Unveiling the Political Economy of Taxation

The worldwide financial related emergency opens the need to investigate the governmental issues of tax assessment. Current global orthodoxy would have the issues and the government is not bound in increment charges. They ought to oversee open funds through descending weight on spending, since business sectors force restrains on state’s income raising endeavors.

Therefore, the 'new fiscal sociology of the state' prompts us to take a long perspective on verifiable and cross-national varieties in tax policies, particularly in the context of politics dissertation help. There might be various equilibriums in the tax spending blend. The tax framework cannot have the result of specialized choice, yet is significantly formed by political and social interests (Hildreth, 2019). Steady, powerful, and impartial duty strategy usage and assessment consistence cannot generally be expected in its implementation.

With respect to assessment approach, at the end of the day, it is profoundly political as whoever makes good on expense and the amount they pay, is at the core of governmental issues itself. But then it is generally minimal about the fundamental governmental issues of tax assessment. Household income assembly has been developing consideration lately (Lü and Scheve, 2016). Universal players, for example, the “Organization for Economic Co-operation and Development (OECD)”, the “World Bank and the G20” are calling for progressively deciding activity to battle on avoidance of tax as well as its evasion. Creating nations are asked to build their own duty assortment and it has been seen in many case, that actualizing and continuing duty changes has demonstrated to be a difficult undertaking for some legislatures. This extraordinary area gives a new proof on the political variables deciding tax collection in creating nations. The articles assembled here provide two particular related inquiries: first, which components shape long haul tax collection examples and for what reason these examples are so hard to change in any event, when they end up being broken from various perspectives (Andersson, 2017). Secondly, which variables decide the destiny of explicit expense changes is also described. There are proof from contextual investigations covering six nations is supplemented by a measurable examination of components impacting income weakness despite outside stuns.

This study delivers helplessness of income to external shocks utilizing composition of export in order to catch financial structure and separating nations as indicated by pay levels, asset endowments and political systems. This provides a more extravagant characterization than the past investigations (Von Schiller, 2018). Lower pay nations are helpless against the shocks, particularly regarding exchange that are related with the best income misfortune, majority rule systems appear to be less defenseless against income misfortunes because of the loss of revenue.

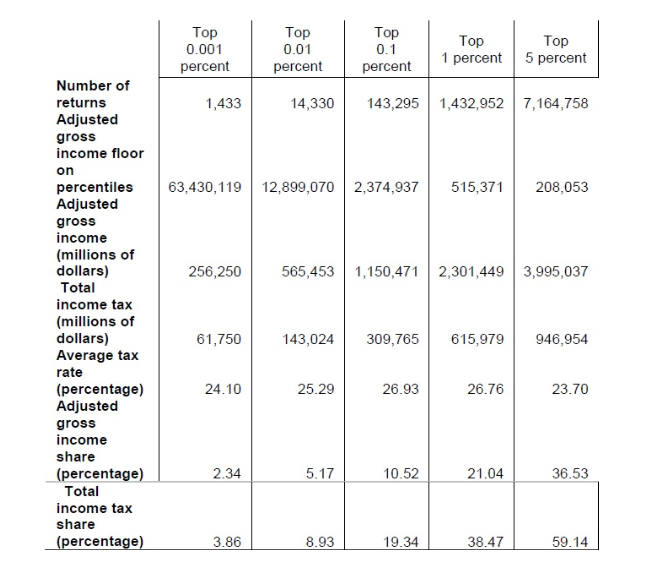

The reason for contemplating the political economy of tax collection, at last, is that a decent duty framework must be politically manageable inside the foundations of political economy as well as government encourages us comprehend sustainability in political assets (Barnes, 2020). To some degree, observationally, few of the approach results are difficult to comprehend without “political economy” is yet less baffling with it. Few models of British that will be examined underneath incorporate the survey charge, as there is no VAT on youngsters' apparel, and the conjunction of country’s protection and individual “income tax”. When seeing models like these, it cannot be said that "it's political", yet these attempts to accomplish more than that. It is needed to be progressively deliberate in considering governmental issues, and to contemplate it in manners, that are reliable with the apparatuses and the techniques for financial matters in order to draw exercises (Ono and Uchida, 2018). The motivation may appear to be a piece of determining the imperative set but has more effectiveness in this aspect. In the policy of issues in tax distributional are focused, so in order to maintain, it cannot be only problems of getting a better advice from financial analysts. [Refer to Appendix 1]

Organization is likewise part of this, but maintainability cannot be problems of collectability. “Tax Policy” ought to be sound, particularly in a unique setting and there is a consideration of races and data is basic. In every one of these process, “political economy” makes it ponder limitations on approach, about what proposals are possible and economical (Hickey and Seekings, 2017). Then non-popular governments while income in asset rich nations is increasingly helpless against the shocks, aside from catastrophic events than non-asset rich nations. It is found that a negative connection between assembling fares and income in lower pay nations has been identified.

It will focus on the outcomes that are drawn out on which political powers and thoughts have gone through the procedure, with a specific spotlight on the UK, however likewise differentiating and looking at the experience of cross-country. It will draw out the primary exercises and can gain from taking a gander at the UK and cross-country experience of assessment change (Haaparanta et al. 2019). Statutory negligible paces of income tax have been cut generously in the UK in the course of recent years. It is to be followed through by their political race triumph in 1979; the “Conservatives” is been cut at the top rate from 83 percent to 60 percent and the “fundamental rate” from 33 percent to 30 percent. In the 1980s, these kept on being cut, with tumbling the top rate to 40 percent in the year 1988. Then labor represented a beginning pace of annual expense in the year 1999, set at 10 percent (ictd.ac, 2018).

“Statutory rates” of personal expense are normally significant in deciding its weight but the limits at which “statutory rates” executes in are additionally significant. The edge for paying “income tax” rose from £4,216 to £5,035 in the year in 1979-80 and 2006-07respectively, subsequent to representing economy-wide expansion – so developed by just 20% in genuine terms, contrasted and a lot quicker development in close to home income. Incompletely therefore, the quantity of payers of income tax has rose by 3.6 million over a similar period. Besides, the limit for paying a higher pace of annual duty has really fallen since 1979, in the wake of representing “economy-wide swelling”. This has prompted an ascent in the quantity of “higher-rate citizens”, from 674,000 out of 1979-80 to about 3.3 million of every 2006-07 (wider.unu.edu, 2020).

Both of these impacts have prompted supposed 'fiscal drag', where the base of a specific assessment expands because of limits not keeping pace with by and large development. Another significant element of “income tax frameworks” that decides its general weight is the degree of assessment consumptions, for example those that can be deducted from net salary so as to ascertain assessable pay. In the UK, single consumption of significant assessment was abrogated step by step during the 1990s which was known as contract intrigue charge help. This was significant duty consumption, and joined with the evacuation of progressively minor ones, has widened the annual expense’s base in the UK.

Reference List

Books

- Hildreth, W.B. ed., 2019. Handbook on taxation. Routledge.

Journals

- Andersson, P.F., 2017. Essays on the Politics of Taxation. Lund: Statsvetenskapliga institutionen.

- Barnes, L., 2020. Trade and redistribution: trade politics and the origins of progressive taxation. Political Science Research and Methods, 8(2), pp.197-214.

- Haaparanta, P., Kanbur, R., Paukkeri, T., Pirttilä, J. and Tuomala, M., 2019. Promoting Education under Distortionary Taxation: Equality of Opportunity versus Welfarism. Helsinki: UNU-WIDER Working Paper, 18.

- Hickey, S. and Seekings, J., 2017. The global politics of social protection (No. 2017/115). WIDER Working Paper.

- Lü, X. and Scheve, K., 2016. Self-centered inequity aversion and the mass politics of taxation. Comparative Political Studies, 49(14), pp.1965-1997.

- Ono, T. and Uchida, Y., 2018. Capital Income Taxation, Economic Growth, and the Politics of Public Education.

- Von Schiller, A., 2018. Party System Institutionalization and Reliance on Personal Income Taxation in Developing Countries. Journal of International Development, 30(2), pp.274-301.

Appendices

Appendix 1: Economic analysis of income tax

Continue your exploration of To What Extent Does The British Nation State Retain Autonomy? with our related content.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts