Culture’s Role in Financial Choices

CHAPTER 1. INTRODUCTION

Culture is majorly made up of norms, assumptions, social behaviours, values, and norms that majorly dictate on the attitudes of individuals. Through culture, individuals portray similar attitudes, thoughts, and behaviours and at the same time, it leads to differentiation among people (Chen, Dou, Rhee, Truong, and Veeraraghavan, 2015). Meaning that people with the same culture (for example, culture A) tend to think, behave, and have a similar attitude, while those who subscribe to a different culture (culture B) think and behave differently from the others. At this point, the ideology of national culture is very crucial when looking at culture as a differentiative element. National culture is the totality of norms, behaviours, values, and beliefs that inform and influence most of the population living in the same country. In this instance, culture not only affects the attitudes of people in a country, but it also influences institutions, processes, and policies of a country. National culture particularly influences the culture of various organizations by affecting organisational policies and norms. Another crucial area that culture affects is the process of decision making (Begulova and Lace, 2019). It affects the process of decision making by dictating individual preferences as per their respective cultural characteristics. National culture can also influence the way the institution to operate in a state, which ultimately will affect decision making. Just like other decisions are affected by culture, financial decisions are also affected by the same. The financial decisions and preferences of managers and investors are not only affected by other constraints and individual characteristics but are also affected by culture (Zhang, 2017). National values and its respective scopes affect the structural decision-making procedures and at the same time affects various managerial actions across cultures, which leads to different investor and managerial actions, preferences, and behaviours. The most commonly used classification used in analysing culture was developed by Hofstede (Kim, Kim, and Han, 2018). Hofstede demarcated four main cultural dimensions as power distance, masculinity, individualism, and uncertainty avoidance. These cultural dimensions affect financial decisions and risk-taking. Zhang et al. (2016) added that the dimensions of culture could lead to biases when making financial decisions. The authors defined financial biases as the frequency of making decisions that leads to irrational outcomes, that is caused by faulty cognitive reasoning influenced by cultural elements and emotions. Chen, Dou, Rhee, Truong, and Veeraraghavan (2015) interpreted behavioural finance as a field that influences the psychology on the behaviour of investors and subsequently affects the market.

Cultural dimensions

The cultural dimensions by Hofstede inform most studies on the most holistic framework to examine the impact if a culture values on financial decision-making. A study collected from the IBM staff from 53 states by Hofstede between 1967 to 1968, which comprised of 60,000 respondents. The same study was repeated in 71 states from 1971 to 1973 with an enhanced questionnaire. From these two studies, Hofstede came up with his four dimensions of national culture. Individualistic cultures underscore the value of personal freedom and achievements rather than group allegiance or dependence. Besides individualistic cultures also promote self-actualisation (Harris, 2017). Individuals from individualistic nations tend to misjudge their capabilities are very optimistic about their investments. Contrary people from collective cultures derive their identity from social frameworks where individuals belong. Individuals from these cultures also inclined to have a higher sense of self-monitoring as compared to people from the individualistic culture. Hofstede outlined uncertainty-avoidance as the anxiety of uncertainty and unfamiliar circumstances that are felt by individuals belonging to a certain nation. In these cultures, people view uncertainty as a threat. Individuals from uncertainty-avoiding cultures usually emphasise on short-run reactions and feedback rather than anticipating for long-term problems. When investing, people from this culture also prefer investing in short-term investments and do not tolerate deviant thoughts and behaviours (Mac-Dermott, and Mornah, 2015). Individuals in low uncertainty-avoidance display low sense of insistence and would be comfortable handling long term investments. Power-distance defines the extent to which less influential adherents of a group accept the existing inequality in authority distribution. In high power distance, culture communications are always structured, and certain principles control every aspect of society. In such societies, uncertainty is reduced by high power distance. Contrary to cultures with low power distance, embrace decentralised decision-making systems and high risk-taking since everyone is empowered and at liberty to decide and act (Hsieh, 2013). Lastly, masculinity represents a society that majorly focuses on distinct gender roles. The connotation that males are expected to be tough, confident, and majorly fixated on quantifiable achievement, while females are hypothetically tender, and submissive. In high masculinity society factors such as monetary success, leadership, and social status matters a lot (Henry, 2018). While in feminine cultures, people value human interaction and quality of life. A detailed analysis of how these cultural dimensions affect the equity market will be discussed in the literature review section.

Cultural values like individualism, uncertainty-avoidance, and power distance among others can lead to different legal schemes that directly affect investor protection and the rights of the creditor, which in turn affects the stock market. For instance, individualistic cultures have a lawful framework that endorses personal liberty and autonomy, which encourages risk-taking. Besides these four dimensions, Hakim & Rashidian (2002) identified religion as a major cultural factor that Hofstede did not analyse yet it has a great impact on risk-taking and the equity market.

Religion as an element of Culture

As noted in a study conducted by, there is sufficient evidence that there is a positive connection between religion, risk aversion, and the equity market, both at individual and institutional levels. Although the objective of this study is to establish a correlation between religion and the equity market, the earlier studied models can help in providing a hypothetical background for the focus of this research. An elucidation of religion, risk-averseness, and the equity market can be drawn from the pervasive teachings of religion on financial behaviours such as wealth acquisition, investments, and risk-taking. For example, the Quran warns its believers against amassing so much wealth that they can no longer concentrate on the work of God (63:9). While the Bible also warns people against wealth acquisition stating that it would be easier for a Carmel to go through the hole of a needle, than a rich trying to enter the Kingdom of God. These are just among the examples of teachings perpetuated by religion that discourage people from wealth acquisition or indulging in any wealth acquisition activities such as investments, and this case investment in the equity market. As to the ideology that may demarcate the relationship between religiosity, risk-taking, and equity market investment, Fehrenbacher, Roetzel, and Pedell (2018) wrote that apprehension could play a major role in this connection. They noted that classical religious literature touched on a relationship between religion and uncertainty. Deb (2018) reports that religion is an escape route used by risk-averse people who use it as a tool of anxiety and risk reduction in their lives. Besides, Islamic and Christian doctrines espouse prudence to living a modest life with no debts. For instance, in Psalms 37:21 the bible states, “the wicked borrows but does not pay back, but the righteous is generous and gives,” Romans (13: 7-8) states, “Pay to all what is owed to them: taxes to whom taxes are owed, revenue to whom revenue is owed, respect to whom respect is owed. Owe no one anything, except to love each other, for the one who loves another has fulfilled the law.” The fact that religious people are more risk-averse, it is expected that people living in extremely religious societies tend to be more risk-averse. From this notion, then one can conclude that higher risk aversion is mirrored in the individual’s financial choices that result in low investment in the equity market.

Objectives

The research aims to examine how cultural dimensions affect the risk and performance of stock exchanges in developed and emerging economies. Using 26 equity markets across the globe, the research sets the following objectives:

• The first objective is to explore the impacts of cultural dimensions on risk and performance of equity markets in different developed and emerging economies.

• The second objective is to test the relationship between uncertainties/performance and cultural disparities, to strengthen or weaken the mentioned-above impact.

• The final objective is to compare the impacts between developed and emerging economies to explore interesting disparities if any.

To achieve these objectives, I will use secondary data collected from DataStream, which will be analysed using the model developed by Chiang and Zheng (2010), when looking at Hofstede’s four cultural dimensions. In the case of religiosity and equity market, I will collect data from various secondary sources, which will be analysed using the chi-square methodology to establish a connection between religion, risk-taking and the equity market.

CHAPTER TWO: LITERATURE REVIEW

Traditionally, most people thought that investing in the stock market is mainly determined by the amount of money one has; this notion assumes that patience and risk attitudes majorly depend on the wealth of an investor and their respective economic environments. Regarding the same notion, an American investor is likely to have the same risk aversion and patience as a Chinese investor, as long as they have the same wealth and live in a similar fiscal environment which is determined by multiple factors such as economic inflation, job security, and the prices of commodities among other factors. However, studies from different scholars have proved that the cultural background of individual matters a lot when an investor wants to invest not only in the stock market but also in other avenues. Kawakatsu & Morey (1999) argued that culture influences people’s investment behaviours even when other variables such as inflation rates, or the accumulated wealth are controlled or considered. The same authors also concluded that culture directly affects finance and economics.

Continue your journey with our comprehensive guide to Binomial Option Pricing.

Culture and Stock Market Investment

Max Weber (2013), was among the earliest researchers who associated culture with economics and finance, by linking Protestantism with the rise of capitalism. Subsequent literature has narrowed down to the effect of culture in more specific areas. Mourouzidou-Damtsa, Milidonis, & Stathopoulos (2017) focused more on the stock exchange of OECD states. They concluded that market equity levels have a higher chance of developing in states where the inhabitants had the least level of uncertainty evasion and higher prevalence of masculinity. Bacchetta, Mertens & Van Wincoop (2009) used the cultural metrics established by Schwartz (1994) to conclude that agents pick lower commercial leverage in nations with a higher prevalence of understanding and conservatism. Shao, Kwok, & Zhang (2013) added that economic growth and financial empowerment, respond positively to spiritual beliefs, specifical beliefs about heaven and hell, but negatively to adherence of religious values such as going to church. Manski (2000) argued that spiritual beliefs are linked with appropriate economic attitude, where “appropriate” is determined by higher incomes and better standards of living. Greenwood & Shleifer (2014) indicated that culture has the potential to influence the financial sector by upsetting the dominant standards, institutions, and the distribution of resources in a state. They further argued that the main religion practised in a nation predicts its cross-sectional disparity in creditor privileges, better than a state that embraces liberal international trade regimes, languages, income per capita, and the foundations of its lawful scheme. However, a study by Rothonis, Tran, & Wu, (2016) encourages liberalism arguing that the local culture has less influence in the trading decision of an investor especially when the market is exposed to foreign cultural facets. Similarly, de Bondt, & Diron (2008) developed a scale to quantify sanguinity and relay to other individuals’ opinions about forthcoming economic situations. The study established that optimistic people work harder than their counterparts, have a higher chance of re-marrying, invest in stocks, and save more resources. McCleary & Barro (2003) associated the prevalence of spirituality of nations with the features of risk exposers such as market reaction, risk exposure, and investment. Such studies give insightful discussions between values and financial results and reveal the intricacy of instruments through which culture can affect financial outcomes. For instance, culture can lead to some attitudes that influence certain outcomes. At the same time, culture can also influence financial institutions in a country. Behavioural economists suggest that the imperfections in equity markets are caused by a mixture of psychological biases like being overconfidence, investor overreaction, human error in processing some information and selection biases (Yarovaya, Brzeszczyński, & Lau, 2016). Shao, Kwok, & Zhang, (2013) argued that for a researcher to associate culture and the stock market, there is need first to choose the right metrics to measure culture and reflect various biases that exist in various cultures. Bacchetta, Mertens, & Van Wincoop (2009) identified the first metric to be considered as the state religion of a nation. Religion is the major cause of most behavioural outlines in both social and fiscal activities. A study conducted by Bhardwaj, Dietz, & Beamish (2007) revealed that there is a direct correlation between spirituality and the state of risk aversion. A study by Miller and Hoffmann (1995) gave an adverse co-relation between spirituality and individual attitudes towards threats. Amromin & Sharpe (2013) argued that risk-averse people tend to be more religious and attend religious meetings regularly than risk-seeking persons. Since the magnitude of risk-aversion can influence the verdict of whether one can invest in the stock market or not, spirituality and religion should matter when analysing various factors in this field.

Take a deeper dive into Marketing Strategies in Restaurants with our additional resources.

Hofstede’s cultural scopes

The second metric of measuring culture is Hofstede’s cultural scopes, which represents various perceptions of the cultural setting that surrounds individuals. Kahneman (2003) identifies the four dimensions of Hofstede’s theory as individualism, masculinity, power distance and uncertainty avoidance, which will be discussed in the subsequent paragraphs. Findings from a study conducted by Chang & Lin (2015) revealed that cultural factors impact on herding patterns to some extent and other aspects such as individualism, masculinity, and power distance have a more profound influence as compared to others. Therefore, it is crucial to analyse Hofstede’s cultural scopes to establish the effect of culture on risk-taking and the growth of the equity market.

Individualism

Individualism is contrary to collectivism, and mainly quantifies the degree to which people can assimilate into social clusters. In societies that practise high egoism (mainly capitalist), the major concerns of go-betweens, (for example, stock market brokers) is to satisfy their interests first. In such a case, agents ensure that they have secured their interests first, which in this case is getting paid for their work, instead of long-term profits or loss. Another implication can be that administrators in states with high egoism can assume a more conventional strategy to ensure success and uphold their status. Contrary agents in low-individualism states are likely to be less aggressive.

Masculinity

Masculinity stresses on facets like monetary rewards and personal achievements. In societies where people are highly masculine, they tend to be more assertive, competitive and are always willing to take risks. In such a state, managers or agents are likely to make their own decisions without consulting a lot; this is different from countries with low individualism, stockholders, and portfolio administrators in states with high masculinity can overdramatise and show boldness when investing in shares, while their counterparts in low masculinity societies will behave conservatively. Gray, Kang, Lin, & Tang (2015) argued that masculinity could enhance the prospect of earning management since the application of earnings administration is an efficient manner of achieving the goal. Therefore, countries with higher values of masculinity are likely had a greater frequency of earning management. Yuan (2015) warns that such activities from managers are likely to draw high market attention, which eventually causes investors to reduce their equity positions dramatically either by redeeming or selling their shares.

Power distance

Power distance quantifies the amount to which the least influential members within an institution submit to the asymmetrical power distribution. In societies with higher power distance, individuals are likely to perceive inequality as normal, can endure the concentration of power, and feel comfortable living dependent on the powerful class. In comparison to elements such as trust, cooperation, and equality in other societies, high power distance societies’ investors are ready to invest for the sake of ‘abnormal’ yields to demonstrate their individuality and independence. In societies with small power distance societies are expected to contend with investments that give them reasonable returns.

Uncertainty avoidance

Uncertainty avoidance quantifies the degree to which individuals are contented or not with uncertainties and therefore try not to find themselves in such circumstances. In nations with high indecision avoidance, people’s favour of certain safety and expectedness, and in most cases, they do not embrace risks. Contrary to individuals in a low indecision avoidance society, are likely to embrace risks. In comparison to the other three scopes, indecision avoidance is likely to be the most pertinent facet to the stock market. In practical cases, when investing in the equity market, investors must deal with the reality that they do not have the all the information pertaining the future price movement of stock prices; this is always the case when markets do not behave expectedly. The inequality in information prompts uncertainty. Therefore, the level of indecision in a country directly influences the attitudes of stock market stakeholders.

Long-Term vs. Short Term-Orientation

This dimension was first tested in 1987 by the Chinese Culture Connection in a survey that involved 23 countries. At this time all the countries involved in the study have had a background of Confucianism, which led to this dimension being referred to as the Confucian Work Dynamism. However, since then it has been tested other scholars as discussed. This dimension analyses the connection between a state’s interaction with its past and the current activities and problems that it faces (Chinese Culture Connection, 1987). A culture with a lower index on this dimension still maintains a high level of connectedness with its past cultures and holds them in high regards. Such cultures tend to be suspicious about any change and resort to conservatism (Hofstede & Minkov, 2010). A culture with a high index in this orientation (low interconnectedness with the primary culture), encourage innovation and education for social success. In a developing state, a lower index in long term orientation leads to economic stagnation and the stagnation of the equity market. While developing states with a high long-term orientation, favour economic growth. A study conducted by Lee & Dawes (2005) revealed that most Asian nations such as South Korea, Japan, and China have a high long-term orientation index, which means that the main objective of any investment serves a long-term purpose; such orientation favours the stock market. Another study by Jenson (2010) conducted in Latin America revealed that South American countries had a low rating index on long-term orientation, which meant that these countries tend to invest in what has worked before and with very short-term goals. Therefore, even when investing in stock market investors from these cultures would only invest in stocks that have a history of performing well in the market. Besides, they would only invest in a short period. Such could be detrimental to the stock market. Societies that appreciate long-term orientation emphasize on the need to remain flexible to achieve long term objectives. They are also persistent when facing challenges that arise on the way, the long-term vision also encourages high levels of thrift in the society, and avoiding luxury to achieve their goals. Contrary, short -term oriented societies stress on the current reinforcement through economic and social status; they struggle to maintain a principle-driven behaviour rather than a flexible and appropriate behaviour that is determined by circumstances. Generally, East Asia countries of Japan, China, and Taiwan are long-term focused (Clark, Qiao, & Wong, 2016), while African states and other developing nations such as Puerto Rico, Trinidad and Colombia tend to be short-focused. The United States of America surprisingly falls in the short-term side, while its counterparts such as the United Kingdom, France, and Germany are long term focused states on average.

Cultural Diversity and the Stock Market

A study conducted by Stulz & Williamson (2003) examined the impacts of cultural diversity in the development of stock markets. The study concluded that cultural diversity has a substantial and robust effect on the stock prosperity of equity markets. The data collected in this study were analysed by linear regression, and established cultural diversity had different effects in various societies. For example, in Europe, cultural diversity had a constructive effect on the expansion of equity markets, while in Asia and South America, the impacts were not that significant. More investigations revealed that different levels of state development, national legal schemes, and cultural diversity within a country lead to different effects of stock market prosperity. Besides, economic development and national legal systems can influence the impacts of cultural diversity on the development of the stock markets. Precisely, low state development level and low national legal quality will lead to the damaging impacts of cultural diversity, while high country development and the appropriate national legal quality, has the capability of inspiring the positive effects of cultural diversity. Similarly, the national development level and the value of the legal framework can regulate the impacts of cultural diversity on the growth of stock markets. The level of economic development, legal systems, and social interactions are a platform that can be used to evoke the constructive influence of cultural diversity. Devoid of constraints of other facets, cultural diversity has the capability of reducing any developments in the stock market. Bekaert & Harvey (2003) wrote that developing states should cease from blindly emulating the developed countries in over-stressing cultural diversity. Rather, it is important to emphasise on economic development and establishing a formidable legal system. Only through this manner can good economic and institutional environment evoke the constructive influence of cultural diversity to realise the development of the equity market. Lehkonen & Heimonen (2015), conducted a study in 49 emerging financial markets and discovered that a country’s democracy directly affects the equity market. Democratic countries with strong institutions encourage stock exchange and the development of the equity market as compared to non- democratic countries.

Regional Cultures and Investment Patterns

The world has different cultures, which are used in various parts/regions. Professor Samuel Huntington in his book “The Clash of Civilizations and the Remaking of World Order,” classified human values into seven different categories which are; the Sinic culture, which is practised in China and other communities in the South-eastern region of Asia such as Korea and Vietnam. The Japanese culture, which is somehow distinct from other cultures in Asia, the Hindu values, which is the core of Indian development. The Islamic culture, which started from the Arabian Peninsula and spread to the rest of the world such as North Africa, Persia, Iberia, and the regions of the far east. The Orthodox culture, which is mainly found in Russia and its proxies such as Ukraine. The western culture that started in Western Europe and spread to North America. Latin American culture, which is mainly found in South America, and is characterized by authoritarian culture, corporatism, and Catholicism, and lastly the African culture, which is majorly found in sub-Saharan Africa (Huntington, 2017). Therefore, subsequent sections will look at how these cultures affect investment behaviours, with specific reference to the stock market.

Eastern Europe

Eastern Europe is majorly made up Russia and its proxies and some countries which practise the Islamic culture such as Turkey. A study conducted by Gaganis, Hasan, Papadimitri, & Tasiou (2019) established that the variation between the expected returns of value stocks and the growth of the equity market is much higher in cultures that practised the orthodox culture, which is characterised by impatient investors who are highly risk-averse. The most notable countries included Russia, Romania, and Lithuania. Investors from these regions need a higher rate premium to clasp value stocks; this implies that stockholders from the Eastern European region are keener to reimburse less for stocks than others such as those from Nordic states who portray more patience and have a lesser risk aversion level. The same observation was also made in the case of equity risk premium – the extra return that investors expect from equity in comparison to a risk-free financial framework. The equity premium is lowest in states like the UK and the USA, and higher in the developing regions such as Eastern Europe and South America. Simply put, investors with an Anglo-Saxon descent are likely to pay more for equities as compared to investors from other regions.

Northern America

A study by Kang (1997) established an interesting conclusion as per the tenet of Hofstede when analysing cultures with high individualism. The study established that the momentum of the market is strongly linked to the degree of individualism in North American countries. Individualistic states are abundant with ego-seeking traders who seek quick profits and return, which ultimately leads to higher market momentum. The United States of America is a perfect example of such a society. In patient cultures such as Nordic cultures, investors prefer to wait a little bit and earn more returns, rather than have lesser cash in a short period. Another study by French & Poterba (1991) revealed that Africa had the most impatient investors. The respondents surveyed responded that they would prefer $400 this month, rather than wait for $450 in the next month. Such results can be accredited to the fact that Africa experiences high inflation levels, low wealth and has weak financial institutions, but at the same time, cultural practices also played a greater role. Díez-Esteban, Farinha, & García-Gómez (2018) also reported countries with high levels of corruption (as in the case of most African countries) are likely to experience low corporate risk-taking as compared to countries with low corruption index. Such results justify why Africans tend to have a lower corporate risk-taking tendency.

Culture and Risk Aversion

It is expected that there is a greater correlation between the behaviours of investors and their economic conditions. In other words, investors from developed countries are expected to be less risk-averse, as compared to investors from the developing nations. However, a study conducted by Kwok & Tadesse (2006) gave contrary results. For example, most investors from Eastern Europe are more risk-averse, and a similar rate of risk aversion is expected in Africa (which is also a developing region), but it turns out that African investors have a much lower risk aversion levels as compared to Anglo-Saxon investors (western culture). Africans had the lowest degree of patience, while Northern Europeans had the highest (Puri & Robinson, 2007). However, Americans were revealed to be rather impatient. It is expected that Americans ought to be patient since they live in an organized society and have a thriving economy as compared to other regions. A study by Demirer, Omay, Yuksel, & Yuksel (2018), also confirmed the same results.

Wealthier Investors are more strategic

In a study conducted by Ashraf, Zheng & Arshad (2016), the researchers revealed that not only cultural difference can be a differentiating factor between clients, but also the clientele segment can help one differentiate and predict the investment partners of clients. A client considered to have a high net worth in this study had investable assets that exceeded 1 million USD, and an ultra-high-net-worth individual was considered to have investable assets that were worth $50 million and above. The study concluded that wealthier investors tend to follow invest policies more, while investors with smaller portfolios tend to be more emotional. Even so, cultural biases were detected in nearly all segments of investors.

CHAPTER 3: DATA AND RESEARCH METHODOLOGY

I will analyse the relationship between culture and certain financial behaviours such as risk-taking, among others that directly affect the equity market by using various models of parameters. To obtain this objective, I will use various models, that examine the impact of risk, herding, return and religion on the stock market. To determine the impact of herding on the stock market, I will use the model developed by Chiang & Zheng (2010). In the case of risk, the study will use the global risk aversion index that was developed by Díez-Esteban, Farinha, and García-Gómez (2018). In conduct return analysis, I will use the model developed by Diebold and Yilmaz (2009).

Data collection

I used secondary data sources to correlate cultural dimensions with investment behaviours and the equity market. The data will comprise of 26 countries selected randomly and the available data on these countries. Some countries were dropped from the list because there is no substantial data available on their respect equity markets. I targeted to gather data from 2009 to 2019 on the national stock exchange market prices (for example, NYSE, FTSE or VNINDEX) as a proxy for the performance of the dependent variable. Concurrently, risk aversion index is used as a proxy for equity market risk dependent variable. We used the DataStream database to the access information on stock markets. Ideally, I envisioned to use data since the establishment of the respective market stocks up to date, to give a comprehensive report on the variables being tested. However, this was not possible because different stock market started at different times. Therefore, establishing the mean of such data not reflect the real situation of the market. Thus, to establish uniformity, I used results from the last ten years up to date, that is from January 1, 2009, to March 25, 2019. Besides I converted the values of the stocks in a different currency to a standard currency (US dollar, $), for the sake of uniformity in the analysis stage. Therefore, for the sake of comparing this data with other variables, I had to find the average value of each country’s stock market as shown in figure 1.

Secondly, the Hofstede cultural indexing will be a handy tool in this chapter as it would be an integral part of the data.

The scale on Cultural and Stock Market Indexes

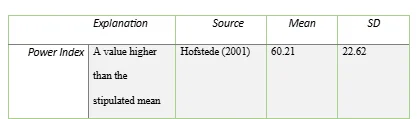

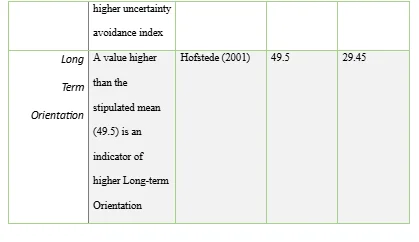

Table 2 explains how Hofstede (2001) quantified his four cultural dimensions and the mean of the data he collected in various countries. For example, when conducting an analysis on Power Index, any value that will be above the mean, which is 60.21, would indicate high power index value, while a value below the mean would indicate low power index. This table will help to inform various analysis in the subsequent sections

Analysis

Herding

The approach used in this model is based on the publication of Chang and Zheng (2010); this model modifies the framework developed by Christie and Huang (1995), which suggests that the most appropriate way of measuring the impact of investors is through dispersion. Cheng and Zheng assume that herding in the market place would imply that there is a non-linear correlation between the dispersal of personal asset revenues and the returns in the market portfolio. The researchers use cross-sectional absolute deviation (CSAD) to quantify distribution. This implies that CSAD that will either increase or decrease at a lesser proportionate rate with the market revenues. Cheng and Zheng use the methodology projected by Christie and Huang (1995) to measure CSAD because it does not the research to estimate beta; this also prevents the probability of making specification error that is linked to a factor Capital Asset Pricing Model (CAPM). Cheng and Zheng (2010) used the relationship between the cross-sectional absolute deviation of revenues and market instability to examine the presence of herding in the market as revealed in the equation below.

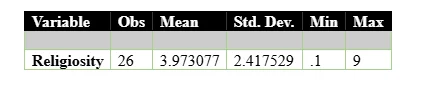

CSAD,t = yi,1+yi,1Ri,m,t+yi,2Ri,m,tyi,3Rⅈ,m,t2+ⅈ,t

In this equation CSADt = Cross sectional absolute Deviation

ɩ = stock market

t= day

Ri,m,t= the market index return in stock market

γi,0, γi,1, γi,2, = regression coefficients

εi,t= error term

Cheng and Zheng (2010) state that the return dispersion in stock is determined by the capital asset pricing framework, with the growth of the absolute value of market return, the model comprises of a linear correlation. In cases where herding prevails in the equity market, the stock market will fluctuate, meaning that there is no linear incremental correlation between the market return and the dispersal of stocks. The authors further concluded that when stocks price grow, and the difference between the market returns lessen, stakeholders are likely to demonstrate herding. As an outcome in the above equation when coefficient, γi,3 has a negative value, then it means that investors are exhibiting herding behaviours. Our study will use the γi, three coefficient as the herding index. Concerning the effects of culture, I aimed at investigating the differences in national cultures using the model developed by Hofstede (2001) to determine the herding behaviour among investors. Therefore, to prove the Cheng and Zheng (2010), the model I will correlate their herding index with other variables to establish a conclusion. Before proceeding to an establishing a correlation, there is need to test the viability of the data provided by Cheng and Zheng (2010) to determine the authenticity of the data; this will be done by using the skewness and Kurtosis test. The outcomes of this test are as shown in table

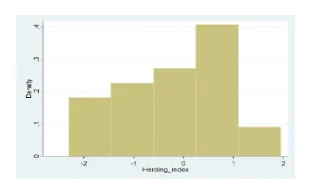

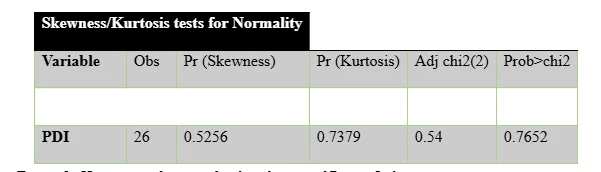

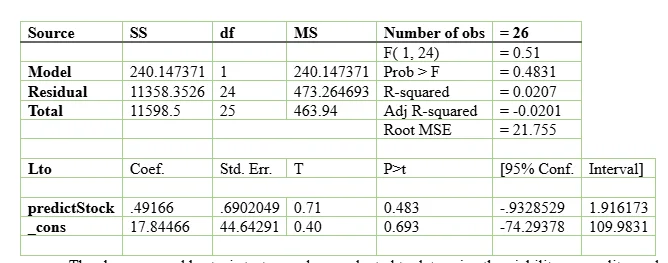

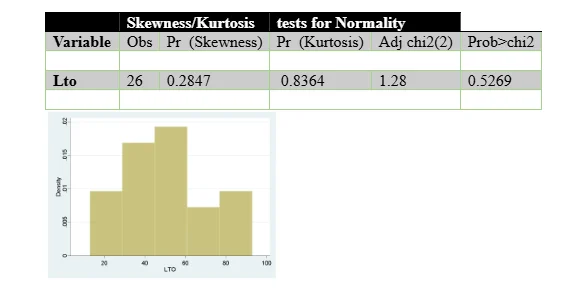

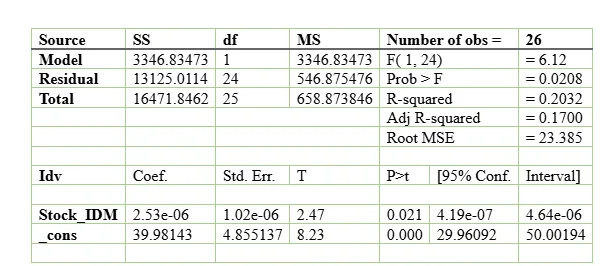

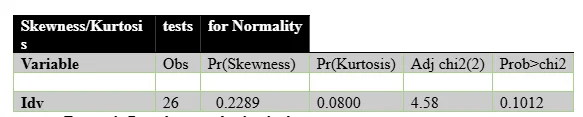

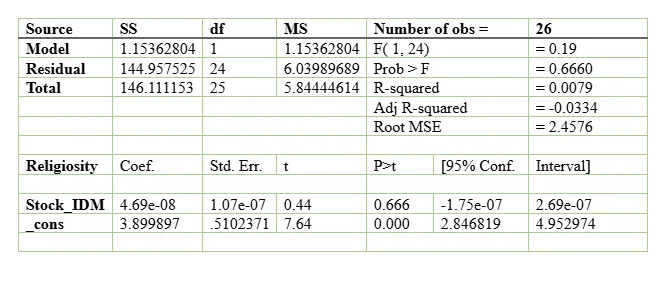

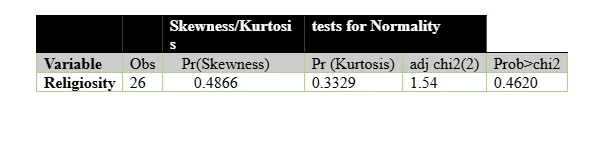

Skewness/Kurtosis tests for Normality

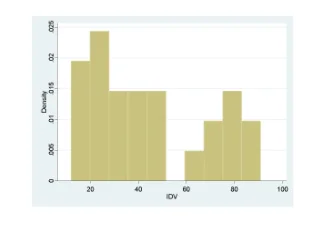

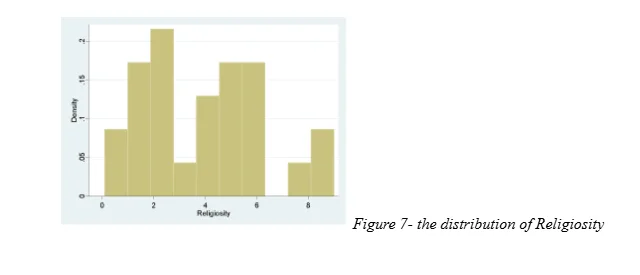

A figure above 0.5 shows that the data has a normal distribution; this is an indicator that the data given by Cheng and Zheng (2010) is viable, and therefore can be used to reach a valid result and evidence. Figure 1, is a histogram showing the distribution of the data; as per the histogram, the data has a normal distribution.

In the study of Cheng and Zheng (2010), negative values meant that investors exhibited herding behaviours, while positive values indicated lack of herding behaviour. Therefore, it is expected that when running a linear regression to establish the relationship between herding, and the stock market, a positive correlation would mean that herding negatively affects the stock market while a negative value would mean that herding positively affects the stock market. In other words

Higher/positive Herding index value= No herding behaviours exhibited

Lower/negative herding index value= Herding behaviour exhibited

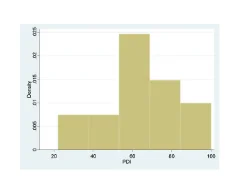

The results from the Analysis are as shown in table 4

As discussed above, the positive coefficient relation is an indicator that the herding negatively affects investment decisions in the equity market which ultimately affects the performance of the equity market.

Risk Taking

Díez-Esteban, Farinha, and García-Gómez (2018) established a model that examined the overall growth of a country in terms of GDP. The model assumed that countries with higher GDP growth is likely to present higher earning instability and therefore to higher risk taking. The GDP data was collected from the World Bank database. Secondly, the researchers used market orientation (MO) to establish if a state’s investment milieu is either a bank or market-based. Market Orientation was established as the relation between the national credit given by the monetary sector and market capitalisation of the corporations listed in the stock market annually. Therefore, according to this model, the more the MO ratio is, the more significant financial institutions are comparative to capital markets. These data are derived from the World Bank Gauges. Besides, the market-to-book value of assets ratio (MB) variable was also given consideration. The researchers calculated the quantity of the stock market value with the debt book worth then divided it with the amount of the book value of stock and debt. From these calculations, the researchers presuppose that higher market-to-book ratio infers lesser assets in place and in turn a higher price to development opportunity and also to financial jeopardy levels. Finally, the capital structure (LEV), was quantified as the financial leverage ratio, while firm sizes (LOGAST), were quantified as the log of all assets. The model also comprised of dummy variables, which were appropriated industry (INDUSTRY) and year (YEAR). The model calculated risk as

In this case

i = the firm

t = time period

the ηi = fixed-effects period of everting firm or unobservable and continuous heterogeneity

εi,t = is the stochastic error utilised to present conceivable errors in the dimension of the independent variables and the omission of descriptive variables. This model hypothesized that power distance is likely to reduce risk-taking, individualism, masculinity, and long-term orientation intensifies risk-taking, masculinity, while uncertainty avoidance decreases risk taking and raises risk averseness. With these assumptions, I will also conduct an independent analysis to proof if the conclusions of the model and its assumptions are valid. The analysis conducted gave the following results

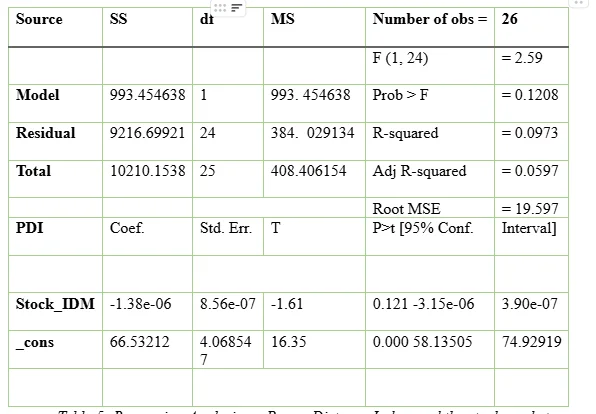

Power Distance Index

On power distance, this analysis is in tandem with the results from the model created by Díez-Esteban, Farinha, and García-Gómez (2018). Both studies thereby confirm that an increase in power distance negatively affects risk-taking, which leads to a weak equity market. This analysis established that for every increase in Power distance the stock equity reduces by – 13.8% as shown in table 5. Skewness and Kurtosis test was also conducted to confirm the validity of the data used, and both tests gave a positive result (>0.5) as shown in table 6. Which is an implies that the distribution is normal as shown in the table below, and represented in figure 2.

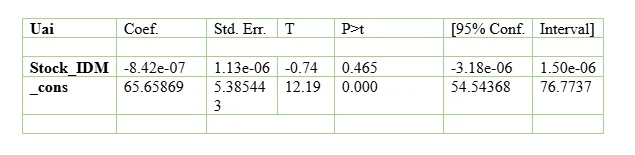

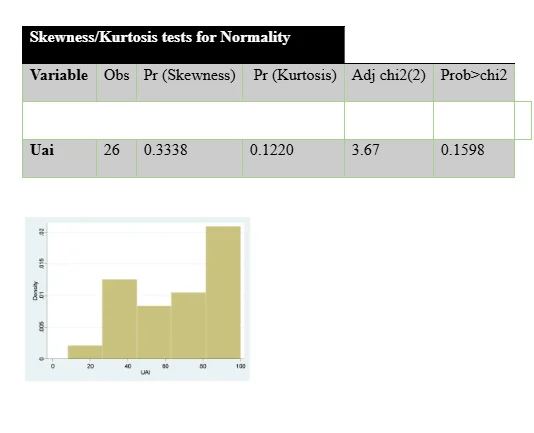

Uncertainty Avoidance

The study by Díez-Esteban, Farinha, and García-Gómez (2018), revealed that higher uncertainty index leads to higher risk averseness in the equity market, which can be seen in the low number of stocks, in the affected countries. This analysis also proves the same; so far, uncertainty avoidance has emerged as the most detrimental cultural element to the risk-taking and investment in the equity market. For any increase in uncertainty avoidance, the stock market reduces by -84%. However, a skewness and kurtosis analysis of the data gave low normality value. Both the Skew and Kurtosis tests gave a variable distribution value on this variable (< 0.5) as shown in table 7.

Long Term Orientation

Since long-term orientation is about the optimism in the future and this case, the future of the stock market, using STATA, this analysis also conducted a prediction test on the stock analysis, which was labelled as ‘predictStock.’ This dummy variable helps in determining the future of sum of stocks that will be recorded in various countries given their previous records on their equity market. The regression analysis on Long Term Orientation and Stock Market prediction gave a positive value of +0.4. Meaning that for every increase in long term orientation the stock market increases by 4% as shown in table 8. The results show that Long term Orientation does not hugely impact on the stock market, although its effects can be felt in any market.

The skewness and kurtosis test was also conducted to determine the viability, normality, and authenticity of the data. Although the skewness test revealed that the data did have a normal distribution, the kurtosis test gave a contrary result as shown in table 9. Therefore, this analysis had to rely on the histogram depiction to conclude.

Figure 4, gives a clear indication of the data distribution. From the histogram, it is clear that the data does not have a perfectly normal dispersal, which still validates the results we had from the regression analysis.

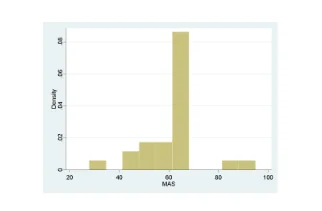

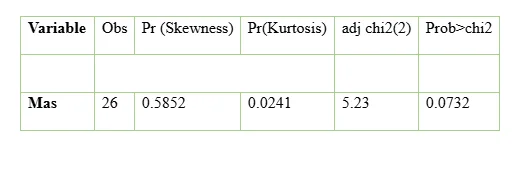

Masculinity

Díez-Esteban et al. (2018), established that masculinity has a positive relationship with risk-taking and investments in the equity market. The same results were confirmed by this analysis, which revealed that for every increase in masculinity index, the stock market also increases by 30%, which also means that most investors are more willing to take risks as shown in table 10. Therefore, countries with high masculinity index are likely to have a vibrant market.

The skewness and kurtosis analysis gave a conflicting result with respect to the normality of the data. However, form figure 5, it is evident that the data is perfectly dispersed, although the interpretation from such data is valid.

Individualism

Díez-Esteban et al. (2018) stated that individualism traits encouraged risk-taking and therefore, positively affected the stock market. The results collected from this analysis revealed that indeed masculinity has a positive correlation with risk-taking, which ultimately trickles down to a vibrant stock market. According to the study, for every increase in the masculinity index, the stock market index increases by 25% as shown in table 11.

Skewness test revealed the following results as shown in 12. The results both from skewness and Kurtosis tests proved that the data did not have a normal distribution and the same can be determined in the histogram in figure 6

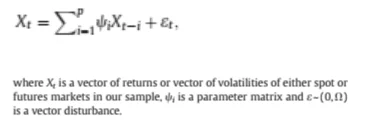

Return

This analysis will prove the effects of returns on the stock market. The analysis seeks to achieve its objectives by establishing a model that was developed by Diebold and Yilmaz (2009), which gave distinct measures on return and stock market unpredictability and was informed by forecast error variance decomposition from vector autoregressive framework (VAR). The weakness of this model is that it massively depends on Cholesky facet identification. Besides, the researchers substituted Cholesky factorisation on variance decomposition, which gave room to the specified weakness of the model to be evaded but manages to retain the benefits of the general system. The model, therefore, estimates return and stock market volatility using the generalised vector autoregressive in tandem with the model established by Diebold and Yilmaz method (2012).

In this report, higher indices represent highly volatile markets, which means that the returns are likely to be low, while low indices represent a stable equity market. Therefore, when conducting a regression, it is expected that a negative correlation would mean that stable markets with certainty in terms of returns, positively correlate with risk-taking and the stock market, while a positive relationship would suggest that market volatility, which leads to unpredicted returns do not affect risk-taking behaviours neither do they impact on the activities in the stock market. As per the analysis is shown in table 13, high market volatility, which directly affects returns has an adverse correlation/impact on the equity market. For every increase in uncertainty in return, the stock market reduces by -75%.

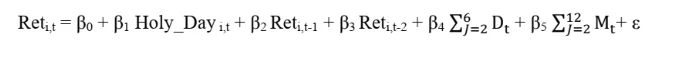

Religion and the Stock Market

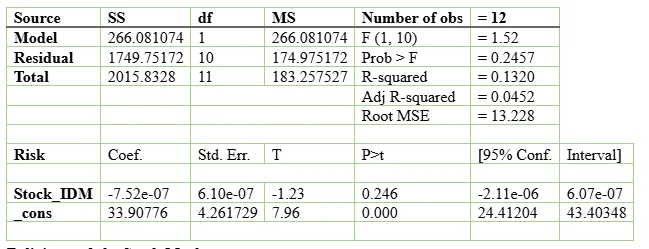

To estimate the impact of faith on the stock market, I will use the model implemented by Al-Ississ (2010). This model estimates the effects of faith on financial markets by running a pooled fixed effect panel regression across all the analysed equity markets. The study included a lagged return variable to account for the nonsynchronous trading effects, and the day, the month, and they year as dummies to control calendar and periodic symmetries. The researcher used the following regression to estimate the impacts on daily returns.

Besides, the study examined the effects of religiosity on the trading volume using the following regression

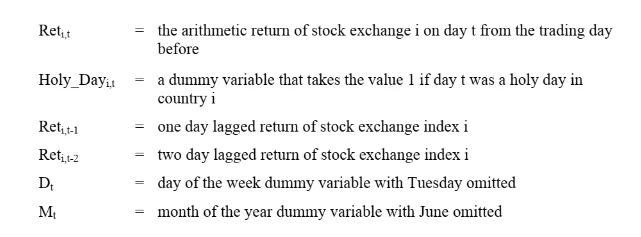

To prove this model, I acquired the data on religiosity index from Pew Research (2014). According to Pew Research (2014), countries that recorded higher religious values were moving towards secularism, while those that recorded lower religiosity index were still conservative to their religion, observed religious laws and based most of their financial decisions on religious ideologies. Therefore, it is expected that countries with that had higher religiosity index ought to have a vibrant equity market.

The summary of the data collected from Pew Research (2014), has been summarised in table 14.

From the linear regression analysis conducted to establish the impact of religiosity on the stock market, it was established that secularism has positive effect on the stock market, such that when a country religiosity index increases (meaning an increase in secularism and decrease in religious beliefs), the stock market improves by 47%, while the adoption of conservatism and religiousness would lead to a reduction in the equity market by 47% as shown in table 15.

CHAPTER FOUR: RESULTS AND DISCUSSIONS

This research proved that national culture (characterised by Hofstede’s cultural dimensions) is directly correlated with the equity market. Despite this, a survey by, Glaser & Weber (2007) also corroborated with the same results, and even going further to analyse the relationship between the culture and the exhibition of herding. I also established that national culture is correlated with herding. From the findings of these two studies, it can be said that cultural factors profoundly influence risk-taking behaviours and to that extent, it also affects the stock-market. Culture determines the human thoughts on some events and frames the behavioural patterns and reaction to the equity market. Majority of investors inevitably make most decisions based on the normative belief from culture. A previous study by Goetzmann & Kumar (2008) also indicated that the significant influence that culture has in the decision-making process. The authors added that individualism and long term-orientation could either increase or decrease an investor’s overconfidence. The analysis I conducted determined that long term orientation is linked to high risk-taking and therefore can boost the confidence of an investor to invest in the stock market, while short term orientation is likely to reduce the determination of an investor to invest in a stock market. Similarly, individualistic societies portrayed high risk-taking patterns as compared to those that had a lower masculinity index. This means that high masculinity index increases risk-taking behaviours and promotes the equity market. Hakim & Rashidian (2002) also argued that individualism also has a positive effect on performance levels of employees. Nations with high individualism index recorded high employee output as compared to those with lower individualism index. Butt, ur Rehman, Khan, & Safwan (2010) recounted that the culture of individualism motivates individuals to work harder, and save more for a better feature. The fact that they can save more makes these people more of risk-takers, because they are always seeking avenues where they can generate more money, and the equity market is among these platforms. Barber & Odean (2013) also concluded that uncertainty avoidance was positively related with the GDP per Capita of a country; this means that states with lower uncertainty avoidance index were more risk takers compared to those individuals living in high uncertainty avoidance index cultures. A study by Fang & Miller (2002) concentrated on the influence of the Confucian culture on the equity market. According to this study, most people who are observing Confucianism are loyalists and conformists to their culture, that they would not want any unknown value to corrupt it. Confucians believe in helping each other to earn a good reputation (meaning that most Confucian societies have low individualism index) and abide by their rules even in commerce and finance. As much as this culture started in China, it has also spread to various nations such as Japan, Hong Kong, Taiwan, Korea, and Vietnam among others. According to the tenets of the study, investors living under Confucianism concluded that investors in these stock markets are hugely influenced by low individualism, low uncertainty avoidance, low long-term orientation, high masculinity, and high-power distance. The cultural facets described in the Confucian society may lead to investors portraying herding behaviour, and record an averagely performing stock market. As per the data analysis, this study argues that investors in the stock markets that are dominated with conservative cultural affiliations that emphasize on public morals, and confirming to the expectations of people, or instead conducting one’s self according to what the majority does are likely to be more risk-averse. Since the aforementioned qualities do not only impact on the decision-making progressions among investors, but it also informs their reaction to some unexpected shocks. In other words, it has implications for the trading patterns of investors.

Return

Through the study, I established that the risk-taking and decision to invest in the equity market is highly dependable on the profits realised in the stock market. Economies that have had a volatile equity market continuously have recorded low yields, which in turn has negatively affected risk-taking in various economies. According to a study conducted by Iannaccone & Bainbridge (2010) in 20 emerging and developed states in Asia, America, and Africa the anticipated stock index (returns) determined the existing investment patterns in various economies, including both the emerging and the developed countries. Another study by Nabar & Boonlert-U-Thai (2007) also gave similar results in an experiential study on the effects of the economy size on the stock market and concluded that small/developing economies had a negative impact on the equity market. This because most developing economies do not have the right institutions to protect their investors from the volatility in the market, and therefore investors in the developing states fear to invest in their respective stock markets, because of the low chances of getting the desired outcomes. Jegadeesh & Titman (1993) argues that return accounts for the most varying results experienced in the stock market, which also evident from this study. However, the author concludes that other macroeconomic and industry to linked variable have added more explanatory sense in defining the stock return variations in different countries. Most models also gave significant outcomes, which reveals the authenticity of the data used in this study

Religion and the Stock Market

From the analysis conducted it was clear that countries with embraced secularism tend to perform in terms of risk-taking and to invest in the stock market as compared to those that conformed to their respective religious beliefs. A study by Naughton & Naughton (2000) also confirmed the same results when the researchers conducted a survey on the effects of religiosity on the equity market. The study concluded that religious holidays such as Christmas holidays and Ramadhan for Muslims reducing the activities in the stock market since the fact that the participant is observing these seasons as holy. Secondly, religious holidays heighten the spiritual faith of the believers, which subsequently affects their decision-making capabilities, and the cognitive ability to assess risk. Kumar (2009) also explains more about the relationship between the moods of the investors and the stock market. The researcher forecasts that on average, the trading capacity will reduce as an outcome of the absenteeism of religiously vigilant stakeholders on their respective designated holy days. Besides, it would forecast that the lack of these stakeholders has the potential of either leading to unidirectional effect on return across the various holy days if when religious shareholders have a joint risk valuation, or that their absenteeism would not impact on the market return if they did not share a common insight on risk that is divergent from other stakeholders.

CHAPTER 5: CONCLUSION AND RECCOMENDATION

This thesis explored how different cultures influence financial decision making with a case study of the equity market ad risk-taking. There were significant statistical differences observed in various countries, especially those that practised individualism (which is a trademark of the western culture) versus those that exercised collectivism (commonly in Asia and Africa). According to the findings, most investors from societies that practised collectivism preferred taking communal risks, in that they would invest more on the stocks other investors had also invested in; in other words, herding was more prevalent in societies that practised collectivism as compared to those that embraced the individualism. Secondly, most investors from cultures that embrace communalism were not open to new ideas or instead were not very ready to invest in unfamiliar stocks, which made herding more prevalent. Besides, as per the analysis conducted, most cultures that had a higher index of individualism also exhibited higher masculinity index. These outcomes support the impression that culture impacts on individual behaviour, and should be measured in various financial frameworks. The challenging part is how to improve cross-cultural trials further to competing descriptions for most outcomes. Further research needs to use a more representative sample to understand how culture impacts on financial decisions and risk-taking at a macro level. As much as this study only dealt with a sample of 26 countries, which does not represent every culture in the world, the results of the survey can still inform various institutions on groups that have been studied. Having knowledge of how financial decisions differ and the factors behind these difference will be beneficial to both future and current investors and stock market planners. Government and the financial institution can also benefit from this report to understand the stock market dynamics, risk attitudes, and financial decisions among investors living in a different culture when framing other financial support plans for people, such as insurance plans, and financial investment systems.

Laban (2014) advises that governments and financial entities can also be interested in the risk attitudes and risk-sharing systems between groups, when coming up with support products for their clients, such as insurance policies and financial emergency support schemes.

Recommendations

In this study I used secondary data, meaning that the data used in this study was derived from secondary sources; this is due to the fact that I did not have enough resources to collect primary data in all the 26 countries. One major weakness of using secondary data is that sometimes the information is outdated. For example, the study used the Hofstede cultural dimension index, which was last updated in 2001. Gaganis et al. (2019) wrote that after 10 years most social structures, and institutions have evolved, and therefore, a study conducted 10 years ago cannot have the exact same results as the one held 10 years after. Using this notion, one is right to conclude that the Hofstede cultural dimension index updated in 2001, is outdated. However, because there are no recent studies on the cultural dimension index, I had no optioned but to use the 2001 index. Therefore, new research needs to be conducted so as to establish an updated and valid cultural dimension index.

References

Al-Ississ, M. (2010). The impact of religious experience on financial markets. Harvard Kennedy School of Government. Al-Khazali, OM, Koumanakos, EP, & Pyun, CS (2008). Calendar anomaly in the Greek stock market: Stochastic dominance analysis. International Review of Financial Analysis, 17(3), 461-474.

Amromin, G., & Sharpe, S. A. (2013). From the horse's mouth: Economic conditions and investor expectations of risk and return. Management Science, 60(4), 845-866.

Ashraf, B. N., Zheng, C., & Arshad, S. (2016). Effects of national culture on bank risk-taking behaviour. Research in International Business and Finance, 37, 309-326.

Bacchetta, P., Mertens, E., & Van Wincoop, E. (2009). Predictability in financial markets: What do survey expectations tell us?. Journal of International Money and Finance, 28(3), 406-426.

Bhardwaj, A., Dietz, J., & Beamish, P. W. (2007). Host country cultural influences on foreign direct investment. Management International Review, 47(1), 29-50.

Chang, C. H., & Lin, S. J. (2015). The effects of national culture and behavioural pitfalls on investors' decision-making: Herding behaviour in international stock markets. International Review of Economics & Finance, 37, 380-392.

Clark, E., Qiao, Z., & Wong, W. K. (2016). Theories of risk: Testing investor behaviour on the Taiwan stock and stock index futures markets. Economic Inquiry, 54(2), 907-924.

Deb, M. (2018). Store attributes, relationship investment, culture, religiosity, and relationship quality: A cross-cultural study. International Journal of Retail & Distribution Management, 46(7), pp.615-637.

Fang, W., & Miller, S. M. (2002). Dynamic effects of currency depreciation on stock market returns during the Asian financial crisis.

Fehrenbacher, D., Roetzel, P.G. and Pedell, B. (2018). The influence of culture and framing on investment decision-making: The case of Vietnam and Germany. Cross-Cultural & Strategic Management, 25(4), pp.763-780.

Glaser, M., & Weber, M. (2007). Overconfidence and trading volume. The Geneva Risk and Insurance Review, 32(1), 1-36.

Hakim, S., & Rashidian, M. (2002, October). Risk and return of Islamic stock market indexes. In 9th Economic Research Forum Annual Conference in Sharjah, UAE (pp. 26-28).

Hakim, S., & Rashidian, M. (2002, October). Risk and return of Islamic stock market indexes. In 9th Economic Research Forum Annual Conference in Sharjah, UAE (pp. 26-28).

Henry, N. (2018). Elizabeth Gaskell: Investment Cultures and Global Contexts. In Women, Literature and Finance in Victorian Britain (pp. 85-137). Palgrave Macmillan, Cham.

Hsieh, S.F. (2013). Individual and institutional herding and the impact on stock returns: Evidence from Taiwan stock market, International Review of Financial Analysis, vol. 29, pp. 175-188.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of finance, 48(1), 65-91.

Kim, H., Kim, K.T. and Han, S.H. (2018). Religious Beliefs, Religious Culture, and Households’ Investment Decisions. Religious Culture, and Households’ Investment Decisions (December 1, 2018).

Kwok, C. C., & Tadesse, S. (2006). National culture and financial systems. Journal of International business studies, 37(2), 227-247.

Lee, D. Y., & Dawes, P. L. (2005). Guanxi, trust, and long-term orientation in Chinese business markets. Journal of international marketing, 13(2), 28-56.

Mac-Dermott, R. and Mornah, D. (2015). The role of culture in foreign direct investment and trade: Expectations from the GLOBE dimensions of culture. Open Journal of Business and Management, 3(01), p.63.

Marini, T.R. (2017). Influence Of Organizational Culture And Environment Work On Job Satisfaction And Employee Performance At The Board Of Investment And Licensing Services Sukoharjo District. Abstract Excellent, 3(1).

Puri, M., & Robinson, D. T. (2007). Optimism and economical choice. Journal of Financial Economics, 86(1), 71-99.

Schwartz, S. H. (1994). Beyond individualism/collectivism: New cultural dimensions of values. In Kim, U., Triandis, H. C., Kagitcibasi, C., Choi, S-C. & Yoon, G. (Eds.), Individualism and Collectivism: Theory, Method and Applications. California: Sage Publications, 85-99.

The Holy Book of Quran. 63:90. Translated Version

Yarovaya, L., Brzeszczyński, J., & Lau, C. K. M. (2016). Intra-and inter-regional return and volatility spillovers across emerging and developed markets: Evidence from stock indices and stock index futures. International Review of Financial Analysis, 43, 96-114.

Zhang, Z. (2017, February). A Study on the Impact of Chinese Hierarchical Culture on Chinese Enterprises' Investment Decision. In 2016 International Conference on Modern Management, Education Technology, and Social Science (MMETSS 2016). Atlantis Press.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts