Online Trading Systems Overview

Introduction

This section contains a review of literature within the domain of commonly used trading systems across the world. It is important to understand how different trading systems work so as to be in a better position when trading. The section discusses different trading systems like GDAX, Bittrex, eToro, Coinbase, the 3 Ducks Trading System, and the Cowabunga trading system. With such information, traders may then be in a position to come up with the best choices of the trading system to use and also be in a better position to make profits.

GDAX

A continuous first-come, first-serve order book is operated by GDAX usually, orders are usually executed in price-time priority as received by the matching engine (Haug and Golub, 2017). On GDAX, self-trading is not allowed. Two orders from the same user will not fill one another. During the placement of orders, an individual has the opportunity of specifying the self-trade prevention behaviour. Decrement and cancel are the default behaviours. Whenever two orders from the same user cross, the smaller order is usually cancelled while the larger order is usually decremented by the order of the smaller size. In the event that the two orders are of the same size, both are usually cancelled. According to Pauna (2018), whenever a market order using dc self-trade prevention encounters an open limit order, the behaviour depends on which fields for the market order message were specified. If size and funds are specified for a buy order, then the size for the market order is usually decremented internally within the matching engine and funds will not change in any way. Iyer and Dannen (2018) hold the view that the intention is usually to offset the target size without limiting your buying power. In the event that size is not specified, then funds are usually decremented. For a market sell, size is usually decremented whenever existing limit orders are being encountered. According to Haug and Golub (2017), orders are usually matched against existing order book orders at the price of the order on the book, and not at the price of the take order. Valid orders that are sent to the matching engine are usually immediately confirmed and are in the received state. In the case that an order executes against another immediately, the order is usually considered to have been done. It is possible for an order to execute either in whole or in part. Any parts of an order that are not filled immediately are considered open. Orders stay in the open state until they are cancelled or filled by new orders subsequently. Those orders that are no longer ineligible for matching are in the done state.

The general Web UI used by GDAX is subpar. Subpar is characterised by limited timeframes, few indicators and limited timeframes. GDAX charts have the tendency of glitching regularly and this is because their servers are overloaded and as such, some requests for data are blocked by rate limits and this brings up gaps in data (Gottschlich and Hinz, 2014). A market-taker model is operated by GDAX. Different fees are usually charged for orders taking liquidity and those orders which provide liquidity. This fee is usually charged as a percentage of the match amount (price*size). Taker and Maker fees are normally calculated hourly and this is based on the 30d USD-equivalent trading volume of the user. GDAX uses cursor pagination for all REST requests which return arrays (Pauna, 2018). Cursor pagination allows for fetching of results before and after the current page of results and is better suited for real-time data. Endpoints such as /trades, /fills, /orders, return the latest items by default. So as to retrieve even more results, subsequent requests need to specify which direction to paginate based on the data that was returned previously. For efficient GUI designs, apps should be able to reflect their users` characteristics, behaviours and thoughts. Developers need to first have a good understanding of people so as to fully know their users for the commonalities between the two. Learning through identification is easier compared to rote memorization (Dayton, Mcfarland and Kramer, 2018).

BITTREX

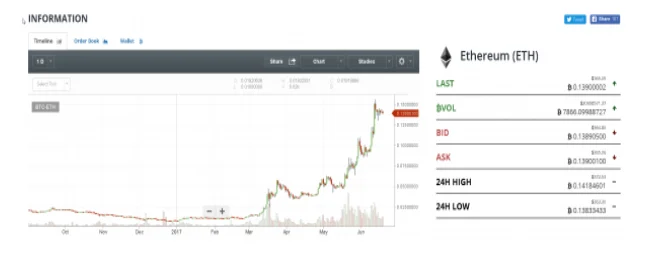

Bittrex is a cryptocurrency trading platform created by security professionals with the pledge and purpose of delivering the most secure and the fastest platform for trading (Pauna, 2018). On Bittrex, it is possible to make withdrawals in FIAT in the form of the USDT and BITCNY tethers and this also makes arbitrage in tethers possible (Guides, 2018. Click on the “+” next to the coin you intend to deposit and in the “-“you intend to withdraw. For accounts that are newly opened and basic, 1 BTC is the daily maximum withdrawal at the current price of BTC. FOR 2FA accounts, this usually increases to 3 BTC at the current BTC price. For accounts that are enhanced, it is usually $50,000 and the process of verification usually requires the user to take a selfie with their passport or personal ID. Their systems work together with Jumio.

Like most other Altcoin cryptocurrency exchanges and this is especially Bittrex as somewhat new to the market, the offered charts are of a very basic nature. And the above is what is seen in most cases.

According to Kim, Sarin and Virdi (2018), a market order is offered by Bittrex and a really convenient conditional order types. It contains the buy/sell dialogue unconventionally flipped when compared to most of the sites and this tends to be confusing to a number of traders. It is possible to browse the opened and completed orders under the menu of the same name, and besides looking at them, the trader is provided with the opportunity of cancelling any positions that are unfulfilled. Bittrex contains no margin trading option. Makarov and Schoar (2018) posit that trading fees with Bittrex are 0.25% with zero reductions and this makes it one of the most expensive trading platforms, even though the high level and potential US-based regulations make the fees even more self-explanatory. There are no extra charges attached to withdrawals on the side of Bittrex. A trader is however required to pay the transaction fee of the particular cryptocurrency which is specified in the blockchain of the coin. Often, bitcoins price is slightly lower than the average exchanges and as such it is possible to arbitrage between exchanges just like it was in the 2013 mtgox debacle, and as such this must be taken into account by all traders and not just arbitrageurs (Gangwal and Longin, 2018). Bittrex is a very viable option for long-term investors and perhaps the average traders in search of the least amount of counter-party risk in Altcoin markets. Its strong focus on security will always make Bittrex a key competitor on the market as this is what sets them apart, and will perhaps even make them the winner in this space if they keep to their pledge.

Etoro

With this trading system, a trader learns by watching other traders and they are able to learn from the mistakes of some and follow the success of others (Lee and Ma, 2015). Etoro offers different types of accounts for its customers, a demo account, a basic account and a premium account. Etoro also has its own platforms for trading. They have both a superior and new eToro browser and eToro mobile. It is very possible to customise the web-based platform and as such, it is possible to select the stocks, currencies, crypto and commodities to have close at hand. To get more details about the currency pairs, the trader should click on the pair in their watch list so as to get graphs that are detailed of the pair on pretty much any time range they want. While there exists no replacement for any technical analysis, it provides a lot of insights in an easier manner. eToro facilitates copy trading. According to Lu (2017), CopyTrader allows the trader to copy and even mimic the trades of any of the active traders in the brokerage. It is also possible to filter and find traders that you would like to copy based on their preferred assets, location, gains etc. also available is an even more advanced search in the event the trader does not find what they are looking for. The latest innovation from eToro is copy finds. This feature gives provides traders with the opportunity of investing in a group of top performing traders on eToro or a fund or a market fund which bundles together all classes of assets in a single market strategy. This kind of diversification and risk management system is usually unique to eToro and is also a powerful tool for newbie traders. According to Assia (2014), all brokers usually have varying amounts of cryptocurrencies they allow trading in. eToro has more than most, and as such is usually a good option in the case a trader wants to add them to their trading strategy where they can invest in a cryptocurrency fund or in individual currencies. The currencies available to traders include Dash, Bitcoin, Ripple, Litecoin, Ethereum, and Ethereum Classic. eToro takes many payment options allowing you the freedom to choose. They accept all major credit cards, e-wallets and bank wire transfers.

eToro`s Unique selling points

The offered premium tools are of huge value and as such is a big draw.

The platform is really eye-catching, unique and able to stand out amongst others.

Optional Personal Rebate Program to participate in.

Telephone trading available.

Occasional trading contests that may be both exciting and rewarding.

A lot of funds with a practice account for helping new investors in getting a feel for trade.

Weekly contests with prizes.

PayPal accessible (and other e-wallets)

High leverage (400:1)

Coinbase

Coinbase is a platform for storing, buying and selling of cryptocurrencies. They provide traders with a ‘one stop shop’ which acts both as a wallet and an exchange and also provides a multitude of trading resources and tools (Aitzhan and Svetinovic, 2016). Understanding account limitations is vital before starting to use Coinbase and trading pairs of digital currencies. Peters and Vishnia (2016), posit that if a trader uses a bank account, they will get limits that are higher of $ 100 transactions and up to $2,500 every week. Verification of transactions will, however, take longer and this depends entirely on the traders’ bank. Using a credit or debit card restricts the trader to lower, $200 every week limits. The trader is however capable of purchasing digital currencies through transferring funds from their account directly to the site. Transactions like this show up in the traders’ Coinbase wallet instantly (Heston, 2018). Coinbase provides traders with opportunities for skipping through the complex underlying technology that is associated with digital currencies. A trader does not need an in-depth understanding of blockchain technology, or to hold a long-term view as to the success of currencies like bitcoin. A straightforward way of capitalising on the cryptocurrencies market volatility. Graphs on Coinbase always look almost the same for Litecoin, Ethereum and Bitcoin and this is largely because price revolves around Bitcoin as it is the leader (Madan, Saluja and Zhao, 2015). Whenever bitcoin goes up, altcoins go up, and this is because most people believe that bitcoin going up implies cryptocurrency markets as a whole are "healthy" and "safe". On the other hand, whenever bitcoin goes down, either alt coins go down or they go up, and this is because people transfer their money from bitcoins to the altcoins. Bitcoin is the main currency. Primarily, the rise and fall of most cryptocurrencies mirror one another, they do not derive the same behaviours that characterise Fiat currencies which are governed by factors and economic conditions that are very different, that see them fall and rise due to fundamental and technical bases. For efficient GUI designs, designers are required to take the perspective of the user into account so that users can be in a better position to understand the graphic UI design even better.

Other Trading Systems

The 3 Duck`s Trading System

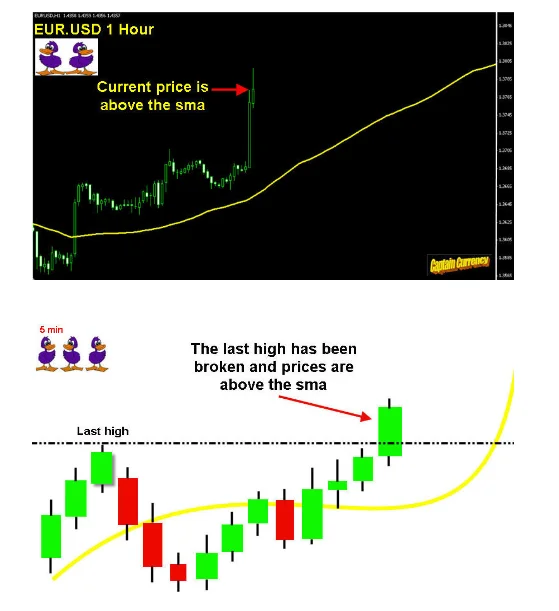

This system involves four different charts: a 4hour chart, a 1hour chart and a 5min chart. There is 1 indicator, a 60-period simple moving average (60 sma) plotted on each chart. When using this system, the first step involves looking at the largest time frame (4hr chart) to see whether current prices are above or below the 60sma. If the chart shows that the current price is below the 60 sma, which is an indication that the trader may be looking to sell. The next step involves dropping down to the 1hr chart (Forex Factory, 2018). A trader needs to see the current price below the 60 sma on this chart too, which gives them the confirmation. In the event that the current price is above the 60 sma on this chart, it is not possible to move to the next step. From the first and second steps, current prices need to be below their 60 sma`s on each chart. For extra confirmation, the trader should let the prices break the last low on the 5 min chart. This would imply that prices would be below their 60 sma on all the three time-frames, and as such, all the three ducks are lined up in the same direction. Stop-Losses allows traders to customise this trading system as their own. In the case of a short-term trader, they may want to put their stop-loss above the highs on the 5 min or the 1-hour chart. In the case of positional traders, they may want to put their stop-loss above a high on the 4-hour chart. The trader could also use a fixed stop-loss, maybe 25-30 pips or even more from the entry. This all depends on the type of the trader. Another “trick” that may help a trader to preserve capital, in the event that they sell and prices get back above the 5 min 60 sma by 10 pips, which is not a good sign, they may want to cut their losses before their stop-loss. This may however not be very much of a deal for longer term traders.

Cowabunga trading system

This is a trend trading system. This trading system uses the 4hr timeframe for identifying the main trend and then trade entries are subsequently taken in the 15-minute charts. If the price in the 4hr charts is trending up, then only buy trades will be taken in the 15-minute charts. In the event that the price in the 4-hour charts is trending down, then only sell trades will be taken in the 15 minutes charts. A trader is usually required to identify the main trend in the 4-hour timeframe. As such, the 4-hour chart settings needed and the indicators needed are; 5 exponential moving average applied to the close, 10 exponential moving average applied to the close, stochastic indicator (settings:10,3,3), RSI (9) (Yu, 2012). To make trade entries in the 15-minute chart, the following are needed; 5 exponential moving average applied to the close. 10 exponential moving average applied to the close, stochastic indicator (settings: 10, 3, 33), RSI (9), MACD (12, 26, 9) (exponential histogram) - the trader has to ensure that the histogram displays the difference between two lines. Good GUI designs should follow and further conform their designs to some other Apps that have achieved success and been commonly accepted. When compiling commercial App software, this one of GUI design principle requires designers to provide users with designs as many as possible as many as possible in line without landing designs.

Conclusion

Trading systems operate best in those markets that are predictable statistically with levels of liquidity that are high and costs that are also low. While most of the traders are usually aware of the initial requirement, very few of them appreciate the important role played by costs in success. Low costs like spreads, commissions and slippage yield even more opportunities and better profits. All trading systems remove cognitive biases. Cognitive biases have been observed to take a heavy toll on trading income and most of these are removed from the equation by trading systems. Those traders who are not able to cope with losses second-guess their decisions, while opportunities may be missed by those who lost their money recently. Traders are removed from actual sell and buy decision-making and create results that are even more predictable. Those trading systems that are developed and further optimised may not require as much effort to maintain compared to sitting by a screen all day finding opportunities and further placement of trades. It is also possible for traders to develop systems of trading at any time of the day, and this implies that they are capable of spending market hours away from the screen. There exist very many scammers today who come to traders with the promise of trading systems in exchange for hundreds or thousands of dollars. Even with this, there have also been very many successful trading systems in the past and many more are expected to crop up in the future. Even though trading systems boast of numerous advantages, there also exist numerous downfalls that traders need to be aware of. The theory behind trading systems that are automated may make them appear simple. However, in reality, automated trading is a method of trading that is automated that is also not infallible. Depending on the platform of trading, trade orders do not reside on servers but on computers and as such, in the event that an internet connection is lost, orders may fail to reach the markets. Discrepancies could also come up between the theoretical trades generated by the platform of entering orders and the strategy that changes them into real trades. Majority of the traders would expect a learning curve whenever using trading systems that are automated and as such, it is a good idea generally, to begin with, trade sizes that are small as the process gets refined.

References

Aitzhan, N.Z. and Svetinovic, D., 2016. Security and privacy in decentralized energy trading through multi-signatures, blockchain and anonymous messaging streams. IEEE Transactions on Dependable and Secure Computing.

Dayton, T., Mcfarland, A. and Kramer, J., 2018. Bridging user needs to object-oriented GUI prototype via task object design. User interface design (pp. 15-56). CRC Press.

Gottschlich, J. and Hinz, O., 2014. A decision support system for stock investment recommendations using collective wisdom. Decision support systems, 59, pp.52-62.

Heston, A., 2018. Cryptocurrencies: How to Safely Create Stable and Long-term Passive Income by Investing in Cryptocurrencies (Vol. 1). PublishDrive.

Lee, W. and Ma, Q., 2015, October. Whom to follow on social trading services? A system to support discovering expert traders. In Digital Information Management (ICDIM), 2015 Tenth International Conference on IEEE.

Păuna, C., 2018. Arbitrage Trading Systems for Cryptocurrencies. Design Principles and Server Architecture. Informatica Economica, 22(2).

Peters, G. and Vishnia, G., 2016. Overview of Emerging Blockchain Architectures and Platforms for Electronic Trading Exchanges.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts