Special Items in Financial Reporting

Introduction

Background

The aspect of special items is fast becoming common in the accounting and business world. Special items can be defined as unusual or infrequent items which are reports as separate or different from regular income gained from the continuing operations. According to Yang and Meyer (2015), the frequency of special items has increased considerably in recent some years. They offer a convenient intermediary and ability to business managers and other such top executives for managing the inappropriate classification of past, present as well as future earnings of the organisation. In a way, it can be said that as special items are increasing quickly, its importance for the managers and other authorities in determining ways through which they can manage them in an appropriate manner, highlighting the need for finance dissertation help to navigate these complexities (Park & Jung, 2017).

Huang and Sun (2017) stated that special items sometimes are misappropriated or misclassified, which causes issues for the company and impact its ability to present an accurate and reliable financial position to the shareholders and other such stakeholders. In this regard, it may right to say that managing the special items is related to the abilities of the managers as well as the overall level of competition in the market or the industry. According to De Clercq and Belausteguigoitia (2015), the more managers are knowledgeable and experienced in such aspects, the better they would handle the issues of special items and also take the most advantage of the situation.

Li (2017) found in their study that more than 50 US trading firms reported income-decreasing special items. Even though the aspect of special items is increasing at a rapid pace, it is recognised as unusual or infrequent. This is mainly due to the reason that by doing, the management can highlight its expectation that these charges are more transitionary in nature instead of being recurring expenses. This way the management can present an image to the shareholders and relevant stakeholders that these special items are a result of one-off activity and the chances of them happening again in the future are very ‘slim’ or minimal (Kshetri, 2018). With such information, the shareholders and stakeholders can also minimise their expectations and therefore do not make the investment or other such decisions due to increased income and profits of the company. Yang (2018) believes that it is a way through which the investors can safeguard their investments and also ensure that they do not make any rash decision that could hurt them.

According to (Liu & Atuahene-Gima, 2018), the increase in income due to special items reflects changes in the economic and regulatory landscapes. However, it also increases concerns for the use of special items in managing organisational earnings. There are chances that the management team or the top executives might misclassify recurring expenses of the past, present, or future as a special item of the current period. In view of Huo and Ye (2015), it is partly related with the ability of the manager to identify and manage the special items in such a manner that they do not negatively influence the performance of the company as well as its overall position in the market.

Teece (2016) argues that assessing the composition of special items is particularly important, especially due to the increasing prevalence of non-GAAP earnings. The author viewed this in terms of the fact that nearly 50% of US firms reported non-GAAP earnings in the year 2013. Thus, it can be said that the non-GAAP earnings, in a way, are more valuable than the GAAP earnings for business organisations (Cain & Kolev, 2020). The GAAP earnings are many times attributed to the removal of special items.

According to Leonidou (2015), the role of managerial ability is crucial in the context of special items. In view of the authors, if the managers are knowledgeable and experienced, then they can manage such situations very easily. This way, they can also ensure that the company operates and performs to the best of its abilities and the market conditions. In this regard, Demerjian and Lev (2013) ) found that the abilities of the managers are directly associated with the quality of earnings of an organisation. This means if the managers are capable enough, then they can provide direction to the company and lead it in such a manner that the organisation earns the maximum amount possible and thus also maintain its overall position in the market (Heirati & O'Cass, 2016). According to the authors, more able managers mean that there have to be fewer restatements, higher earnings and accruals persistence along with lower errors in the bad debt provisions. On this basis, it can be said that managers have a significant impact on the overall performance of the organisation and its ability to achieve success as well as to maintain its position in the market (Jiang & Liu, 2015). If the company employs well trained and experienced managers, then they can help the firm to fulfil its goals and targets and also ensure that the earnings are as high as possible.

In a similar manner, competition and its resultant pressures also have a significant influence on overall earnings of the organisation. Charan (2018) stated that if the competition is very high, then there are chances that the organisation might have higher instances of earnings/losses from special items; and vice-versa. On this basis, it can be said that the scale of competition in the market has a direct and significant influence on the ability of the organisation to control as well as maintain its earnings. If the firm fails in appropriately managing the competition and competitive pressures, then there are chances that the firm could have irregular earnings, which then can influence its performance as well (González & García-Meca, 2014).

Through this study, the researcher analyses the role of managerial abilities and competitive pressures on opportunistic special items. In this investigation, the researcher has explored different aspects of special items and the way they are influenced by various elements of the environment, both internal and external, for companies. The information gained from this study can help companies in determining ways to improve the abilities of their managers and thereby determine effective ways of managing the special items.

Literature Review

Introduction

The section of the literature review holds significant importance to any research investigation. It helps in laying down the foundation that enables the researcher to gain clarity about different concepts and aspects related to the research topic. Through the section of the literature review, the scholar can focus on reviewing past studies and identify gaps in them that the current investigation can fill. In the following paragraphs, different aspects of the research topic have been thoroughly analysed and evaluated. Performing this has enabled the scholar to obtain better knowledge and understanding as well as theoretical clarity about the research topic.

Concept of Opportunistic Special Items

In recent years the concept of special items has gained a considerable amount of attention. It has grown to become an aspect of great importance and influence on business organisations (Yang & Meyer, 2015). By managing special items appropriately, companies, regardless of their industry, can focus on improving their operations and ensuring that its goals and targets are achieved to the greatest possible extent. According to Flammer (2018), special items are one-off gains/losses that occur due to a myriad of different reasons but are shown under a separate heading in the income and other such financial statements. The main reason behind marking special items separately is that it helps in sharing appropriate information to the investors, thereby enabling them to make the right decision (Pousa & Mathieu, 2014). It then also helps in improving the overall performance and image of the company as well.

Special items need to be recognised properly and dealt with in a similar manner. Any mistake in this regard can adversely influence the firm. It can hamper the image and position of the company as well. Due to this, it is imperative for the managers to identify the special items and determine how best to deal with it. Dobbin (2014) recommends that revelation choices reflect both educational inspirations and deft inspirations. In this investigation, the scientists concentrated on the board decision of introduction inside the fiscal summaries as an exposure medium. In this manner, the creators inspected administrators' decision to introduce independently (and in this way feature) certain components inside the fiscal summaries, a thought that identifies with the writing on the accumulation of execution measures (Allen & Adomdza, 2015). Earlier examination on revelation decisions to stress money related execution measurements has commonly centred around elective settings, especially star forma revealing. Various papers give proof reliable administration detailing in this setting, reflecting advantage. Pearce (2017) looks at profit official statements, and archives that supervisors are bound to independently report an earlier period gain from the offer of benefits than a misfortune, steady with administrators astutely choosing the earlier period income sum utilised as a benchmark to assess current-period profit.

Bharati and Chaudhury (2015) inspect the announcing impacts of the 1993 change in corporate, personal duty rates, and also finds that supervisors are bound to independently unveil contrary than constructive non-repeating things in public statements, predictable with chiefs endeavouring to feature the pessimistic things as temporary or non-core costs. Ali and Larimo (2016) give comparable proof, recording that administrators shrewdly move announced costs from core costs, (for example, cost of products offered) to unique things, consequently exaggerating "core" profit. Taken together, these papers propose that chiefs utilise certain introduction choices – especially with regards to "ace forma" announcing – in a shrewd style (Pousa & Mathieu, 2014).

Managers can likewise control the characterisation of costs inside the salary articulation. Gunasekaran and Subramanian (2015) archives that supervisors misclassify core working costs as unique things so as to blow up core profit Moreover, Allen and Adomdza (2015) records administrators are eager to bring about genuine expenses to order charges as assessment costs as opposed to working costs. These examinations bolster the idea that directors care about the characterisation of costs inside the pay statement. Shifting working costs to uncommon things permits chiefs to report better core execution without evolving main concern profit, which might be seen as gainful in those investigators, speculators, and pay boards will in general markdown the exceptional things, concentrating on core income. Without a doubt, Eloranta and Turunen (2015) give some proof that financial specialists are contrarily astounded when these misclassified core costs repeat in future periods.

Managers may move future repeating costs into the current time frame exceptional thing, in this manner falsely improving future profit. In particular, chiefs have been blamed for taking part in enormous shower bookkeeping to improve future profit; and, the time-arrangement properties of unique things bolster this guess. In this way, extraordinary things can contain future costs, in which case uncommon things will be related to future surprising upgrades in income. Despite the fact that Mom and Fourné (2015) find that organisations with misfortunes and different rebuilding charges will in a general improvement in the next years, they note that the improvement is more articulated in profit than in incomes, and admonition that they cannot preclude profit the executives. Unravelling the common segment of extraordinary things is hard for fiscal summary clients, as they by and large do not have adequate data to distinguish the amount of a particular cost speaks to properly ordered unique things versus misclassified repeating costs.

Thinking about the achievability of utilising extraordinary things as a vehicle for overseeing profit, a characteristic inquiry becomes why individuals watch other, a lot costlier, kinds of income the board (Ali & Larimo, 2016). Initially, firms do not report exceptional things each period. In this way, the analysts place that shrewd administrators ordinarily benefit from the presence of a legitimate unique thing, utilising it as a disguise. Second, the valuation and pay advantages to revealing unique things decrease as this training increments in recurrence. In particular, as extraordinary things repeat, fiscal report clients start rewarding them increasingly like repeating income. This forces a characteristic imperative on how as often as possible administrators can move past, present, and future costs into extraordinary things (Gupta & George, 2016).

Managerial Abilities

The modern-day business environment is extremely competitive in nature. Companies, regardless of their industries and sectors, are intensely competing with other organisations. A large number of factors that influence the overall performance of a firm and its ability to manage the competition are the managerial abilities. Patil and Kant (2014) stated that it could be a distinguishing force in the success or failure of a company. If the managers are competent, then there are much better chances for the firm to perform effectively and achieve its goals and objectives. However, the lack of managerial skills and competence can be extremely dangerous for the firm and could even jeopardise its very existence in the market (Chowdhury, 2015).

There are a number of skills and abilities that the managers need to possess. Through such skills, they can manage the business functions appropriately and ensure that the firm is able to achieve its goals and targets (Pérez, 2015). Through such abilities, the managers can pay attention to different aspects of organisations’ operations and therefore focus on enabling the organisation to perform as effectively as possible and fulfil its mission and vision.

In business, a plan is generally brought to a gathering to guarantee everybody comprehends what will be talked about. Plans ought to be appropriated a long time before the gathering or conversation to guarantee people going to have the opportunity to set up their conversation focuses and to acclimate themselves with what others will talk about (Ankrah & Omar, 2015). Perusing the plan ahead of time guarantees that the overall objectives of a given gathering are clear and comprehended by all members preceding the conversation.

Plans may likewise be utilised as a method for featuring current advancement and anticipating future advancement. This kind of plan gives a course of events and following systems for members engaged with a given venture and could conceivably require nearby gatherings. Plans demonstrating venture progress are frequently utilised by contractual workers and those in the field of the task the executives (Libby & Emett, 2014). Plans are likewise utilised comprehensively in the political and open space, where gatherings held by open foundations, NGOs, or political gatherings are drawn nearer and sorted out by means of a given plan.

Open organisations have a more significant relationship with plans than privately owned businesses, as they are typically required to record meeting minutes. These minutes are basically a verbatim record of what was examined and are made accessible for the open survey and thought. As these conversations are open by all partners, the diagram and planning of a legitimate and significant plan are of especially high significance (Varadarajan, 2017).

Competent managers may develop and actualise a plan in an authoritative setting. Building a plan requires expansive nature with every basic segment of a given office, venture, or hierarchical target. Making a pertinent plan and disseminating it to concerned gatherings in an opportune manner requires authoritative capacity, relational abilities (counting the capacity to compose unmistakably and compactly), and vital skill (realising what to talk about and in what request). Supervisors must be talented in controlling the pace, tone, and direction of conversations at gatherings. Plans are a superb apparatus for arranging contemplations and driving conversation (Alimov, 2014).

The quest for plans requires a comparable arrangement of administrative abilities. Guaranteeing finish and keeping representatives on task and on time requires a capacity to perform multiple tasks—to supervise different parts of a given operational territory at the same time (Shaltoni, 2017). Great managers can adjust the different interests, activities, and specialised aptitudes of an offered group to guarantee the destinations and courses of events set out in the plan are done.

Managers must possess various skills and abilities so that they manage the business operations and thereby ensure that the company is able to achieve its goals and objectives. Liu and Liu (2014) states that communication skill is among one of the most important managerial abilities. If the managers are not excellent communicators, then they cannot oversee and control operations of the company and share information regarding the aim and objectives to the employees. In addition to this, communication skill as a managerial ability has a significant impact on the way the managers lead and provide direction to the company. (Vergne & Depeyre, 2016) further explained the importance of communication skills for the managers in terms that the level and scale of competition is increasing at a very rapid pace. Due to this reason, if the managers are not able to communicate effectively, then they will not be able to control business functions and therefore their ability to effectively manage the company will decline at a rapid pace (Allen & Adomdza, 2015).

According to Karpen and Bove (2015), managerial abilities influence the performance of the company. However, the authors failed to provide information about whether managerial abilities are related to the way firms’ financial situations are managed and conducted. If the managers are unable to use their skills properly, then they will not be able to manage the employees and thus, the firm’s operations (Bonsall , 2017). Due to this reason, there are significant chances that the firm might not be able to achieve its goals and objectives.

Impact of competitive pressure on firm performance

The modern-day business environment is described as highly competitive in nature. Due to this reason, there are a number of factors and aspects that influence overall operations of a company and its ability to fulfil its goals and targets, as argued by (Iyer & Srivastava, 2014). If any mistake is made in dealing with the competition and in understanding it, there are chances that the firm might not be able to operate effectively. This might also result in non-attainment of its goals and targets. In this regard, it is crucial for companies that they determine ways through which they can manage a competitive environment within the industry (Gunasekaran & Subramanian, 2015).

According to Yang and Sheng (2018), one of the most significant influences of competition on a firm and its overall performance is that it reduces the chances of the organisation to realise its targets. This is because the firm would face issues in attracting the customers and other such stakeholders, which in turn will hamper the performance of the organisation; and thus, it could result in non-attainment of the targets. The management team has to be very careful about its overall environment to ensure that its operations are not negatively influenced by competitive forces. In this regards, Vijayvargy (2017) suggested that firms should conduct a thorough search and analysis of the environment. This would provide the company with invaluable information, which would help it to make appropriate decisions and thus help in the attainment of the corporate goals and targets.

Past studies, for example, those of Beck and Schenker-Wicki (2014) drove a few onlookers to expect that the principal gains from the change would originate from a redirection of assets between segments of the economy, from those where esteem included was low (or even negative) to those where worth included was high (Jena & Sahoo, 2014). Others figured the fundamental additions would originate from changes in corporate administration, explicitly from the privatisation of until now state-possessed undertakings (SOEs) and from the end of state appropriations. However, others imagined that the fundamental fixing was a rivalry, which could not be guaranteed simply by privatisation since SOEs were successfully monopolists. All the more as of late consideration has been attracted to the significance of the general condition for advertising exchanges, which may influence all organisations in an economy however not really in a uniform manner (Ankrah & Omar, 2015).

This condition contains a scope of elements related with the working of the express that impacts the gainfulness and consistency of monetary movement – from charge frameworks to administrative obstacles, to authentic debasement, to sorted out guiltiness and the dubious implementation of business agreements and property rights. Without a sound business condition, it is contended, new speculation and improved efficiency are probably not going to rise up out of surrendering focal arranging, changing costs and exchange, changing possession and cutting state support (Yusr, 2017).

An ongoing endeavour has been made to utilise the factual method of meta-examination to blend the observational consequences of more than one hundred investigations. Meta-examination means to give a target quantitative mix of all examinations that have researched a typical inquiry (Krammer & Strange, 2018). The bit of leeway, contrasted and the "story" or "chronicled" way to deal with the audit, of the writing is that individual examinations might be uncertain in light of the fact that they need measurable force and surveys are inclined to columnist inclination in the choice of studies. Meta-analysis gives a pooled gauge dependent on the evaluations in the individual examinations. The key issues with utilising meta-investigation are the heterogeneity in the example choice and in the models tried in the individual examinations. Meta-examination is least tricky on account of randomised preliminaries. (Bratten & Payne, 2016) endeavoured to consider such factors by scoring singular examinations as per the nature and nature of the approaches embraced.

However, they neglect to address the issue that there may exist an inclination that is predictable in its impact across examines. For instance, if, on normal across nations and studies, better firms are chosen for privatisation, at that point averaging across examines midpoints the predisposition and scoring as they do just loads the inclination in an unexpected way, however, does not dispose of it (Beck & Schenker-Wicki, 2014). In light of these significant admonitions about the reasonableness of meta-investigation to examine the determinants of execution in the change, the discoveries of Ülkü and Gürler (2018) are accounted for.

Impact of managerial abilities on firm performance

According to Sun (2016), the ability of the managers has a major influence on organisational performance. Thus, the way they manage the firm influences management and handling of the special items. Results obtained by Koester and Shevlin (2017) corroborated with the current findings, as the author argued ability and experience of the managers influences the way special items are managed within the company and presented to the shareholders and other such stakeholders. In this study, it was observed that managers’ discretion influences the presentation of the special items. The authors argued that it is the managers who decide on how to present the special items. Thus, it can be said that if they are unable to identify and understand the special items, then there are chances it might not be shown within the financial statements as well. Due to this reason, Bonsall (2017) rightly stated that manager’s ability has a crucial role to play in the management of special items.

In this context, Duellman and Hurwitz (2015) found that the abilities and qualities of managers such as their knowledge, experience, etc. enable them in determining and managing special items. Mishra (2014) further argued that the manager’s decision making is also a crucial aspect. It is the managers who decide on whether or not to present the special items either as an individual aspect in the income statement or to aggregate with other line items in the financial statements. Managers are responsible for identifying such items and deciding on how to present it. Similar to the current findings, Jena and Sahoo (2014) also found that managers’ discretion and ability have a major impact on the way special items are handled and managed.

Managers must possess various skills and abilities so that they manage the business operations and thereby ensure that the company is able to achieve its goals and objectives. Karpen and Bove (2015) state that communication skill is among one of the most important managerial abilities. If the managers are not excellent communicators, then they cannot oversee and control operations of the company and share information regarding the aim and objectives to the employees. In addition to this, communication skill as a managerial ability has a significant impact on the way the managers lead and provide direction to the company. Li (2017) further explained the importance of communication skills for the managers in terms that the level and scale of competition is increasing at a very rapid pace.

However, the results obtained by Roberts and Campbell (2016) are very different from the current findings. The authors found that managers tend to be relying more on separately announcing the special items. By doing so, their intention is to safeguard the shareholders, investors, and other such stakeholders and thereby to attract them for making future investments in the company. According to Allen and Adomdza (2015), showing special items separately in the income statement, the managers also aim at protecting image of the company, along with ensuring that it is ready for future activities as well. However, the results of Ali and Zhang (2015) were different, as the authors found that in such instances when managers present special items as separate lines in the income statement, they involuntarily end up reducing the benchmark used for evaluating firms’ earnings.

According to Bysted (2014), there are chances that the managers might separately disclose negative than positive non-recurring, i.e. special items. This way, they highlight these negative items as transitionary or non-core expenses. Authors further stated that performing such activity moves it to more general settings. This means that the managers end up opportunistically shifting the reported expenses to special items from core expenses (Bonsall , 2017). It results in the special items, which are now part of the non-recurring expenses end up having abilities for predicting future cash flows. It thus further influences the overall performance of the firm.

In recent years the concept of special items has gained a considerable amount of attention. It has grown to become an aspect of great importance and influence on business organisations (Pearce, 2017). By managing special items appropriately, companies, regardless of their industry, can focus on improving their operations and ensuring that its goals and targets are achieved to the greatest possible extent. According to Yusr (2017), special items are one-off gains/losses that occur due to a myriad of different reasons but are shown under a separate heading in the income and other such financial statements.

The main reason behind marking special items separately is that it helps in sharing appropriate information to the investors, thereby enabling them to make the right decision. It then also helps in improving the overall performance and image of the company as well (Allen & Adomdza, 2015).

Special items need to be recognised properly and dealt with in a similar manner. Any mistake in this regard can have a significant negative impact on the company. It can hamper the image and position of the company as well (Beck & Schenker-Wicki, 2014). Due to this reason, it is imperative for the managers to identify the special items and determine how best to deal with it. There are a number of skills and abilities that the managers need to possess. Through such skills, they can manage the business functions appropriately and ensure that the firm is able to achieve its goals and targets (Allen & Adomdza, 2015). Through such abilities, the managers can pay attention to different aspects of organisations’ operations and therefore focus on enabling the organisation to perform as effectively as possible and fulfil its mission and vision.

Design Of The Investigation

Introduction

The research methodology is the section where the researcher presents and discusses various tools, methods and techniques that have been used for conducting the study. In essence, this chapter acts as a control mechanism for the researcher and therefore helps in ensuring that the study is carried out in a planned manner (Bharati & Chaudhury, 2015). This thereby makes the study more effective and also aids in fulfilling the aim and objectives of the study. In this chapter, the researcher has discussed various means which have helped in the successful conduct of the study. In addition, the reasons for selecting the particular methods and their possible limitations also have been discussed in this chapter.

Research Design

The quantitative design has been used in the current investigation. This design was selected because of the fact that the data was very vast and therefore analysing it through qualitative means would have been very time consuming (Allen & Adomdza, 2015). In the quantitative method, the researcher relied on using statistical methods for investigating the data obtained. Use of this method further helped the scholar in performing an intense and detailed assessment of the data. This further helped in making the study easily understandable for the readers.

Although Huang and Sun (2017) state that the use of quantitative methods sometimes complicates the research process, even then it was used in the current investigation. It allowed the scholar to analyse a vast amount of data. Apart from this, the fact that the current data is large in number and therefore to be able to generate some meaning out of the data, use of quantitative design was most appropriate, was another reason for selecting this research design (Yang, 2018). Using the quantitative methods enabled the researcher to analyse and then present the data in a very simpler manner so that it can be easily understood by the readers.

A quantitative design was much suited to the current study. The main reason behind it is the fact that the data was very vast and therefore, could not be analysed through qualitative methods (Mishra, 2014). Apart from this, using quantitative methods provided the researcher with the ability to thoroughly analyse the data and thus fulfil the objectives and goals of the investigation.

Data Collection

In the current study, data of US-based companies were collected. This data was between the years 1997 to 2016. The dependent variable in the current study is Opportunistic Special Items; while product market fluidity (prodmktfluid), Accruals_Pre_Si, SalesGrowth, Capex, ATO and ma_score_2016 are the independent variables.

Data Analysis

The researcher used quantitative methods to analyse the data. Statistical methods were used to analyse the data (Jiang & Liu, 2015). These methods are highly effective in analysing large amounts of data. These methods enabled the scholar to perform a thorough and detailed analysis of the data. This could then enable the readers to get a better understanding of the data and understand the whole study (González & García-Meca, 2014). In the current study, descriptive analysis and Ordinary Least Squares (OLS) method have been used to analyse the data.

Baik & Choi (2019) argued that managerial abilities are of particularly great importance for any organisation. They can be the greatest differentiating factor in the ability of the firm to achieve its goals and targets. The following formulas were used in the current study to analyse the data.

H1: Opportunistic Special Items = a + b1Managerial Ability + b2Accruals_Pre_Si + b3SalesGrowth +b4Capex +b5ATO + Fixed Effects + e

H2: Opportunistic Special Items = a + b1Managerial Ability + b2ProductMarketCopmetition (prodmktfluid)+b3Accruals_Pre_Si + b4SalesGrowth +b5Capex +b6ATO + Fixed Effects + e

H3: Opportunistic Special Items = a + b1Managerial Ability + b2ProductMarketCopmetition (prodmktfluid)+b3Interactive_Variable + b4Accruals_Pre_Si + b5SalesGrowth +b6Capex +b7ATO + Fixed Effects + e

where Interactive_Variable=Managerial Ability x ProductMarketCopmetition

Here,

Accruals_Pre_Si is the Accruals adjusted for special items;

SalesGrowth is the percentage change in sales;

Capex is the capital expenditure which is calculated by dividing capex by total assets (capex/total assets);

ATO is calculated by dividing sales by average net assets (sales/average net assets);

Prodmktfluid is the product market fluidity (Sheikh, 2018); and

ma_score_2016 is managerial ability score.

Data Analysis And Discussion

Descriptive Statistics

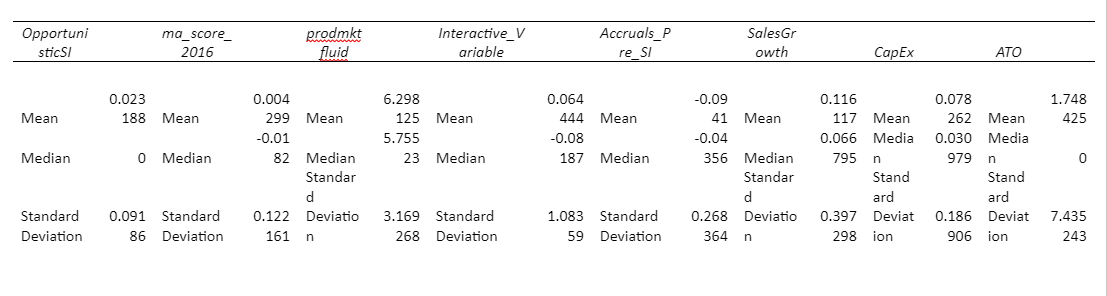

From the descriptive statistics table below, it can be seen that the mean of opportunistic 0.023 while the standard deviation is 0.09. On the other hand, mean for ma-score_2016 is 0.004, and the standard deviation is 0.12. The average value of product market fluid is 6.29, and the standard deviation is 3.16. Mean of the interactive variable is 0.06, while the standard deviation is 1.08. The mean value of Accruals_Pre_Si is -0.09, and the standard deviation is 0.26. Similarly, the average sales growth is 0.11, and the standard deviation is 0.39. Average of Capital expenditure is 0.07, and the standard deviation came out to be 0.18. ATO’s average value was 1.74, and the standard deviation was 7.43.

Hypothesis 1

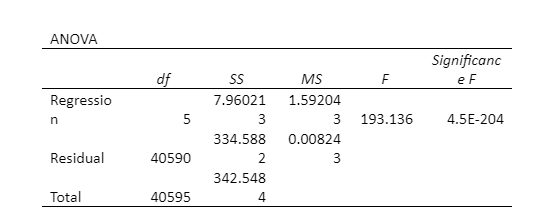

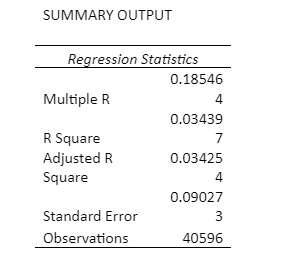

From the above table it can be seen that the value of R-Square is coming out to be 0.02, which means that with a 100% change in the independent variables, there will be a 2% chance of change in the dependent variables. Now whether this relationship is significant or not can be seen from the following ANOVA table.

As per ANOVA, F(5, 40590) = 193.136; p = 0.000. Since the p-value is less than the significant alpha value of 0.05, it can be said that the independent variables have a statistically significant impact on the dependent variable.

From the above table, it can be seen that the coefficients of ma_score_2016, Accruals_Pre_Si, SalesGrowth, Capex, and ATO are coming out to be positive. This means these variables have a positive relationship with the dependent variable of opportunistic special items.

Hypothesis 2

From the above table, it can be seen that the value of R-Square is 0.03. This means with a 100% change in the independent variables; there will be a 3% chance of change in the dependent variable. Now whether this relationship is significant or not can be seen from the following ANOVA table.

As per ANOVA, F(6, 40589) = 240.97; p = 0.000. As the p-value is less than the significant alpha value of 0.05, it can be said that the independent variables have a statistically significant impact on the dependent variable.

From the above table, it can be seen that coefficients of all the variables are coming out to positive. This means that these variables are positively related to the dependent variable.

Hypothesis 3

It can be observed from the above table that the value of R-Square is 0.03. Therefore, with a 100% change in the independent variables, there will be a 3% chance of change in the dependent variable. Now whether this relationship is significant or not can be seen from the following ANOVA table.

As per ANOVA, F(7, 40588) = 214.18; p = 0.00 Since the p-value is less than the critical alpha value of 0.05; it can be said that there is a statistically significant impact of independent variables on the dependent variable.

From the table above, it can be seen that the coefficients of all the variables are positive. This means that these variables have a positive impact on the dependent variable of opportunistic special items.

Discussion

From results obtained in the above analysis, it can be said that managerial ability and product market competition, i.e. the competitive pressures have a significant impact on opportunistic special items. Through this study, it is clear that managerial abilities and competitive pressures have a major role to play in determining the special items in financial statements of organisations. According to Sun (2016), the ability of the managers has a significant impact on the overall performance of the organisation. Thus, the way they manage the firm influences management and handling of the special items. Results obtained by Koester and Shevlin (2017) corroborated with the current findings, as the author argued ability and experience of the managers influences the way special items are managed within the company and presented to the shareholders and other such stakeholders. In this investigation, it was seen that managers’ discretion influences the presentation of the special items. The authors argued that it is the managers who decide on how to present the special items. Thus, it can be said that if they are unable to identify and understand the special items, then there are chances it might not be shown within the financial statements as well. Due to this reason, Bonsall (2017) rightly stated that manager’s ability has a crucial role to play in the management of special items.

In this context, Duellman and Hurwitz (2015) found that the abilities and qualities of managers such as their knowledge, experience, etc. enable them in determining and managing special items. Mishra (2014) further argued that the manager’s decision making is also a crucial aspect. It is the managers who decide on whether or not to present the special items either as a separate line on the income statement or to aggregate with other line items in the financial statements. Managers are responsible for identifying such items and deciding on how to present it. Similar to the current findings, Jena and Sahoo (2014) also found that managers’ discretion and ability have a major impact on the way special items are handled and managed.

However, the results obtained by Roberts and Campbell (2016) are very different from the current findings. The authors found that managers tend to be relying more on separately announcing the special items. By doing so, their intention is to safeguard the shareholders, investors and other such stakeholders and thereby to attract them for making future investments in the company. According to Allen and Adomdza (2015), showing special items separately in the income statement, the managers also aim at protecting image of the company, along with ensuring that it is ready for future activities as well. However, the results of Ali and Zhang (2015) were different, as the authors found that in such instances when managers present special items as separate lines in the income statement, they involuntarily end up reducing the benchmark used for evaluating firms’ earnings.

According to Bysted (2014), there are chances that the managers might separately disclose negative than positive non-recurring, i.e. special items. This way, they highlight these negative items as transitionary or non-core expenses. Authors further stated that performing such activity moves it to more general settings. This means that the managers end up opportunistically shifting the reported expenses to special items from core expenses (Bonsall , 2017). It results in the special items, which are now part of the non-recurring expenses end up having abilities for predicting future cash flows. It thus further influences the overall performance of the firm.

In this study, it was found that managerial abilities tend to have a major influence on the way companies manage their operations and thus their overall performance as well. If the managers are not competent, then there are minimal chances for the organisation to perform effectively and also manage their earnings. According to Kim (2016), it is the responsibility of the managers to determine ways in which they can present the special items. Lack of managerial abilities influences the ability of the managers to control firms’ operations, and therefore they are unable to decide on the presentation of the special items as recurring or non-recurring. Gupta and George (2016) described special items as ‘pro forma’ earnings, which are then included in the income statements and other such financial statements of companies.

Similar to the current findings, Cain and Kolev (2020) argued that the role of managerial abilities is imperative in managing the special items. In this regard, the authors state that the main objective of income statements is to provide and share information regarding economics about a firm’s operations. As one goes down reading the income statement, it can be seen that the income starts to decline; its persistence starts to go down as well. In such situations, the persistence of special items is acceptable in terms of the types of charges that form the special items such as asset write-offs, gain/loss on the sale of assets, restructuring charges and many more. Huo and Ye (2015) furthers this argument and states that investors, compensation committees and analysts tend to discount the income-decreasing special items, thereby eliminating them GAAP earnings while they are assessing the performance of the firm or determining its managerial compensations. Due to this reason, the special items then become a tool for managing earnings of the firm. This then also reflects the managerial abilities and competence as well as skill levels of the managers in handling firms’ operations and in managing the special items to the best of organisations’ goals and targets (Koester & Shevlin, 2017).

Even though the aspect of special items is increasing at a rapid pace, it is recognised as unusual or infrequent. This is mainly due to the reason that by doing, the management can highlight its expectation that these charges are more transitionary in nature instead of being recurring expenses (Heirati & O'Cass, 2016). This way the management can present an image to the shareholders and relevant stakeholders that these special items are a result of one-off activity and the chances of them happening again in the future are very ‘slim’ or minimal.

According to (Liu & Atuahene-Gima, 2018), the increase in income due to special items reflects changes in the economic and regulatory landscapes. However, it also increases concerns for the use of special items in managing organisational earnings. There are chances that the management team or the top executives might misclassify recurring expenses of the past, present, or future as a special item of the current period. In view of Huo and Ye (2015), it is partly related with the ability of the manager to identify and manage the special items in such a manner that they do not negatively influence the performance of the company as well as its overall position in the market.

Demerjian and Lev (2013) found that managerial ability and earnings of the organisation are directly associated with one another. This means if the managers are capable enough, then they can provide direction to the company and lead it in such a manner that the organisation earns the maximum amount possible and thus also maintain its overall position in the market (Heirati & O'Cass, 2016). According to the authors, more able managers mean that the issue of developing updated financial statements can be tackled. Along with this, it also helps in increasing earnings of the organisation as well, along with reducing the errors in provisions for bad debts. On this basis, it can be said that managers have a significant impact on the overall performance of the organisation and its ability to achieve success as well as to maintain its position in the market (Jiang & Liu, 2015).

In a similar manner, competition and its resultant pressures also have a significant influence on overall earnings of the organisation. Charan (2018) stated that if the competition is remarkably high, then there are chances that the organisation might have higher instances of earnings/losses from special items; and vice-versa. On this basis, it can be said that the level and intensity of competition in the market has a direct and significant influence on the ability of the organisation to control as well as maintain its earnings.

CONCLUSION

The aspect of special items is fast becoming common in the accounting and business world. Special items can be defined as unusual or infrequent items which are reports as separate or different from regular income gained from the continuing operations. They offer a convenient intermediary and ability to business managers and other such top executives for managing the inappropriate classification of past, present as well as future earnings of the organisation. In a way, it can be said that as special items are increasing at a rapid pace, it is becoming more and more important for the managers and other authorities to determine ways through which they can manage them in an appropriate manner.

Through this study, the researcher analysed the role of managerial abilities and competitive pressures on opportunistic special items. In this investigation, the researcher explored different aspects of special items and the way they are influenced by various elements of the environment, both internal and external, for companies. The information gained from this study can help companies in determining ways to improve the abilities of their managers and thereby determine effective ways of managing the special items. In recent years the concept of special items has gained a considerable amount of attention. It has grown to become an aspect of great importance and influence on business organisations.

By managing special items appropriately, companies, regardless of their industry, can focus on improving their operations and ensuring that its goals and targets are achieved to the greatest possible extent. Earlier examination on revelation decisions to stress money related execution measurements has commonly centred around elective settings, especially star forma revealing. Various papers give proof reliable administration detailing in this setting, reflecting advantage. These examinations bolster the idea that directors care about the characterisation of costs inside the pay statement. Shifting working costs to uncommon things permits chiefs to report better core execution without evolving main concern profit, which might be seen as gainful in those investigators, speculators, and pay boards will in general markdown the exceptional things, concentrating on core income.

REFERENCES

Cain, C. A., & Kolev, K. (2020). Detecting Opportunistic Spcial Items. Management Science .

Demerjian, P., & Lev, B. (2013). Managerial ability and earnings quality. The Accounting Review, 463-498.

Yang, W., & Meyer, K. (2015). Competitive dynamics in an emerging economy: Competitive pressures, resources, and the speed of action. Journal of Business Research, 1176-1185.

Park, S. Y., & Jung, H. (2017). The effect of managerial ability on future stock price crash risk: Evidence from Korea. Sustainability , 2334.

Huang, X. S., & Sun, L. (2017). Managerial ability and real earnings management. Advances in accounting, 91-104.

De Clercq, D., & Belausteguigoitia, I. (2015). Intergenerational strategy involvement and family firms’ innovation pursuits: The critical roles of conflict management and social capital. Journal of Family Business Strategy, 178-189.

Li, S. (2017). The effect of supplier development on outsourcing performance: the mediating roles of opportunism and flexibility. Production Planning & Control, 599-609.

Kshetri, N. (2018). 1 Blockchain’s roles in meeting key supply chain management objectives. International Journal of Information Management, 80-89.

Yang, D. (2018). Suppressing partner opportunism in emerging markets: Contextualising institutional forces in supply chain management. Journal of Business Research, 1-13.

Liu, W., & Atuahene-Gima, K. (2018). Enhancing product innovation performance in a dysfunctional competitive environment: The roles of competitive strategies and market-based assets. Industrial Marketing Management, 7-20.

Huo, B., & Ye, Y. (2015). The impacts of trust and contracts on opportunism in the 3PL industry: The moderating role of demand uncertainty. International Journal of Production Economics, 160-170.

Teece, D. (2016). Dynamic capabilities and entrepreneurial management in large organisations: Toward a theory of the (entrepreneurial) firm. European Economic Review , 202-216.

Leonidou, L. (2015). Environmentally friendly export business strategy: Its determinants and effects on competitive advantage and performance. International Business Review, 798-811.

Heirati, N., & O'Cass, A. (2016). Do professional service firms benefit from customer and supplier collaborations in competitive, turbulent environments? Industrial Marketing Management, 50-58.

Jiang, J. Y., & Liu, C. W. (2015). High performance work systems and organisational effectiveness: The mediating role of social capital. Human Resource Management Review, 126-137.

Charan, P. (2018). Institutional pressure and the implementation of corporate environment practices: examining the mediating role of absorptive capacity. Journal of Knowledge Management .

González, J. S., & García-Meca, E. (2014). Does corporate governance influence earnings management in Latin American markets? Journal of Business Ethics , 419-440.

Sun, L. (2016). Managerial ability and goodwill impairment. Advances in accounting , 42-51.

Koester, A., & Shevlin, T. (2017). The role of managerial ability in corporate tax avoidance. Management Science, 3285-3310.

Bonsall , S. (2017). Managerial ability and credit risk assessment. Management Science, 1425-1449.

Duellman, S., & Hurwitz, H. (2015). Managerial overconfidence and audit fees. Journal of Contemporary Accounting & Economics , 148-165.

Mishra, D. (2014). The dark side of CEO ability: CEO general managerial skills and cost of equity capital. Journal of Corporate Finance, 390-409.

Jena, S., & Sahoo, C. K. (2014). Improving managerial performance: a study on entrepreneurial and leadership competencies. Industrial and Commercial Training.

Roberts, N., & Campbell, D. (2016). Using information systems to sense opportunities for innovation: Integrating postadoptive use behaviors with the dynamic managerial capability perspective. Journal of Management Information Systems, 45-69.

Allen, M., & Adomdza, G. (2015). Managing for innovation: Managerial control and employee level outcomes. Journal of Business Research , 371-379.

Ali, A., & Zhang, W. (2015). CEO tenure and earnings management. Journal of Accounting and Economics, 60-79.

Bysted, R. (2014). Exploring managerial mechanisms that influence innovative work behaviour: Comparing private and public employees. Public Management Review, 217-241.

Kim, Y. (2016). Detecting financial misstatements with fraud intention using multi-class cost-sensitive learning. Expert Systems with Applications, 32-43.

Gupta, M., & George, J. (2016). Toward the development of a big data analytics capability. Information & Management, 1049-1064.

Yang, W., & Meyer, K. (2015). Competitive dynamics in an emerging economy: Competitive pressures, resources, and the speed of action. Journal of Business Research, 1176-1185.

Flammer, C. (2018). Competing for government procurement contracts: The role of corporate social responsibility. Strategic Management Journal, 1299-1324.

Pousa, C., & Mathieu, A. (2014). Boosting customer orientation through coaching: a Canadian study. International Journal of Bank Marketing.

Dobbin, F. (2014). Introduction: Economics meets sociology in strategic management. Advances in strategic management.

Pearce, J. (2017). Toward an organisational behavior of contract laborers: Their psychological involvement and effects on employee co-workers. Academy of Management journal.

Bharati, P., & Chaudhury, A. (2015). Better knowledge with social media? Exploring the roles of social capital and organisational knowledge management. Journal of Knowledge Management.

Ali, T., & Larimo, J. (2016). Managing opportunism in international joint ventures: The role of structural and social mechanisms. Scandinavian Journal of Management, 86-96.

Gunasekaran, A., & Subramanian, N. (2015). Supply chain resilience: role of complexities and strategies. Jounral of Business Management, 6809-6819.

Eloranta, V., & Turunen, T. (2015). Seeking competitive advantage with service infusion: a systematic literature review. Journal of Service Management .

Mom, T., & Fourné, S. (2015). Managers’ work experience, ambidexterity, and performance: The contingency role of the work context. Human Resource Management, s133-s153.

Patil, S., & Kant, R. (2014). A fuzzy AHP-TOPSIS framework for ranking the solutions of Knowledge Management adoption in Supply Chain to overcome its barriers. Expert systems with applications, 679-693.

Chowdhury, H. (2015). A multiple objective optimisation based QFD approach for efficient resilient strategies to mitigate supply chain vulnerabilities: The case of garment industry of Bangladesh. Omega, 5-21.

Pérez, A. (2015). Corporate reputation and CSR reporting to stakeholders. Corporate Communications: An International Journal.

Ankrah, S., & Omar, A.-T. (2015). Universities–industry collaboration: A systematic review. Scandinavian Journal of Management , 387-408.

Libby, R., & Emett, S. (2014). Earnings presentation effects on manager reporting choices and investor decisions. Accounting and Business Research, 410-438.

Varadarajan, R. (2017). Innovating for sustainability: a framework for sustainable innovations and a model of sustainable innovations orientation. Journal of the Academy of Marketing Science, 14-36.

Alimov, A. (2014). Product market competition and the value of corporate cash: Evidence from trade liberalisation. Journal of Corporate Finance, 122-139.

Shaltoni, A. M. (2017). From websites to social media: exploring the adoption of internet marketing in emerging industrial markets. Journal of Business & Industrial Marketing.

Liu, Y., & Liu, T. (2014). How to inhibit a partner's strong and weak forms of opportunism: Impacts of network embeddedness and bilateral TSIs. Industrial Marketing Management, 280-292.

Vergne, J. P., & Depeyre, C. (2016). How do firms adapt? A fuzzy-set analysis of the role of cognition and capabilities in US defense firms’ responses to 9/11. Academy of Management Journal , 1653-1680.

Karpen, I., & Bove, L. (2015). Service-dominant orientation: measurement and impact on performance outcomes. Journal of Retailing, 89-108.

Iyer, K., & Srivastava, P. (2014). Aligning supply chain relational strategy with the market environment: Implications for operational performance. Journal of Marketing Theory and practice, 53-72.

Yang, D., & Sheng, S. (2018). Suppressing partner opportunism in emerging markets: Contextualising institutional forces in supply chain management. Journal of Business Research, 1-13.

Vijayvargy, L. (2017). Green supply chain management practices and performance. Journal of Manufacturing Technology Management .

Beck, M., & Schenker-Wicki, A. (2014). Cooperating with external partners: the importance of diversity for innovation performance. European Journal of International Management , 548-569.

Yusr, M. M. (2017). Does interaction between TQM practices and knowledge management processes enhance the innovation performance? International Journal of Quality & Reliability Management.

Krammer, S., & Strange, R. (2018). The export performance of emerging economy firms: The influence of firm capabilities and institutional environments. International Business Review , 218-230.

Bratten, B., & Payne, J. (2016). Earnings management: Do firms play “follow the leader”? Contemporary Accounting Research, 616-643.

Ülkü, A., & Gürler, Ü. (2018). The impact of abusing return policies: A newsvendor model with opportunistic consumers. International Journal of Production Economics, 124-133.

Baik, B., & Choi, S. (2019). Managerial ability and income smoothing. The Accounting Review.

Sheikh, S. (2018). Corporate social responsibility, product market competition, and firm value. Journal of Economics and Business, 40-55.

Continue your journey with our comprehensive guide to Service Standards In Italy.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts