Corporate Disclosure and Market Valuation

Introduction

Financial disclosures help to bridge the information gap between the managers and the stakeholders of a business and thereby reducing conflicts or strenuous relationships between these two groups. Even so, corporate disclosure can help in decreasing the information gaps that lead to such tensions and augment the authenticity of financial reports and complement the mandate of accounting information in regards to the value of the firm. Various investigators have studied the effects of disclosure on the valuation of a firm in the market. Elshandidy et al. (2013) argued that improved accessibility to information on a firm has the potential of increasing its capital market efficacy and lure more investors to the company. The authors also reported that disclosure is deployed as a tool that would check and balance agency costs that are as result that managers would not act in the interests of stakeholders. Nelson & Pritchard (2016) also argued that disclosure is a tool that would allow stakeholders to broaden their capacity in monitoring and enhancing the valuation of the company. Published studies on economic effect of disclosure has majorly focused on developed economies and directed their arguments toward non-risk voluntary disclosure. Furthermore, …. Purported that all the findings on disclosure have followed most financial theory extrapolations, which meant that greater public disclosure of information to investors and other groups interested in the company. Past studies have also assessed the relationship between voluntary disclosure and the cost of capital and the liquidity of the equities. At the same time a small number of publications have also assessed the link between voluntary disclosure and value of a company. However, so far, there is no evidence on the effects of both mandatory and voluntary disclosure on the company.

This study is influenced by the fact that the impact of disclosure in the value of a firm is still an issue that needs empirical evidence. Besides, Gholami et al. (2008) stated that there is a limited field of empirical evidence that combine these two variables and asses their impact on a firm. Therefore, the study is motivated to use the empirical evidence of various companies which either operate under voluntary or mandatory disclosure frameworks or both and how these variables adds value to companies. Besides, Li et al. (2009) stated that the findings linked with the correlation between disclosure and the value of a company is not yet conclusive. The state of inconclusiveness has created various gaps that would help in further investigation not only in the field of risk disclosure but also in other types of disclosure. Moreover, previous studies have made an assertion that the relationship between firm value and disclosure is sensitive to the proxy utilized to value of a company. The arguments in this paragraph highlight the essence for further studies into the link between these two variables and a firm’s value. From the previous studies, it is clear that there is a positive correlation between the level of disclosure in a company with its value. Though, this relationship has continued to be vague in terms of whether the rise in information can lead to an improved market value of a company’s MTVB and ROA or not. Therefore, the probable effects of risk disclosure in a company is still open to empirical investigations especially for companies operating in different locations that have different policies of disclosure. Thus, this study will try to bridge this gap by giving direct analysis of voluntary and mandatory risk disclosure and the value of a firm based on two measures of a company’s value, which are the Market to Book Value (MTVB) and ROA. The first unit of measure (MTVB), is a market-based measure, while the second one (ROA) is an accounting measure. The study would majorly focus on companies in the United Kingdom and other developing states, which a peculiar empirical set up that allows the researcher to have a clearer and comprehensive picture between the levels of voluntary risk disclosure and the valuation of companies. The research will add to the risk literature by stating how corporate risk disclosure (either mandatory or voluntary) can affect the risks of a company.

Background information

There is a little body of research on how risk level drive companies to disclose their risks in their yearly financial reports. Emm, et al. (2019) found that the aggregate risk exposure is linked more to the size of a company, rather than its risks levels. Fishman & Hagerty (2003) also revealed a positive relationship between the average risk disclosure and total risk as a control variable, though this is not the major driver. From our prior arguments, it is clear that information asymmetry affects theories of disclosure, such theories include;

Regulatory theory

The theory provides a conceptual framework for mandatory disclosures, which are necessary in terms of compensating for market failure. The agency-based and signalling theory is among some of the incentive theories for voluntary risk disclosure. According to the Capital Asset Based Pricing (CAPM) theory the association of market-risk measure with leverage, the growth of a company, accounting beta, the variability of earning and the size of a company. According to the tenets of the regulatory theory, imperfect markets needs some amount of mandatory disclosure to safeguard stakeholders and resolve the problem of information asymmetry. The issue of economic disadvantage can lead to disincentives to disclose risk information voluntarily. Risk reporting varies across companies both in voluntary and mandatory reporting regimes Saggar and Balwinder (2017) applauded the regulatory disclosures that have been made possible by institutions like the Institute of Chartered Accountants in England and Wales, and the reports from the survey of UK institutional investors, which stated that the managers needed to give detailed risk information. Anand (2005) also indicated that there has been an enhancement by the new stipulation in FRS 13, however companies have still failed to provide sufficient information on the risk management. The major issue is that risk information provided in annual reports is currently perceived to lack coherence. Even so, the same study stated that the disclosure of more risk information is not equated to improved risk management unless the managers voluntarily write the information with more clarity on the risks that the company faces. In short mandatory disclosure policies does not mean that the company will be transparent with its stakeholders, nor does it mean that the company will truthful on its accounts. However, it is expected that the information that managers give voluntary will be a reflection of the outmost truth of the situation in the company. The only problem is that voluntary reporting does not imply that the managers will unveil give all the information, sometimes what is perceived as a voluntary disclosure could be fictious information that could mislead the stakeholders more, especially in cases where such actions are not controlled by the relevant authorities.

Chalmers (2001) wrote that managers could make voluntary disclosures to decrease various information risks that are linked with the company’s inventories. The authors also added that for a firm to reduce agency based issues, managers ought to present various risk information to prove that they are working in tandem with the objectives of the stakeholders and the companies creditors. At the same time, Chalmers (2001) stated that directors would choose to voluntarily disclose various information on risks in the company’s financial reports to convey various signals to the current and potential users according to the theory of signalling. Bischof & Daske (2013) gave a significant conclusion that company emphasise on disclosing information both on the previous and current risks rather than the future or projected risks. In the few cases where companies have disclosed their future risks, they have failed to assess whether the risk would lead to positive or negative impacts. Shivaani, et al. (2019) also suggested that the providing future risks and giving a comprehensive analysis of the what should be expected , would beneficial to shareholders. The fact that companies are hesitant to disclose their projected risks, means that most investors are subjected information asymmetry knowingly by firms. Such practises would only deter investments in a firms rather than encouraging such trends. He, Plumlee, & Wen (2019) argued that directors are not willing to voluntarily disclose quantitative information on the size of the risk exposure. Managers could only publish information that will convince the stakeholders to perceive them as people working towards the interests of all parties involved in the company. Shehata (2014) sampled firms in the United Kingdom and confirmed that there was a positive correlation between the volume of information given by companies and their sizes. An essential issue is the number of good and bad risk disclosures in annual reports. The conclusion made by Mbith et al. (2020) reveal that neutral risk disclosures are always dominant. The rate of both good and bad disclosures reveal that directors do not chose to hide negative news from their stakeholders.

Financial Statements as Tool of risk disclosure

Both voluntary and mandatory risk disclosures are reported through financial statement and other official documents, which are relevant via the national and European legislation. Besides, the listed countries ought to follow various regulations from the Capital Market Commission. According to the principles of the modern theory, the information on risks are important in assisting various stakeholders to make decisions on their engagement with the company. Institutional investors state that it is essential to have direct access to the risk profiles of companies, and for such an occurrence to happen firms must voluntarily provide the necessary information. In most cases, annual reports act as an essential source of the information needed for an operative investment pronouncement. However, current studies provide risk information through interviews with the company’s manager and some press releases. Annual reports are mixed documents that have to meet various requirements on legislation and various regulations or in some cases the directives of bodies that manage the operations of the market and control viable and voluntary information on the strategies of a company. Businesses are also bound by various snowballing numbers of regulation and norms, which would force them to communicate various risks. In voluntary systems companies would choose on the extent of the additional information that they would want to give beyond mandatory disclosures that is needed by various regulations and laws in annual reports. At the same time, annual reports give companies the chance to enlighten its shareholders on some of the issues that cannot be understood by just looking at financial statements. The multifaceted accounting circuit and specifies of the accounting treatment of every entity needs more information to better comprehend the financial situation of the company and enhance the readability of accounting statements for those who do not have a background in accounting.

European Markets and Risk Disclosure Policies

Most countries in the European market have been subjected to voluntary disclosure by various accounting authorities. However, in Greece every company must give mandatory risk assessment statements, because of the International Financial Reporting Standards implemented in the country, which besiege various companies to give consolidated financial reports as per the stipulations of IFRS. The IFRS system has gained a common reputation for being a friendly accounting system for various investors due to the fact that the financial reporting of companies that follow this guideline is more informative on the performances of the company that can be easily understood for the sake of good decision-making processes. The international Financial Reporting Standards requires the company to give a description on its annual reports and the nature and extent of exposure to various risks that arise from these monetary instruments. Besides, the process of disclosing risks ought to have both quantitative and qualitative contents.

H1= Relationship between the Size of a Company and risk disclosure

Various studies have established that there is a positive correlation between the size of a company and the total number of risk disclosures that made by established companies. Bagnoli & Watts (2007) argued that larger entities tend to be politically sensitive (highly regard the national laws, regulations and policies), thus larger corporations present higher levels of risks information to reduce political sensitivity because of their monopolistic position in the market. Studies by Vander Bauwhede and Marleen (2008) and Templ and Andreas (20101) and …revealed that a positive correlation exists between the size of a company and risk disclosure. In other words, larger entities are likely to develop reporting systems using lesser costs as compared to smaller entities. Therefore, the process of disclosure is less expensive. It implies that in a voluntary system, larger corporations are likely to disclose more about their risks as compared to smaller ones. While in cases of mandatory disclosure, large companies are likely to disclose more information and explain the information to its stakeholders to avoid future controversies and complications with the authorities as compared to small businesses. This argument is supported by the theory of legitimacy, which states that larger companies are likely to disclose more risks and satisfy the needs of their shareholders and at the same time satisfy the legal mandates to avoid frictions with its stakeholders and the government. Therefore, in regards to this hypothesis it can be concluded that a positive correlation exists between the size of a company and the total number of risk disclosures that exists.

H2: Difference between Disclosure of monetary and non-monetary risks

Disclosing monetary risks in a company’s annual report is essential and valuable for both investors and credit holders. Einhorn (2005) state that firms enhance their risk reporting by measuring risk disclosures. Disclosing on monetary risks is among the most common methods of quantifying risks in terms of money. The methodology of quantifying risks can lead to various problems due to the fact that it is challenging to transfer all monetary risks. The process requires management techniques, analysis and a comprehensive historical data. Various investment decisions rely on the monetary risks and so the precise transition is necessary for a company to remain truthful. Therefore, in either way, under a mandatory risk disclosure system or a voluntary one companies would always report more on non-monetary risk disclosures as compared to monetary disclosures.

H3: Correlation Between Industry type and risk disclosure

A study by, Marzouk (2017) revealed that companies that operate in a similar industry tend to disclose same levels of risk disclosure to prevent negative market valuation. Similar operational environment and reporting guidelines is the major factor that drives entities from the same sector to stick to the same reporting policies. At the same time, the signaling theory states that company’s convince stakeholders that they can adhere to the same reporting framework with other industry and report using the same risk disclosures. The same theory has also been confirmed by the institutional theory due to the fact that some industries have higher institutional pressure as compared to others. Thus, various literatures have argued that there is a relationship between risk disclosures and the type that the industry that a company associates itself with. However, this relationship is mainly determined by the national or regional reporting frameworks.

Data

Annual reports have been identified as a source of risk reporting in various studies. Sexena et al. (2017) provided vital reviews on risk disclosure using various data from annual reports. Annual reports can be applied to derive the necessary insights in revealing various disclosure information. It therefore implies that the study will use secondary data sources, in form of annual reports.

Sample

The study sample consists of annual reports from 20 different countries listed in the European market in 2016. Since Greece provides a perfect example of a state with mandatory reporting policies some companies will be drawn from the large cap index of Athens Stock Market. The initial stage involved checking the annual reports of smaller firms. However, there are various gaps in most annual reports of small firms, which rendered it more challenging to use these reports. The study excluded banks and insurance companies due to the fact that they followed different risk disclosure legislation and policies. Using the exclusion criteria, 20 companies were eligible for analysis. The size of the sample can be a limitation based on the available time for research in the concept, and the gaps presented by smaller firms because the insights from these firms could be beneficial in making various comparisons.

Analysis

The data collected was analysed using content analysis. The methodology would help in establishing a valid inference from the data collected on a specific case. The first preliminary of conducting a content analysis is to ensure that the data is accessible. The study has only 20 firm reports, which would help in answering the study questions. The second condition is to use content analysis when investigating a central theme that is related to the subject’s language. In this study, the language utilized by the companies in reporting various risks allowed the research to infer their perception towards risks. The third condition is that content analysis is only useful when the investigator has a large volume of materials for analysis. The methodology allows the researcher to systematically code and classify data. In such a situation the study will examine large quantities of information published in 20 different companies. The major weakness of this design is the reliability of the categorization process; the problem arises the different definitions that people ascribe to various words to describe risks. … described the weakness as stability, reproductivity and accuracy.

Content analysis uses words, characters, and pages as the unit of analysis. Besides, in more advanced analysis graphic elements such as graphs can be used to improve the outcomes of the study. The only problem is that words can have different meanings depending on the context. Therefore, to avoid contradictions, the study will use sentences as the most accurate unit of analysis.

Overall Analysis

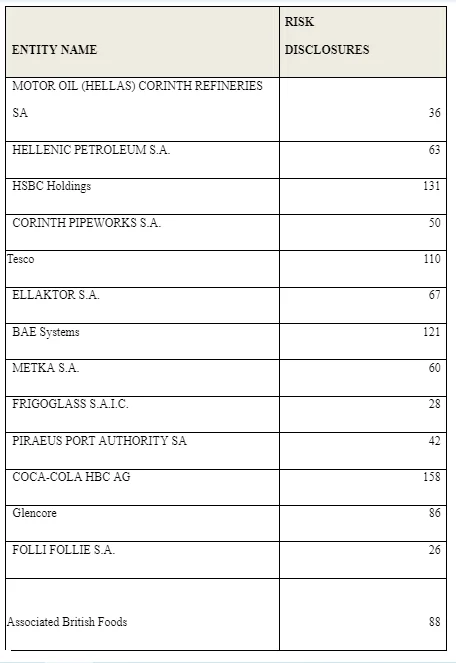

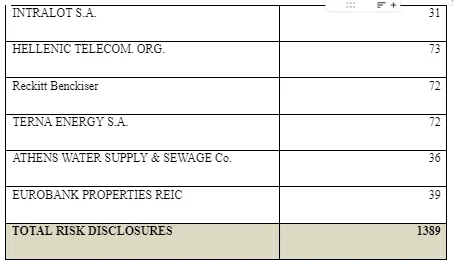

This section will give the results of the 20 annual reports analysed. The outcome of the study yielded the following results

The average number of disclosures in the 20 annual reports were 1389, it is also evident that the disclosure ranged for 26 to 158 per company. The company with most disclosures was Coca Cola, which confirms the assumption that larger companies are likely disclose more information as compared to smaller companies keeping all other factors constant. Besides, industrial firms are likely to disclose more information to its stakeholders as compared to non-industrial firms.

Discussion

The objective of the study was establish whether voluntary and mandatory disclosures presented various differences. The aim was to compare voluntary regimes and mandatory regimes using Greece as a case study for a mandatory regime in Europe. From the data collected, it was clear that risk disclosure majorly relied on the size of the company as opposed to the regulatory rules in a country. For example, Hellenic Telecom was only reported what was required by law, as compared to Coca Cola that reported its risks voluntarily. The difference between these disclosures could be attributed to the fact that Coca Cola is an established company as compared to Hellenic Telecom.

The hypothesis with use of risk ratio has been tested by various researchers. Only the risk indexed that were applied in the past studies have confirmed relationship between risk level and the risk disclosure such as rating models. The study revealed that monetary risks were more likely to be reported over non-monetary risks, which contradicts the findings of the previous studies. An explanation of this occurrence is the absence of qualitative risk disclosures form various annual reports and the evident unwillingness of directors to disclose various risks. In such an occurrence, companies majorly disclose some tables with financial data produced by the accounting departments to satisfy their obligations to their shareholders. Through a simple analysis, it is necessary to report that firms in mandatory disclosure do not use financial reporting tools as a framework to communicate to their shareholders, but majorly release their financial data and general company descriptions to satisfy the objectives of the government. However, companies that voluntarily disclosed their risks, did so at the interests of their shareholders and investors. Besides, companies preferred to disclose their previous risks to justify the capabilities of the managers and among other reasons. It is in this regard that Agyei-Mensah and Buertey,(2019) Revealed that companies under the voluntary disclosure are likely to disclose more future risks as compared to those under mandatory disclosure rules. The study openly revealed that Greek companies (mandatory disclosure) lacked the willingness and the incentive to disclose future risks.

Conclusion

In spite of various limitation of this study in terms of time and available data on the study and the aim of the study, the final results are insightful in drawing various conclusions and make various assumptions. Among the significant results of this study, Greek firms are mostly not familiar with risk reporting practices and at the same time there are various frameworks with regulations and are currently formatting. After such a discussion based on the emergent theories one can point out that small sized companies are likely not to disclose more. One method of enhancing risk reporting is to publish lots of information by improving wording at the same time.

References

Agyei-Mensah, B.K. and Buertey, S., 2019. Do culture and governance structure influence extent of corporate risk disclosure?. International Journal of Managerial Finance.

Anand, A. I. (2005, May). Voluntary vs mandatory corporate governance: Towards an optimal regulatory framework. In American Law & Economics Association Annual Meetings (p. 44). bepress.

Bagnoli, M., & Watts, S. G. (2007). Financial reporting and supplemental voluntary disclosures. Journal of Accounting Research, 45(5), 885-913.

Bischof, J., & Daske, H. (2013). Mandatory disclosure, voluntary disclosure, and stock market liquidity: Evidence from the EU bank stress tests. Journal of accounting research, 51(5), 997-1029.

Chalmers, K. (2001). The progression from voluntary to mandatory derivative instrument disclosures–look who's talking. Australian Accounting Review, 11(23), 34-44.

Crawford, E. P., & Williams, C. C. (2010). Should corporate social reporting be voluntary or mandatory? Evidence from the banking sector in France and the United States. Corporate Governance: International Journal of Business in Society, 10(4), 512-526.

Elshandidy, T., Fraser, I., & Hussainey, K. (2013). Aggregated, voluntary, and mandatory risk disclosure incentives: Evidence from UK FTSE all-share companies. International Review of Financial Analysis, 30, 320-333.

Emm, Ekaterina E., Gerald D. Gay, and Honglin Ren. "Corporate risk exposures, disclosure, and derivatives use: A longitudinal study." Journal of Futures Markets 39, no. 7 (2019): 838-864.

Fishman, M. J., & Hagerty, K. M. (2003). Mandatory versus voluntary disclosure in markets with informed and uninformed customers. Journal of Law, Economics, and organization, 19(1), 45-63.

GHOLAMI, JAMKARANI REZA, and ALI LALBAR. "Studying the Relationship between the Financial Incentives of Board Members and Disclosure of Corporate Risk, Emphasizing the Levels of Corporate Performance and Risk." (2018): 69-78.

Kalkanci, B., & Plambeck, E. L. (2020). Managing Supplier Social and Environmental Impacts with Voluntary Versus Mandatory Disclosure to Investors. Management Science.

Marzouk, Mahmoud. "A Framework for the Quality of Corporate Risk Disclosure." PhD diss., University of York, 2017.

Mbithi, Erastus, David Wang'ombe, and Tankiso Moloi. "Multi-theoretical perspectives for corporate risk disclosure: a literature review." International Journal of Critical Accounting 11, no. 2 (2020): 125-143.

Nelson, K. K., & Pritchard, A. C. (2016). Carrot or stick? The shift from voluntary to mandatory disclosure of risk factors. Journal of Empirical Legal Studies, 13(2), 266-297.

Polinsky, A. M., & Shavell, S. (2006). Mandatory versus voluntary disclosure of product risks (No. w12776). National bureau of economic research.

Saggar, Ridhima, and Balwinder Singh. "Drivers of Corporate Risk Disclosure in Indian Non-financial Companies: A Longitudinal Approach." Management and Labour Studies 44, no. 3 (2019): 303-325.

Sexena, Achintya Nath, Indrajit Dube, and Chandra Sekhar Mishra. "Corporate Risk Disclosure: a review." US-China Law Review (2017).

Shivaani, M. V., P. K. Jain, and Surendra S. Yadav. "Moderating Role of Governance in Risk-Disclosure Relationship." In Understanding Corporate Risk, pp. 223-249. Springer, Singapore, 2019.

Templ, Matthias, and Andreas Alfons. "Disclosure risk of synthetic population data with application in the case of EU-SILC." In International Conference on Privacy in Statistical Databases, pp. 174-186. Springer, Berlin, Heidelberg, 2010.

Vander Bauwhede, Heidi, and Marleen Willekens. "Disclosure on corporate governance in the European Union." Corporate Governance: An International Review 16, no. 2 (2008): 101-115.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts