The UK's Taxi and Private Hire Sector

Chapter 1: Introduction

1.1 Background of the Research

The United Kingdom distinguishes two existing systems within the private transport industry- the taxi industry and the private hire sector. The taxi and private hire services in London are an integral part of the transport sector not only in London but also in the whole of England and Wales. These services are essential in their role of promoting social inclusion and implementing the public transport sector. Together, the taxi and private hire sectors form a crucial part of the economy and have primarily been termed as profitable and growing with statistics showing that UK citizens spend an average of 3 billion annually on taxis and minicabs. There exist clear distinctions between the taxi industry and the minicab or private hire sector legislations. Legislations that regulate the taxi industry predate the 1600s, while the minicab regulations are more recent (from 1998). While only a few aspects relating to the taxi drivers' quality, the standard of vehicles used, and taxi fares are subject to regulation, there is no limit on the number of taxis that do not have a monopoly, anyway. Therefore, when it comes to the expected outcomes, the taxi and private hire vehicle market remain highly unregulated. As of 2017, this market represented close to 150000 drivers in London, which is 40% of the total 356000 licensed England drivers by then. That presented a stark difference when compared to the year 2011 when there were only about 77000 taxi drivers in the whole of England. Out of these, nearly 60 percent belonged to the private hire sector.

1.2 Record-keeping and its Importance

Record keeping can be the difference between the survival and failure of a business. Previous works by researches have demonstrated that one may have increased chances of remaining in business if they maintain a sound system of record keeping. Records are the forms that enable a business to account for its activities, financial or otherwise and keep running. Record keeping will involve capturing business activities, and provision of original and readily-available records of the same activities. Different businesses have different reasons for keeping and maintaining records, although the primary motive remains at least to provide sufficient proof and information on the activities of the business (ASA and RIM (2011). The records serve as evidence, way of controlling the use and management of resources by entities, governments, institutions, and even individuals. Records provide evidence of what has been done, because as the saying goes, what has not been recorded has not been done (Howard, 2009). Records are also a critical source of information since they can be referenced at future or later dates, as such record keepers must ensure that the records they keep are accurate, timely, and comprehensive. Correct records will enable players to make astute decisions, which leads to effective and efficient policy decisions. Besides underpinning the decisions made and actions undertaken by a business, records also give a back-up. In line with this, Hughes (2013) argues that record keeping is a contributor to the success and performance of a business. Business managers and owners are also able to monitor the progress and prospects of the business through timely and accurate financial reports (Fasasi, 2010) that can be developed if they adopt a comprehensive system of record keeping. Record keeping is, therefore, an integral and essential part of most, if not all, businesses, including the self-employed minicab drivers in London. Regardless of where one works, record keeping and management is usually a full-time job that often generates large amounts of paperwork at times. Although it is widely recognized that record keeping is integral and contributes to good practice, little guidance on how to write records has been provided. While it is recommended that it may not be realistic to imagine the emergence of a standard record, it is crucial to adhere to the basic principles of recordkeeping. Among these principles are: records should be dated, written chronologically, and signed legibly; the records should be current, factual, and comprehensive; and records should enable changes in various aspects to be detected. Record-keeping has a significant influence on the growth and development of any business, and therefore its importance cannot be undermined. The focal point of this study, however, is to bring to the fore deficiencies and challenges that self-employed minicab drivers face concerning their record keeping. These deficiencies have caused and continue to cause a great hindrance to the development and growth of the self-employed minicab drivers in London. Poor recordkeeping or lack thereof among minicab drivers in London has caused them to fail at keeping track of their transactions and business activities. This lack of or improper keeping of records has had some other perceived effects on the drivers and their businesses, including government and financial institutions, such as banks finding it difficult to deal with them due to the lack of transparent accounting records. As a result, they end up missing out on financial financing or access to loans which they would have otherwise got. It has also been suggested that poor recordkeeping has been among the most common causes of problems when it comes to taxi and private hive vehicles’ tax compliance, especially regarding business activity statements and returns. Previous studies have shown that the industry, as well as others, risk the possibility of non-intentional non-compliance due to poor recordkeeping or, in cases of compliance, they miss out on refunds should they make tax overpayments (McKerchar, 2013). Also previously suggested is that poor recordkeeping may result in compliance costs that are higher than usual due to fees paid to advisers and sorting out arising taxation and compliance issues. While many factors may lead to business failure, for example, insufficient capital, fewer sales, high operating costs, poor management, bad debts, poor business location among others, more attention is now being paid to poor recordkeeping or lack of it as a reason for business failure.

1.3 Statement of the Problem

Several authors and past studies have looked at the state of the taxi and private hire market in the UK, the market-specific regulations, and the various problems facing the sector and emerging issues and trends in the industry. However, not much has been done when it comes to recordkeeping among the minicab -or private hire- drivers in London, its importance, significant effects, and challenges. It is time increased attention was paid to the challenges that the private hire drivers are faced with when it comes to (adequate and proper) record keeping in the course of their business.

Therefore this study seeks to determine the challenges that face self-employed private hire drivers in London concerning adequate record keeping.

1.4 Rationale of the Research

The taxi and minicab industries are fast-growing in the United Kingdom, more specifically in London. Recent statistics show that as of 2017, the number of taxi and private hire drivers in London stood at about 150000, which accounts for 40% of the total number of licensed drivers in England, which was 356000. These figures, when compared to the 2011 figure of 77000 taxi and minicab drivers in the entire England, show that the sector has more than quadrupled in six years. This growth has brought with it new trends (such as taxi-hailing apps, ride-sharing, among others), requirements, and challenges. One such challenge that is increasingly affecting the market is in the area of recordkeeping. While most minicab drivers lack the requisite knowledge or skills to keep adequate records, others do not keep any records at all. That is increasingly becoming problematic to the drivers since it brings about other problems, legal or financial, that the drivers don’t even know are as a result of their inadequate recordkeeping or total lack of. The study will, therefore, be critical in enlightening drivers on the importance of recordkeeping as well as to identify the challenges they face that hinder their recordkeeping capabilities.

1.5 Objectives of the Research

The overall aim of this research paper is to assess the importance of recordkeeping among London minicab drivers and to find out the challenges that emanate from the same. To achieve the mentioned aim, the study will focus on the below objectives:

A look at the taxi and private hire vehicle sectors in London

To analyze the purpose and importance of recordkeeping by minicab drivers, the records they should keep, and their features.

To identify the problems that the minicab drivers are likely to encounter as a consequence of no or inadequate record keeping.

To examine the challenges that self-employed private hire vehicle drivers face in their record keeping.

To identify reasons that lead to some private hire drivers choosing not to keep records at all or keep inadequate records despite the several benefits that result from the process.

1.6 Research Questions

To effectively assess the role of recordkeeping in the private hire business, the study seeks to answer the following questions:

Is it essential for the self-employed private hire drivers to keep and maintain records?

What are some of the records that private hire drivers should keep?

What benefits are likely to accrue to minicab drivers if they keep adequate records?

What are some of the consequences that they will be faced with if they do not keep adequate records?

What factors contribute to proper or improper recordkeeping by private hire drivers?

In keeping records, what are some of the challenges that emanate therein?

1.7 Research Hypotheses

H0: Record keeping is a crucial aspect of the private hire sector that must be adopted and taken seriously by the drivers

H1: Adequate recordkeeping by the minicab drivers in London does not have a significant effect on their business

H2: Adequate recordkeeping by the minicab drivers in London has a significant impact on their business

H3: Challenges in recordkeeping pose a substantial threat to the growth and development of a private hire driver’s business and should be immediately addressed

H4: Challenges in record keeping do not pose any significant risk to the growth and development of a private hire driver’s business and should not necessarily be immediately addressed

1.8 Structure of the Dissertation

To effectively achieve its intended and set objectives of this study, the research will be carried out in an organized and systematic manner. To its total completion, the research paper will have a total of five chapters. Every chapter will be crucial in demonstrating the importance of recordkeeping, specifically among the private hire drivers in London, and may or may not have subtopics. Chapter 1, which is the introduction chapter, will focus on introducing the topic area. It provides an enhanced background of information relevant to the research title. Also included in this chapter is the research rationale, which outlines why it was necessary to conduct this study, how it may be used, and by who. To ensure the effectiveness of the study, the chapter will also include research aims and objectives to be accomplished, the research questions that the study intends to answer as well as several hypotheses that the study seeks to approve or disapprove. Chapter 2 (Literature review) will delve deeper into the research topic by providing detailed information relevant to the title. The information included in this chapter will be from multiple databases and secondary sources, including previously conducted studies. To add value to the finished research in its entirety, the chapter will employ specific theories and academic frameworks. This critical review is vital as it will create a deeper understanding of a vast body of literature related to the topic being investigated. This review of literature is specific to the research, thereby answering the research questions identified, and this assessment helps in identifying existing research gaps. This chapter is significant in aiding the research paper, achieving the set goals and objectives. Chapter 3- the research methodology will look into the means and procedures used to collect and analyze the relevant data needed to achieve the aims and objectives of the research paper. Discussed herein will be the specific research method, design, and philosophy used when collecting the necessary data, and the type of data collected. It will also outline the analysis methods and tools used to analyze the collected data. The rationale, as well as limitations of the chosen data collection and analysis methods, will also be discussed. Chapter 4- analysis and discussion- will critically and systematically evaluate the data collected and transform it into meaningful information of higher relevance. For presentation purposes, tables, graphs, and visual charts may be incorporated to enhance understanding of the analysis conducted. This analysis will be discussed to provide full information on the research topic i.e. the importance of recordkeeping and the challenges that taxi and private hire drivers in London face when keeping records. Chapter 5 (conclusion and recommendation) will provide a detailed summary of the entire analysis, while also justifying if and how the study achieves the objectives and aims of the research paper sufficiently. Following the assessment of the study, the research paper will go ahead to give recommendations, if any, on what (more) needs to or could be done.

Chapter 2: Literature Review

2.1 Taxi and Private Hire Industry and Self-employment in London

Regulations on cabs in London date back to the 17th century. Although the system used currently has been in place since the 19th century, a majority of the applicable regulations can be traced back to 1934 (Butcher, 2017). According to Taxis and private hire vehicles statistics of 2011, the whole of England had only 77000 taxi and private hire drivers. Similar statistics in 2017 showed that, in the six years between, the market had more than quadrupled with London alone having 40% (150000 drivers) of the total 356000 drivers in the entire country. This growth and boom can be attributed to the new technologies and players that have entered the market over the years, including Uber- which is considered the flagship or pioneer of ‘gig-work’ in the UK, Mytaxi, Addison Lee, Kabbee, among others. Taxi drivers in London are self-employed people, and they can either choose to buy the vehicles they operate or to hire one. They also have the freedom to decide whether or not they would like to belong to a radio taxi company, and can choose their work hours and days and also work in whichever part of London they prefer (Public Carriage Office, 2007). As part of regulations that have been in existence since 1927, taxi drivers are only allowed to drive purpose-built vehicles that conform to Metropolitan conditions of fitness. Since the industry offers no career path that is formal or recognized, there are no tangible or explicit rewards that come with the longevity of service. There are a few recognized trade unions and associations in the taxi industry, and nearly a third of taxi drivers belong to one or a radio taxi company (Townsend, 2003). The primary source of competition for taxi drivers has been the minicabs. Minicabs, which include saloons, mixed-purpose vehicles, and limousines, have, for nearly forty years, operated unregulated until very recently when the London Private Hire Act (1998) was enacted. This legislation led to the gradual licensing of all private hire vehicles (minicabs) and their drivers. While taxis accept rank and street hirings, minicabs only take prior bookings, which over the years have been done through telephone and in recent years through the internet or mobile applications. Private hire drivers, on the other hand, can drive an extended range of vehicles. That has led to taxi drivers coming to hate minicab drivers since they hold the view that the minicab drivers are taking away their clients and businesses. Taxi drivers are also of the view that since minicab drivers are not subjected to various requirements (including the Knowledge of London test and qualification), they are not sufficiently qualified and that without them, they would have more businesses and consequently more income for themselves- the taxi industry-which they consider the ‘legitimately licensed’ industry. Since 2008, the number of self-employed individuals in the United Kingdom has been rising, seeing the number stand at 4.6 million as of 2016. That represented about 15% of the total workforce at the time. The self-employed group is indeed a diverse one, spread over various sectors, industries, and occupations. While nearly 60 % of self-employment cases between 2009 and 2014 came in high skilled managerial jobs, professional jobs, and associate professional jobs, the skilled trade jobs in carpentry, joinery, taxi and cab drivers and construction accounted for about a quarter of those in self-employment. For this research and in line with its objectives, however, the focus of this study will be on the minicab drivers in London.

2.2 Objectives of Record Keeping

Because of the many objectives of recordkeeping, businesses (and individuals alike) carry out recordkeeping for various reasons. Having accurate and precise information is among the significant, essential, and most basic assets of any business operation, including the self-employed ones. Once the businesses realize the importance of information to their operations, they will, therefore, strive to ensure proper record keeping and, consequently, good record and information management. Despite different businesses having different reasons for keeping records, the primary motive remains at least to provide sufficient proof and information on the activities of the business (ASA and RIM (2011). Records should be able to achieve its major purpose, which is to satisfy its wide range of users’ needs for information. Records also serve as evidence and also as a way of controlling the use and management of resources by entities, governments, institutions, and even individuals. Record keeping should be done with a view to achieving certain objectives, including provision of the exact and downright picture of business operations; permission of comparison of current and previous data on business goals and operations in a quick manner; provision of financial statements to the management and other parties such as creditors and financial institutions; facilitation of filing of reports and tax returns as required by relevant government agencies; and to allow reliable and timely access to records and to be able to identify redundant or obsolete information and to protect the crucial information. Accurate records, when kept, should enable the business owners make sound business decisions that lead to effectiveness, efficiency, and increased business performance. Besides underpinning the decisions made and actions undertaken by a business, records also give a back-up. In line with this, Hughes (2013) argues that record keeping is a contributor to the success and performance of a business. Business managers and owners are also able to monitor the progress and prospects of the business through timely and accurate financial reports (Fasasi, 2010) that can be developed if they adopt a comprehensive and adequate system of record keeping.

2.3 Features of a Good Record Keeping System and the Records Kept

In line with these objectives and to be considered good, a recordkeeping system should conform to a few standard features (Vickery, 1973). The essential elements are simplicity of use, ease of comprehension, accuracy, consistency, reliability, and timely provision of the required information (Jessop and Morrison 2015). The National Archives of Scotland (2005) identifies the organized and efficient availability of information when and where it is required in a proper state of maintenance as the guiding principle of record management. It further continues to state that to conform to the above principle, the records must be complete, accurate, authentic, accessible, comprehensive, compliant, effective, and secure. As such, records must precisely reflect the transactions and financial position of a business they document (accurate), and there should be a way of proving that the records are an accurate representation of what they purport to be (authenticity). The records should have sufficient content and context (complete) and should give a complete outlook of all business operations- comprehensive. The records must also comply with set guidelines, principles, and regulations governing record keeping (compliant) and should be kept for specific purposes (effectiveness). Records should also be kept in a manner that prevents unauthorized persons from accessing them, alterations, removal, or damage to them (secure). Businesses can adopt either of the two forms of keeping records, which are manual and electronic. For manual records, a file, pen, or pencil and paper are all a business will need to process and keep records, whereas computers and other electronic information management systems and devices are used in the case of electronic records. Thus, depending on the form chosen, records may be classified as either electronic or manual (Drexler, Fischer and Schoar, 2014).

2.4 Records to Be Kept By the Private Hire Drivers

To successfully and profitably run their businesses, private hire drivers need to keep several significant records. Among them are: accounts receivable, accounts payable, accruals, receipts and payments, bank statements, inventory records, cash records, and purchase records.

2.5 Benefits of Adequate RecordKeeping Systems and Practices

Previous empirical and theoretical research papers have shown that adequate recordkeeping has a lot of benefits to businesses (Edwards, 2013; Weggant, 2015), self-employed minicab drivers included. The benefits that accrue to the self-employed private hire drivers in London cannot be stated enough. Adequate recordkeeping by these drivers, and other small business, are likely to earn them the external funding they require to grow their business. While financial institutions and other investors frown upon businesses with no or poorly kept records and financial reports (Ghasia, Wamukoya, and Otike, 2017), they are most likely to support one whose past transactions and operations they can authoritatively gauge. That, they can only do if a business keeps a proper, adequate, and transparent record of all its dealings. Records kept over a while give background information and pictures that could help organizations and businesses cope with change (Abdul-Rahamon and Adejare, 2014). He goes ahead to say that businesses should not just keep financial records but also personal records that are useful in the evaluation of personnel and their abilities, which is an important aspect when selecting and recruiting employees. The avoidance and prevention of business failure is identified as one of the benefits of record keeping. Other specific benefits will include: the ability to effectively plan, supervise and monitor its operations (Fasasi, 2010); provision of useful financial information needed for controlling and planning by management; helps the business owners in making effective business decisions; effective resource allocation (Abdul-Rahamon and Adejare, 2014); gives a detailed background picture of the business activities and transactions, thereby helping in dealing with organizational changes (Davis, 2016); and contributes to business survival. Following these benefits, it is, therefore, of importance that taxi and private hire drivers recognize and appreciate the significant influence that adequate recordkeeping will have on them and their business growth, development, and performance.

2.6 Problems Arising From Inadequate RecordKeeping by Private Hire Drivers in London

Most private hire drivers, just like other types of small businesses, in London have generally expressed a lack of interest in recordkeeping for their business. Rather than seeing it as in integral part that contributes to their operation of the business, most drivers and other SMEs perceive it as a waste of their time, and that their small businesses do not require them should, therefore, be left to much larger businesses. This attitude has led to a total lack of recordkeeping or for those who choose to keep them, deficiencies in recordkeeping by many businesses, and among most minicab drivers. These deficiencies further bring various problems to the business. Poor recordkeeping or lack thereof among minicab drivers in London has caused them to fail at keeping track of their transactions and business activities. This lack of or improper keeping of records has had some other perceived effects on the drivers and their businesses, including government and financial institutions, such as banks finding it difficult to deal with them due to the lack of transparent accounting records. As a result, they end up missing out on financial financing or access to loans which they would have otherwise got. A 1992 study of business failures in England identified that problems in operations and management, including low and ineffective record keeping, were the primary reasons behind their failures. Inadequate record keeping hampers the ability to manage and control cash flows sufficiently and has been listed among most small businesses as the leading factor for business failure. Other researches, including that by the Productivity Commission (2013) have also come to similar conclusions. The other problems were insufficient operation capital and improper management of debts and credit. Barbara (2010) notes that as a result of poor and ineffective record keeping, the minicab and private hire drivers make decisions that are not backed by a robust analysis of facts, but guesses and their financial records remain fragmented. Roper and Millar (1999) argue that without a proper recordkeeping system, it becomes hard, if not nearly impossible, to tell for sure the exact condition and position of the business at any given time, and continues to stress the importance of depending on accurate and authentic records (financial or otherwise). Without records or if they keep improper and inadequate records, the taxi and private hire drivers will have insufficient records and information they could use to assess the financial performance of the business and run the risk of disorderly conduct of the business, increased chances of early business failure and poor planning and controlling of business operations (Reed, 2005). The relationship between the quality of records kept and tax compliance problems have been conceptualized as either direct or indirect. The indirect relationship postulates that issues such as late filings, abnormal or suspicious financial ratios, and assessment amendment requests as a result of inaccurate or inadequate records may cause the business to come under the radar of tax bodies. In the direct relationship, it is hypothesized that although tax scrutiny may come about regardless of the recordkeeping quality, a business once selected for audit has a higher chance of amended assessment if it lacks adequate recordkeeping systems and practices compared to those with proper recordkeeping practices. Tax compliance problems or non-compliance have been exacerbated by poor recordkeeping among self-employed taxi and private hire drivers and other businesses in London. It has been suggested that poor recordkeeping has been among the most common causes of problems when it comes to taxi and private hive vehicles’ tax compliance, especially regarding BAS (business activity statements) and returns. The UK Department of Trade and Industry study of 1999 found that tax matters play a significant role in the whole cycle of business failure. A longitudinal study of bankruptcies and failures in the mid-1990s among businesses in the USA conducted by Sullivan et al. (1998) gave the same results. Poor recordkeeping has been cited as the reason for system and calculation errors that have led to most small businesses failing their tax audits. Previous studies have shown that the industry, as well as others, risk the possibility of non-intentional non-compliance due to poor recordkeeping or, in cases of compliance, they miss out on refunds should they make tax overpayments (McKerchar, 2003). Also previously suggested is that poor recordkeeping may result in compliance costs that are higher than usual due to fees paid to advisers and sorting out arising taxation and compliance issues. From the onset, this research paper has hypothesized that minicab and private hire drivers stand to gain massively from adequate record keeping. This is specifically true when it comes to tax compliance since drivers with adequate and proper recordkeeping systems are likely to face fewer problems compared to their counterparts with poor or no recordkeeping systems. Tax compliance problems that have been associated with poor recordkeeping among taxi drivers in London attract higher chances of tax audits and unfavourable outcomes- such as financial penalties and time expenses- as a result, higher than normal costs of compliance and difficulties in tax remittances due to cash flow and liquidity problems. It is, therefore, recommended that the taxi and private hire drivers should undertake steps towards adequate recordkeeping, thereby minimizing or averting such issues and the accompanying risks.

2.7 Challenges of RecordKeeping That Lead to Inadequate RecordKeeping Among The Private Hire Drivers in London

Several problems that face private hire drivers in London emanate from their lack of keeping of records or keeping inadequate records. The keeping of inadequate records can, on the other hand, be attributed to the challenges that they face in their endeavor to keep records. Therefore, while they will be keeping records, the said records will not be sufficient and adequate to satisfy the intended purposes of record keeping. Various researchers- Clatworthy and Peel (2016); Brown (2013)- have in their past studies and research papers identified a number of challenges to adequate recordkeeping among small businesses. These challenges are also a reflection of the situation when it comes to the minicab drivers in London. The challenges as identified by the researchers in their works include: lack of legal framework or provisions that need them to keep records and/ or prepare fiscal reports; business owners’ lack of commitment or their unwillingness to keep records; ambiguity when it comes to what can be considered as a record; the lack of a standard guide or record manual to follow or rely on when keeping records; lack of guidelines and principles to observe in record keeping; difficulty in effectively retrieving and referencing previously processed and kept records; failure by the drivers to appreciate the value of keeping and properly controlling records; insecurity; their attitude and perception towards risk; lack of funds to invest in a proper record keeping system or hire someone to do it for them; inadequacy of necessary recordkeeping skills and capabilities (Karlan and Valdivia, (2011); lack of record retention; record management problems (leading to misplacement and loss of kept records) due to lack of education and professional training especially in the area of record keeping; and lack of basic computer literacy and skills needed for record keeping.

2.8 Gaps in Knowledge

The empirical literature discussed above shows that; record keeping is an important aspect of any business that strives to grow and develop, there are various benefits of significance that arise to businesses that carry out adequate record keeping, as well as consequences that arise from improper or inadequate record keeping. Previous researches and study papers have, however, tended to focus more the aforementioned areas with regard to SMEs in general and very little research material exists when it comes to private hire drivers in particular. None of the previous researches have shown reasons why minicab drivers choose to keep no records at all or keep inadequate records. This proves that there is limited or no literature available on record keeping among private hire drivers in London and hence, shows that there exists a gap among minicab operators on why it is imperative for them to keep adequate records and the challenges they face therein. Given the little work that has been put in with regard to private hire drivers in London and the challenges they face in record keeping, this research paper seeks to fill that gap.

Chapter 3: Research Methodology

3.1 Introduction

To ensure the effectiveness of a research and the attainment of the intended objectives, research methods that are appropriate for the type of research need to be applied. This chapter will, therefore, outline research design or techniques that are applied, the type of data collected, the methods used to collect the data, the target population, the sampling techniques and data analysis method used.

3.2 Research Philosophy

Research philosophy is a very pertinent issue when it comes to research and Mackey and Gass (2015) posit that it can significantly affect the data that is collected in relation to its quality. It is therefore crucial for researcher conducting any type of study to adopt the most appropriate philosophy as it will impact the overall nature and quality of the entire research. Wahyuni (2012) identifies three different research philosophy types that are usually employed by researchers: interpretivism, realism and positivism, and he adds that each has both advantages and downsides to researchers depending on the type of research being conducted. In line with its objectives, this research will use the positivism research approach. This is because the philosophy has, as a matter of fact, been found to remove any bias that a researcher may have while collecting the data he or she will use to conduct the study. This elimination of bias during data collection will in turn minimize the chances or margins of error in the results or findings of the study. As a result, the study will be able to paint the true picture of the situation, with regard to London minicab drivers and the challenges they encounter in keeping records.

3.3 Research Approach

This refers to the ‘route’ a researcher will choose to follow in order to achieve the objectives they set for their research (Sekaran and Bougie, 2016). According to Mantere and Ketokivi (2013), researchers can use either the deductive approach or inductive approach for their studies, but warn that the choice of approach is highly dependent on the quantity and accessibility of available data crucial to the research. Large volumes of data on a research topic implies the adoption of the deductive approach, while a limited source and access to the data will necessitate the adoption of the inductive approach. This study will use the deductive approach since the approach will facilitate the researcher to use and review information from various sources, and to draw a conclusion on the hypothesis he seeks to prove or disprove. This approach and the fact that it allows the use of multiple data sources will contribute to a high quality of the research.

3.4 Research Design

Research design refers to how the researcher conducts the research (Creswell and Poth, 2017). Researchers have various options of research designs, depending on the type of research, such as descriptive, exploratory or explanatory (Eastwood, Jalaludin and Kemp, 2014), among others. To successfully investigate the challenges that minicab drivers in London face in their recordkeeping processes, and because of the need to gather as much information as possible on the topic, this research will use the combination of descriptive research method and cross-sectional research design. Survey research has been touted as the most acceptable research method that should be employed in a fact-finding study such as this as it facilitates adequate and accurate interpretation of the research findings. Cross-sectional research design, on the other hand, involves the collection of data at a single time point. These research methods, besides enabling the use of both primary and secondary data sources, contribute to the validity of the entire research, and therefore, its quality and accuracy.

3.5 Type of Data Collected and Data Collection Methods Used

The research was conducted through the collection of both primary and secondary data. The major source of the primary data was the questionnaire. Secondary data was also used to complement the primary data gathered from the questionnaires. Among the secondary sources of data used are; journals, reports, articles, magazines and literature review of previous research works.

3.6 Target Population

For the collection of primary data, a research is highly dependent on an adequate sample size or target population. This refers to the people from whom data will be gathered. To come up with this sample size, a researcher has to adopt a sampling technique that will give him the right quality and quantity of participants Uprichard (2013). The sampling techniques used could be either probability sampling or non-probability sampling. To identify and choose participants, the researcher employed the non-probability sampling techniques. A purposive or convenience sampling method was used to identify the minicab drivers, because the research was limited to a certain group and needed to exclusively involve minicab drivers in London, and drew up a sample size of 100 drivers. The target study population for this research was the minicab or private hire drives in the city of London.

3.7 Data Analysis and Presentation

Being that the data collected is descriptive and qualitative, it will be analysed using the descriptive statistical analysis method with the help of Microsoft Excel. The analyzed data will then be presented in the form of charts, bar graphs and tables and as percentages.

3.8 Reliability and Validity of the Research

Research reliability refers to potential of the results attained by a study to be obtained once more should the research be carried out under similar circumstances and contexts (Drost, 2011). There are four groups of research reliability, and they are: parallel forms reliability, internal consistency reliability, test-retest reliability and inter-rater reliability. Validity focuses on whether researchers adhered to and followed the prescribed guidelines of research, and Pandey and Patnaik (2014) identify various validity tests that researchers could use: validity, construct validity, formative validity, criterion related validity and sampling validity.

Chapter 4: Findings and Discussions

This section presents the results obtained from the analysis of the data collected through questionnaires. The main objective for carrying this objective was to find out the importance that would accrue to minicab drivers as a result of adequate record keeping and challenges the private hire drivers encountered in their record keeping activities, and that contributed to the keeping of no or insufficient records. The findings illustrated herein will be analyzed from the questionnaires that were sent out and returned duly completed.

4.1 Response Rate

Out of all the 100 questionnaires sent out, only 90 were returned duly filled. The rest were either not returned or were incompletely filled. This represents a 90% response rate. This is shown in the chart in figure 4.1 below:

4.2 Respondents’ Demographic Characteristics

4.2.1 Respondents’ Gender

All the respondents were male, as would be expected. This result shows that the private hire sector is male-dominated industry, revealing an existing gender gap within this industry.

4.2.2 Respondents’ Ages

The study found that, out of the 90 minicab drivers who responded to the questionnaires, 33 were aged between 25 and 35, 28 were between 36 and 45 years, 20 between 46 and 5 years, and only 9 were above 55 years. This shows that the industry has in it people from all age groups and brackets. These results are as illustrated by the graph in figure 4.2 below.

4.2.3 Respondents’ Highest Level of Education

When it comes to the highest level of education attained, the information gathered illustrates that majority of the private hire drivers in London have either a high school qualification or a college certificate. 41(45.5%) of the respondents said they had gone up to high school level, thus had no tertiary education; 24 drivers (26.7%) reported to have a college certificate; 16 (17.8%) had a diploma; and 9 (10%) of the minicab drivers had an undergraduate degree from the university. None of the 90 respondents had attained any post-graduate qualification. An illustration of these results is shown by the pie chart in figure 4.3. These results portray the true picture of the private hire drivers in London; majority- almost half- of the minicab drivers possess no tertiary education, while those who possess a college certificate, diploma or university degree are spread unevenly over the other half of the divide. The education level attained by the respondents is crucial in ascertaining their skills; competence and capacity to both correctly respond to the questions in the questionnaire and keep or maintain records of their transactions. This finding confirms that the respondents have the basic education and therefore, are able to duly fill the questionnaires.

On longevity of service, 9 drivers (10%) had been on the job for less than 5 years, a majority of the drivers (50%) had done between 5 and 15 years, another 10% had also been on the job for over 30 years, while 30%- 27 drivers- had been on the job for between 15 and 30 years. These results are shown in figure 4.4.

The determination of this job experience is important because it will highlight how long the drivers have been undertaking record keeping and if they have perceived any benefits to it. Those who had stayed on the job longer had learnt what worked and what did not (Collins, 2012) and were therefore able to decide their undertakings based on this.

4.3 Participation in Record Keeping by Private Hire Drivers in London

When asked whether or not they kept any form of record for each of their daily transactions, 63 (70%) private hire drivers affirmed that they kept records, while the remaining 27 drivers (30%) admitted to keeping no form of records. However, keeping records is not as simple as that; they must conform to a certain quality in order to be useful. On the question of what they thought about the quality of records they kept, 37 (41%) of the private hire drivers agreed that they kept adequate records. 29% (26 drivers) said that they did not think of their record keeping as accurate and adequate. These findings are shown below.

Those who responded that they kept adequate records also admitted to having some level of recordkeeping knowledge, as well as encountering several challenges during the process of keeping records. Those who admitted to keeping inadequate records said they did not have sufficient knowledge in record keeping, and they, therefore, encountered numerous challenges in their attempt to keep and maintain records. They attributed these challenges to the inadequacy of the records they kept. That shows that while a majority undertook record keeping in their businesses, few of the drivers had the necessary knowledge and skills needed to do it adequately. Those who responded that they did not keep any records confirmed that they did not know how to keep records or did not have to keep records due to outright disinterest since they did not just see the need or value of doing so. On the question of whether the private hire drivers sought outside professional help in keeping records, 3 (11.53%) of the 26 drivers who agreed to keeping adequate records confirmed seeking help from professionals or their friends who were well-versed with record keeping. Previous findings have shown that the lack of involvement of professionals was caused by the drivers’ lack of capital as well as the high costs of hiring such professionals. Education and any training on recordkeeping were, again, found to be a major influence on the quality of records kept, if any. A 70% affirmation of involvement in record keeping (despite cases of the inadequacy of some) shows that a majority of private hire drivers understand and value the importance of recordkeeping to their businesses.

4.4 Records Kept by the Private Hire Drivers in London

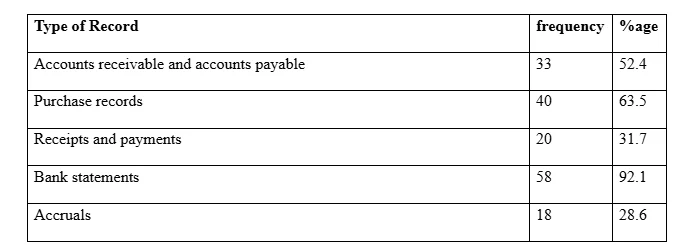

Under this objective, the research supposed to investigate the various types of records, if any, that the drivers kept, and the recordkeeping systems they used for the process. These two factors would then be analyzed by the user to highlight how they impacted on the quality and adequacy of records kept, because the recordkeeping system being used is only as good as the type of record being kept. The findings of this aim are as illustrated in table 4.6 below.

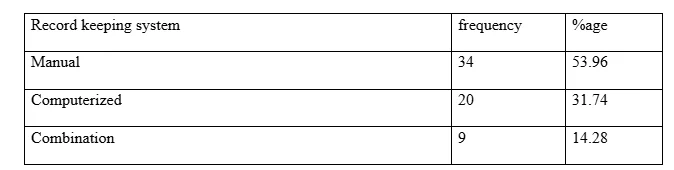

Tied to the type of record keeping system used, the researcher also intended to find out how long the drivers had used those systems, and the benefits the drivers thought to be getting from them. The question with regard to the types of record keeping systems used by the 63 private hire drivers who admitted to keeping records (adequate or inadequate) revealed that 34 drivers (53.96%) used manual systems, 20 of them (31.74%) used computerized systems and 9 (14.28%) of them used a combination of computerized and manual record keeping systems. These findings are illustrated in table 4.7.

Majority of drivers use manual systems, compared to computerized and combined systems. This is because the computerized systems are deemed to require a high skill level and knowledge on record keeping that most drivers have admitted to not having. However, research has shown the computerized systems to be more reliable since records can be easily edited, retrieved and stored for very long periods. Records can be kept manually (Jessop and Morrison, 2014), but in the case of complexities this can be done electronically to improve effectiveness (Colin, 2012). Responses to the question on how long the minicab drivers had used the said system showed that a majority (37) of the private hire drivers, which represents 58.73% had used their record keeping systems for less than 5 years, 22 (34.9%) of the drivers had used the systems for between 5 and 10 years, and just 4 (6.35%) had used their record keeping systems for over 10 years, as shown in figure 4.8.

Length of usage of a system is dependent on a number of factors such as effectiveness, accessibility, ease of use, and so on. When asked reasons for their usage of the chosen systems for the stated periods, most drivers responded that they tended to keep or change their record keeping systems depending on their convenience, benefits and ease of use. Length of usage sought to derive how experienced the drivers were in this task, as experience in using a system has been found to minimize chances of errors and increase effectiveness. Extended use of a system implies effectiveness of the system and also breeds familiarity thereby contributing to the keeping of adequate records. When it came to the perceived benefits of the chosen record keeping systems, results indicate that ease of use and less operating costs significantly stood out in both manual and computerized record keeping systems. Among those who used manual record keeping systems, 30 (88.23%) of them agreed that they were easy to use, while all of them (100%) found them less costly to use. For those that used computerized or electronic record keeping systems, 18 (90%) found them easy to use, 19 drivers (95%) found them to be quick and time saving, and 16 (80%) of the drivers found that they made records easy to edit and store for long periods. For those using a combination of both electronic and manual systems, 55.55% (5 drivers) found them easy to use and 6 (66.66%) found them to complement each other. This is illustrated in figure 4.9. Out of the 63 respondents who kept record, 56 (88.9%) believed that the type of system they used affected their ability and the quality of the records they kept, with a majority 90% (51 0f the 56) confirming that the easier the systems were to use, the more they were committed to record keeping and the better the records they kept. They also believed that a complicated system made it difficult to keep records adequately. On how long they kept records, the results show that 30 (47.6%) kept records for five years or less, 24 (38.1%) for between 5 and 10 years, while only 9 (14.3%) kept them for periods exceeding 10 years. This shows that a majority kept records for the short-term. Records kept for the short-term pose challenges as they may be impossible to retrieve and reference, should need arise, once they have been deleted or discarded. Singh (2012) noted that records could be kept for periods as short as few hours or for very long periods.

These findings point to the importance of a good keeping record as far as the quality of records is concerned. Of the 27 (30%) drivers who did not keep records, when asked why they did not do so a combined 20 drivers (74%) admitted that they thought it both unimportant and unnecessary for their business, 10 drivers (37%) considered it to be a waste of their time, 9 drivers (33%) said they were both uninterested and they their records in their heads, while 66.7% (18) of the drivers admitted they were willing to keep records but limited by their lack of knowledge and skills. These are illustrated in figure 5.0 below

Majority of those who fail to keep records have been found to do so out of lack of appreciation for the value of record keeping and the benefits they stand to gain should they undertake this activity. However, a significant number is also held back by their lack of knowledge and skills in record keeping and they therefore give it up altogether.

4.5 Benefits of Record Keeping

Asked whether they found record keeping to be beneficial, 45 respondents (71.4%) said they found record keeping very beneficial, while the remaining 18 (28.6%) rated it important, as illustrated in figure 5.1 below. This shows that minicab drivers attach a significant importance to record keeping.

4.5.1 Gives a clear background picture of the business activities and transactions

An analysis of the responses shows that 55 drivers (87.3%) agreed to record keeping giving a clear picture of the business in relation to its transactions and activities. This shows that majority of the drivers used their records to determine their transactions and activities they undertook.

4.5.2 Provision of useful financial information needed for controlling and planning

59 respondents (93.7%) agreed that records give information that is essential to the controlling and planning of the business. This means that, through records, a driver is able to reflect on his past business activities and what he needs to do for business posterity.

4.5.3 Effective resource allocation

49 (77.8%) found records beneficial in helping them determine how they spent their resources. From records of past transactions, drivers are able to determine areas where most of their resources were spent, if the resources were well spent, if there’s need to allocate more resources or if it is not beneficial to use the resources in that area.

4.5.4 Avoidance and prevention of business failure

56 respondents (88.9%) admitted that records helped them avoid business failure. This is because record keeping enables them to wisely use resources available to them in areas that improved business performance therefore contributing to business survival and growth.

4.5.5 Making effective business decisions

61 drivers (96.9%) used records to help them make business decisions. Basing on the records they keep of their transactions, minicab drivers are able to use this information to make effective decisions; instead of guesses as would be the case if they didn’t keep records.

4.5.6 Enables one to effectively plan, supervise and monitor business operations

47 (74.6%) said they benefitted from records as they enabled them to plan, manage, and monitor their business operations.

4.5.7 Facilitates access to financial funding or business loans

59 drivers (93.7%) said they believed the records they kept would help them access loans or funding from financial institutions if they so needed. These records would help banks assess their suitability as well as the business position. Adequate records will likely make them qualify for the services.

4.5.8 Enhances and enables measurement of business performance

60 (95.2%) of the drivers said records helped them assess the true position and performance of their business. Records help businesses evaluate what they spend, on what, and how much they earn.

The findings on the benefits of record keeping as perceived by the private hire drivers are summarized in table 5.2.

These results on the benefits of record keeping as identified by the minicab drivers are in line with the findings of previous studies (Karlan, and Valdivia, 2011; Weggant, 2015), and point to their appreciation of the importance and value of record keeping to their business. Records help ascertain the true financial position of the business and also help in planning, managing and controlling the business in an effective manner that steers it to growth and posterity. Businesses that keep adequate records also find it easy to access funding from banks and government when they need to as these institutions are better enabled to assess the business performance. While financial institutions and other investors frown upon businesses with no or poorly kept records and financial reports (Edwards, 2013), they are most likely to support one whose past transactions and operations they can authoritatively gauge. Records kept over a period of time give background information and picture that could help organizations and businesses cope with change (Abdul-Rahamon and Adejare, 2014).

4.6 Factors leading to the keeping of inadequate or no records

The question on the factors that led minicab drivers to keep inadequate or no records revealed a myriad of issues, a majority of which ranked highly among the drivers. The results on the challenges are as follows: Insufficient record keeping knowledge and skills (66.7%); Lack of legal framework that requires record keeping or preparation of fiscal reports (76.7%); Lack of commitment or unwillingness to keep records (55.6%); Ambiguity on what constitutes a record (52.2%); Lack of a standard guide or record manual to follow or rely on (61.1%); Difficulty retrieving and referencing previously processed and kept records (58.9%); Failure to appreciate the value of keeping adequate records (38.9%); Lack of funds to invest in a proper record keeping system (64.4%); Insecurity of records 32.2%); Record management problems (mismanagement or loss of records) (66.7%); Lack of record retention (41.1%). The findings of this study correlate to the findings of previous researchers such as Fasasi (2010) and Davis (2016). These findings are summarized in table 5.3.

These findings are in line with those of Danford, John and Lazaro (2014); and Karlan and Valdivia (2011).

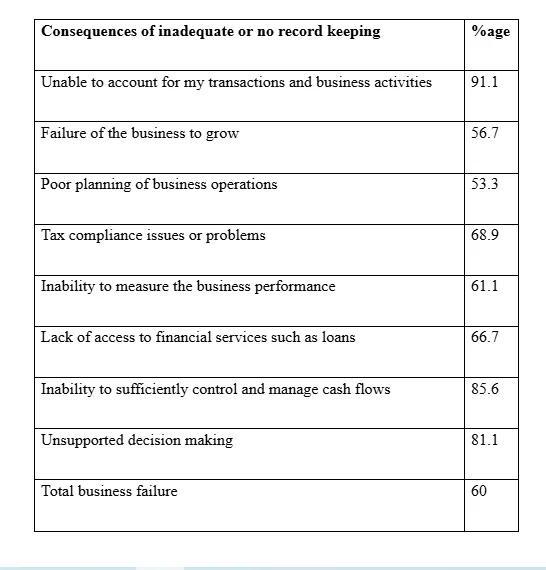

4.7 Consequences of inadequate or no record keeping among private hire drivers

Proper and adequate records reflect the true position of a business at any given time. They provide information that is useful in determining the business’ financial situation, effectiveness of its operations and activities, and an outlook of its likely future. Previous reports have shown that businesses that overlook proper record keeping usually ended up being adversely affected. On the consequences of minicab drivers keeping inadequate or no records, the study’s results are as follows: Unable to account for my transactions and business activities (91.1%); Failure of the business to grow (56.7%); Poor planning of business operations (53.3%); Tax compliance issues or problems (68.9%); Inability to measure the business performance (61.1%); Lack of access to financial services such as loans (66.7%); Inability to sufficiently control and manage cash flows (85.5%); Unsupported decision making (81.1%); Total business failure (60%). These ate illustrated in table 5.4 below.

Lemieux (2017) also found that adequate record keeping impacted positively on the profitability and growth of a business, and added that inadequate record keeping made it difficult for small businesses to effectively measure their performance. He also asserts that in order for a business to prosper and not fail or collapse, it is essential for the business owners to conduct adequate record keeping so as to be able to ascertain the true performance of the business. Findings by Pijper (2017) also reveal that businesses which didn’t keep any records of their operations, tax audits, finances, transactions and so on have encountered a lot of challenges in accessing loans and credit from financial institutions since they are considered high risk. For those who managed to access the loans, a majority were charged exorbitant interest rates. The difficulty of retrieving and referencing previous records has also been a major problem (Aryeetey et al., 2014) due to mismanagement or loss and since most small businesses claimed to keep the records in their heads.

Chapter 5: Conclusion and Recommendation

The findings of the study reveal that a majority of the private hire drivers in London have some awareness about record keeping, although a few of them are adequately doing it. The inadequacy of record keeping has been attributed to various challenges, as discussed in the above chapters. The study also shows that some drivers deliberately choose not to undertake record keeping as a part of their business despite the immense benefits they’d get if they did so. This inadequate or total lack of record keeping has been seen to have numerous negative consequences on the private hire drivers’ business. From these findings, it can be concluded that the study achieved its objective since it was able to prove and disprove its identified hypotheses. This study has proven that record keeping is an essential part of any business. If adequately done record keeping results in numerous benefits. The opposite is also true. The researcher therefore answers the research questions in the following ways: adequate record keeping is an essential activity that should be at the centre of a private hire driver’s business; and it is important that all private hire drivers adopt and undertake record keeping in order to succeed in their business. It is therefore the recommendation of this study that the private hire sector leaders in London should take it upon themselves to enlighten their members on the importance of record keeping and to conduct record keeping and financial management trainings that would equip them with the necessary skills and knowledge in order to adequately keep their records.

REFERENCES

Abdul-Rahamon, O.A. and Adejare, A.T. 2014. The analysis of the impact of accounting records keeping on the performance of the small-scale enterprises. International Journal of Academic Research in Business and Social Sciences, HR MARS exploring intellectual capital, Vol. 4 No.1, pp.1-17.

Aryeetey, E., Baah-Nuakoh, A., Duggleby, T., Hettige, H., & Steel, W. F. (2014). Supply and Demand for Finance of Small-Scale Enterprises in Ghana. World Bank Discussion Paper No. 251. Washington, D.C.: The World Bank.

ASA and RIM (2011). Statement of Knowledge for Record Keeping Professionals, Prepared by the Australian Society of Archivists Inc. (ASA) and RIM Professionals Australasia, Australia

Barbara, R. (2010). Record Management, Change Management, Service Systems. Management Journal Vol 20. No 1, 2010. pp 124-137.

Choy, L.T., 2014. The strengths and weaknesses of research methodology: Comparison and complimentary between qualitative and quantitative approaches. IOSR Journal of Humanities and Social Science, 19(4), pp.99-104.

Clatworthy, M.A. and Peel, M.J., 2016. The timeliness of UK private company financial reporting: Regulatory and economic influences. The British Accounting Review, 48(3), pp.297-315.

Creswell, J.W. and Poth, C.N., 2017. Qualitative inquiry and research design: Choosing among five approaches. London: Sage publications.

Davies, H. and Green, D., 2013. Global financial regulation: The essential guide (Now with a Revised Introduction). John Wiley & Sons.

Danford, S., John, K., Lazaro, K. 2014. A challenge of business record keeping for Tanzania Small and Medium enterprises (SMEs): A case of Madukani ward Dodoma region. European Journal of Business and Management, Vol. 6 No. 38, IIste.org pp. 82 – 86.

Eastwood, J.G., Jalaludin, B.B. and Kemp, L.A., 2014. Realist explanatory theory building method for social epidemiology: a protocol for a mixed method multilevel study of neighbourhood context and postnatal depression. SpringerPlus, 3(1), p.12.

Ghasia, B.A., Wamukoya, J. & Otike, J. 2017. Managing Business records in small and medium enterprises at Vigaeni ward in Mtware-Mikindani Municipality, Tanzania, International Journal of management Research & Review, Vol. 7 Issue 10, published by IJMRR, pp. 974 – 986.

Hsu, Y.L. and Reid, G., 2018, May. A two-stage model of decision-making over financial reporting regimes and techniques in the uk: theoretical analysis supported by illustrative case studies. In 41st Annual Congress of the European Accounting Association.

Karlan, D. and Valdivia, M., 2011. Teaching entrepreneurship: Impact of business training on microfinance clients and institutions. Review of Economics and statistics, 93(2), pp.510-527.

Lemieux, Victoria L. "A typology of blockchain recordkeeping solutions and some reflections on their implications for the future of archival preservation." In 2017 IEEE International Conference on Big Data (Big Data), pp. 2271-2278. IEEE, 2017.

Pandey, S.C. and Patnaik, S., 2014. Establishing reliability and validity in qualitative inquiry: A critical examination. Jharkhand Journal of Development and Management Studies, 12(1), pp.5743-5753.

Roper, M. & Millar, L. (Eds), 1999. Management of public sector records: principles and context, International records management trust.

Siyanbola, T. O. (2015). Challenges to the growth and development of manufacturing and services SMES in Nigeria. The 2015 WEI International Academic Conference Proceedings Harvard, USA, The West East Institute.

Webster, B.M., Hare, E.C. & Mcleod, J. 1999. Records management practices in small and medium sized enterprises: A study in North-East England. Journal of Information Science, 25 (4), pp. 283 – 294.

Zhou L (2010). The Research on Issues and Countermeasures of Accounting Information of SMEs. Intl. J. Bus. Manage., 5(3): 223-225.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts