PepsiCo Inc.: A Comprehensive Financial Analysis

Introduction

The stock exchange is being developed as the most well-known alternative of speculation through which an individual can deal with its venture inside an association. With regards to contemporary venture condition, the money related execution of an organization assumes a significant job in impacting the market costs of offers (Bhowmik and Saha, 2013). This report will examine various parts of monetary execution investigation through which an individual financial specialist can settle on fitting venture choices identified with 'purchase, sell, or hold' (James, Leavel and Mainam, 2002). Moreover, the study assesses the monetary presentation of PepsiCo Inc. as securities exchange patterns, fiscal reports, and proportions investigation and furthermore applies three equity valuation strategies to decide the estimation of the business element. PepsiCo Inc. is the main American Company which deals into snacks, food, and beverages. PepsiCo Inc. has its interest in the manufacturing, marketing, and distribution of grain-based snack foods, beverages, and other products.

Overview of Financial Performance of Tesla Inc

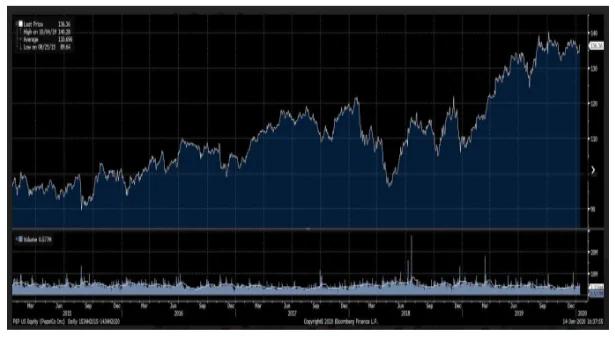

Share Price

As per the above graph, the stock price of PepsiCo Inc has seen a growth over the period of time. The growth was slower in the year 2015, and at the end of 2017, it sees a decline in the growth. However, from early 2018, the company again regain its performance and once again its share price starting rising with a better pace as compared to the year 2015 and 2016. This clearly shows that brand PepsiCo Inc. has gained respect in the market and among the stakeholders. This is the main reason that investors are always ready to invest in this company which has helped PepsiCo several times to sustain even in bad times. Thus, it can be said that this stock is a good option to have in an investor’s portfolio (PepsiCo, 2020).

Evaluation of Current Market Statistics

In 2014, the revenue of PepsiCo Inc was $66.7 billion, which was reduced to $62.8 billion in 2016. However, with the passage of time, the revenue of PepsiCo Inc has been slowly inching back up. Net income has been a little more sporadic over the past five years. In 2018, the company recorded a 2% growth in its sales from the last year, and its sales reached $64.7 billion. The main reason behind this growth was due to Frito-Lay North America, which saw volume growth in variety packs and the Doritos brand, and Europe Sub-Saharan Africa, which saw volume growth in both snacks and beverages in Germany, Poland, and the Netherlands, among a handful of other areas. On the other hand, in 2018, Quaker Foods experienced a decline in sales in North America, Asia, the Middle East and North Africa. In 2018, there was an increase of $112 in its cash which goes to $10.8 billion. Cash from operations contributed $9.4 billion to the coffers, while investing activities added another $4.6 billion, mainly from short-term investment maturities. Financing activities used $13.8 billion for payments of long-term debt, dividends to stockholders, and stock repurchase, among other activities.

Looking for further insights on Management Decision-Making? Click here.

Assessment of the Last Five Years Financial Performance

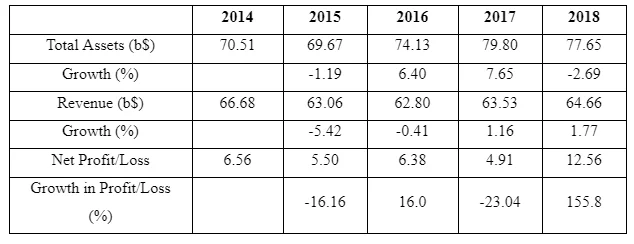

Key Elements of Financial Statements

The above table of key elements of financial statement shows that the total assets of the company have seen a gradual increase over the five years. This means the company is making efforts in investing in assets. However, despite investing in assets, in 2015 and 2016, the company was not above to generate enough revenue, showing incapability of its assets to generate revenue. However, after 2016, once again, the company has reported positive growth in its revenue. Similar trends were seen in the profits of the company. In certain years PepsiCo Inc has booked profits and in others, it has reported loss.

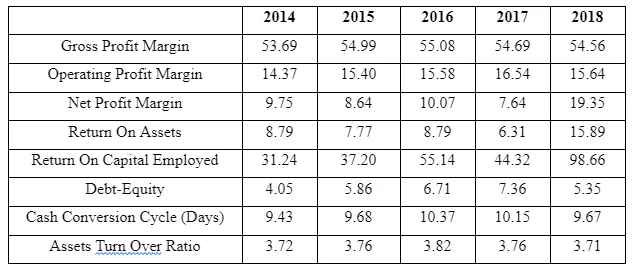

Key Financial Ratio

The gross profit margin of the company was more or less stable in the last five years, showing that in spite of market fluctuations and changes in prices of its raw material, PepsiCo was able to maintain its gross profit margins (Keller, 2011). Same is with the operating margins; the company is able to maintain its operating margins near about 15%. Its shows that the company has proper control over its assets and other resources and its assets and resources are optimally utilised (Bravo, 2007). Also, the company has proper control over its operating expenses. Finally, the net profit of the company has shown tremendous growth in 2018, this is due to the reasons that the company was able to reduce its loans and borrowing (Brigham and Ehrhardt, 2011). As a result, it had to pay less in the form of interest. This is due to the reasons that its assets started to perform well, which can be seen from its improved return on assets. ROA was significantly increased in 2018 as compared to the previous four years. The same trend was seen in return on equity (Broadbent and Cullen, 2012). The company has delivered handsome ROE in 2018. The main reason behind this is the decline in the debt-equity ratio. As debt capital was reduced, the company has to incur less in interest and this had a positive impact on ROE of the company (Correia et al., 2012). Finally, a reduced cash conversion cycle in 2018 as compared to 2017 also shows that the company was able to generate cash more rapidly in 2018 as compared to 2017. As its turnover ratio was reduced from 10.15 to 9.67, it has enough cash in hand to meet its day to day operations, and thus it does not have to seek loans for maintaining its working capital (Shim and Siegel, 2008). The asset turnover ratio of the company was also stable, showing that all its assets are optimally utilised. It also shows that the company is investing in the correct assets. That is, the management knows how much and on which asset it needs to invest in order to generate more sales and profit (James, Leavel and Mainam, 2002). Thus, overall the financial performance of the company is quite stable in the last five years, in fact, the company is reporting growth at most of the financial parameters.

Looking for further insights on Financial Analysis and management? Click here.

Application of Equity Valuation Methods

i. Net Assets Value (NAV)

The net assets value can be considered as an important tool to determine enterprise value. This is information assists an external investor in the evaluation of the financial strength of the business entity (Correia et al., 2012). In the present case of PepsiCo, the net value of assets in the balance sheet of the company is $77648 Million. This information assists investors in analysing the organisational efficiency of business entity.

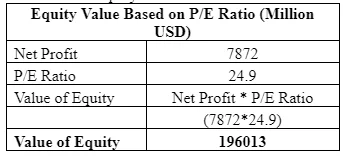

ii. Equity Value Based on P/E Ratio

P/E ratio plays a critical role in the assessment of the relative value of an organisation’s shares so as this tool is being termed as a great approach in the evaluation of the market value of company’s equity (James, Leavel and Mainam, 2002).

As per the above calculation, the value of PepsiCo’s equity capital is $196013 Million.

Conclusion

As per the above assessment, different equity valuation methods have found very effective in the investment decision of individual shareholders of PepsiCo. Further comparison of current stock market trends and financial performance or profitability of the company has concluded that PepsiCo has maintained stable growth in the profit margin and share prices along with appropriate value equity capital. Therefore, existing shareholders of PepsiCo should hold their investment. Apart from that, a new stock market investor can consider the shares of PepsiCo as an investment option because PepsiCo has maintained strong financial performance in terms of assets value, the high value of equity capital and profit margin.

References

Andreas Keller., 2011. Finance & Financial Management: Managing Financial Resources. GRIN Verlag

Bhowmik, K. S. and Saha, D., 2013. Sources of Finance. Financial Institution of the Marginalized India Studies in Business and Economics. pp61-71.

Bravo, G. M., 2007. Prior Ratio analysis procedure to improve data envelopment analysis for performance measurement. The Journal of the Operational Research Society. 58(9). pp. 1214-1222.

Brigham, F. E. and Ehrhardt, C. M., 2011. Financial Management: Theory and Practice. 8th ed. Cengage Learning.

Broadbent, M. and Cullen, J., 2012. Managing Financial Resources. Routledge.

Correia, C. and et.all., 2012. Financial Management. 6th ed. Juta and Company Ltd.

James, J., Leavel, H. W. and Mainam, B., 2002. Financial planning, managers, and college students. Managerial Finance. 28(7). pp. 35-42.

Shim, K. J. and Siegel, G. J., 2008. Financial Management. 3rd.ed. Barron's Educational Series

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts