Analysis of Securities Listed on the Bombay Stock Exchange

Choice criteria for selecting stock exchange market and sample data

The Report takes a sample of eleven securities listed on the Bombay Stock Exchange (BSE). The Bombay Stock Exchange is known as the oldest exchange in Asia. BSE as a brand is synonymous with capital markets in India. The BSE SENSEX is the benchmark equity index that reflects the robustness of the economy and finance, making it a critical topic for those seeking finance dissertation help. At par with international standards, BSE has been a pioneer in several areas. SENSEX is an index of thirty securities.

These include – ACC, Googl , Bharti Airtel, Cipla , FTR , Grasim, Maruti Suzuki Wipro ,TCS,AON,TATA Motors . All of these are listed on the Bombay Stock Exchange. The time duration of the study is February 2015 to June 2017.

Companies in sample data-

Googl - Google is an American multinational technology company that specializes in Internet-related services and products.

FTR(Frontier communications)- Frontier Communications Corporation is a telecommunications company in the United States.

TCS(Tata consultancy services)- Tata Consultancy Services Limited is an Indian multinational information technology service, consulting and business solutions company Headquartered in Mumbai, Maharashtra.

AON- A leading global professional services firm providing a broad range of risk, retirement and health solutions.

TATA Motors- Tata Motors Limited is an Indian multinational automotive manufacturing company headquartered in Mumbai, India, and a member of the Tata Group.

Wipro- Wipro Limited is an Indian Information Technology Services corporation headquartered in Bengaluru, India.

Maruti Suzuki- Maruti Suzuki India Limited, formerly known as Maruti Udyog Limited, is an automobile manufacturer in India.

Bharti Airtel - Bharti Airtel Limited is an Indian global telecommunications services company based in New Delhi, India.

ACC- ACC Limited one of the largest producers of cement in India. It's registered office is called Cement House.

Grasim- Grasim Industries Limited is an Indian building materials manufacturing company based in Mumbai, Maharashtra.

Cipla- One of the top global pharmaceuticals companies in India, uses latest technology for high quality & affordable medicines for all patients.

Sample Data- please referred Appendix -1.

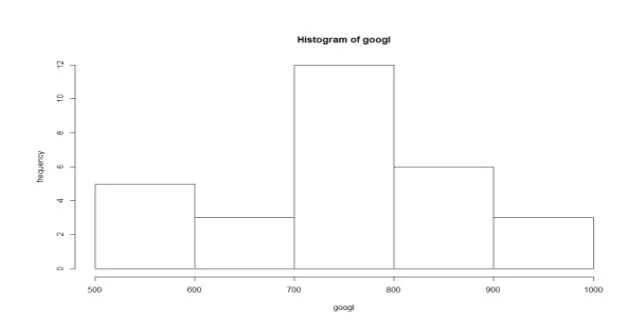

Graphical Analysis of data- Graph-1)

Boxplot of data

market effieciency

Interpretation

Above Graph shows sample data information and market efficiency of each company yearwise.Graph1 tells year wise stock price of Google company which is high in 2017 with respect to 2015 and histogram of frequency of Wipro and Google company stock price which mostly lies between 700-800 it is sign of company growth. Graph 2 shows scatter plot of the stock price data which indicates correlation between the company stock prices. Graph 4 shows the trend graph of companies stock price with respect to time .Most of the companies have consistent stock prices in 2015 -2017 but maruti have increases its stock price greatly from 2015 to 2017. Scatter plot also tells about outlier in the dataset.

Reflects relevant empirical statistical / econometric analysis which tests the efficiency of the stock market of your choice , explains the statistical econometric method you have used in your empirical analysis .you have to check if your empirical findings and results are consistent with empirical findings in the stock market you have chosen in this study.

Statistical tests for testing efficiency of stock market

This assignment is based on Effective Maket Hypothesis -

“A capital market is said to be efficient if it fully and correctly reflects all relevant information in determining security prices. Formally, the market is said to be efficient with respect to some information set, t, if security prices would be unaffected by revealing that information to all participants. Moreover, efficiency with respect to an information set, t, implies that it is impossible to make economic profits by trading on the basis of t.”

We can use Runs Test and Autocorrelation Test in order to test the Efficient Market Hypothesis of the Indian securities.

a)Runs test- The Wald–Wolfowitz runs test (or simply runs test), named after Abraham Wald and Jacob Wolfowitz, is a non-parametric statistical test that checks a randomness hypothesis for a two-valued data sequence.

Here, the null hypothesis to be tested is that the stock prices do not make pattern i.e.

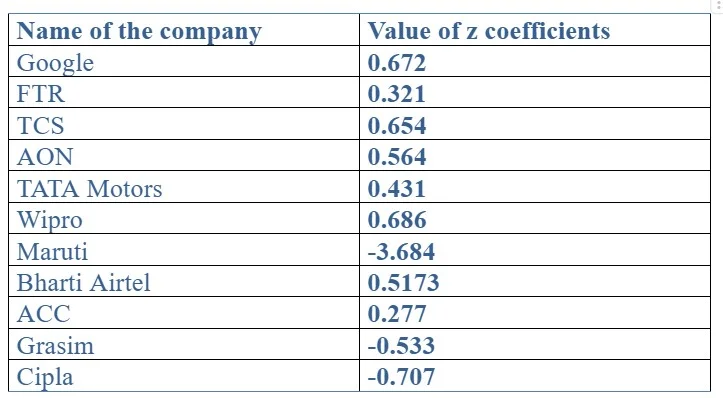

Ho = The prices do not make pattern. The null hypothesis considered here is common for all the sample companies. The null hypothesis Ho is accepted if the value of Z is less than 1.96 and it is rejected if the value of Z exceeds 1.96.

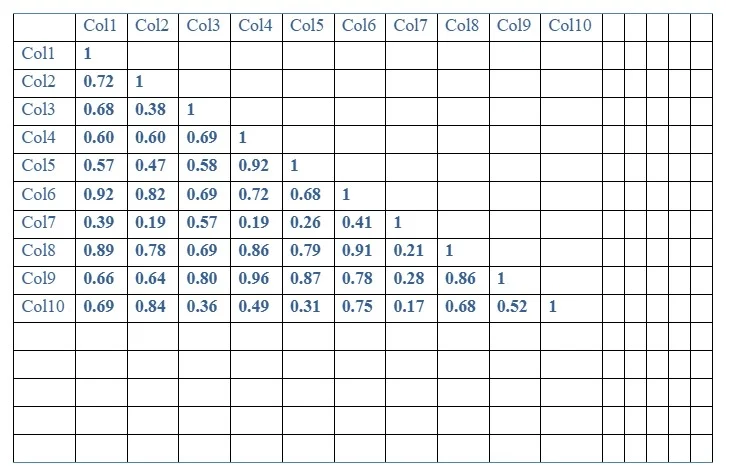

Autocorrelation test- Autocorrelation test is applied to weekly share prices of different sample companies and also to the first differences of share prices of different sample companies. In autocorrelation test, lag t is correlated with lag t+1, lag t+2, lag t+3 and so on. In the same way, lag t+1 is correlated with lag t+2, lag t+3, lag t+4 and so on.

Results and Interpretaion of the tests-

Interpretation

It can be seen from Table-1 that the value of Z is 0.672 for the stock prices of googl from Jan 2015 to june 2017.value of Z is less than 1.96. So, the null hypothesis Ho is accepted i.e. the stock prices do not make pattern.

The calculated value of Z is 0.321 for the stock prices of FTR from Jan 2015 to june 2017. This value of Z is less than 1.96 and hence the null hypothesis considered in this case is also accepted. i.e. stock prices of this company do not make any pattern.

In case ofTCS, the calculated value of Z is 0.654. Clearly it is less than 1.96. So, it shows that stock prices of TCS do not make pattern. It also shows that stock market of TCS is weak form efficient.

It is clear from Table-1 that the value of Z is 0.564 for AON which is much less than 1.96. As the value of Z less than 1.96 accepts the null hypothesis Ho, therefore, null hypothesis that the stock prices do not make pattern is accepted.

It is clear from Table-1 that the value of Z coefficient for TATA motors is 0.431. This value of Z is not in comparison with 1.96. So, share prices of dr. Reddy’s Lab also do not make any pattern and

Similarly, in case of Grasim, the calculated value of Z coefficient is-0.533. The value of Z coefficient less than 1.96 accepts the null hypothesis Ho, that stock prices do not make pattern.

In case ofMaruti, the calculated value of z is -3.74. This value of Z is not within +1.96 and -1.96.

So, the null hypothesis that stock prices do not make pattern is rejected. Stock prices of Maruti make pattern . The calculated value of Z is 0.5173 for Bharti Airtel. This value of Z is again less than 1.96. Here, null hypothesis is accepted which shows that stock prices of Bharti Airtel do not make any pattern.

Similarly, in case of ACC , the value of Z coefficient is 0.277. The value of Z is less than 1.96. Here, null hypothesis is accepted which shows that stock prices of ACC do not make any pattern.

At the end, the analysis of Runs test shows that in every case the null hypothesis is accepted except one .

It means stock prices of the sample companies do not make any pattern and hence move randomly except MAruti.

With references to your graphical and econometric investigators performed ,critically access the level of market efficiency of this stock exchange market of your choice and the wider implications of this for the financial sector

This examined the weak-form efficiency of ten (10) companies listed on the Bombay Stock exchange (BSE) using monthly data from Jan 2015 to june 2017. The Runs Test and Autocorrelation Tests were used as means of determining whether the BSE was efficient in weak-sense. The Autocorrelation test when directly applied to share prices gives conflicting results with Runs test and thus, making it difficult to reach a definite conclusion. Therefore, though the results lead us into believing that the BSE is weak form efficient, yet we choose to remain cautious in letting our belief transcend into a generalization. The findings of this study indicate that the BSE needs to strengthen its regulatory capacity to boost investors’ confidence. This would involve them being more stringent in enforcing financial regulations, performing regular market. Thus, at the end it can be inferred that the effect of stock prices for the sample companies on future prices is very meajure and an investor cannot reap profits by using the stock price data as the current stock prices already reflect the effect of past stock prices.

References

Achal Awasthi1, Dr.Oleg Malafeyev 2 “Is the Indian Stock Market efficient – A comprehensive study of Bombay Stock Exchange Indices” Faculty of Applied Mathematics and Control Processes, Saint Petersburg State University, Russia

P.K. Narayan and R. Liu “ A GARCH Model for Testing Market Efficiency” , School of Accounting, Economics and Finance Faculty of Business and Law ,Deakin University, 2015

Looking for further insights on Analysis of Anxiety Severity and Treatment Effectiveness? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts