Investment Portfolios in British Petroleum and Next Plc

Company Background

In the context of investment planning, risk and return are being termed as important elements that influence the investment decisions of different investors and the selection of investment portfolio. This report evaluates the total rate of return on the investment portfolio with reference to different risk factors (Kallberg and Ziemba, 2013). In this regard, this report is going to evaluate the investment portfolio of two companies i.e. British Petroleum and Next Plc. The British Petroleum is a leading UK-based brand that manages several businesses within the oil and gas industry of the London, England. In the context of oil and gas industry, it is termed as the one of biggest firm of the world. It is listed on the FTSE 100 Index company. On the other hand, the Next Plc is being addressed as a leading multinational retail chain of the UK. The offers a variety of products and services associated with clothing, footwear and home care. For students who are seeking assistance with their dissertations related to topics such as investment planning, risk, and return, UK Dissertation Help can provide the best support.

Section A: Two asset portfolio

For carrying out the risk and return assessment, an investment portfolio is being categorised in two types of stocks that include British Petroleum and Next Plc. In this context, the concept of diversification has been emerged as a critical technique in which investors diversify their investments (Liesiö and Salo, 2012). It plays a critical in maximisation of the return and minimisation of risk factors within financial planning and investment management. In this context of the contemporary investment decision, an individual investor has to consider several risk factors that is known as systematic or market risk. It includes change in the inflation rate, exchange rates, political stability, and interest rate.

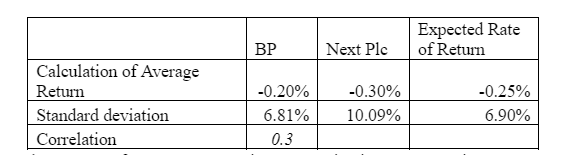

In the context of present case, an investor maintains 50%-50% investment two types of stock. Therefore, the weight of the investment in British Petroleum (BP) and Next Plc is respectively 0.5 and 0.5. In the regards, the evaluation of the average rate of return of the stock data of BP and Next Plc from 1st July 2015 to 30th June 2020 has been floated near -0.20% and -0.30%. The overall value of the expected rate of return of the investment portfolio is near to -0.25% (BP p.l.c. (BP.L), 2021) (NEXT plc (NXT.L), 2021).

). As per the above table, both stocks are offering negative returns. The relations between the average of return have been recorded to near 0.3. The comparison of average rate of return of the individual stocks with expected rate of return of the overall investment portfolio has disclosed that the total return of the overall investment portfolio is offering better returns. It plays a critical role in lowering the risk in overall investment planning. In this context, ……. () stated that the diversification of the investment supports the investors in lowering the up downs towards a certain investment portfolio. This is one of the major benefits of diversification. In this context, A well-diversified investment portfolio seems an effective for absorbing the shocks during a market downturn. The risk is well-spread out when the business entity is managing its investment in different asset classes (Guo and Sun, 2012). The investment product diversification plays a critical role in managing the risk and return. This is because it is termed as an important benefit of the product diversification. When two portfolios are offering same yield then a diversified investment portfolio will take lesser risk than a concentrated one. The above table determines the investment in British Petroleum contains the low risk, but it offers low returns. On the other hand, Next Plc is offering the high rate of return but contains high risk (Zhang, Li and Guo, 2018). Overall, the consideration of diversified investment portfolio will support the investors by improving the earning capabilities and lowering the risk factors. In the present case, the investment portfolio contains two stocks of different industries one is associated with the oil and gas, another investment option is associated with retail sector. Therefore, it provides stability and peace of mind so as the diversification strategy provides a significant advantage to investors because it cuts out the emotional quotient from investments, essential and other for attainment of desired goals.

Section B: Optimal portfolio

In the context of investment planning and decision making, it has been perceived by the investors that more risk offers the more returns. The theory behind the Efficient Frontier and Optimal Portfolios determines that an appropriate investment portfolio contains an optimal combination of risk and return. The theory relies on the certain assumption that investors prefer portfolios that generate the most substantial possible return with least risk on the investments (Bertelli and John, 2013). In this regards, different combinations of assets facilitate different levels of return. The optimal portfolio does not pay extra attention on the investments that would offer either high expected returns or low risk. It mainly focuses on the balance stocks that are carrying the best potential returns with appropriate level of acceptable risk. In the current investigation, construction of different portfolio is carried out below with reference to average annual stock returns of British Petroleum and Next Plc and standard deviation of all portfolios is also being extracted to evaluate the risk in investment. In this context, the proportion of first stock is associated with range from -100% to 100% with an increment of 10%.

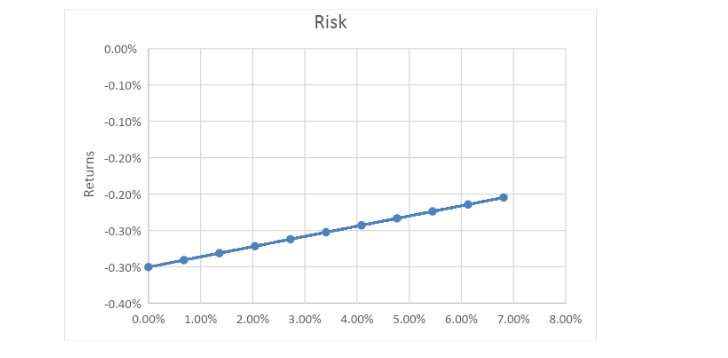

The above table provides a great support for setting-up the efficient frontier. The Efficient Frontier assists investors for setting of optimal portfolios that give the highest possible expected return within certain level of risk or the consideration of the lowest risk for a desired expected return. In the present case, the standard deviation of 6.81% and 10.09% has been taken to evaluate risk level in different proportion of portfolios (Teller, 2013). For this model, the standard deviation of the return on the asset has been considered as an important risk measure. Lower covariance between portfolio securities determines the smaller portfolio standard deviation. Moreover, the optimal portfolios comprise the efficient frontier that could be associated with the higher degree of diversification. The compounded annual growth rate is being perceived as the common choice for the return component but the annualized standard deviation represents the risk factors (Hilal, Poon and Tawn, 2014). In the context of efficient frontier, the curve is essential in shows that how diversification in investment portfolio improves the risk/reward profile for the investor and it could play a key in long term investment planning. It shows that the relation between risk and return is non-linear.

In the present case, the above table and diagram show stability in risk and return. The level of risk has recorded at the highest level when the proportion of BP is high within the total investment portfolio. However, the increase in weight of the stocks of the Next Plc in total portfolio reduces the risk factors along with average rate of return. As per the data, the investor should have to maintain the high proportion of investment in Next Plc for development an optimum portfolio that would offer high return in low risk (Jiménez and et.al., 2020). In this context, weight of BP and Next Plc should be near to 0.4 and 0.6 respectively in the investment portfolio that would the average returns of -0.26% at the risk of 2.72%. The above table shows that this investment portfolio is offering negative return in all possible combination but investors can reduce the risk factor by lowering the investment in British Petroleum.

Dig deeper into Conflicts in Investment Banking with our selection of articles.

Section C: Cost of capital

The weighted average cost of capital (WACC) plays a critical role in business planning and investment decisions because it is worked as a financial ratio that calculates a company’s cost of financing and acquiring assets with reference to the debt and equity structure of the business. Moreover, it seems a great tool to measure the weight of debt and to determine the an appropriate cost of borrowing money. In this context of contemporary financial and investment planning, the cost of capital plays a critical role in determining the company ability to raise debt capital by measuring the solvency position of the business entity. In the financing decisions, management typically uses this ratio for deciding whether the company should use debt or equity to maintain the availability of finance new purchases (Lin, Watada and Wu, 2013). This ratio is very comprehensive because it provides the average of the expenditure made by an organization for raising all types of capital to attain the distinct business requirements that include long-term debt, common stock, preferred stock, and others. It is also extremely complex tool because an organization or investors has to consider multiple variable in determine the cost capital. In the assessment of cost of capital, the identification of the cost of debt seems a simple approach. Bonds and long-term debt are issued with stated interest rates that can be used to compute their overall cost. On the other hand, the management finds some problems in assessment of the cost of equity because the issuance of stock is free to business entity. This is because an individual invests in certain stock with reference to certain rate of return and risk factors.

In the context of investment planning and corporate decision-making process, the cost of equity is the amount of money that an organization has to spend for attainment of interests such as required rate of return. It plays a critical role for keeping the stock price steady. As per the above table, cost of equity is being calculated with reference to three basic components such as risk-free rate, market risk premium, and beta value (Average market risk premium (MRP) in the United Kingdom (UK) from 2011 to 2020., 2020). The risk-free rate determines the minimum rate of returns provided by government securities to investors. The beta value of systematic risk and volatility within a certain investment option. Moreover, the concept of the market risk premium determines the additional returns that must be provided to investor for taking a certain level of risk in investment. As per the table, the calculation of cost of equity capital of two companies has determined that the cost of equity capital of BP and Next Plc is respectively 4.64% and 6.51% (United Kingdom Government Bonds - Yields Curve, 2021). Therefore, it can be stated that the Next Plc is offering the higher returns to investors so as the cost of equity of Next Plc is relatively high. Therefore, the investment in Next Plc offers the higher returns to investors.

Overall conclusion

As per the above assessment, this investigation concludes that an individual investor has to consider several tools and elements for the selection of an appropriate investment portfolio such as risk and return assessment, optimum portfolio, diversification and others. These measures are playing important role in selection of appropriate investment portfolio with consideration of different stocks. The above assessment concludes that the investment portfolio of the stock of British Petroleum and Next Plc would offer negative returns because both companies have offered inappropriate returns to investors within the last 10 years. In this regard, the concept of optimal portfolio provides a great support in maximising the returns and minimising the risk for the development of appropriate investment portfolio.

Take a deeper dive into Implications For Borac Plcs Subsidiary with our additional resources.

References

Average market risk premium (MRP) in the United Kingdom (UK) from 2011 to 2020. (2020). [Online]. Accessed through:

Bertelli, A. M., and John, P. (2013). Public policy investment: risk and return in British politics. British Journal of Political Science, 741-773.

BP p.l.c. (BP.L). (2021). [Online]. Accessed through:

Guo, H., Sun, B., Karimi, H. R., Ge, Y., and Jin, W. (2012). Fuzzy investment portfolio selection models based on interval analysis approach. Mathematical Problems in Engineering, 2012.

Hilal, S., Poon, S. H., and Tawn, J. (2014). Portfolio risk assessment using multivariate extreme value methods. Extremes, 17(4), 531-556.

Jiménez, I., Mora-Valencia, A., Ñíguez, T. M., and Perote, J. (2020). Portfolio risk assessment under dynamic (equi) correlation and semi-nonparametric estimation: An application to cryptocurrencies. Mathematics, 8(12), 2110.

Kallberg, J. G., and Ziemba, W. T. (2013). Comparison of alternative utility functions in portfolio selection problems. In HANDBOOK OF THE FUNDAMENTALS OF FINANCIAL DECISION MAKING: Part I (pp. 389-408).

Liesiö, J., and Salo, A. (2012). Scenario-based portfolio selection of investment projects with incomplete probability and utility information. European Journal of Operational Research, 217(1), 162-172.

Lin, P. C., Watada, J., and Wu, B. (2013). Risk assessment of a portfolio selection model based on a fuzzy statistical test. IEICE transactions on information and systems, 96(3), 579-588.

NEXT plc (NXT.L). (2021). [Online]. Accessed through:

Teller, J. (2013). Portfolio risk management and its contribution to project portfolio success: An investigation of organization, process, and culture. Project Management Journal, 44(2), 36-51.

United Kingdom Government Bonds - Yields Curve. (2021). [Online]. Accessed through:

Zhang, Y., Li, X., and Guo, S. (2018). Portfolio selection problems with Markowitz’s mean–variance framework: a review of literature. Fuzzy Optimization and Decision Making, 17(2), 125-158.

Continue your journey with our comprehensive guide to Information Systems in Accounting and Finance.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts