Strategic and Financial Performance Management

- 10 Pages

- Published On: 18-11-2023

Introduction

Financial analysis provides a scope to evaluate the performance and productivity of the firms and in this regard, the organisations try to evaluate their outcomes and productivity for analysing their position in the market (Guarese and Maciel, 2019). The study focuses on analysing the performance of the firms, Microsoft and Oracle to understand their position in the market and financial stability of the brands. Both the companies are efficient to perform better and they try to secure future sustainable development and this financial analysis is beneficial for evaluating their productivity and performance in order to conduct in depth evaluation of the financial performance of the companies and make effective investment decision for the stakeholders, who are engaged with the business. For students looking for data analysis dissertation help, understanding such financial analysis methodologies and their application in real-world scenarios can provide valuable insights for academic research and practical implementation.

Background of the company

Microsoft Corporation is an American multinational technology company which develops licences and manufactures the computer software, electronics and different hardwires like personal computer and related services to a wide range of consumers across the globe. The company is efficient to serve the customers with quality product and services that satisfy the consumers in long run. The organisation is financially stable and serves the customers worldwide, where the major products are Skype, visual studio, dynamics, xbox, and surface and mobile, servers, windows and offices as well as the services are such as MSDN, Office 365, One Drive, GitHub, LinkedIn, Bing, Azure, Microsoft stores and windows. These are the major products and services, provided by Microsoft and it is efficient to manage the consumers worldwide by delivering high quality services. It has generated US$ 143 billion in the recent year and total numbers of employees are such as 156439, who are efficient to serve the end users successfully (Microsoft, 2020). On the other hand, Oracle is also another American computer technology corporation selling database software and technology, cloud engineering system, and enterprise software programs. It has more than 135000 employees, but in the recent years there is lack of revenue generation for which the company faces difficulties to attract the investors and expand the business internationally. The major services of Oracle are such as business software, application and consulting as well as the products includes Oracle application, database, Oracle cloud, enterprise manager, storage and servers as well as workstations which are beneficial to satisfy the consumers worldwide (Oracle, 2020).

Financial analysis

Both the companies are operating in the computer technology industry and the firms are able to expand their business internationally to serve the consumers successfully. In this regard, the companies are competing against each other in the same industry and try to expand their business in order to gain high competitive advantage (Guarese and Maciel, 2019).

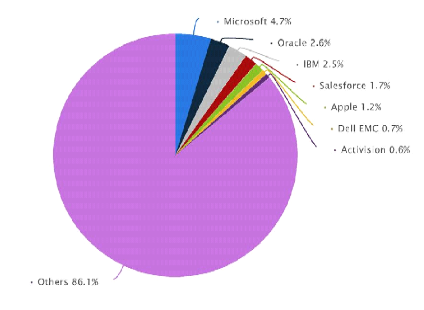

As per the market share of the software companies, the company Microsoft has 4.7% share in the global software market and on the other hand, Oracle has 2.6% market share. The major competitor of Oracle in the market is Microsoft and it is necessary to analyse their financial performance during these years for further evaluation (Statista, 2020).

Profitability

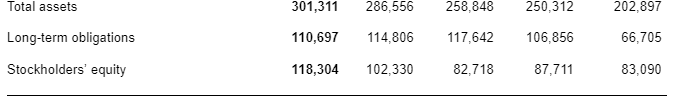

The company Microsoft is efficient to generate profitability which provides a scope to the stakeholders mainly the shareholders to make effective investment decision for the company investment. The company has generated US$ 143015 million in the recent years and Microsoft is able to establish the business and secure the future sustainable development. There is positive growth in the organisation, where the employees are productive and efficient to serve the consumers in long run. As per the table below, revenue in the recent year has been increased as compared to previous year 2019, from $125843 million to $143015 million. Gross margin of the company has also been increased which shows that, the company Microsoft is efficient to serve the consumers in the recent era of globalisation and the recent pandemic era of COVID 19, the company deliver high quality hardware and software services to their clients worldwide (Sehgal et al., 2020). It is beneficial for the stakeholders, engaged with the business including the employees and other staff members, technicians, engineers, shareholders and the management team as well as the consumers who are satisfied with the business activities and the company growth. In terms of profitability, Microsoft is able to maximise profitability and fulfil the economic responsibility of the firm. The profit generation and the gross margin are maintained efficiently (Microsoft, 2020).

As per the recent financial performance of the company, net income as well as earning per share is also increased in 2020 as compared to the previous year and it indicates that, productive workforce and efficacy of the employees are the contributing factors to achieve the organisational aim. The profitability are enhanced over the years where increased in net income, revenue and gross margin are effective performance indicators, which shows that Microsoft is good at stabilizing their financial position and secure future sustainable growth of the company. Throughout the period of time, the company is able to satisfy the consumers and retain them for long run (Sidharta and Affandi, 2016). Hence, the organisational stakeholders are also satisfied with the organisational activities and management where the firm is able to run their operations and strengthen their consumer base, where the product quality and service efficacy are the major contributing factors in the company to sustain in the global software and computer electronics market. As per the liquidity, the company is able to pay the debt and maintain effective liquidity ratio which is good for the organisation to run the business operations and expand the company worldwide. The company is also able to manage their market share and gain competitive advantage over other competitive firms (Aljamal, El-Mousa and Jubair, 2020). The company Oracle is the biggest competitor and Microsoft is able to gain higher market share as compared to the company Oracle. The company Microsoft is hereby efficient to run their business operations and manage their position in the global software and computer market. The organisation is also efficient to manage their stakeholders and provide high return on investment to satisfy all the stakeholders, engaged with the firm (Microsoft, 2020).

Dig deeper into Marketing strategic Planning with our selection of articles.

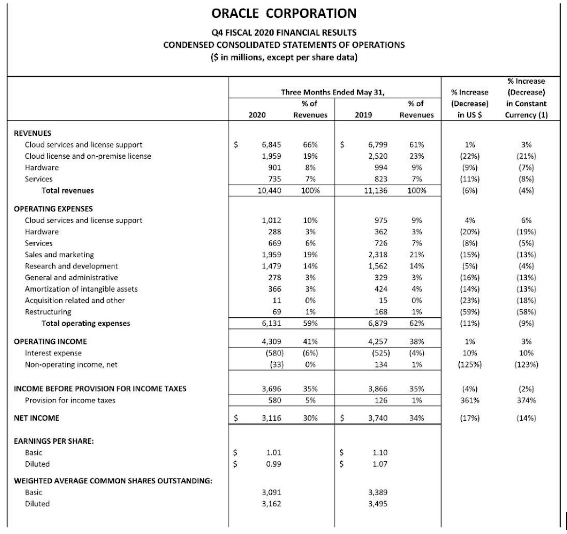

On the other hand, Oracle is also another renowned organisation, which focuses on delivering quality products and services to all their clients. However, the market share is less as compared to Microsoft. In the recent pandemic era of COVID 19, the revenue and the sales volume of Oracle have been affected in a negative way, where the revenue has been decreased in this year as compared to the previous year 2019. The organisation is efficient in providing high quality products and services and there are a huge variety of products to serve the consumers, but it is difficult for the firm to generate high revenue and maximise profitability. In the previous year, the revenue of the firm was $ 11136 million, and in the recent year the revenue has been dropped down to $ 10440 million, which indicates that there is deterioration of the revenue of the organisation for which the brand is not able to maximise their profitability. As per the figure below, the operating expense has also been affected in a negative way. The operating expenses in the previous year were $ 6879 million and in these years, it has deteriorated to $ 6131 million, which indicates that the liquidity ratio is not good as compared to the company Microsoft (Oracle, 2020).

Oracle’s net income has also been affected in this year and in the recent year; it is $ 3116 million, which was $ 3740 in the previous year. There is financial downturn in the company due to lack of efficacy of the employees where the clients are not satisfied and the company also fails to retain the long run clients (Holanda, 2020). Due to lack of management and financial structure as well as poor activities to strengthen the customer’s base are the major issues of the business for which the market share is being deteriorated. The liquidity ration and current asset are also affected due to lack of profit maximisation. In the recent year, there is deterioration of profitability and sales volume which decreases the financial stability of the brand. Though the organisation is able to expand their business internationally, it is difficult for them to gain high competitive advantage, due to lack of profit maximisation and lack of revenue generation. As per the analysis, it is difficult for the brand to generate revenue in the recent situation and it further deteriorates the efficiency of the firm to operate in the market and sustain in the business (Oracle, 2020).

Efficiency and financing structure of the companies

The efficacy of the organisation is mandatory factor to maximise the organisational performance and increase productivity to sustain in the market and operate the business successfully. The organisation Microsoft is able to gain the competitive advantage and it is beneficial for the organisation to satisfy the consumers (Alcaide González et al., 2020). On the other hand, Oracle is also efficient brand, however in the recent years; it becomes difficult for the company to retain more long run clients which deteriorates the profitability and revenue of the firm. Gross margin and net income of the company have been deteriorated in the recent years as compared to the financial performance in the previous year. It is also problematic for the company to generate revenue due to lack of client retention in the international market. Oracle provides quality products and services, but lack of efficacy and productive performance further deteriorate the efficacy and performance of the firm in long run. However, Microsoft is efficient to perform better and secure their financial position in future (Bhasin, and Stiel, and Oracle International Corp, 2019). During this year also, the company is successful in generating revenue and maximise gross margin. The company is also successful to provide high return on investment as well as retain the stakeholders for further brand expansion. The client base is strong in Microsoft as well as efficacy in delivering high quality products and services, market performance and the financial structure are the major contributing factors ion the company to generate revenue and run their business operations worldwide. As per the liquidity and financial performance of both the brands, the company Microsoft has more capability to maintain shares and dividend as well as expand the business by maintaining its financial stability.

Summary

Through financial performance analysis and evaluation, it is possible to evaluate the performance of both the brands, Microsoft and oracle, which are operating in the global software and computer technology industry. Both the companies have diversified products and efficient services which are beneficial to satisfy the consumers and in this regard, the brands are also able to strengthen their consumer base for long run. As per the financial performance analysis, Microsoft is successful to gain high competitive advantage as compared to Oracle, where the revenue generation and gross margin are also higher in Microsoft as compared to the performance of the previous year. However, Oracle fails to generate revenue and maximise profitability, which deteriorate the financial efficacy of the company. Microsoft has the capability to provide high return on investment and secures the customers base for long run. The positive financial performance and organisational growth are the major strengths of the company which further provides an opportunity to the firm Microsoft to expand their business operations and satisfy the client by delivering high quality products and efficient services.

Continue your journey with our comprehensive guide to Strategic Analysis of Royal Bam.

Reference List

- Alcaide González, M.Á., De La Poza Plaza, E. and Guadalajara Olmeda, N., 2020. The impact of corporate social responsibility transparency on the financial performance, brand value, and sustainability level of IT companies. Corporate Social Responsibility and Environmental Management, 27(2), pp.642-654.

- Aljamal, R., El-Mousa, A. and Jubair, F., 2020. Benchmarking Microsoft Azure Virtual Machines for the use of HPC applications. In 2020 11th International Conference on Information and Communication Systems (ICICS) (pp. 382-387). IEEE.

- Bhasin, M.S. and Stiel, H., Oracle International Corp, 2019. Performance analysis and bottleneck detection in service-oriented applications. U.S. Patent 10,230,600.

- Guarese, R.L.M. and Maciel, A., 2019. Development and Usability Analysis of a Mixed Reality GPS Navigation Application for the Microsoft HoloLens. In Computer Graphics International Conference (pp. 431-437). Springer, Cham.

- Holanda, M., 2020, June. Performance Analysis of Financial Institution Operations in a NoSQL Columnar Database. In 2020 15th Iberian Conference on Information Systems and Technologies (CISTI) (pp. 1-6). IEEE.

- Microsoft, 2020. Annual report 2020. [online] Available at: https://www.microsoft.com/en-us/Investor/annual-reports.aspx [Accessed on 22 October 2020].

- Oracle, 2020. Oracle Announces Fiscal 2020 Fourth Quarter and Fiscal Full Year Financial Results. [online] Available at: https://s23.q4cdn.com/440135859/files/doc_financials/2020/q4/4q20-pressrelease-June.pdf [Accessed on 22 October 2020].

- Sehgal, G., Kee, D.M.H., Low, A.R., Chin, Y.S., Woo, E.M.Y., Lee, P.F. and Almutairi, F., 2020. Corporate Social Responsibility: A Case Study of Microsoft Corporation. Asia Pacific Journal of Management and Education, 3(1), pp.63-71.

- Sidharta, I. and Affandi, A., 2016. The empirical study on intellectual capital approach toward financial performance on rural banking sectors in Indonesia. International Journal of Economics and Financial Issues, 6(3).

- Statista, 2020. Software industry market share in year to end June 2019, by major supplier. [online] Available at: https://www.statista.com/statistics/1055464/worldwide-software-market-share-by-main-supplier/ [Accessed on 22 October 2020].

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts