Data Analysis And Interpretation

Introduction

Data analysis is a technique used to convert raw data into useful and valuable information. The valuable data is then interpreted to have a better understanding of the information and the findings of the analysis. The data collected by the researcher was in the raw form that needed to be converted into a valuable form that is why the researcher has used the data analysis technique. In the study, the researcher has collected the data by interviews and questionnaire. 97 respondents were selected as sample. The qualitative and the quantitative both the techniques were applied to analyse the data, and for those seeking further guidance, data analysis dissertation help can provide additional support. The results and the findings of analysis were then interpreted.

Theme 2: The maximum respondents of the survey were holding a bachelors degree.

The graph demonstrated above shows various positions held by the respondents in their SME’s. According to the graph, 68.25% respondents were the owners, 28.57% respondents were the managers, and only 3.175% of the respondents were accountants. This shows that majority of the respondents were holding the position of the owner in their SME’s and other respondents were holding the positions of manager and accountants.

Theme 2: The maximum respondents of the survey were holding a bachelors degree.

The graph of academic qualification shows that 12.70% of the respondents have done a diploma, 60.32% respondents were holding a bachelor degree, 7.937% respondents were holding a masters degree, and 6.349% respondents were professionally qualified and 12.70% respondents were holding other qualifications. From the above figure, it can be concluded that most of the respondents were holding a bachelor degree and only a few respondents have done a diploma, masters and other courses.

Theme 3: Maximum of the respondents experienced their job for almost 5years.

The graph depicts that 42.86% of the respondents were holding their current positions for less than 5years, 41.27% respondents were holding their position for more than 5years but less than 10years, 9.524% respondents were holding their position for more than 11years but less than 15years and 6.349% respondents were holding their positions for more than 16years. From the above graph, it can be interpreted that 42.86% respondents have been working in their respective Small and Medium sized enterprises for less than 5years, and these respondents are holding the highest percentage as compared to the other respondents.

Theme 4: The present study focused more on clothing sector.

The above graph of the firm sector demonstrates that 25.40% of the respondents were indulged in manufacturing business, 9.524% of the respondents were indulged in retail and food business, 33.33% respondents were doing clothing business, 15.87% respondents were doing telecoms business, and 6.349% were indulged in oil and gas business. This shows that 33.33% of the respondents were dealing in the business of clothes, i.e. the main area of business of the SME’s was clothing, and 6.349% of the respondents i.e. only a few of them were doing the business of oil and gas under Small and Medium sized enterprises.

Theme 5: The SME’s had an average capital of 3177777.78

There are 63 respondents as shown in the above table, and the minimum capital of the Small and Medium sized enterprises were 200000.00, and the maximum capital of the SME’s was 26000000.00. From the above table, it can be evaluated that the average capital of the Small and Medium sized enterprises is 3177777.7778.

Theme 6: Private funding was the main source of capital.

The various sources of capital of Small and Medium sized enterprise are private funding, bank loan, government bodies, shares, foreign investors and other sources. The above graph shows the main sources of capital from which 53.97% of the SME’s capital is obtained from private funding and 46.03% of the SME’s capital is obtained from the source of bank loan. Therefore, it can be concluded that there are two main sources of capital through which Small and Medium sized enterprises obtain their capital and they are private funding and a bank loan.

Theme 7: On an average 9 employees were there in the firm.

As shown in the above table, the number of employees in Small and Medium Enterprises is 63. It is analysed that the minimum number of employees in the firm was 1 and a maximum number of employees was 23 and the average number of employees was 9.

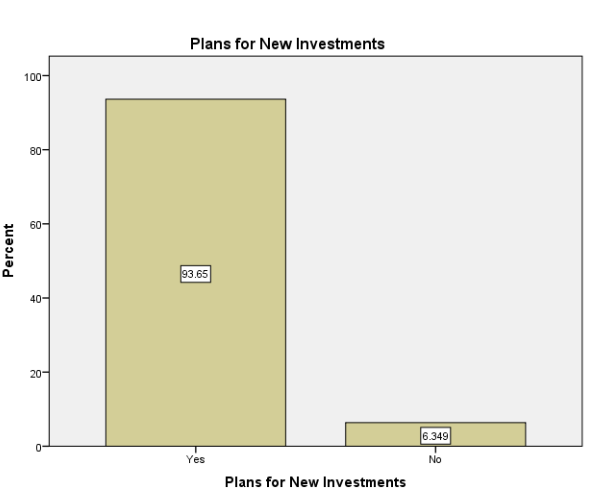

Theme 8: The SME’s have plans for investments in capital project and expansion.

From the graph shown above it can be interpreted that from 63 companies that were been taken as a sample for the study, 93.65% of the respondents said yes and the rest, i.e. 6.34% said no. So it has been analysed that a large number of respondents had plans to invest in new capital projects or to expand the existing project in the near future.

Theme 9: The banks funded most of the new investments planned by the SME’s.

From the above graph, it can be interpreted that if the Small and Medium sized Enterprises have any plan to invest in new capital projects or to expand the existing project then the percentage of the source of the fund from the bank was 65.08%, from the financial market was 19.05% and from self – funding was 15.87%.Here, it is analysed that bank is the major source of funding for new investments.

Theme 9: Payback is analysed to be the best technique in the investment appraising process.

The table reflects that the payback technique has minimum statistic of 3 and Maximum Statistic of 5 and the average statistic of Payback technique is 4.19, the minimum statistic of Net Present Value is 3, and maximum Statistic is 5, and the average of Net Present Value is 3.73, The minimum statistic of Internal Rate of Return is 2, the maximum statistic is 4 and the average importance of Internal Rate of Return is 3.37, the minimum statistic of Accounting Rate of Return is 3 , the maximum statistic is 5 and the average importance of Accounting Rate of Return is analysed to be 3.56 and the minimum statistic of other technique is 3,the maximum statistic is 3 and the average importance of others is analysed to be 3.

From the above graph, it can be interpreted that 19.05% respondents were neutral about the importance of payback technique, for 42.86% it was important, and for 38.10% it was very important. So it can be concluded that Payback technique is important and can be applied by Small and Medium sized Enterprises for investment appraising process.

The above graph interprets that 46.03% were neutral about the importance of Net Present Value Technique, for 34.92 % it was important and for 19.05% it was very important. Hence, it can be concluded that net present value can be used for investment appraising process.

From the data given in the above graph, it can be depicted that for 7.937% respondents Internal Rate of Return technique is unimportant, 47.62% of the respondents were neutral about its importance, and 44.44% felt that it is important. Hence it can be concluded that Internal Rate of Return Technique can be applied by Small and Medium sized Enterprises.

The above graph depicts that 50.79% were neutral about the importance of Accounting Rate of Return technique, 42.86% felt that it is an important technique and only 6.349% of the respondents felt that it is very important. Hence it can be evaluated that Accounting Rate of Return Technique can be used as a technique for investment appraising process by Small and Medium sized Enterprises.

The above graph shows that all the respondents were neutral about the importance of the other techniques that whether it can be used in the investment appraising process by Small and Medium sized Enterprises or not.

Theme 10: The non-financial criterion used is political priorities of the state.

The Non-Financial Techniques that were been used by the Small and medium sized Enterprises are political priorities of the state, development plans of the state, competition and personal experience. 50.79% of the Small and Medium sized Enterprises used political priorities of the state as their non-financial appraisal technique, 3.175% of the Small and Medium sized Enterprises used Development Plans of the state, 28.57% used competition as their non-financial appraisal technique and 17.46% of the Small and Medium sized enterprises used personal experience as their non-financial appraisal technique. Therefore, it can be said that most of the SME’s use political priorities of the state as their non-financial appraisal techniques.

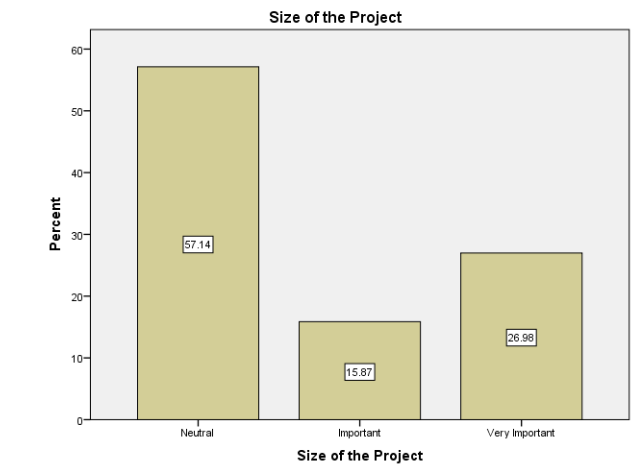

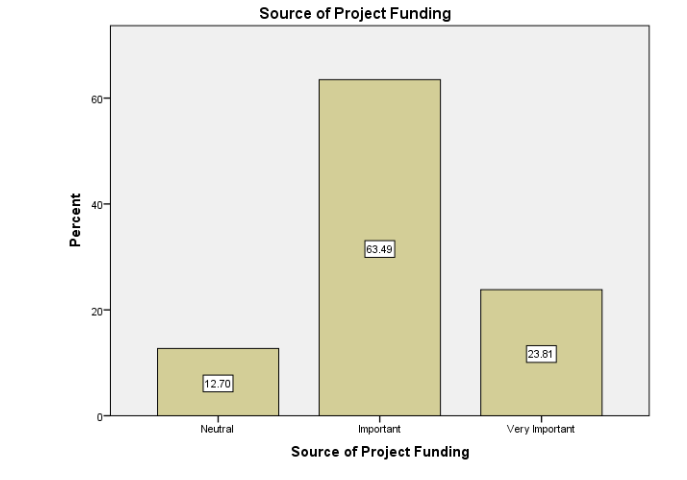

Theme 11: The source of project funding is the important feature of the project of the SME’s.

As per the table, the minimum statistics of all the features of the project like the size of the project, nature of the project, the source of project funding and other features is 3. On the other hand, the maximum statistics for the size of the project, nature of the project and source of project funding is 5, and for other features, it is 4.

The mean statistics of the size of the project is 3.70, nature of the project is 3.60, the source of project funding is 4.11, and the mean value of other features is 3.06. Therefore, it can be interpreted that the source of funding is the most important project feature in determining the type of technique which is used in the decision-making process of capital investment done by the small and medium sized enterprises.

The above graph of the size of the project shows that 57.14% of the respondents were neutral about the importance of size of the project, 15.87% of the respondents answered that size of the project is important in determining the techniques and 26.98% of the respondents said that size of the project is very important in determining the technique. It can be evaluated from the above graph that maximum respondents were not sure about the importance of the size of the project, whether it is important for determining the type of technique or the combination of technique used in the capital investment decision making processes or not and as per 15.87% respondents, size of the project is important in determining the techniques for capital investment decision making processes.

The above graph of the nature of the project shows that 55.56% of the respondents were neutral about the importance of the nature of the project, 28.57% of the respondents said that nature of the project is important in determining the techniques and 15.87% of the respondents said that nature of the project is very important in determining the technique. It can be interpreted from the above graph that maximum respondents were not sure that whether the nature of the project is important for determining the type of technique or the combination of technique used in the capital investment decision making processes or not and as per 28.57% respondents nature of the project is important in determining the techniques for capital investment decision making processes.

The above graph of the source of project funding depicts that 12.70% of the respondents were neutral about the importance of source of project funding, 63.49% of the respondents said that the source of project funding is important in determining the techniques and 23.81% of the respondents said that source of project funding is very important in determining the technique. From the above graph, it can be evaluated that most of the respondent said that source of project funding is important in determining the techniques for capital investment decision making processes.

The graph is related to the other features that are important in determining the techniques. It shows that 93.65% respondents were not sure about the importance of other features in determining the techniques and 6.349% respondents said that other features are also important in technique determination. Therefore, it can be interpreted that more than 90% respondents think that other features are not important in determining the techniques or types of techniques used in the capital investment decision-making process.

Theme 12: Monitoring and control are considered as the important stage in the investment decision-making process.

The various stages that have importance in Small and Medium sized enterprises in investment decision-making process are Determination of budgets, research and development, evaluation, authorisation and monitoring and control. The mean statistic of determination of budgets is 3.27, for research and development is 3.43, for evaluation is 3.62, for authorization is 3.75 and for monitoring and control are 4.57. Hence, it can be said that among all the above stages, monitoring and control hold more importance than others.

The above graph depicts that73.02% of the respondents were neutral about the stage of determination of budget, and only 26.98% of the respondent thought that determination of budget is an important stage in Small and Medium sized enterprises in their investment decision making process.

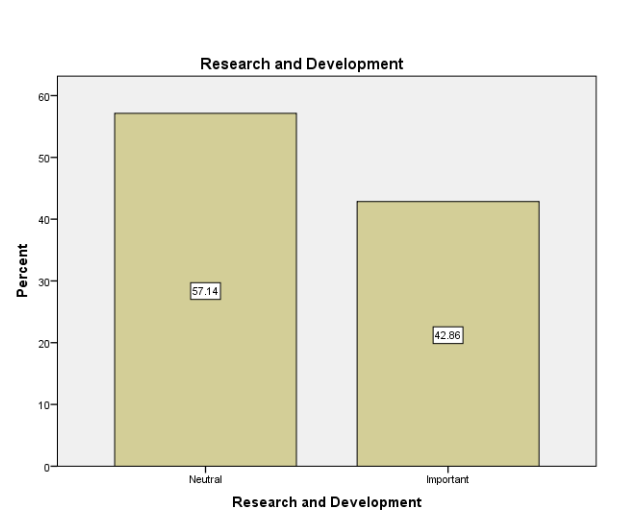

The above table depicts that 57.14% were neutral about the importance of the Research and Development stage and rest of the respondents, i.e. 42.86% thought that research and development was an important stage for Small and Medium Sized Enterprises in their investment decision-making process. Hence, it can be said that research and development can be used for investment decision-making process.

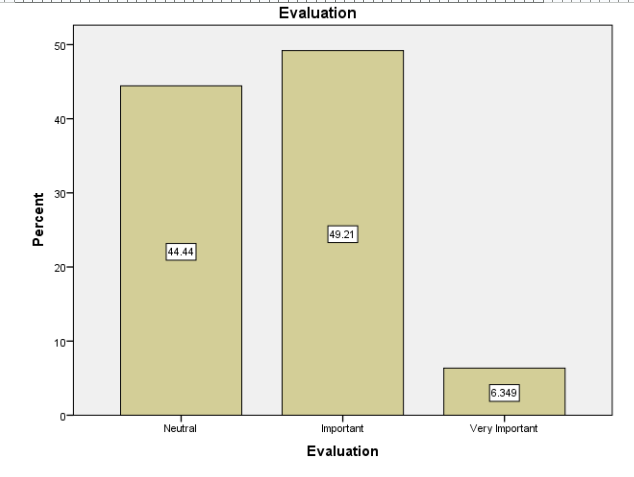

The above graph shows that 44.44% of the respondents were neutral about the importance of evaluation stage, 49.21% of the respondents thought that it was important and 6.349% of the respondents thought that evaluation stage was very important in investment decision-making process. So, it can be interpreted that evaluation stage can be used in investment decision-making process by Small and Medium sized Enterprises.

The above graph shows that 41.27% of the respondents were neutral about the importance of authorization stage, 42.86% felt that it is an important stage for Small and Medium sized enterprises and for 15.87% it was very important. Hence, it can be concluded that the Authorization has its importance and can be applied by SME’s.

The graph given above depicts that 42.86% felt the importance of monitoring and control stage in investment decision-making process and 57.14% thought that monitoring and control is a very important stage that can be used by Small and Medium Sized Enterprises in their investment decision-making process. So, it can be said that in investment decision making process monitoring and control stage is very important and can be used by Small and Medium sized Enterprises.

Theme 13: The SME’s are high risk assessed firms in the potential investment of projects.

From the above graph, it can be interpreted that the 96.83% of the Small and Medium sized enterprises assessed the risk of potential investment in projects and 3.175% of the Small and Medium sized Enterprises did not assess the risk of potential investment in projects.

Theme 14: The post audit took the highest time and regular follow up method without comparing was used for ex-post audits.

As per the graph, the duration taken by the small and medium sized enterprises in conducting ex-post audits is 57.14% whereas 26.98% firms take more than 48 months in conducting ex-post audits. So, it can be concluded that small and medium sized enterprises take 37 to 48 months in conducting ex-post audits.

In the bar graph, the method used by small and medium sized enterprises in conducting ex-post audits is given in percentage form. It shows 84.15% small and medium sized enterprises use regular follow-up phase without comparing the performance. Other methods of conducting ex-post audit such as by comparing the performance after implementation with the predictions of the feasibility study in the evaluation phase, Implementation with the predictions of the feasibility study in evaluation phase are used by only 15.87% of respondents. Thus, mostly regular follow-up method without comparing performance is used by small and medium sized enterprises.

Theme 15: Few investments of the SME’s faces a shortage of funds.

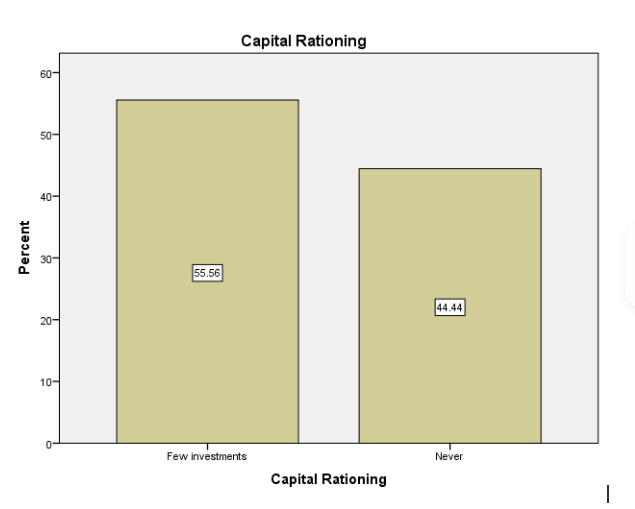

The above graph shows that 55.56% of small and medium sized enterprises faced a shortage of funds for any of its investment and 44.44% firms did not face a shortage of fund for its investment. So, to conclude we can say that most of the firm faced a shortage of funding in its investment (i.e. Capital Rationing).

Theme: 16. The Nigerian stock market is used as a source of funding by issuing shares

As it is seen, In future the Nigerian stock market will be a source of funding for 100% of small and medium sized enterprise. The Nigerian stock market will be used as a source of funding by the following way:

With the help of the following graph, we can depict that small and medium sized enterprise will raise funds by issuing new shares and bonds. The graph shows that 84.15% of the companies will raise funds by issuing new shares, and 15.87% of the companies will raise funds by issuing bonds. Therefore, it can be said that most of the small and medium sized enterprises use the Nigerian stock market as a source of finding by issuing new shares.

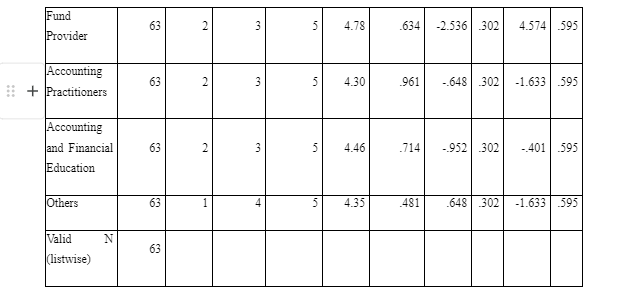

Theme 17: Fund providers majorly influence the investment decision-making process.

The descriptive analysis done above shows that the minimum statistics of fund provider is 3, and maximum statistics of fund provider is 5 but the mean statistics of fund provider attempts to influence the investment decision-making process is 4.78. The minimum statistics of accounting Practitioner is 3, and maximum statistics of accounting practitioner is 5, but the mean statistics of accounting practitioner attempts to influence the investment decision-making process is 4.30. The minimum statistics of accounting and financial education is 3, and maximum statistics of accounting and financial education is 5 but mean statistics of accounting and financial education attempts to influence the investment decision making process is 4.46. Others minimum statistics is 4, and maximum statistics is 5 but mean statistics of others attempts to influence decision-making process is 4.35.The graph below shows the percentage of Fund Provider that attempts to influence the small and medium sized enterprises investment decision-making process:

From the above graph, it can be depicted that 88.89% of the fund provider attempts to influence the investment decision-making process of small and medium sized enterprises and rest 11.11% fund providers will not influence. Hence, it can be concluded that Fund Provider attempts to influence the investment decision-making process of small and medium sized enterprises. The percentage of accounting practitioner that attempts to influence the investment decision-making process is as follows:

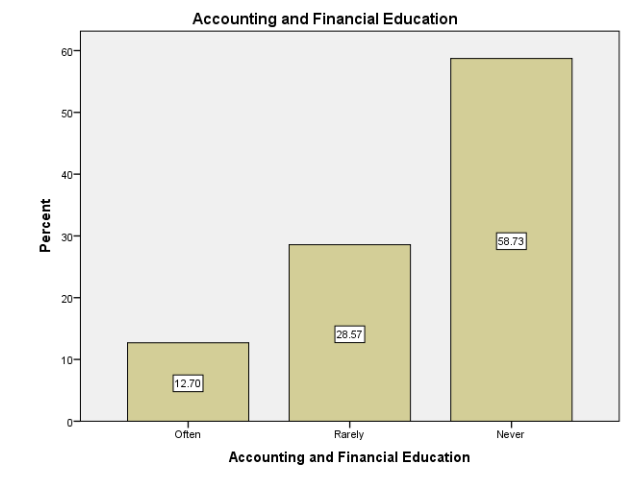

It shows that 65.08% of accounting practitioners will never attempt to influence the investment decision-making process of small and medium sized enterprises and rest 34.92% will attempt to influence the investment decision making process. So, it can be concluded that Accounting practitioners will never attempt to influence the investment decision-making process of small and medium sized enterprises. The percentage of accounting and financial education attempts to influence small and medium sized enterprises investment decision-making process is analysed in the graph given below:

From the above bar graph, it can be said that 12.70% of accounting and financial education attempts to influence the investment decision-making process, 28.57% rarely attempts to influence the investment decision-making process, 58.73% of accounting and financial education never attempts to influence the small and medium sized enterprises investment decision-making process. Hence, it can be concluded that accounting and financial education never attempts to influence the investment decision-making process of small and medium sized enterprises.

It shows that 65.08% of accounting practitioners will never attempt to influence the investment decision-making process of small and medium sized enterprises and rest 34.92% will attempt to influence the investment decision making process. So, it can be concluded that Accounting practitioners will never attempt to influence the investment decision-making process of small and medium sized enterprises. The percentage of accounting and financial education attempts to influence small and medium sized enterprises investment decision-making process is analysed in the graph given below:

The percentage of others attempts to influence the investment decision-making process of small and medium sized enterprises are shown as below:

The graph is reflecting the percentage of respondent others than Fund Providers, Accounting Practitioners, Accounting and financial education attempts to influence the investment decision-making process of small and medium sized enterprises. It shows 65.08% of other respondents rarely attempts to influence investment decision-making process, and 34.92% of respondent does not attempt to influence the investment decision-making process. Thus, it can be interpreted that accounting and financial education rarely attempts to influence the investment decision-making process of small and medium sized enterprises.

Hypothesis Testing

H0: There is no significant impact of choice of capital appraisal investment method on the financial and overall performance of SME clusters.

H1: There is a significant impact of choice of capital appraisal investment method on the financial and overall performance of SME clusters.

In order to test the above-formulated hypotheses, following regression analysis has been done by the researcher:

In the above table, the correlation value is 0.271; this shows that there is a weak positive association between capital appraisal investment method (Payback, NPV and ARR) and overall performance of SME’s clusters and a negative association between capital appraisal investment method (IRR) and overall performance of SME’s clusters.

Further, in the table, the value of regression coefficient that is R Square is 0.073 which shows that if there is 100 % variation in the capital investment appraisal methods, then the dependent variable which is the overall and financial performance of the enterprises will vary by 7.3% only.

The payback, net present value and accounting rate of return have a positive relation, and internal rate of return has a negative relationship with the overall and financial performance of the SME’s clusters.

The ANOVA table given above demonstrates the significance value 0.345 which shows that there is no significant impact of capital investment appraisal technique on the overall and the financial performance of the Small and Medium sized enterprises.

The above table containing the coefficient depicts that the significant value of Payback is 0.228; Net Present Value is 0.995; Internal Rate of Return is 0.162 and Accounting Rate of Return is 0.907. It can be interpreted that the significance value of all the capital investment appraisal method is more than the p-value which is 0.05. This shows that none of the capital investment appraisal techniques has a significant impact on the financial or overall performance of SME. Therefore, in this case, the null hypothesis can be accepted and according to which there is no significant impact of choice of capital appraisal investment method on the financial and overall performance of SME clusters and the alternative hypothesis will be rejected which advocates the impact of the independent variable on the dependent one.

Findings of the Study

Maximum respondents who filled the questionnaire were the owners of the SME’s having a rich experience of at least 10 years. The average capital of the Small and Medium sized enterprises as per the respondents was £3177777.77. Private funding and bank loan are the two main sources from where the Small and Medium sized enterprises obtain their capital. Majority of the respondents feel that their company is eager to invest in new capital projects or the expansion of the existing projects and the maximum investment was funded by the banks. Among all the capital investment appraisal techniques payback technique is the most important in the investment appraising process in SME’s followed by IRR.

The Small and Medium sized enterprises use various non-financial criteria in their investment appraising process. Among all such criteria, political priorities of the state were used mostly by the SME’s in investment appraisal process. Post Audits in most of the SME’s ranges between 37 and 48 months and is majorly conducted using regular follow-ups. Respondents feel that at a certain point of time they feel shortage of funds to invest in their project. According to them, in future, they can get funding through Nigerian Stock Market through issuing shares. The regression analysis accepts the null hypothesis meaning that there is no significant impact of choice of capital appraisal investment methods on the financial and overall performance of SME’s cluster.

Discussion

From the above analysis, it can be said that there are some determinants of investment decision-making process in small and medium enterprises which are to be taken into consideration while doing so. It is fact that the interest in small and medium sized enterprises in the form of an engine of the economic growth and employment increased from the era of the 70s and early 80s of the 20th century because of the changes in the economic structure, development of the advanced and new markets and improvements in the low costs industries. In the views of some theoreticians the growth of a country should be essentially based on the large enterprises operating in that particular country, but still, the innovation and the flexibility of the small and medium sized enterprises have been able to prove themselves effective in the efforts to reduce the costs.

These days the small and medium enterprises have been disseminated into all the sectors of economic structure, they are merely not envisaged into the current sector of modernisation but they are valuable in the primary and the secondary sectors too. In the very beginning, the small and the medium sized enterprises were mostly labour intensive sectors with a very small number of employees, less volume of capital, minor or no innovation and they were not so strong from the view point of technology. But later gradually they also expanded in all the sectors with greater investments, increased innovations and higher risks. As per some studies (Best, 1989) the small and medium enterprises have become an important and the necessary precondition for the functioning of the markets. The small and medium enterprises have been considered as an important factor of economic growth and due to which more and more credit was given to these enterprises for their development. And these small and medium enterprises represent their merits and demerits compared to the large enterprises and their significance for the economies are making investment decision process entirely differently. So, there are numerous determinants which affect the investment decision-making process of small and medium enterprises.

The financing of the small and medium enterprises is one of the eminent factors for their growth and development. The foundation and the establishment of a small and medium enterprise and the expansion of its business activities, the development of the new products and investment in the machinery, equipment and human resources, are the conditions from the opportunities of the enterprises to satisfy the needs for a capital. The use of the various resources should be able to secure sufficient volume of capital as well as corresponding dynamics of its securing which would be adequate to the accounting value of the investment made in a project and as well as the dynamics for the implementation of the investment activities. The financial construction for the investment projects can be the combination of different resources. For example the provision for the funds for making the new investment can be arranged from these activities: by disposing of the equity, initial invested assets of the owner or by issuing of shares; and by deploying the capital from the bank or other external sources. These two aspects can be verified with the help of the theories too.

As per the Mendes et al (2014) the investment theories of the firms can be divided into two major groups, in which one group considers that the investment of a form depends majorly on the external conditions in which the company operates and as per the other group the investment depends more on the firm’s internal conditions. The participation of the resources which have been mentioned above is combined differently in any particular small and medium enterprises where the ratios between them change over time. It is a general and a normal thing for these enterprises that they may have a prevalence of own funds or through issuing the shares rather than the use of external sources. When the management by using its own funds, can alleviate or reduce the implementation of the investment project while using funds from other sources creates problems if the financial institutions do not approve the funds which have been requested and hence the entity goes to seek funds from the private resources. But here also the acceptance of the private investor depends on his interest of achieving positive results of the business or have the wish to support the investment for a particular fee. The private sources of investments are special because they help in making the finances in phases where at the beginning they would prefer to invest a lower amount due to the higher risk and would wait to see the development of the investment in order to lose less if the project remains unsuccessful. The investors use this way due to the small volume of the information which can be gained from the operation of the business. With the growth and the development of the business, the uncertainty for its further development will reduce definitely. And because of this, the delay in the financing with the higher amount or the diversification of the time allows the investor to manage the risk. It is an another fact that obtaining funds is the most difficult task which primarily requires good planning in the respective enterprises and as well as the acknowledgement of the availability of the specific financial solutions, the suitability of each opportunity with the product of the entrepreneur, the adequacy of the possible options with the existing phase of enterprise development, good and fine knowledge of the conditions of financing before accessing them, preparation of the operations of the enterprise for financing and then access to funding sources. The small and medium sized enterprises may cause some difficulties due to their characteristics regarding securing funds from different sources. These determinants of investment decision making are making the investment decisions different as compared to other enterprises. The determinants of differences in the evaluation process of the efficiency of investment projects as per their influence can be grouped in the three groups which are being mentioned here: determinants of the calculation of equity costs, determinants of opportunities for use of different types of sources and determinants of liquidity of the operations of the enterprise. By the means of the use of various sources, is the combination of the prices of the sources in the investment decision making process as price is the most important determinant factor while selecting the use of some sources and this is reflected in the overall decision of investment.

Mostly the small and medium enterprises in their early stages of development, generally depend their own source of funding that is their own equity whereas in the later stages of their life cycle, the equity needs exceed the internal capabilities of the owner and he finally takes into consideration the external sources of the finance in order to provide the essential funds for investments and the development of the business. For those small and medium enterprises which are running into their early stage, it can be very problematic to arrange finance from the external sources of funding. Because initially the owners of the new business unit may be able to finance the initial activities but later it becomes difficult for them to finance the capital projects in future. The eminent reason behind it is the perception that the small and medium enterprises are riskier than the large companies in a few things. As the most common determinants of this particular problem are: the lack of history that is lack of references for long term business references, lack of funds which are helpful in serving as collateral and rarely have assets which can serve as a guarantee to the investor for the received funds. At the initial stage the small and medium enterprises employ well trained and experienced management; still, they are at risk in the views of the investors making investments in them. Therefore the potential investors primarily prefer to invest in already established entities where the risk is minimum. Along with this, it is also observed that the investors would like to accept funding ventures which have achieved a remarkable competitive advantage through the intellectual property protection rather than evaluating the ability to operate hard. Besides the above-mentioned determinants, in the investment decision-making process in the small and medium enterprises, another group of determinants arises from the internal characteristics of the company. This group mainly and primarily arises from the implemented financial management techniques in the small and medium enterprises or from the different and various aspects of their financial management. The eminent characteristics of the management of the small and medium enterprise are that the owner of these enterprises himself acts as a manager of the company and he only manages the business and thus lacks the management body and these enterprises and the owner of the small and medium enterprises does not have the specialised knowledge. This causes a lack of planning within small and medium enterprises. Overall it can be said that these enterprises do not hire the competent and specialised workforce so that they may very easily get the finance from various external sources.

Thus, all the above-mentioned influences of internal and external determinants of the investment decision-making process would lead to incomplete operation of their business continuity and especially documented, which would further reflect towards the application of certain activities of investment. The small and medium enterprises have the possibility timely to anticipate the unpredictable environment and to research and evaluate the investment paying more actively as ways for exploring the changes that occur in the markets. These enterprises are generally more successful and should be a role model for the other managers of the small business which would prefer to advance but because of the availability of the various reasons are abandoning or partially are implementing the essential or mandatory activities in the preparation of the investment decision-making process.

As stated in the previous sections of this study the strategic investments are the decisions on the investments which have a significant impact on the long term financial and operational performance of companies and which have a greater impact on the competitive advantages of the firms. These strategic investments have their influence on the set of the product and service of the companies and geographical scope and dispersion of their operations. The introduction of the new product lines, mergers and acquisitions, the installations of the new manufacturing processes and technologies of the businesses are the best examples of strategic investment decision making of small and medium sized enterprises. There are ample of complexities in the strategic decision-making processes and this fact has led the researchers to undergo an analysis. The previous studies develop the models to evaluate investment projects merely from the financial point of view but the newer studies try to develop models which help in evaluating the strategic outcomes of the investments and emphasises the significance of integrating the financial and strategic analysis tools while making strategic investment decisions.

Conclusion and Recommendations

A capital investment in the organisations is a serious matter which needs to be made very carefully. The poor and wrong investments decision can cause a huge problem to an enterprise. Furthermore, we talk about the small and the medium sized enterprises; special care needs to be taken. The small and medium size firms are very crucial for the economic growth of the country. They contribute a significant role in the overall development of any nation. This study is very relevant as it focuses on the investment decision making of the small and medium size enterprises. As stated in the previous section of this study which elaborates that due to the poor capital investment decision-making process, most of the SMEs in Nigeria fail within the first five years of their establishment. The mismanagement of the funds is the eminent reason behind it. The cause of the mismanagement of the funds arises due to the investments made in the unprofitable areas. Because of this, the profitability of the small and medium size enterprises gets decrease, and it experiences ample of loss as the return on the capital investments is not up to the mark.

Here in this study, the 63 SMEs from the different regions of Nigeria, majorly from Lagos, Abuja and Port Harcourt were selected, and a logistic regression analysis had been performed to examine the capital investment decision-making process of these SMEs. This was a cross-sectional study. The study aimed at finding the efficient investment decision-making process for the SMEs of Nigeria and further to determine that if the SMEs clusters consistently follow the suitable and efficient investment decision-making process make use of the discretion of the owners and managers, in order to make decisions regarding the capital investments.

Making decisions regarding the capital investments in an organisation is very important because it fulfils several objectives of the business. And if the decisions are not made in an efficient manner, the companies can never achieve their objectives, mission and vision. Basically, the capital investment decisions involve the development of the new products, new investments providing the facilities, acquiring new assets, technological advancements, adopting new business lines or developing a combination of those above are seen to have either positive or the negative effect on a particular firm. Therefore there are two major situations which constitute the need to make capital investment decisions and these situations are the objectives of the firm and the list of investment alternatives that are capable of contributing to the actualisation of these set objectives.

There are ample of techniques which are used in the investment making decisions for a company but the main point is to select the best technique which can help in selecting the best investment decisions is an important task. In the previous section of this study, various processes elaborated by several scholars have been discussed. But as per the objectives of this study, the SMEs of Nigeria need to know the best investment decision-making process. In order to fulfil this purpose, a questionnaire got filled by the respondents which contained all the questions which are important to be answered for making the best decision regarding the capital investment. The information was collected and then was analysed using the SPSS software which analysed each question and delivered the results.

As per the information received through the questionnaire, the maximum numbers of the positions were occupied by the owners of the companies and the minimum number of positions was held by the professionals. Most of the respondents were holding the bachelor's degree. The major area of working was the clothing of the sample companies. The average size of the capital was £3177777.7778 which was okay. Besides this, the SMEs receive their most of the funding from the private funding and the remaining from the bank loans. The average of the number of the employees working in the SMEs was 8.79. As per the next question, the 93.65% respondents consented that their company make plans for the new investments. And if the companies need funds for the new investments then they get maximum funds from the banks, partial from the financial institutions and remaining from the self-funding.

As far as the techniques of the investment appraising process in the small and medium-size enterprises then it was found in the results that the payback techniques were important whereas most of the respondents were not sure about the net present value techniques of making investment decisions. Again most of the respondents were not sure about the internal rate of return techniques. Same results were extracted for the accounting rate of return techniques, means most of the respondents were not sure about it. Moreover, no respondent had any information about any other techniques of investment decision-making process in SMEs. When the respondents were asked about the non-financial appraisal techniques, then it was seen that 50.79% political priorities of the state techniques were used which was the highest one. Near about 28.57% competitive techniques were used, 17.46% personal experience techniques and remaining 3.175% development plans of the states were used. The respondents were having different opinions regarding the importance of the project features which were helpful in determining the techniques or the combination of the techniques which are used in the decision-making process of capital investment. The respondents were not sure about the size of the project that whether they were important in the decision-making process regarding investment, but nearly 26% respondents found it very important. Besides this, nearly 15% respondents considered that the nature of the project is very important factor in investment decision-making process whereas most of the respondents were not sure about it. About 63% respondents believed that the source of the project funding is the most important factor in determining the investment decision-making process. And about 93% respondents were not sure about any other factor that can impact the investment decision-making process, but near about 6% respondents considered the other factors important in this.

The stages of the decision-making process are also very important in determining the investment decision-making process. All the respondents had different opinions over this. 73% of the respondents were not sure about the determination of the budget whether it is important in investment decision-making process or not. But 26% respondents believed it as an important stage. Near about 42% respondents considered the research and development stage important in determining the decision making process regarding the investments. But 57% respondents were not sure about this stage.49% respondents considered the evaluation stage as an important factor in determining the investment decision making process and 6% respondents believed that the evaluation stage is very important in this context; on the other hand, 44% respondents were not sure about it. The authorization stage is important in the determination of the investment decision-making process, and near about 42% respondent consented to it. And 41% respondents were not sure about it, but 15% respondents considered it as very important. 57% respondents believed that proper monitoring and control stage is very important in determining the investment decision-making process and 42% respondents considered it important. Therefore it can be concluded that monitoring and control stage plays a crucial role in determining the investment decision-making process.

As far as the assessment of the risk is concerned, 96% respondents asserted that they assessed the risk factor in the potential project and merely 3% respondents said that they did not assess the risk factor. Thus it can be said that assessing the risk is very important in investment decision-making process. Further, the researcher wanted to know whether there is a significant impact of the capital appraisal investment method on the financial and overall performance of SME clusters. In this context, the researcher formulated the hypotheses and then tested it by applying the regression analysis over it. As per the findings the significance value of the payback, net present value, the internal rate of returns and the accounting rate of returns were more than 0.05 which meant that the null hypothesis has been accepted, and there was no significant impact of the choice of capital appraisal investment method on the financial and overall performance of SME clusters. And a positive relationship had found between the payback, net present value and the accounting rate of return with the overall and financial performance of the SMEs clusters.

Therefore, overall it can be concluded that the investment decision-making process needs full attention and all the techniques and stages are to be used efficiently. The techniques and the stages of investment decision-making process play a crucial role in this context. Further, the risk assessment is also very necessary so that the SMEs can easily handle the risk factor which comes in the way of the implementation of the projects. Monitoring and control and evaluation stages are also important in determining the investment decision-making process of the SME clusters. The arrangement of the funds for making the decision is one of the most important aspects regarding this.

It can be concluded from the above analysis and explanation that in a highly competitive environment, industrialisation is very important to gain the competitive advantages. The small and medium enterprises that intend to go international should be aware of the risks and uncertainties which keep waiting for them besides the advantages. Thus these enterprises need to take their steps very carefully. It is very crucial to make sophisticated appraisals and evaluate the alternatives in every aspect, especially from the financial and strategic point of view. The traditional methods of investment decision methods generally help in evaluating the investments from the financial perspectives only. The multiple appraisal methods are the best suitable one in the investment decision making process in the small and medium enterprises.

Recommendations

As per the study conducted regarding the investment decision-making process of SMEs in Nigeria, each and every aspect of the decision-making process is very important. It has been made clear previously that SMEs contribute to the economic growth of the country. Therefore, they should be strengthening in all aspects. In this context, the SMEs should make the investment decisions very carefully. Proper investment decision-making process should be followed, and in order to do this, they should set some priorities first. All the elements which are necessary for the decision-making process should be taken into consideration very carefully. For example, the techniques of decision-making process should be selected as per the requirements. Moreover, the stages of decision-making process should be followed properly. There should be proper monitoring and control of the whole project. Efficient evaluation techniques should be applied to evaluate the whole process.

Other than this the risk assessment is very necessary, and therefore it should also be paid attention. Besides these factors, the basic factors like proper human resource management, proper financial management and efficient risk management should be done. Thus in this way, the SMEs can make the best decisions regarding the investments and can avoid any mismanagement in the context of investments. So overall it is recommended that the SMEs have to be very careful in investment decision making process.

Besides the above-mentioned recommendations the there should be an acquisition of a greater knowledge of the financing of the investments from external sources of funding. Knowledge, regarding the process of investment decision making, should be improved and experiences should be evaluated first before making any decision regarding the investments. The small and medium enterprises should go for an in depth evaluation of the wide range of investments in which the firm has applied, and the managers should gain proper and thorough knowledge of the techniques and problems in calculating capital costs. There should be an increased representation of the formal planning of all the activities of investment. The investment decision making needs should be taken as the projection of the future inflows and outflows of funds impose the need for the appropriate documentation of those cash flows. The small and medium sized enterprises should plan for the investments which are based on the quality and they should undergo effective scanning of various environmental factors of the business because in contrary the investment ambitions range only in the limits for smaller results and where their eminent concern becomes how to survive and not how to get developed.

Further it is recommended that the small and medium sized companies should go for the internationalisation decisions because it is one of the strategic investment decision, and it poses even more risks and uncertainties like the exchange rate fluctuations, political ambiguities, financing difficulties, additional costs of operations, the lack of knowledge of new markets, expectations of the consumers, high rate of inflation, low purchasing power in the new markets etc. It is a reality that during the high financial uncertainties the firms are more intended towards the usage of the sophisticated methods and multiple risks adjustment tools simultaneously. So the companies should also stress upon integrating the financial and strategic analysis tools while making the strategic investment decisions. Hence the small and medium enterprises should go for the usage of the multiple appraisal techniques or methods and risk adjustment tools in the investment decision making process. Although the larger firms are able to use more sophisticated methods because they have easy access to various administrative innovation and managerial experiences but in case of the small and medium enterprises, they have to be very careful regarding this.

Dig deeper into Data Analysis And Findings with our selection of articles.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts