Tesco's Strategic Financial Performance

Introduction

Tesco Plc is one of the leading retail companies with its headquarters in the UK. It is the third-largest retail chain company across the globe, and it is aggressively growing to market the leading position. Tesco Plc offers a wide range of products and services to customers to ensure better financial performances. There are several stakeholders involved with the operations of Tesco and also for the proper management of stakeholders for the business to be successful. Tesco has about 895 stores and around 50000collegues, with an operating profit of £186m in 2019 (Tesco Plc, 2019). Stakeholders are individuals and groups interested in the organization and have the power to influence the process of decision making. The stakeholders for Tesco include the government, investors, staff’s management, and customers. The objective is to demonstrate Tesco's strategic financial performances for five years.

Corporate Governance of Tesco plc

For the business to be successful and sustainable right corporate governance role is critical. The corporate board is responsible for maintaining high standards for the company and its management, thus augmenting the accountability of stakeholders. Corporate governance is a newly reviewed strategy which is to manage the risks and to respond to the changing events. The board of Tesco is taking measures to ensure high standards by leading the group performances and market environment (Tesco Plc, 2017). Culture plays a substantial role in creating value and taking the right measures and decisions based upon the behaviour for ethical leadership. Tesco Board is encouraging colleagues to improve the work environment of the business, thus increasing the percentage points by about 7pts. Proper succession planning is essential for the management to make correct decisions based upon the diverse talent pools. The intention is to ensure continuous quality in the management process to avoid the instability risks affecting the business performances. Tesco plc tends to promote diversity and ensure appropriate talent management for the future based upon succession planning (Tesco Plc, 2017). For the business to be successful and augment performance, risk management is part of the corporate governance so that the internal control system is effectively managed. The challenge is to protect the Tesco plc group from reputational risks and operational risks for better strategic objectives and opportunities. The engagement of stakeholders is the key to ensure financial performances and better business considerations. The management and compliance of corporate governances promote better standards and increases investors. The success of Tesco plc is based upon effective decision making and corporate governance.

Evaluating the five-year performance Of Tesco Plc

To determine the success of the business and to analyse the strategic policies in the future, it is essential to attain proper financial analysis. Tesco sales have improved across the globe in the last five years, and it is determined through the table below:

The financial strategy of Tesco is changing to satisfy customers and meet the core purpose. The group sales of Tesco plc in the year 2019 have increased by 11.5% to £56.9bn. The group operating profit has increased by 34% to £2206m and dividend per share by 92.3% to 5.77p in the year 2019. The performances are growing to create long term sustainable value. Tesco plc is passionate about serving shoppers better every day. Thus, group sales are £56883m in the year 2019. The strategy is to create value for customers; therefore, exclusively, it has about93% of products of customer likings. The total revenue of Tesco Plc has increased over the years, which is due to the increasing sales and income generation from business operations (Guo & Wang, 2019). The revenue is being determined to analyse the performances of the Tesco Plc for five years.

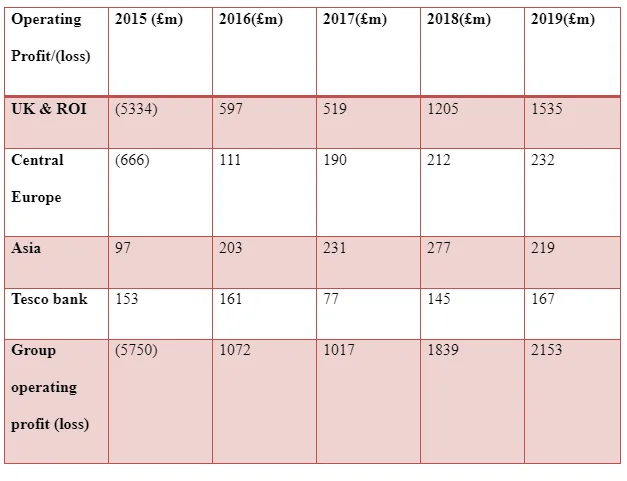

This implies that the company is improving its business activities, and income is increasing with the increase in sales. It is the total amount that is received by Tesco plc from its customers based upon goods and services. Based upon the interest coverage, it is noted that Tesco is taking measures to meet the financial obligations for the development of the business. The revenue and group sales state that the remuneration policy is valid; thus, it positively influences stakeholders (Tesco Plc, 2019). To determine the financial performances of the company, it is vital to evaluate and analyse the operating profit and loss, which is based upon the core business activities. The operating profit acts as an accurate indicator to analyse the business potential and its profitability. It is determined for the five years to analyse the trend of Tesco Plc through the help of the table below:

It is determined and analysed that performances of the company have increased over the last five years, which implies that Tesco plc has strong potential in the market with growth opportunities. From the analysis of the gathered data, it is determined that the profit and loss for Tesco plc have increased over the year. The position of Tesco plc in the year 2015 was not good, but with the management of activities and strategic financial moves, the company ensured profit over the years.

To attain a better understanding of the financial performances of the company, it is vital to analyse various other statistics, which include the diluted earnings per share of the dividend per share policy.

Looking for further insights on Financial Performance Evaluation of Alumasc Group Plc? Click here.

Dividend Policy and Shareholders Return

Tesco Plc pays dividends as interim and final years to analyse the growth pattern and yields. The increase in the dividend policy and relatively low yield impacts the business. Tesco plc can attract investors with long term investment plans for high earnings. For capital gains, the capital in the market is invested fort positive net present values. This strategic financial planning is useful for Tesco plc with a lower yield, and the dividend has significant investments for diversity. The dividend per share for the five years is depicted below:

The share price also impacts financial performances and influences the earnings per share. AS per the Modigliani and Miller Theory, whatever a dividend is earned by the company when it pays more profits, the price appreciation is less, and shareholders return. Tesco is one of the market leaders are ensures stability even after facing a crisis. To analyse the performances of the business and to attain a better understanding of Tesco plc, the Return on capital employed (ROCE) is evaluated for five years.

The representation of shareholder return acts as a tool to determine the performance of the company with its competitors. In this case, as per the financial analysis, it is noted that the achievements of Tesco have improved over the years. It is a financial gain that helps the company to expand its business and ensure long term sustainability.

Capital structure

Capital structure states the combination of debt and equity that is being used by the company. It is essential to analyse the capital structure to understand the use of finance and activities of the business for growth. From the analysis, it is noted that the gross profit of the Tesco plc has increased over the years from 2015 to 2019 due to the capital structure. The EPS has also increased from -70.24p in the year 2015 to 13.55p in the year 2019, thus increasing the confidence of the existing investors and helps to attract potential investors. The decrease in the net gearing is also vital to determine the growth prospects of Tesco plc. The net gearing for the years is determined below:

Thus, from the financial analysis and evaluation of Tesco plc, proper decision making can be taken with appropriate financial performance analysis.

Conclusion

The Tesco plc faces competition across the globe to maintain market share and growth. Tesco has a low risk in the business with lowered gearing and proper valuation of the shareholder returns. The performances of Tesco are improving with greater effectiveness and are attracting investors. The company is strategically taking measures to improve its finances and growth through diversification.

References

Guo, L. & Wang, Z., 2019. Ratio Analysis of J Sainsbury plc Financial Performance between 2015 and 2018 in Comparison with Tesco and Morrisons. American Journal of Industrial and Business Management, Vol. 9, pp. 325-341.

Kochnev, M., 2015. Companies’ mergers and acquisition in example of Walt Disney Studios and Pixar. Faculty of Economics and Administration, pp. 1-111.

Sharfman, B.S., 2017. Shareholder Wealth Maximization and Its Implementation Under Corporate Law. Law Review, Vol. 66, Iss. 1, pp. 1-44.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts