Business Continuity Planning for the Banking Sector- The Case of a Qatar Central Bank

Introduction

The banking sector works in a very volatile and uncertain environment. Various problems and challenges such as financial situations and economic turmoils could put their impact at the working and sustainability of the organization. The banking sector needs certain strategies and plans that could enable them to deal with such kind of problems (Sofat and Hiro, 2011). Other than the financial situations and economic turmoil, terrorist attacks, fluctuations in prices, sudden fall in the economy of any other country and catastrophe are other aspects that are also responsible for affecting the operations of the banking industry. For students seeking expertise in navigating these complex issues of economic dynamics, seeking economics dissertation help is a great source of guidance.

Business continuity planning is one of the major strategies that provide solutions to the above-stated problem. Various steps and stages could be implemented by the banking sector so that the sustainability of business operations could be ensured. Business continuity planning is the process through which an organization can take the preventive steps so that in future this kind of dynamism could be handled effectively (Thomas, 2001). The major reason for the current study is to understand the volatility of the business environment in the banking sector. Further, identifying the role of business continuity planning in running the company is also another reason for the study. Thus, the clear purpose of conducting this study is to concentrate on the information technology and security system for protecting the business information. Through information technology, it becomes easier to get innovative solutions. Thus, these are the major reasons for conducting current study. To have a better understanding of the topic, the research area will be restricted to the Qatar banking industry.

Aim, Objectives and Research Questions

Aim

The major aim of the study is to assess the significance of business continuity planning for the banking sector. The entry study will concentrate on the Qatar Central Bank.

Objectives- To understand the concept of business continuity planning

- To assess the ways to ensure business continuity planning for banking sector

- To identify the importance of business continuity planning for the Qatar Central Bank

Research Questions

- What is the concept of business continuity planning?

- How business continuity planning could be achieved by the Qatar Central Bank?

- What is the significance of business continuity planning for the Qatar Central Bank?

Case Study: Qatar Central Bank

Like any other bank, the Qatar Central Bank has also faced lots of troubles due to unpredictable events. There is never ending the threat of losing all the data, information and assets (up to certain extent) due to the dynamic business environment. The bank has to deal with complex transactions for managing the business at world level. Thus, there is a huge requirement of ensuring the security and safety of data and information. In this regards, technology plays a significant role. The protocols, firewalls and technical infrastructure must be firm so that the objectives of business continuity planning could be fulfilled. The technical solutions are reliable as the technological advancements are increasing rapidly. It ensures the safety and security of the intellectual properties of the Qatar Central Bank. The ERP and MIS are among some the software that can help the Qatar Central Bank in securing the information even after the disaster. By implementing business continuity planning, the Qatar bank can improve their competitiveness in the global financial market.

Personal Interest

The banking sector is one of the growing sectors all around the world. There are lots of challenges and issues which are associated with the banks. So it is essential to understand how these challenges and issues could be handled. Through current study will help in understanding the fundamentals of the banking sector. Further, the researcher's interest is high as the intellect about the banking sector, and its dimensions could be developed. Thus, due to these aspects, this particular topic is selected for the research work. Continue your journey with our comprehensive guide to Cyber Bullying in UK Children.

Literature Review

Nowadays, business continuity perspective has gained a huge consideration by the banking sector. The information technology and its interference have been increased tremendously within the business. According to Arduini and Morabito (2010), the business continuity planning is a solution that can help in extracting the information and data during the period of trouble or challenges. It includes the use of technology that can store the information and data in a secured manner. Further, it embraces all kind of support such as transactions details, financial assistance, infrastructure protection and many more. The technology has become so advanced that the sustainability is ensured even after losing the useful database (Arduini and Morabito, 2010).

Business continuity planning works in a very peculiar manner. It helps in avoiding the negative impact of problems or blunders and continues the business operations from any corner of the world. The technology has allowed improving the connectivity and such networks are responsible for the business continuity planning. The major threat now days is related to cyber attacks and hacking activities. To overcome from such threats, the bank needs to rely on information security systems. It is to acknowledge that banks deal with the economy and financial transactions, thus, there is an enormous requirement of ensuring that the security system within the banks must be proper and efficient. It helps in dealing with the cyber attacks and hacking activities.

According to Arduini and Morabito, the business continuity planning works on three fundamentals; these are, people, process and technology. The role of technology is enormous as it helps in retrieving the useful information and ensuring the connectivity with the server. This fundamental element makes the whole business continuity planning process stronger and efficient (Arduini and Morabito, 2010). Further, people are another important business continuity planning fundament; that works on the gathering of employees and human resource. The need for manpower is immense at the time of any vulnerability or uncertain events. The team of business continuity planning process needs to be aware of the availability of manpower so that the work pressure could be dealt in a proper way. Further, the major aspect related to fundamental elements also includes the process. It has direct relevance with the updating of the continuity plan. It must have potential and credibility to deal with the challenges. The process also includes the modified and updated business continuity plan with respect to physical as well as technological aspects. Therefore, these fundamental aspects of business continuity plan should be taken into special consideration by the organizations.

The business continuity planning could become successful when the managers and top management is working hand to hand. It is something that helps immensely on the ground of ensuring the success of the plan. It is advantageous for the banking sector, as well as they can empower their business operations (Elliott, Swartz and Herbane, 1999). The managers are required to be aware so that the implementation of the plan could become possible. According to Sofatand and Hiro (2011), the role of business continuity planning is huge in avoiding the varieties of risk. The major risk that could be prevented is the payment settlement risks. The settlements of the payment could be smooth if the business continuity planning is supported by IT and IS. The managerial and administrative risks could also be minimized through business continuity plans. The banks can build a reputation among the customers as the payment is secure and the transactions remain smooth. Further, the credit risk and liquidity risks could be dealt in an appropriate manner. Most importantly, the security risks could be handled in an effective way. So, these are the major significances of business continuity planning and IT support for the banking sector (Elliott, Swartz and Herbane, 1999).

The way through which business continuity planning could be implemented includes a six stages cycle. It is clear that it starts from the government structure where the top management needs to give an adequate amount of support to develop the technological infrastructure. The second stage of the cycle involves the plan initiation which includes various partners or associated parties. They get information about the plan so that consent and support from them could be gathered. Business impact analysis and risk assessment is the third stage which must be taken into special consideration during business continuity planning (Cook, 2015). Through this particular stage, the company can analyze the impact of every risk, and can investigate the situations. The risks could be identified along with its probability and impact on the business operations. The fourth stage is directly associated with the designing of the plan. It has a huge relevance with the fact that all the risks and business environment situations must be prioritized while designing the plans. The most advanced and updated technological solutions must be including within the scheme. It includes the communication plan, legal aspects, manpower requirements, information technology infrastructure, financial regulations and many other supportive plans. The fifth stage includes the testing and training of people (Cook, 2015). Training should be effective so that successful results could be achieved through the business continuity plan. Technical training should be provided to the employees or business continuity planning process team. The last stage is related to the maintenance of the business continuity plan. The maintenance must be done on the regular basis, and it is required to be modified as per the change in business environment and technology. Therefore, in this way, the six stages could help in implementing the business continuity plan within the banking sector. Overall, it could be stated that the banking industry must avail the benefits of such new strategies and plans that could ensure sustainability in their business operations with fewer interferences.

Research Methodology

The research methods act as science for the research as they deal with the logical treatment of the entire process. Here, in this report, the research philosophy will be positivism research philosophy as the whole study will be focused on the Qatar Central Bank. Further, the deductive research approach will be taken into account for this work (Muijis, 2010). It could allow assessing the feasibility of current business continuity plan of Qatar Central Bank. Additionally, the study will be exploratory in nature so that various dimensions of the business continuity plans could be investigated accurately. The current study will be qualitative in nature as it will collect only subjective information. To accumulate the data, the unstructured interview technique will be put into practice in current research. During the interview session, the existing documents and the current techniques of the business continuity plan will be reviewed (Merriam, 2009). The data will be collected from the officials of the Qatar Central Bank which includes the:

- Director of banking system, payment and settlement department (Qatar Central Bank)

- Head of database and operation section (Qatar Central bank)

- Head of contingency and follow-up section (Qatar Central bank)

- Head of networks and infrastructure section (Qatar Central bank)

- Head of security section (Qatar Central bank)

- Internal IT Auditor from General controller Department (Qatar Central bank)

To analyze the data, thematic analysis will be performed so that the interpretations of the collected information could be done in a proper way.

Ethical Considerations

Here, in this report, certain aspects will be taken care of as ethical issues. The major ethical issue is that there will be no manipulation of the information. The data and results will be presented in an appropriate manner and exact way. Further, the identity of the respondents will remain confidential. It is very much significant with respect to ensuring the ethical issues. Additionally, the sensitive information will not be shared with anyone under any circumstances and it will remain secured.

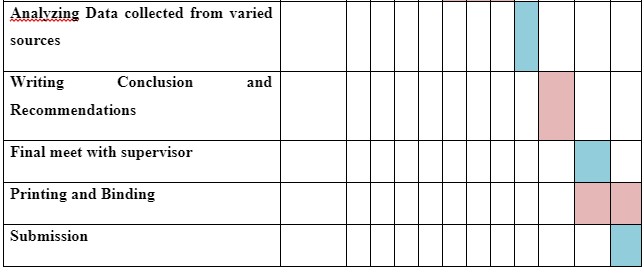

Gantt Chart

References

- Arduini, F. and Morabito, V. 2010. Business continuity and the banking industry. Communication ACM. 53(3).

- Cook, J. 2015. A six stage business continuity and disaster planning cycle. SAM advanced management journal.

- Elliott D. Swartz E. and Herbane B. 1999. Just waiting for the next big bang: business continuity planning in the UK finance sector. Journal of applied management studies. 8(1). p.43.

- Merriam, B. S. 2009. Qualitative Research: A Guide to Design and Implementation. 3rd ed. John Wiley & Sons.

- Muijis, D. 2010. Doing Quantitative Research in Education with SPSS. SAGE.

- Sofat, R. and Hiro, P. 2011. Strategic Financial Management. PHI Learning Pvt. Ltd.

- Thomas, H. 2001. Managing financial resources. Open University Press.

Looking for further insights on Biomechanical Principles and Measurement Techniques? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts