Household Consumption in Capitalist Economies

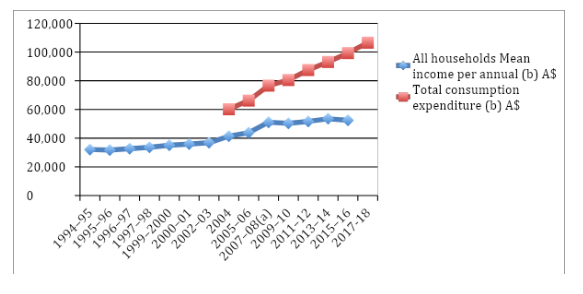

Household consumption refers to the amount which individuals spend on purchasing economic resources purchase their economy. It is normally exchanged with currency type in the market, which is a place where the interest of industries and consumers meet. In class struggle perspective, it is natural that even industries paid less as a wage form; still, a consumer should purchase more than they can for matching expected return. It is ironic that in an economy, the unbalanced vale circling should be maintained for constant capital accumulation. Base on historical contexts, capitalism helped in many different ways. For example, in Fordism era, capital had promised a certain level of household income for engaging consumption of their products throughout the wage system. It is considered that during the period United States household accumulated a certain level of HH wealth, and got higher consumption power. However, according to Robert Rich US average income has been fixed since the 1980s and its economy shifted to the neoliberal economic system, which also constitutes the concept of financialisation. Australian HH financialisation has been occurring since the 1980s. According to the Australian Bureau of Statistic data, as presented below, the Mean of Australian HH income has been almost constant, with the consumption level increasing rapidly.

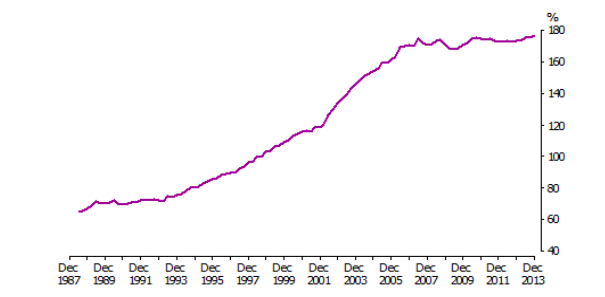

From the above presentation, all dollar values presented in the graph have been converted since 1994 to 2018 dollars using the average household income per annum. Besides, all dollar values shown in the chart have been converted from 2004 to 2018 dollars using the total consumption expenditure. Arguably, the financial sources did spend on the macroeconomic domain, which maintained an increasing trend of the national consumption level with a relatively weak average wage increment. Moreover, from the above graph, it can be deduced that HH debt would be the primary source of finance to consume rather than wag the increase of another additional financial source. Besides, the second graph, from same ABS report, size of household debt compared with annual income lies that in 2014, 180 percentage of debt, compare with Australian HH’s disposable income, had been borrowed for the HH consumption.

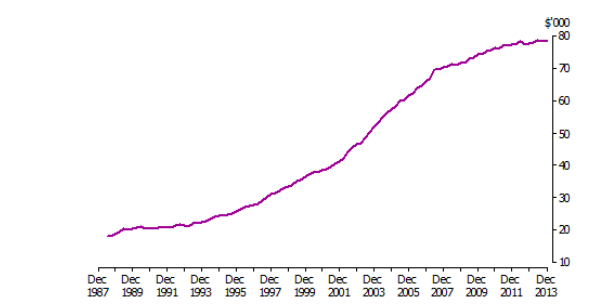

Real (a) Household Debt Per Person

All dollar values presented in this graph have been converted into December quarter 2013 dollars using the All Groups Consumer Price Index.

Size of Household Debt Compared with Annual Income (a) (b)

(a) Gross disposable household income received during the previous year.

(b) Household debt to income ratio (e.g., at the end of 2013, the value of households debt was almost 1.8 times the amount of gross disposable income received by households during 2013).

It means that the financial industry leveraged the Australian HH consumption by their consumption debt service, such as the house loan and credit card service. Consumption thus has been managed by financial industry’s industrial service, and in extreme case, HH would be an assistant of the new mechanism based on the premise that HH lost their financial position, fixing average disposable income. Based on this fact, this thesis intends to research answers for three questions in the household economy perspective, under the assumption that the average trend income would be maintained in the same level, and still preserve debt obligation to credit card user. First of all, this financialised income system in economic structural perspective, credit card usage for maintaining consumption would have sustainability? Theoretically, it is a famous mainstream consumption theory argument; liquidity constrains Hypothesis, that household tent to facing lack of liquidity and what would be good subsidized temporary income source to HH maintain consumption. For answering the first question, this paper will research two different mechanisms in the Australian credit card system, which in Australian Financial, industrial arrangement to manage their financial product, if the client could not keep their payment promise and to individual’s mechanism to go to bankruptcy, caused by credit card indebtedness. The second question will be built on the perspective of capital accumulation. The study will seek to answer as to whether the system would be useful or efficient? For researching the answer, this paper would be calculating total capital accumulation in the credit card industry by their annual financial report and analysis its productivity of commercial service.

Continue your journey with our comprehensive guide to Globalization and Economic Integration.

The last question will be if system brings to benefit to only one side like the financial industry, and harmed another side, card users; the population is significant, what would be expected, and reasonable political substitutes to maintaining the system. For example, it would be increased labor immigration for supplying new user group or removing the systemic loser to another jurisdiction? To sum up, this project is relevant, since it will unravel the legitimacy of credit card generalization as a stable temporary income source in the Australian household economy with micro and macroeconomic perspective.

Default and Systemic Solutions

Every social system has its mechanism to prevent systemic failure. Australian Credit card system has two different sorts of solutions for credit card default. Entities can define each solution. For instance, in the users’ perspective, credit card default causes personal bankruptcy under the Bankruptcy Act 1966 (Australian Government Federal Register of Legislation 2017). The Issuing of bank’s point and the client’s default would be the subject of securitization; according to financial scholar groups. However, the industry has a method for hedging the default risk.

Default: a personal bankruptcy

According to the Australian Bankruptcy Act, 1966 individual concern about personal bankruptcy would be bankruptcy three years and one day. However, according to parliament; the registration process should be one year and not three (INHEBLACK. 2018). Moreover, the individual’s name will be permanently listed on the National Personal Insolvency Index (NPII), which is accessible to anyone online, including bank, and employer. The bankrupt individual will be forced to sell some assets to pay back the debt and be requested to get permission when you travel overseas. The individual’s income will charge from the top on a certain amount for pay back the debt (Australian Government AFSA 2015). Preventing personal Bankruptcy, as a result of Credit card default, has bred forth a new type of financial products including debt consolidation loan or the transfer of lower interest charge credit card. Michael Janda maintained that the new debt consolidates loan which could not be the first solution, but it is famous since the financial product provide commission to bank employee like the manager who confirmed the loan contract (ABC NEWS 2016). Due to the new loan, the rate of bankruptcy has been reduced by A$ 5 billion in Australian credit card balance from 2012 to 2016. It is evident that the financial industry temporary delayed their debt default moment because, for debtor perspective, the new product would not reduce debt payment amount. On the contrast, even transfer to lower charge card or little interest of debt consolidation loan; still, a debt obligation is maintained that lies card user are the final charger.

Securitisation

According to the accounting standard, individual’s payable loan is considered as a liability, which always brings debt obligation. But in Bank perspective, the loan receivable is deemed as assets. The card issuer bank which owns defaulted credit card debt can be pooling the mortgages and other financial products to make a so-called particular purpose vehicle (SPV). Once the SPV is transferred to the issuer, the issuer would be orphaned from the securities such as a trust system, SPV which pooling with credit card debt, assets backed securities (ABS) would be called master trust or issuance trust. According to the Financial Accounting Standard Board (FASB), such a transfer is classified as a valid sale, a financing, a partial sale (FASB 2019). In Australia, The SPV would be sold out in Australian Stock Exchange (ASX) security market process. So credit card issuing bank would have an official channel to hedging their uncollected Loan receivable. The current financial system, including international accounting standard, legally support the securitization transaction.

Australian securitization for credit card debt is evolving. From the Reserve Bank of Australia Report (2018), still, 98% of assets back security is back in mortgage loan and not a credit card. In 2017, there were warnings about strong demand of Australian credit card securitization in Reuters (2017), and before 2017, ABC News journalist, Michael Janda had written about the significances of credit card debt in Australia (ABC News 2016). However, from same ABC News article, it is logical to assume that due to the trend of increase of credit card debt and default rate, as REUTER reported Australian Credit card debt backed security market would be increased, because it is excellent business opportunity without concern about its socioeconomic fundamental.

Looking for further insights on Market Equilibrium: Supply and Demand? Click here.

Conclusion

From the above research, the Australian financial market is designed to benefit the concerned rather than the credit card user perspective. Concerning the social system whereby the credit card usage has been enforced to the individual through mass media advertisement for increased credit card industry’s profit; more hazard will occur in the industry. For instance, the Australian Credit Card Company issued a card with a higher credit limit than a user’s financial capacity to increase issue rate (ABC NEWS. 2016). Besides, the Australian credit card industry has not had a fair business surrounding (the stadium is not flat); which should thus be one of the crucial research matter of Australian HH Financialisation transformation.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts