The Case of Airbnb in South Africa Management

- 14 Pages

- Published On: 04-11-2023

Introduction

In the past two decade, technology based businesses have gained unprecedented level of success to a point whereby technology and in particularly the internet, is presently the winning factor capable of creating overnight success stories (Becker & Niebuhr, 2010). This is unlike before when traditional businesses/industries such as mining, construction, real estate, banking, and stock market were the key sources of wealth and credited with creating superrich individuals such as John Rockefeller, JP Morgan, Henry Ford, and Andrew Carnegie (Freund, 2016). Bill Gates remains to be the anchor of technological success, followed closely by Jeff Bezos of Amazon, Jack Ma of Alibaba, and a new bunch of billionaires lead by Mark Zuckerberg of Facebook, Peter Thiel and group for Pay Pal, Dorsey and group for Twitter, among others who built global businesses based on the internet (Schoner, 2014). If you are working on a business dissertation, seeking business dissertation help can be a strategic move.

Presently, there are two success stories that remain to be epoch of internet success, more so because of how they are redefining mode of doing business to any extent regulators are still grappling on the aptly legal guidelines that can be used to regulate the businesses; they include AirBnb and Uber (Cusumano, 2015). Airbnb formed in 2008 and Uber formed in 2009 are billion pound companies that are presently leading the sharing economy that operates through the internet platform in the form of peer-to-peer commerce sites (Boswijk, 2016). A distinctive factor that can be extrapolated from the success stories of technology and internet based companies is their ability to expand at an exponential rate thereby easily generating massive income unlike traditional brick and mortar business such as Starbucks whose expansion is limited by numerous factors that mostly include capital, environmental, and human resource constrains.

Despite not having a fully functional office in Africa or in this case, South Africa, Airbnb already had an established presence in the country through more than 10,000 listings mostly in Cape Town and Johannesburg (Holmes, 2015; Brophy, 2016). Therefore, it will be interesting to see through this study the motive of the company’s foreign direct investment into South Africa, its entry mode choice, the risk and challenges of this investment, and future prospects of Airbnb in South Africa.

Continue your journey with our comprehensive guide to Strategies of Air Liquide .

Analysis

The concept of Foreign Direct Investment

According to the writings by Bayar & Kiliç (2014), Foreign Direct Investment (FDI) refers to investments undertaken by an individual or company on business interests that are located in another country through various avenues that such establishing a branch location or business operations in another country, which could be fully owned by the foreign investor or partially owned. Schutter et al (2013) stated that they key feature for any FDI is that the foreign investor should have either substantial or full control of the decision making process within the foreign subsidiary.

With reference to the studies conducted by Froot (2008), it is noted that FDI is normally undertaken in open economies where there are few restrictions that could hinder free trade, secondly, target country should readily avail skilled work force, and the economic growth projections should be above average. Another critical tenet of FDI is the fact that it does not necessarily have to be in the form of capital investment but rather it can be through provision of technology or superior management skills (Jordaan, 2009). In the case of Airbnb, its business model in regards to FDI does not entail provision of capital investment but rather it simply provides a platform (Website) and management expertise through which they connect willing hosts and willing guests thereby earning a commission out of the transaction (Ahmad et al, 2016).

The case of Airbnb’s Foreign Direct Investment in South Africa

In the writings by Bock (2015), he stated that the justification of Airbnb’s business model could be pinned or traced to the inquisitive or exploratory nature of human beings. This pushes human’s desire to know much more about their surrounding unlike otherwise presented within the confines of a traditional hotel or conventional touring package that is completely guided and limits social interactions between tourists and the local community. Yang et al (2014) also stated that emergence of experiential tourism created the launching pad of Airbnb since through the websites; visitors to a new location can share a room with a local host instead of staying at a hotel. Through the process of staying at a local’s house, the visitors will be able to learn more about the local community, which would have otherwise being impossible if they stayed in a hotel, most of which have been designed to depict the Western lifestyle.

Consequently, owing to its position that can be simplified as a ‘broker,’ Airbnb does not own any of the facilities that it rents out yet so far, there are more than 3million listings on its websites for properties distributed in over 65,000 cities across the World in 191 countries. Its level of outreach easily surpasses that of its counterpart, Uber. This is because, latter puts into consideration numerous factors before registering a car on its sites such as year of manufacture whilst in Airbnb the requirements for one to list his/her property are a few even in terms of geographical location. This is contrary to Uber, which mostly operates in urban areas that are densely populated (Mudallal, 2015).

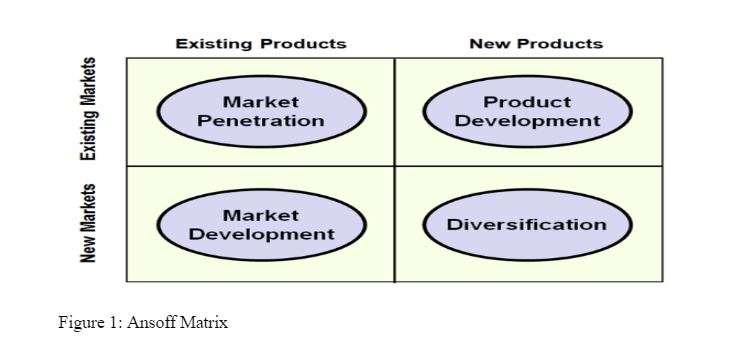

Airbnb mode of entry to any market is by simply ensuring its website is live within the market i.e. hosts can login and list their properties same as guests who can login to search for a listed property to rent out. Summarily, its entry mode is powered by the availability of internet technology. This contravenes the traditional mode of entry that entail full or partial acquisition of an existing business or opening/establishing own business operations in a foreign country. However, using Ansoff matrix that is illustrated in the image below, this study will aim at explaining how Airbnb distinctively enters a new market. The Ansoff matrix is commonly applied as a strategic tool that provides a framework through which organisations can plan strategies for their future growth (Gianos, 2013).

Under the Ansoff matrix, growth strategies are usually categorized into either market or product. Under market strategies, a business organisation can gain growth through market penetration and market development. While under product strategies, it is stipulated that a business organisation can gain growth through product diversification or product development (Pettus, 2015). In the case of Airbnb, it is not likely to gain explosive growth through product strategies as it has been accustomed to over the recent years since there are limited opportunities (Pettus, 2015). For example, its business model is simply brokerage, which means the only option is to diversify to other products that it can broker as well. As for Uber, in the recent past it has undertaken steps to diversify its product by launching Uber services for delivery of meals and parcels (Rauch and Schleicher, 2015).

The feasible strategic option Airbnb has been applying across its market including South Africa fall under market strategies, particularly market penetration. Under market penetration, Airbnb has been keen on increasing on the number of listed properties in South Africa, and Brophy (2016) stated that to this effect Airbnb has been conducting educational conferences in South Africa that are aimed at educating the South African population about their services and how they can benefit from listing and renting via Airbnb. There is evidently little effort that is being directed towards market development considering the company already has presence in 191 countries out of the 195 countries of the World (Boswijk, 2016).

Looking for further insights on 404 Page? Click here.

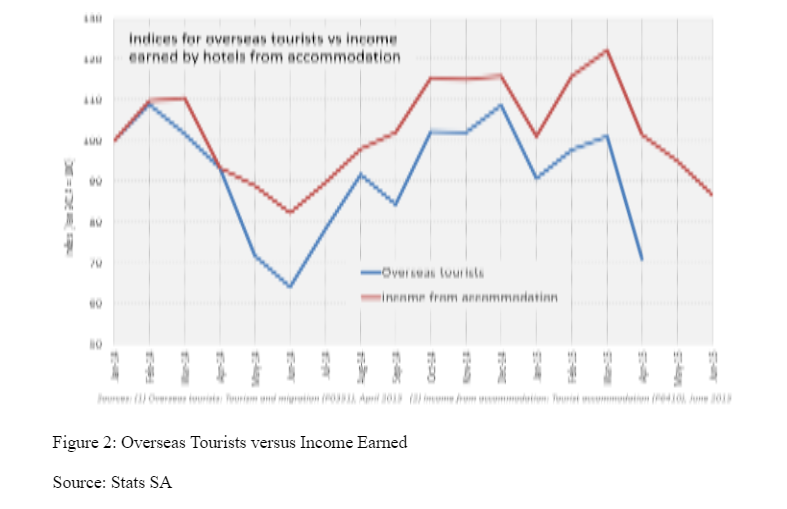

Considering competition emanating from other competitors in the South African markets such as bookings.com, Airbnb motive under market development is to increase the number of listed properties on its site, which will result into increased earnings from commission. Especially considering that despite a drop in overseas tourists in the year 2014 to 2015, the income earned from hotels accommodation rose as shown in the graph, which hints to the fact that overseas tourists visiting South Africa were willing to pay more. This means that by increasing the listing in South Africa, Airbnb is likely to tap into increased earnings since they will charge slightly more for overseas guests using their platform more so in peak season.

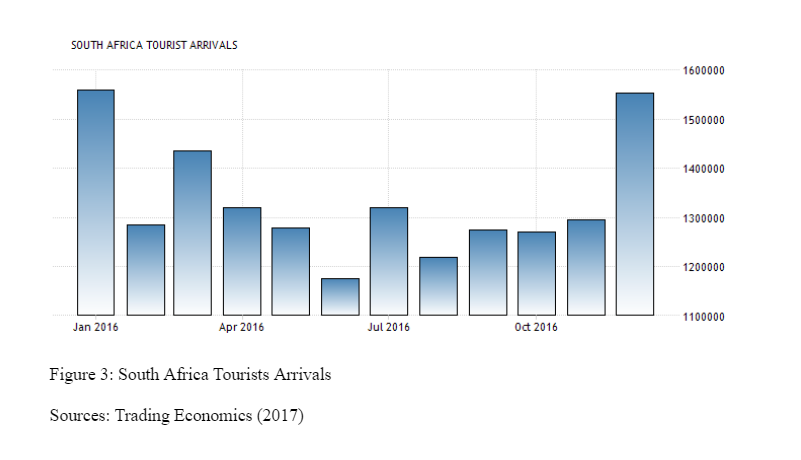

Secondly, South Africa’s tourism sector is on a recovery path of which the epoch was in January 2016 when it recorded the highest number of tourists ever into the country at 1,558,854 (Brophy, 2016; Trading Economics, 2017). The image below shows that in the previous year tourist arrivals in South Africa never when below 1.1 million mark and the highest peaks were in January and December. Ergo, Airbnb FDI in South Africa is substantiated on the basis that there is potential of connecting more hosts and gests owing high tourists arrivals in South Africa.

In regards to the stage of Airbnb’s FDI in South Africa, the General Manager for Middle East & Africa, Ms. Nicola D’Elia noted that through word of mouth the South Africa market grew to become the company’s largest market in Africa with over 9,400 listings. This means that presently, the South African market is on an upward rise and it is expected that the new team led by Ms. D’Elia, which focuses on the region, will further accelerate the growth of the South African market (Brophy, 2016).

Risk Analysis and Challenge of the FDI

The most sever risk and challenge that is facing Airbnb in South Africa is the threat emanating from its key rivals such as booking.com, FlipKey, VRBO, and Homeaway. There increased popularity in the South African market will result in a reduction of their market share thereby defeating their initial motive, which was to increase their earnings from the same market (Nickelsburg, 2016). Secondly, the emergence of hotels that offer experiential services to their guests such as neighborhood bike rides is likely to reduce the number of people that will be using Airbnb in South Africa. Thirdly, South Africa ranks among the most crime-ridden countries, which will make guests to be more afraid of staying in neighborhoods where security is not guaranteed unlike the confines of a hotel (Noah, 2016). Lastly, the regular negative publicity on Airbnb platform such as damage to host’s house or theft of guests items is likely to decrease the number of users of online vocational rental platforms such Airbnb (Dhiman, 2016).

Scenario Projections

In case the status quo persist, it would mean hotels in South Africa are still operating in the traditional or conventional manner but they are gradually incorporating experiential services to enable their guests interact with the surrounding community. During such time Airbnb will have to really on peak times such as January and December when tourist arrivals is at highest peak or when they are major/international events taking place in South Africa cities such as Cape Town and Johannesburg. During these times, Airbnb will record a sharp rise in the demand for their services (Neirotti et al, 2016). In a scenario whereby South Africa’s hotel sector fights for exclusivity thereby agitating for legal hurdles to curtail the operations of Airbnb and other online vacation rental platforms, it would mean, the hotels will enjoy their monopoly and hence they will lack the incentive to innovate their offerings. In addition, they will also increase their cost of accommodation during peak times (Salvioni, 2016). The last scenario is whereby Airbnb gains increased popularity to a point it is fully commercialized. In such a scenario, property owners will convert their rentals to full-time Airbnb rentals, which will mean locals will be pushed from tourists designated areas and there will be subsequent rise in rental prices (Boswijk, 2016).

Conclusion

Airbnb business model is unique to an extent that the South African market rose to become its largest African market despite the company not having a functional office to overseas its business operations in Africa. Its foreign direct investment is largely in the form of management expertise and technological support.

Evidences shows the FDI is face with numerous risks and challenges, which are shared across all the markets that the company operates. However, it is hoped that with the appetite of empowering citizens in terms of their economic viability, national governments will put measures in place to protect the business, which enables citizens to generate income whilst providing guests with local experience.

Looking for further insights on The Art of Successful Teamwork? Click here.

References

Ahmad, N. Walter, H. and Sherman, H. (2016) The home away from home: an analysis of the lodging industry in 2015. American Journal of Entrepreneurship. 9(1), p60, 22

Bayar, Y., & Kiliç, C. (2014). Effects of sovereign credit ratings on foreign direct investment inflows: Evidence from turkey. Journal of Applied Finance and Banking, 4(2), 91-109.

Becker, S. A., & Niebuhr, R. E. (2010). Cases on technology innovation: Entrepreneurial successes and pitfalls. Hershey, PA: Business Science Reference.

Bock, K. (2015). The changing nature of city tourism and its possible implications for the future of cities. European Journal of Futures Research, 3(1), 1-8.

Boswijk, J. (2016) Airbnb: The Future of networked hospitality businesses, Journal of Tourism Futures, 2(1) p22-42

Brophy, S. (2016) Tourists to SA Hits New Record for January 2016. Traveller 24. [online] retrieved from http://traveller24.news24.com/News/visitors-to-sa-hits-new-record-for-january-2016-20160407 [accessed on 4 March 2017]

Cusumano, M. (2015) How Traditional Firms Must Compete in the Sharing Economy. Communications of the ACM. 58(1), p32-34

Dhiman, M. (2016) Opportunities and Challenges for Tourism and Hospitality in the BRIC Nations [Online]. Hershey PA: Business Science Reference.

Freund, C. (2016). Rich People Poor Countries. Washington: Peterson Institute for International Economics.

Froot, K. (2008). Foreign direct investment. Chicago: University of Chicago Press

Gianos, J. F. (2013). A brief introduction to ansoffian theory and the optimal strategic performance-positioning matrix on small business (OSPP). Journal of Management Research, 5(2), 107-118.

Holmes, T. (2015) Airbnb in SA Selling Trust to the Wary. Mail & Guardian [online] retrieved from https://mg.co.za/article/2015-09-17-airbnb-in-sa-selling-trust-to-the-wary [accessed on 5 March 2017]

Jordaan, J. A. (2009). Foreign direct investment, agglomeration and externalities: Empirical evidence from Mexican manufacturing industries. Farnham, England: Ashgate.

Mudallal, Z. (2015) Airbnb Will Soon Be Looking More Rooms Than The World’s Largest Hotel Chains, Quartz. [Online] retrieved from http://qz.com/329735/airbnb-will-soon-be-booking-more-rooms-than-the-worlds-largest-hotel-chains/ [accessed 5 March 2017]

Nickelsburg, M. (2016) Frustrated Homeowners Say Expedia’s HomeAway Changes ‘Dramatically Impact’ Their Rentals. GeekWire [Online] retrieved from http://www.geekwire.com/2016/frustrated-homeowners-say-expedias-homeaway-changes-dramatically-impact-their-rentals/ [accessed 5 March 2017]

Neirotti, P. Raguseo, E. and Paolucci, E. (2016) Are Customers’ Reviews Creating Value In The Hospitality Industry? Exploring the Moderating Effects of Market Positioning. International Journal of Information Management. 36(6) p1133-1143

Noah, T. (2016). Born a crime: Stories from a South African childhood. New York : Spiegel & Grau

Pettus, M. L. (2015). Growing a firm’s resource base over time. Competition Forum, 13(1), 58-62.

Rauch, D. and Schleicher, D. (2015) Like Uber, but for Local Government Law: The Future of Local Regulation of the Sharing Economy. Ohio State Law Journal, 76 (4), p901-963

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts