Management Information Systems in Deutsche Bank

- 15 Pages

- Published On: 22-11-2023

Introduction

The Management Information System has always been helpful for organizations. The MIS includes the study of the innovative technology, organization and people and the interrelationship between them (Nambisan et al, 2017). The MIS workers assist the organizations to extract the maximum advantage from investment in the business execution, making it crucial for businesses that to by seeking business dissertation help. The research would reveal the work process of the Deutsche Bank, role of the data warehousing, the advantages and the disadvantages of the systems, the code of conduct of the bank and so on. In accordance with Amato et al.(2019), the analysis on the work of the different sectors of the bank with the interconnections of the divisions and their impact on the growth of the organization is discussed vividly. It would also summarize the ethical, legal and professional implications associated with information handling and security.

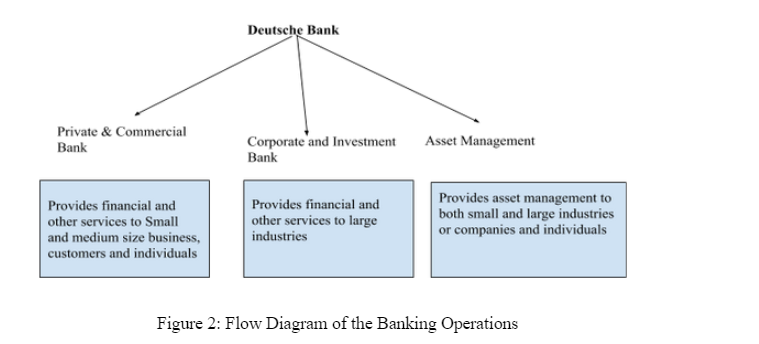

Description of how the different business divisions of Deutsche Bank are interconnected

Different division of business in a bank usually interconnected with the help of cloud platforms and chain of network mainly associated with the global operating network. In other words, banking sector in respect of corporate and investment bank is associated for the purpose of having suitable functional areas like global banking and market flow and channel (db.com. 2020). In other words, the bank works in a matrix organisational structure with its global operating branches. Below are the organisational chart and the process of data flow within global operations of the bank.

Considering this diagram, it throws on the strategic ways that the bank works from one of its units to the other. As per db.com (2020), it works in four of its divisions from its corporate Bank, to its investment bank, private and Asset Manager DWS. In this entire flow, it can be drawn and focused below:

The main aim of all the three units of Deutsche is to develop and offer financial and other services to their respective clients and customers by improving or outstrip the infrastructure effectively by introducing new technologies and using digital gadgets. In the present era new technologies and modernise digital gadgets are used to increase efficiency and flexibility to build better customer relationships in banking sectors. Deutsche Bank fails to adapt digitally remarkably whereas other banking and financial sectors modernize with the technological methods and services (dbresearch.com, 2020). The bank has invested on new technologies to improve their product service, hoping to solve bank problems but efforts have proved unsuccessful. However, the implementation of new technologies did not work out and the bank suffered from regionalizes system and procedures, poor usage of data and IT reports and above all problems with traditional software.

The dependence of each business units on each other

On the other hand, Deutsche bank has opened five innovation labs in different parts of the world. The innovation labs have been proved to be useful for improving and developing the system and procedure of the bank. The first innovation lab opened in Asia Pacific by Deutsche bank was in Singapore (dbresearch.com 2020). However, the bank could increase their efficiency and productivity by implementing a standard IT structure, improve customer experience through digital application and taking the advantages of innovation labs and keep on expanding in other cities of the world.

Apart from that, the products they are dealing with are mainly the retirement planning, securities, loans and deposits. Corporate finance ensures the delivery of the entire range of financial products and services to the industries and sectional team. The wide range of financial market products are bonds, equities and equity related products, money market, foreign exchanges and many more. The asset management helps to preserve and increase wealth among the individuals and institutions both (companieshistory.com 2020). They mainly deal with the selection of finest products and solutions of wealth and resource or asset management means. From the above study, it has been identified that Deutsche bank has taken steps to improve their IT structure but have failed in various aspects like streamlining the process and improving customer relationship with implementing the digital gadget (ft.com 2019). Hence, it can be evident from this perspective here that the bank can even develop and well settle itself in all its divisions.

Reasons for this Structure:

The main sources of revenue for Deutsche Bank are generated from the three business units. Investment banking is the core business of Deutsche Bank. Through this trading bank earns revenue in the form of commission or brokerage. There are some other ways from which banks generate revenues like demand drafts, guarantees and also from the transfer of funds utilized for overseas transactions via wire (companieshistory.com 2020).

The bank earns revenue from mortgage 5%, capital market or asset management 10%, loan fees 5%, services charges 10% and from other 5% and rest 65% from interest- SNL and Company document; Deutsche Bank (May 2011). The Private and commercial bank revenue growth up to 2.2 billion euro every year, Asset Management revenue has a growth of 9% and Investment banks revenue was driven up by 18% due to the growth in foreign exchange, currencies and fixed income (dbresearch.com 2020).

Looking for further insights on Professional IT Support for Database Management at Punthers? Click here.

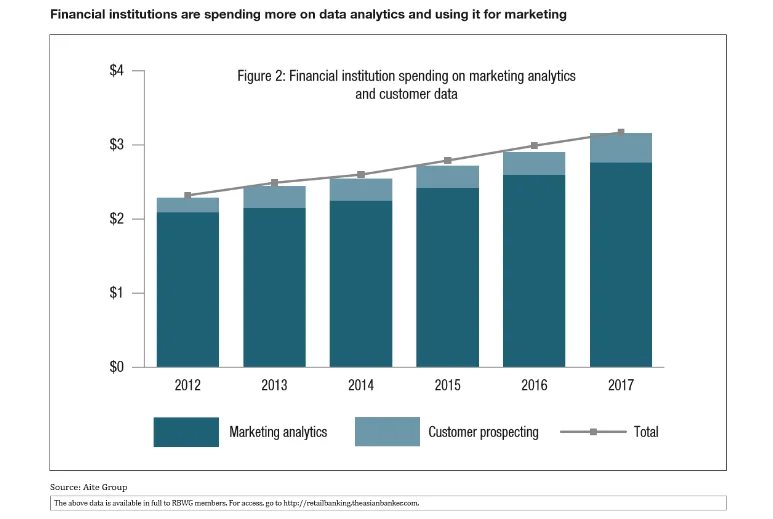

The importance of maintaining marketing strategy for a bank has an impact on its performance and it also stimulates the turnover year after year. The Deutsche bank plays a vital role for its groups. It is responsible for economic analysis and advises its stakeholders, customers and other business units (db.com 2019).The bank has been facing losses and stock decline for the past few years. This is not only due to economic endorsement and regulations that has imposed on the company but also due to companies’ failure to adapt digital trends and mismanagement in the IT department. To keep a foothold in the market of banking and services, the bank has invested and is robust on the practice of digital gadgets and new technologies (db.com. 2020). Deutsche Bank has a great reputation for their commercial banking activities apart from investment banking and asset management. So, the main objective for a bank in running this kind of business structure is to have a successfully engaging and coordinated people working in a chain of matrix structure so that their customer can be satisfied, as per customised choice and ways.

Describe the different forms of data and role of data warehousing with its advantages and disadvantages:

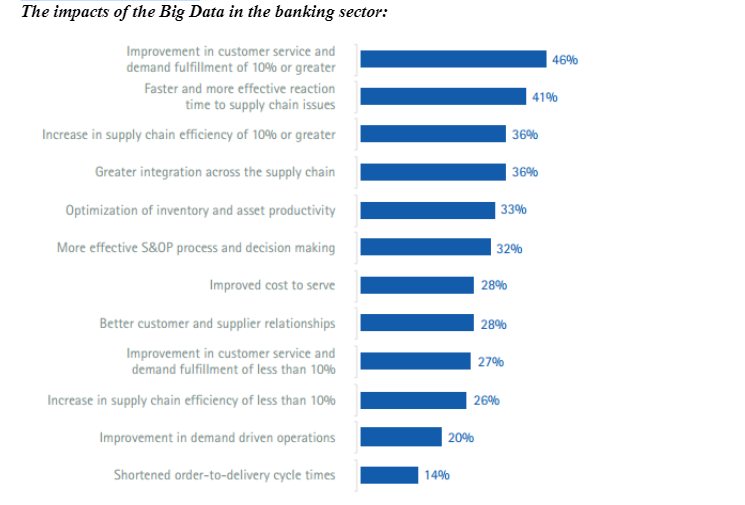

With the transformation of work from manual to digitization it has been observed that the whole system has changed the work pattern. The banking sector too has developed a lot by embarking the path to digitally transform their organization for betterment (Nagy et al.2018). Moreover it has been recorded that the Deutsche bank has equipped the big data to actually digitalize the work processes and become more effluent and at the same time augment client experience as a banking partner. The storing of the data for the future use and execution of the proper business working with the help of digital technologies has improved the work policies of the banking sectors (Madakam et al.2019). The roles of Data Warehousing in the Deutsche Bank to uplift the working process are as follows:

Objective of the data warehousing:

The main objective of data warehousing lies in making the most profitable customers and providing them with the best services through bank loans with respect to the account balances, providing them with as many services as possible and aiming to be the most profitable branch.

How is data warehousing helpful:

Understanding the needs of the customers and providing the bank with the details of their customers to access accordingly to enhance profitability (Ramanathan et al.2017). This system would be helpful in a continuous data flow and keep track of the needs and the trend of the market to supply with the required product. The collection of data of various customers helps in accessing and managing the customers in the future with perfection. Online analytical process function helps the bank as well as the customers to know about the status of their account very easily. Data warehousing further allows elevated management of customers' profiles and proper plans to enhance the profit margin by the protection of high services to them (Buhalis and Leung.2018). It further initiates diversified customers reports as well as the data of products services and the branches.

Big Data Solution:

The big data plan became apparent as a term to recount huge datasets that are not possibly captured or stored in the older version of work (Willmott.2016). The uses of the new and latest technologies in the work and up bring the banking business by solving the issues and helps in many other banking related works and functions. The big data plan of the Deutsche Bank has been a commanding way of continuing the good business as data flows from all the corners and gets accumulated in one spot resulting in the bank to work effluent satisfying its customers to the fullest (Fang and Zhang.2016).

The big data plan has been useful for the bank to accumulate and bring the necessary data in one system to enhance the working agenda and satisfy the customers (Groves et al.2016). It has been recorded that the data analysis of the Deutsche bank has driven the bank profit margin at a higher level.

A greater scope of Information: The big data solution would bring a greater scope of information for the Deutsche banking sector to amplify and strengthen the position in the market and hold a lot of customers who would rely on the services provided by the bank (Anagnostopoulos.2018).

New kinds of data and analysis: The new kind of services that would be offered by the bank would encourage its customers as the whole system would be secured and confidential. The online survive entails trust and security to the customers as they become loyal customers and up brings the profit margin of the bank.

Real time information: The big data solution of the Deutsche bank helps to store the data and information for future use and influence the banking business. The real time information of the customers and the banking execution help the smooth running of the banking progress.

Data influx from new technologies: The inward flow of data and information with the use of new technologies would help the bank to hold the necessary way of executing the work.

Modern media: The modern media would be helpful in accumulating the data and restoring them for future use for the bank.

Large volumes of data: The innovative technologies of the big data solution would restore large volumes of information and data for future use and for the growth of the business by influencing the customers to come forth and open accounts in the bank.

The latest buzzword: The big data solution had been the latest buzzword as it had helped the banking sector to work with bigger numbers of input and information at ease without any pitfalls and glitches (Meredith et al.2017). It has excited the customers as they too get easy access to the system and reliability of strong security systems.

Data from social media: The data from the social media also help in the upliftment of the business for the Deutsche bank by attracting new customers and new markets.

It has been seen that the system though is very helpful for the banking sectors has many advantages and drawbacks:

Advantages

- Time reduction: Data analysis helps in the less time consumption of time. The time reduction helps to find the flaws in the work and rectify it accordingly.

- Improves efficiency: Data analysis helps the bank to improve work efficacy. This in turn improves the profitability of the banking sectors.

- Foster competitive pricing: The data collection and analysis helps to foster competitive pricing in the Deutsche bank.

- Better sales insight: Big data analysis helps in the better sales insight of the Deutsche bank for the future as they can calculate the sale percent through the data collected (Grover et al.2018).

- Fraud detection: the big data solution helps in to collect data in a vast method and work in accordance with the data analysis. New and improved technology implication in the banking sector helps to detect fraud and recover the data and save it in a secured way.

- Understanding the market condition: The data collected succours the Deutsche bank to understand the market and its customers (Pfeiffer et al,2016). The way to deal with them and assist with services that would attract them and be a part of the renowned bank.

Disadvantages

It is a true fact that everything comes with a positive and a negative side. The negative side dives an adverse effect on the working of the Deutsche Bank.

- Need for talented people: If the banking operations are not done by talented people then it would lead to malfunctioning of the whole work. As the data analysis work is a critical job and execution needs to be done by talented people to avoid mistakes that could result in the downfall of the banking business.

- Incompatible tools: The tools that are used needs to be more advanced to execute the work in a smooth going. So incompatible tools should be replaced with the new advanced and innovative tools.

- Cost issues: The implementation of the new technologies could lead to the cost issues which would be a disadvantage for the bank as a whole (Guo and Liang.2016).

- Security and privacy concerns: The main disadvantage is the concerts for privacy. If the security of the data collected is not strong it would result in the loss of data and a matter of disbelief would grow in the customers losing them and the downfall of the banking business (Hughes et al.2019).

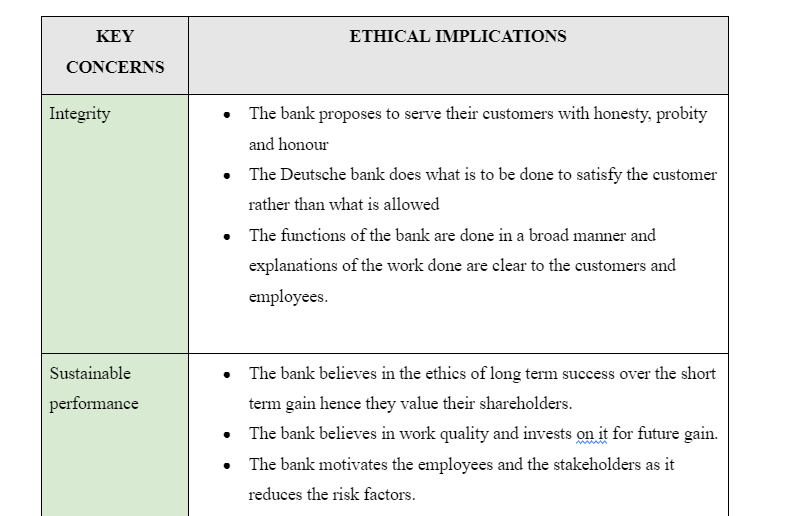

Latest report of the Deutsche Bank’s (Code of Conduct)

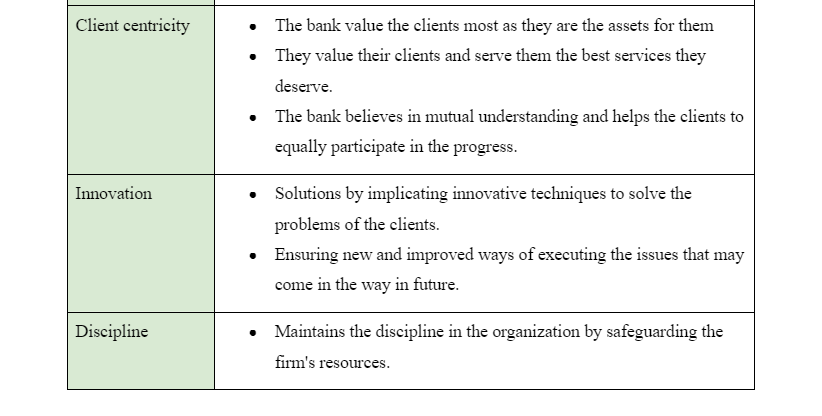

The code of conduct of the organization focuses on the sets of rules and regulations that they have to follow to maintain the decorum of the work environment (Elsiger.2017). The code of conduct is very crucial for any organization as it gives detailed information of the duties, responsibilities and rules that an individual or the whole organization has to follow. The Deutsche bank to earn the trust of the client, customers, investors, regulators and each other performs the work with honesty and probity (Kane.2020).

For the bank maintaining the code of conduct is a crucial part as they believe that this would lead to their economical and societal progress.

The new GDPR data protection legislation

Talking of the GDPR data protection legislation it was created and delineated to protect the data and maintain privacy so that it does not get distorted easily.

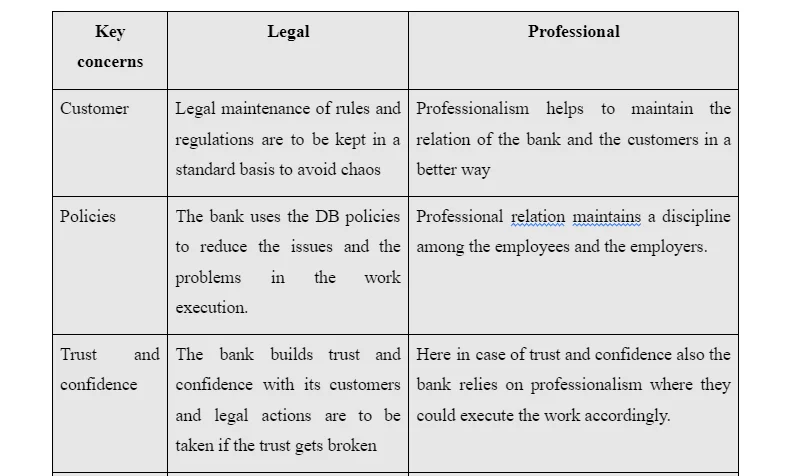

Key concerns of the Deutsche bank’s legal and professional implications: The table below shows a view of the legal and the professional implications of the Deutsche bank:

Conclusion

The whole study revolves around the facts and the facets that the Deutsche bank performs as a renowned bank. The ways it executes its works and gets it done with a smooth finish is commendable. The code of ethics and the legal rules implicated in the functioning is also given a vivid description. Hence, it brings into fact the advantages and the disadvantages it faces while data analysis and the ways how it overcomes from such a situation.

Continue your exploration of Management Information and Costing with our related content.

References

Anagnostopoulos, I., 2018. Fintech and regtech: Impact on regulators and banks. Journal of Economics and Business, 100, pp.7-25.

Buhalis, D. and Leung, R., 2018. Smart hospitality—Interconnectivity and interoperability towards an ecosystem. International Journal of Hospitality Management, 71, pp.41-50.

companieshistory.com 2020. [Online] https://www.companieshistory.com/deutsche-bank.html [Accessed on 5th Dec 2020]

D'Amato, D., Korhonen, J. and Toppinen, A., 2019. Circular, green, and bio economy: how do companies in land-use intensive sectors align with sustainability concepts?. Ecological Economics, 158, pp.116-133.

db.com 2019. [Online] https://www.db.com/ir/en/download/Deutsche_Bank_Annual_Report_2019.pdf [Accessed on 5th Dec 2020]

db.com. 2020. [Online] https://www.db.com/careers/en/grad/divisions.html[Accessed on 5th Dec 2020]

dbresearch.com 2020. [Online] https://www.dbresearch.com/PROD/RPS_EN-PROD/Deutsche_Bank_Research__economic_cyclegrowth_trends_economic_policy/RPSHOME.alias [Accessed on 5th Dec 2020]

Esliger, J.R., 2017. Creating a safe, caring and inclusive school environment through a code of conduct that is educative, preventative and restorative in practice and response.

Fang, B. and Zhang, P., 2016. Big data in finance. In Big data concepts, theories, and applications (pp. 391-412). Springer, Cham.

ft.com 2019. [Online] https://www.ft.com/content/99f27434-0241-11ea-b7bc-f3fa4e77dd47[Accessed on 5th Dec 2020]

Groves, P., Kayyali, B., Knott, D. and Kuiken, S.V., 2016. The'big data'revolution in healthcare: Accelerating value and innovation.

Hughes, J.P., Jagtiani, J., Mester, L.J. and Moon, C.G., 2019. Does scale matter in community bank performance? Evidence obtained by applying several new measures of performance. Journal of Banking & Finance, 106, pp.471-499.g

Kane, E.J., 2020. Immaculate Deception: How (and Why) Bankers Still Enjoy a Global Rescue Network. Institute for New Economic Thinking Working Paper Series, (130).

Madakam, S., Holmukhe, R.M. and Jaiswal, D.K., 2019. The future digital work force: Robotic process automation (RPA). JISTEM-Journal of Information Systems and Technology Management, 16.

Meredith, J.R., Shafer, S.M. and Mantel Jr, S.J., 2017. Project Management: A Strategic Managerial Approach. John Wiley & Sons.

Mordorintelligence.com. 2020. Big Data Analytics In Banking Market | Growth, Trends, Forecasts (2020 - 2025). [online] Available at:

Nagy, J., Oláh, J., Erdei, E., Máté, D. and Popp, J., 2018. The role and impact of Industry 4.0 and the internet of things on the business strategy of the value chain—the case of Hungary. Sustainability, 10(10), p.3491.

Nambisan, S., Lyytinen, K., Majchrzak, A. and Song, M., 2017. Digital Innovation Management: Reinventing innovation management research in a digital world. Mis Quarterly, 41(1).

Pfeiffer, J., von Entress-Fuersteneck, M., Urbach, N. and Buchwald, A., 2016. Quantify-me: consumer acceptance of wearable self-tracking devices.

Ramanathan, U., Subramanian, N. and Parrott, G., 2017. Role of social media in retail network operations and marketing to enhance customer satisfaction. International Journal of Operations & Production Management.

RDA. 2020. Big Data - Definition, Importance, Examples & Tools. [online] Available at:

Wilmott, C., 2016. Small moments in spatial big data: Calculability, authority and interoperability in everyday mobile mapping. Big Data & Society, 3(2), p.2053951716661364.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts