understand the research problem (Creswell, 1998). According to Creswell (1998), in methodological point, the data collection strategy, planned before the study, needs to be modified to accompany the “emerging” questions. During the data analysis, the researcher follows a path of analyzing the data to develop an increasingly detailed knowledge of the topic being studied.

Character of qualitative methodology

There is academic approach about character of qualitative research from different scholars. Hammersley (1990) states the six character of qualitative methodology. First he states that, researching some subject matter in ordinary life environment rather than experimental condition. Second, there are many different sort of data collection method. Third, non-traditional data collective methods exist in qualitative methodology. Moreover, qualitative methodology is interesting microeconomic issue, which closely related with social life rather than macroeconomic issue. Additionally, there is interest on the meaning and function of social activity, which related with this project. Finally, currency value is assistant rather than main research subject matter. Also, Hammerly (1992) pointed another characters as a scientific research method in feminism study and ethnography research, which mostly use language rather than numerical data. Secondly, data is collected in natural environment, like social life. Nevertheless, character focuses on the meaning of actions rather than action or result itself. In qualitative research character fails to satisfy the natural science modeling as a methodology. Finally, qualitative method is hypothesis generation method rather than hypothesis test method. This illustrates that qualitative method would be concerned more on the researcher’s own opinion and research capacity. These reason makes motivates me to use qualitative methodology, for proving different opinion about Australian CCDDer’s decision making process, challenging commonly accepted conventional understanding. Also Bogdan & Biklen (2007) argues that in qualitative methodology, researcher himself or herself became a research tool, which means that the level of dependency in all process including result in qualitative methodology is significantly higher. Additionally, the researcher narrows dissertation with linguistic expression and visual evidences rather than numerical figure. It focuses more research process itself rather than result, or conclusion and computation process. Qualitative methodology is inductive method, which start from natural social phenomena to find research subject, suitable method and conclude the research. Therefore, research object and process would be important. As per Bogdan & Biklen’s (2007), qualitative methodology characters as found in this project, adopts different perspective to research same social phenomena.

Eisner (1991) states that qualitative methodology is concerned about fieldwork, which is match with this project. Moreover, the study emphasize that research’s thought and skill as a research tool. Because the weight of fieldwork is heavy, analysis in the field is important which shows researcher’s explanation of situation, and control power. Throughout the research process, linguistic skill, especially many expressing language skill would be requested. Many detail in each research process would be concerned especially in the field work, interview with CCDDer, because each interviewee would be in different financial and social environment, and the condition would be change research process in some times. From the academic’s pointing this project matches with the qualitative method. As a mentioned in chapter 1, the significant financial treat in Australian household has been occurred with poor conventional economic explanation. So from the social financial factor, the study researches on the CCDDer’s decision-making process in specific economic environment, from 2008 to 2018, for detection of how much individual’s financial literacy would result in the CCDD, rather than economic inevitability.

Research Steps

Before start research design for this project, the study starts will the summarization of qualitative research method. It defines the three steps in big picture, which are research design level, data collection level, and data analysis level. Under the levels there are many sublevel to research. At the research design level, the study decides the research question. It is therefore necessary to create hypothesis from the first, though qualitative method tend to observe social economic environment to find research subject for example, in this project; Australian news, CCDD case in 2017 etc., were the turning point of this research. For scientific research it would be necessary to research on the economic theory which are involved in the case. Only one conventional theory was mental accounting theory. There would also an identification of research frame, literature review, research method, research sample population, and realistic data collection method. Second step is data collection. This step involves collection of data from field. For this level, many researcher’s personal skill have been requested. One such skills is interpretation skill, which covers chunking up, chunking down, about good question and survey participator’s answers. Second skill is active listening. Third researcher’s skill would be adoptive power in every interview situation and high flexibility of reaction skill. Next skill would be rich knowledge about the research questions and research topic. Moreover, there is need to identify if researcher uses many different kinds of tool or devices like recorder or Mobile phone camera while collecting data which increases data collection capacity. Using abbreviation would be another tip, if the word has to repeat in many times. Collect data with plain would be safe time and cost. Third level is analysis of the collected data. In this stage, data classification skill and data analysis skill would be requested. First, the collected data should be simplified and summarized. For example, record of interview and survey sheet should be summarized by own coding system for get a final result. Next step would be rearranging all the coding data or collected data for easy and efficient analysis. In this stage, researcher should conclude the research. There are many analysis skills are available. For instance, explanation-building skill and pattern matching skill, and time–series analysis. Furthermore, if there is process for suggesting alternative, it would be better. Next, stage would be verification of the research and research result. If there are third entities that can audit the research process, if would be increase reliability of the result in public. Also the auditing should include all data collected, analysis process, and reality of suggested alternative solution. In this project this stage would be performing with University academic in after return from field.

To sum up, those three levels would be fundamentals of this project. In each levels, there are many personal skills or research environmental concern for getting best result. The second level activities would be performing in field. Because of the physical distance between researcher’s residential and the research field, researcher should properly prepare first level tasks for increasing efficiency of research.

Credit card debt defaulter case

Research question

For description of the main question of this project, “what would be main factor to Australian CCDDer fail to pay back credit card debt”, first it would be reasonable to detect to aspect to fail to pay credit card debt in both side externally, and internally.

Consumerism society trend (overconsumption?)

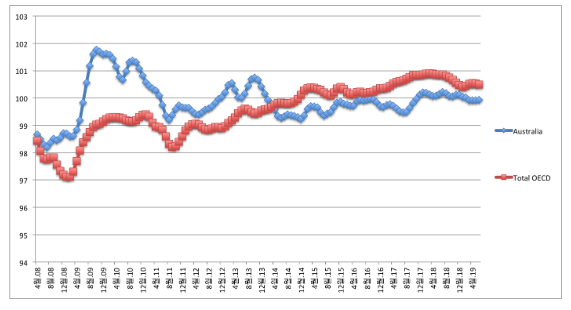

In the present consumer society, social succession is measured by amount of commodities owned and financial capacity for consumption based on consumer’s freedom of choice ( ) . This sort of consumer society has several characters, which include, quantitative consumption, diversification of commodities and service that consumers are able to purchase and global consumption pattern which resemble advanced economy consumption pattern. It is therefore observed that the consumption patterns create huge energy than expected. To conclude, consumer society means the consumer era which has enough commodities and services to consume, so in material perspective pursued as richness ( ). Bauman argues that the capitalism entered new stage with the establishment of consumer, due to symbols and signs which became a subject matter of consumption ( ). Furthermore, Baudrillard (1996) mentioned that, “Subject of consumption is not individuals, but rule of signs”, while Laclau & Muffle (1990), states that commodification of social life have been substituted into social relationship before this new era. This kind of argument describe that recent individuals are living in different sort of society, and in the new society, all aspects, include human relationship have become new type of commodities, and disorganized modern-human and objects, individual and society. However, this kind of consumerism credits many new problems in society, over consumption based on conspicuous consumption, waste of natural resource, increase of pollution etc. It is therefore reasonable to study the character of consumer society which is causing over consumption. The Australian credit card debt default might be caused by over consumption. Over consumption approach would be one of the possibility to the cause of CCDD. Behavior economists Ianolea & Cornescu, (2013) argues that “The optimism is rooted in the concrete results which shows valid correlation between consumption, materialism, wellbeing and happiness which suggest a conclusion that we already know from popular wisdom: money neither brings happiness nor supports it after a certain threshold”. Therefore, Australian household consumption should show higher consumer confidence index (CCI), which illustrate the consumption willingness in Australian household. Graph below describes (CCI) from 2008 to 2018. Compare with total CCI in OECD countries, Australian CCI has been lower the total OECD figure from 2014. Even the Australia CCI commonly staying in 100 levels except two periods (2009~2011, and 2013). Australian consumption confidence is near by 100 or lower than 100, which means Australian consumer did not have an optimistic view about their purchasing power (OECD 2019).

Conclusion

Recent Australian consumer society raised curiosity about over consumption as a result of Australian CCDDer which occurred due to over consumption; which is one of the character of consumer society that the CCDDer are living in. From the OECD data that represent willingness of consumers to spend more than their financial capacity, shows that the Australian consumers did not have a high consumer confidence last decade, except two short periods, compared with consumers in another OECD’s countries. As a result, it would be obvious that the CCDDers did not have the willingness to over consume then their capacity. It is therefore reasonable to ask about the capacity, “than whether the Australian consumers had enough purchasing power?”

Average wage and purchasing power

From figure 7 (p13), compare labor productivity in Australian household’s real income which has been reducing, except 2010. However, Australian household consumption expense has been continually increasing according to figure 8 (p13). The economic factors force many scholars to assume that after the GFC, Australian household consumption is as a result of consumer credit, credit card usage (figure 9, p14). Nevertheless, there is a confusion whether the credit spending was necessary or it was some sort of Australian consumer’s moral hazard in decision-making process. There is no scientific method to measure individual consumer’s level of moral, decision-making process, except consumer survey. But from the third graph, it would be reasonable to argue that Australian household did not have a financial capacity though, they had to spend. However, argument about the credit card debt and household consumption growth are arguable. Some former studies about correlation between credit card debt and consumption are positively described. According to Murphy (1998) and Olney (1997), there are positive relationship between lagged debt and household consumption growth. It is majority opinion of former research result (Ekici and Dunn 2010). However, as a minority research report, Ekici and Dunn (2010) work argues that “lagged credit card debt is negatively related to total household consumption growth” (Ekici and Dunn 2010). Without concern about the relationship between lagged debt and consumption growth, it would be interesting to research what would be an aspect to take the consumer credit to Australian household during the period.

Confidence to take credit (Assets Market bubble effect)

From official data, Australian household used consumer loan for maintaining consumption. There is high possibility to use credit because of liquidity constraint. However, it would be more reasonable to assume that in the deficit condition, there would be unexpected or hidden economic aspect that supporting household depending the consumer loan, increase of credit card usage. One of the assumptions factor is the increased assets price in Australian house market (OECD 2019). The graph below describes how the Australian house market had a boom from 2000. The price increase was rapid compared to the average of other 17 OECD house price.

it is similar case in U.S, American household leverage increasing house price to maintain spending. According to Federal Reserve Bank of San Francisco (FRBSF) economic letter 2009, “household leverage is measured by the ratio of debt to personal disposable income which reached an all-time high, exceeding 130% in 2007 (Federal Reserve Bank of San Francisco, 2009). National house prices peaked in 2006 and have since dropped by about 30% “. It needs more systematic research about the correlation between consumer loan taking and assets bubble in Australian case, but it is logical to assume that increase of Assets side of household balance sheep might be encouraged therefore having a higher debt in credit side of Australian household balance sheet. Moreover, from all statistical evidence, the credit consumption were necessary for maintaining life style of Australian household in general since the results of this paper shows no willingness to overconsume, from 2014, with liquidity constraint condition (average wage decrease), and at the same time there are other economic aspect such as increased level of confidence to take a credit resulting from assets price increase.

Conventional view

For developing the argument of Australian credit card debt defaulter, it would be a natural to detect conventional economy school’s view about debt default in macro and micro level. Credit card debt default has two different aspects. The first aspect is the failure to observe the consumer loan payment obligation until due day in individual level. However, Credit card debt default would have another economic aspect, which is consumption, or household purchasing power in aggregate demand level, therefore due to total failure of repayment, there are legal, and financial penalties. And in long-term perspective it reduces the aggregate demand in macro level. First, in macro level, credit card debt default is a significant concern in many economy stockholders, like Government authority, consumer loan provider (credit card corporations and banks), and credit rating companies etc. Therefore, such a mass default reduces household consumption and in extreme cases, it decreases the aggregate demand. As a result, recent economic trend in Australia society the risk involves is being addressed in mass media and another entitles. Reaction of the expected credit card default in Australian economy is significant. Australian news media warned about the credit card default possibilities as well as its expected economic effects ( ). Government bodies also like ASIC published official report in 2018, summarizing industry and economic situation. Central Bank (RBA) regularly announced their analyzing about inner credit card industry with expected effect in macro perspective. As a result, macroeconomic view about the credit card debt default would be obvious. Australian society and financial industry also warns of an economic treat caused by the high CCDDer rate. Furthermore, industrial adjustment, transfer lower interest card, has been suggested by mass media and RBA. It is arguable how much the lower interest transfer would prevent credit card default and effect to maintain Australian household consumption stably. Secondly, in micro level, debts default especially, credit card debt default would not only damage household consumption capacity, but also consumer’s Credit rating (social and financial reputations), and future consumption pattern. However, from the ASIC report 580, Government and conventional economic view about the case are more focusing on the consumer’s personal choice rather than macroeconomic failure approach. The economic environment in recent Australian credit card default has been discovered to reduced average wage. However, only for CCDDer Australian society and government authority have maintain typical neo liberal perspective, and individual’s economic personal failure. furthermore, human mind set sometimes misunderstand credit card, due to its unique payment terms in mental accounting approach.

Conclusion

Conventional economic view about Australian credit card debt default risk is obvious. It is focusing protect interest of industry, in macro level, and furthermore preventing economic recession in extreme case. to prevent the economic recession from 2017, Australian government authorities and mass media registered new regulation and campaigned adjustment program, low interest card transfer. However, there is still a view about CCDDer who are mostly based on typical neo liberal thoughts, rational consumer made a mistake, it is individual’s personal failure rather than systemic consequence. It would therefore be better to explain the fact with mental accounting perspective, even it is not matched with neo liberal economic view about consumer, rational decision maker, but it can transfer all responsibility to each individual.

Organizing Main question

From the conventional view’s conclusion, it would be reasonable to question ‘the mental accounting views, that conventional economist describes as an alternative analysis, about the CCDDer which are not really differently influenced in adjustment program. In policy practical level, still it protects industry’s interest not solved or prevent CC user’s debt treat. Point is finaicalisation consumption trend; consumer loan and mental accounting theory are supporting same side, which is interest of financial industry. And industrial risk hedging system would be same situation, concern protect financial industry’s interest from the default risk. However, main theoretical challenge of this project is questioning the mental accounting theory. It is important because if this project prove CCDDers were not irrational but were reasonably rational to understand their financial situation, which is going to bankrupt. It would be theoretical discovery, and cornerstone of card industry reform in public in even conventional economic view, a sort of household economy’s financial disaster which typical rational consumer could not prevent. Also, if the result of this project support systemic weakness, and liquidity constraint, then it is a turning point to argue economic aspect that cause liquidity constraint. For example, average wage, or distribution issue in economy. Regardless of the rejection of the mental accounting theory, qualitative method would be reasonable methodology for this project, because the mental accounting focuses and explains the specific individual psychological character. As per former studies, ASIC report 580 shows less by 20 defaulters in 2018. While this study has not analysed the ASIC survey questionnaire sheet, it is reasonable to assume that there was no mental accounting approach in the survey for the ASIC 580 report. If this project would have been surveyed enough focusing on sample population, including psychological analysing questions for detecting Australian credit card debt defaulter’s decision making process in mental accounting perspective, it would be chance to move to another stage about role of consumer loan in Australian economy. First, it would be more logical to define in the ‘rationality’ in English literature and economy perspective. Cambridge dictionary (2019)defines that “the quality of being based on clear thought and reason, or of making decisions based on clear thought and reason. From the literature, two elements are evident which are clear thought and reason. First, clear thought would be substituted by awareness about personal financial situation. And clear reason would be self-interest that is able to be many things. Under the assumption this project does not address the Australian consumer’s wiliness and personal idea, but only the consumer’s mental capacity to understand their financial situation, testing the word “clear” would be main point of discovering. So the survey question would be focusing awareness. One of example to organizing survey questionnaire sheet should address the financial awareness among other question. So CCDDer unconsciously and naturally response the chosen questions in interview or survey time. And it would be better than analyzing the two different types of questions separately. For example, analyzing the awareness questions first and measure statistical information, and as an assistance information the non-awareness questions can be used. Therefore, the main research subject would be test the mental accounting perspective in the case.

Survey questionnaire sheet

Sample survey?

To formulate the survey process, the projects references similar former research, which covers Australian household, and credit card debt indebtedness. Australian government and financial authorities regularly published report or articles to public, especially for urgent economic issue at that time. Credit card debt would be a recent rising economic issue in Australia. In 2018, ASIC published special report of the expected economy affect and the increase of CCDDer (ASIC 2018). Moreover, ASIC’S report specialised on the Australian credit card industry and its expected financial treat to household economy. the report suggested that the two solution, which are credit card account transfer, as well as the solution for increase of credit card market risk, and industrial reform, mainly suggest for more regulations to protect interest of industry. As per ASIC report, the review illustrates its methodology. It discloses that ASIC received review form 12 credit card corporations, and it listed the name of the corporations. Besides, it explains data collection and analysis. In the end of the report explains how the report interviewed individual with 51 questions as well as the objectives of the interview. The lists were: consumer and their card, responsible lending, balance transfer, consumer repayments, financial hardship, and additional requirements that apply to credit card (p78 ASIC 2018). And ASIC report 580 disclosed that principle to survey design, which are “capture providers’ process and identify where they took proactive steps to identify consumers with products that do not suit their need or offered help to consumer in replaying their credit card”. From the narrowing it is obvious that ASIC report suggest balance transfer as a solution of Australia credit card issue, and the report emphasised it. It might be not appropriate because researcher have not observed the original the 51 questions, but from the narrowing It is obvious that the AISC report missing consumer’s behaviour economic perspective rather than emphasised their policy for the expected financial treat. Interestingly, ASIC report shows that ASIC had an in-depth interview with 16 consumers in three different cities. This project has already requested for ASIC to observe the original interview scenario, unfortunately, until now (15 August), there were no positive response yet. The report describes, “the consumer journey which was explored in five stages, including the contacts for the debt accumulation, their consideration of balance transfer, the decision to transfer balance, their promotional period and time after that period expired” (p78 ASIC 2018). From this part, the purpose of to publish ASIC 580 report is obvious, promoting ASIC’s policy to expected risk hedging. Another reason why the intention is obvious is that, the report illustrates the information on the online survey that ASIC conducted. Line 423 of page 78 indicates that “This survey included questions about the prevalence of multiple credit card ownership among consumers who have transferred balances, including the frequency of use, balances, total credit limits, whether the debt was increasing and what repayment strategies were being adopted”. To sum up, the AISC report was concerned about the prevention of expected Australian household financial treat, though did not address psychological approach of Australian consumer’s credit card indebtedness, which is main research question in this project.

Sample size

Calculating the research population would be another controversial issue in formulation of questionaries’ sheet. Former surveys had a 16 interviews and 800 online survey (p78 AISC 2018). The sample sizes used in qualitative research are not justified (Marshall et al, 2013) even though researchers are concerned with the right sample size (Dworkin, 2012). However, limitations observed in the previous studies, to increase persuasive of this project the number of the interview ad research population will be larger than sample number other studies where applicable. From the principle, for interview, the sample number would be more than 16 and around 30 in six different cities that located each states; Sydney Brisbane, Melbourne, Perth, Adelaide, Gold cost. Principally, it would be better, to have similar sample size to those of online survey i.e. close to 800 or more than 800 or even approximately 1000 may be better. But the main concern of planning sample size of online would be different compared to previous research, because the 800 sample size were not about indebtedness, rather, it was about general online survey for credit card usage ( p78 ASIC 2018). So logically, online survey sample would be smaller than former research. Variable for calculating the number would be heavily depended on how many CCDDer’s email address is available. Under the assumption researcher received CCDDer’s detail from debt provider, same information source compares the former research, reasonable strategy for calculating the online and interview sample size depending on the each CCDDer’s willingness. It means that if the Australian CCDDer willing to have an interview it would be best case though the online survey option is opened unless total size is bigger then 16.

Formulating questions

This project will use two qualitative methods for analysis Australian CCDDer’s decision-making process. First method is interview and second method is focusing on group survey. Both methods request the use of sets of questions. In this part, formulating the questionnaire would be mentioned. And as mentioned before, the main idea of the questionnaire’s questions is to detect self-awareness of financial situation in every stage, including understand of credit card usage in simple accounting perspective. In formulating for questions for interview, first, common questionnaire, which will share both qualitative and quantitative has been organized with two different types of questions, which asks about general household financial situation or personal financial questions, like employment, or unexpected spending, and psychological understanding of each situations. The two different questions groups could be cording in different way in both methods, because of different character of the both method. Interview has a unique character, which is improvisation. It means that researcher can asks questions that follow the questionnaire sheet, it is also possible to ask questions without a prepared questionnaire sheet due to some unexpected answers. To prevent time and energy wastage, it would be better to design interview questionnaire sheet with the study’s concern- This explains why cognitive interview techniques are required. Beatty (2004) shows that “cognitive interviewing is the practice of administering a survey questionnaire while collecting additional verbal information about the survey responses where this additional information is used to evaluate the quality of the response or to help determine whether the questions are generating the type of information that the researcher intends”. From the definition, it would be reasonable that interviewer try to stay in the original scenario as much as possible. But if there are some elements which are unexpected, there is a chance to ask more about the fact though basically, interviewer should focus the organized questionnaire sheet questions. There would be some sort of guideline for formulating questions. McLeod states that questionnaire is written interview (SImply Psycology, 2018). It can be carrying out face to face, by telephone, computer or post. In present day, online survey would be another new options; it was a method that used by ASIC. As a result, the contents of the questionnaire would be similar compared to survey scenario. For satisfied research purpose, two different questions would be narrow each by each, so it helps the participants of a study to naturally disclose their sense of mental accounting. For example, when asking financial situation in certain point in participator’s history of card debt default, and then the researcher enquire on how much was awarded for the situation at that time. So two questions contrast financial figure and psychological awareness at that time. Another example which might be asked is the time line of bankruptcy from received Bank statement, and when psychologically awards such participator bankrupt. If the two-time lines are close or it same, it would be good evidence that is able to reject mental accounting theory about credit card, which explains why consumers have different financial sense; do not realize that they are spending money when they use credit card.

Expected problems in practice

There were several issues that have to concern to in qualitative research procedure. This study will focus on people (debt defaulters), therefore it is bound by legal issue while approaching the information of the population, if participant do not support this project, there is a challenge.

Approach the population list

First of all, collection of Australian credit card debt defaulter would be first step. For approaching the CCDDer list, there are couple of ethical and legal issue in United Kingdom and Australia. This project would be not be sensitive to politics and probably there would be no significant physical damage the researcher would cause though, it will be important to check legal issue in the Australian, Privacy Act 1988, and SOAS London University research rule respectively for publishing final result. This part would be researched some legal issues related with data collection stage. Researcher University request to their staffs and students follow ethical research guideline in Code of Practice for University Staff and Students. From the code, researcher University are concerned about data usage especially when it is published outside the University. In this project, data collected and analysis for research will be formed as a statistical figure, like proportion of CCDDer who answered in certain questions in certain way. There will also be cases to announce some Australian CCDDer’s personal detail: name and age, or occupation directly. Australia Privacy Act 1988 defined that “information or an opinion (including information or an opinion forming part of a database), whether true or not, and whether recorded in a material form or not, about an individual whose identity is apparent, or can reasonably be ascertained, from the information or opinion”. (Privacy Act 1988 (Cth) 6 (1)). It states that Australian Privacy ACT 1988 protects information that is able to identified the person like address, telephone numbers etc. However, in this project there will be no instance of mentioning the identify of certain person’s detail, because finial result of the project will only illustrate the collected CCDDer’s information by statistical figure. However, there will be exception In some cases like some extreme case though technically it is not necessary to disclose personal information to approach an academic achievement. Another issue, which has to concern would be condition of the data collection. There is needs for more legal advice, though already one of Australian lawyer gave me advice therefore under no condition, the information of CCDDer will be disclosed in any circumstance. Such confidential information will involve name, date of interview, state etc. additionally before the interview, participates will be fully informed of the study and its intention and that the result will be purely used for academic purposes. However, another concern is finding the list of Australian CCDDer. It need more legal research or advice from Australian lawyer, though it is not clear whether the list would be protected under the privacy act 1988 or not. If it is binding by the privacy act 1988, it might be hard to approach the information. In contrast, the approach might be simple considering the Australian bankruptcy act ( ), where personal financial information is disclosed to public. Therefore, this study can use some list of information published online To sum up, for dealing data, there were two guidelines appear, which is ethical research guideline at researcher’s University administration, and Australian law, privacy act 1988. It still needs more legal advice but concern with data management style of this project. Analysis and publish anonymously there would be no serious issue.

Identified the sample population

From Babbie (1990, 2001), there are five essential aspects of the population and sample. Babble (1990, 2001) states that identification of sample population is the first steps. Additionally, the size of the population should be stated at the same time. Sample accessibility is the next aspect that researcher should be concern of. With accessibility also availability of sample frames is important, for example mail or published lists. In this project, main expected difficulty would be accessibility, because Australia has a legal protection for individual’s sensitive personal information, like financial information, credit record. It needs legal advice to use the financial information for this research project, especially research should concern Australian Privacy Act 1988 for approaching the information. Also sample frame would be another issue since even with the list of the CCDDer organizing interview would be another challenge. With expected rejection rate, it will be good strategy to use sample population which is big than the normal sample population needs of the study. And stated earlier, before starting interview sending mail to explain purpose of this project and arrange possible interview day is a good start. In a sampling design, Babble (2001) mentions that there are two different kind of sampling, which are single stage sampling and multistage sampling or called clustering. First, multistage sampling is deal with when it is impossible to compile a list of elements composing the population. And secondly, single stage sampling is suitable when researcher is able to access name in the population and can sample the people, which is matched with the case of this project. It may need government organisation or financial industry’s supporting forget the list of CCDDer, and then statistically choose the list of name. It might be better to organise the population list with age, gender, wage level, and region. Babble (2001) argues about the population selection process. Babble suggest that random sampling, for the population has an equal probability of being selected, but in this project it would be not appropriate because the defaulters list already has been given. Also Babble mentioned about specification of sample information, which would be useful for this project. Because for further study, collecting more name, personal detail would be useful, for instance, gender and age relationship in the defaulter research, especially the wage level would be good corner stone of Defaulter study with class perspective. In Debt defaulter research, if researcher focus relationship between income level and indebtedness, CCDDers who earn less money, but had to spend for maintain basic life maintain. It would be a research about consumer loan and class relationship, which research matter that covered by consumer loan as a paid welfare. Babble (2001) talks about selecting sample from available list. In this project, the sample number should be larger than 16 (AISC 580 report), but reasonably lesser than the real research capacity, researcher would have personal interviews or researcher can finically cover, if request to Australian research agency. It should decide by basic academic requirement of sample population number, research period and budget. To sum up, with Australian CCDDer list and calculated reasonable number of sample population this project would be performing. Academic concern and financial concern to calculate the number would be important. But once researcher get the list then calculating the number would not be hard. But it should be also important to get the list of CCDDer in legal perspective.

Hiring Research Agency?

Another issue might be how physically executing the research in overseas. Due to the character of qualitative method, there would be only two options. One would be visit Australia with some level of progressed research result and information about the sample population, and physically visit or meet the sample population to asking and confirming survey questionnaire sheep. In condition that a researcher is living in another country during the research period, it will costly to the researcher. And another method would be the request of survey service to social science survey agency in Australia, like social research centre in Melbourne (Social Research Centre. 2019). This case would be also cost for practice the survey service. And there would be a risk to have to visit Australia even after finish, if the agency does not provide certain service might miss after received result. But in this case, researcher is able to expect some professional research assistance service, specialised not for local language but, for local environment. First, in direct visit Australia option, there must be pre research about Australia environment. Main strong point of this plan would be controlling the research procedure, and weakness which will be energy consuming. Because researchers do have basic understanding of country, it is important to get the proper research plan and information possible to make a decision immediately in the field. And if extra research has to be undertake reaction time would be shorter than second case. But it would be energy-consuming schedule due to the character of survey. And also there must be a concern about staying period, due to the fact that UK T2 visa does not allow one to stay overseas more than two months, if the visa holder wants to apply another next step UK working visa. Second option that hiring research agency or research assistance would be cost. It is depending on agency and assistance, realistically need more research, but the cost would be not cheaper than first option, if there were unexpected trip for adjust research result. But strength will be reduced for pre research on the Australian legal, financial industrial, governmental system, and getting more freedom of time etc. It is depending on contract, but if research period is able to extend more than the case that researcher research by him with British researcher visa condition, more systematic research would be expected. To sum up, overseas research would be not easy to compare with research in residential country. It opened two options, but each option has an own strength and weakness. Main concerns for the decision-making should be a based on budget and expected assistance skill, if it is necessary.

Time plan

Under the assumption that we do not hired research agency or assistance in this research project, there would be three steps to confirm this project. First step would be preparation. It is stage that collects all basic information; include statistical data, organising survey questionnaire sheet, and researching Australia contact information. It might be need two months; it is not necessary to spend more than two months due to character of qualitative method, there are possibility to need more time to have a fieldwork, so unless got all basic information, it is better to start early. And second stage would be fieldwork and following analysis together. Now, it is planning one period of fieldwork, less two months, but extension of the fieldwork is possible if result of data collection is believed not to enough or information is not accuracy. It will cost more, and there would be Australia visa issue, it need more research about Australia visa condition that how long British researcher would stay in the country. Point in the stage is until got satisfaction of collected data analysis; it is hard to move to next stage. Research plan especially fieldwork would be organized by Australian calendar. Australia share many legal and social tradition compare with researcher’s residential country, but there is significant difference in public long term vacation period, that should concern to planning research schedule. Australia is located in southern hemisphere, which has a different holiday period. For example, Australian have a long vacation from Christmas until the end of January, Government offices would open from January, but private sector would not be functioning in general. And August vacation period is shorter then researcher’s residential country commonly school holiday would be one month in Australia. So it would be reasonable idea concern out the schedule difference, especially for survey. Essential part of research plan would be fieldwork planning or preparation stage, because even there is ability many to extend total schedule, but more accurate plan would be reduced the risk. Main concern should be to understand different long term public holiday period in the two countries, and suitable organisations to help this project. Under the assumption that research start from 2019, concern about Australia schedule, and research preparation, it would be better to finish the preparation until end of 2019 and start field work from February 2020, may be one or two time and analysis the collected data. Final stage of this project will be writing the thesis. If fieldwork has been finished August in 2020, writing is able to start. It will take approximately three months in general, under the assumption researcher only focusing only writing. After writing there would be a couple of more process to depend on the dissertation. But that is out of topic in this article.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts