A Study on the Banking Industry in Australia and New Zealand

Abstract

The corporate finance decisions in different companies are being influenced by several factors such size of firm, market conditions, cost of capital, and many more. The size of firm is aligned with nature of business, scale of business operations, market value, total assets employed by an organisation, and other. The size of firm is significantly aligned with the efficiency of corporate financing operations. The corporate finance refers to combination of different activities and transactions that are aligned with raising the capital of business entity for the creation, development, expansion and acquisition of businesses. Therefore, this study has aimed “To evaluate the impact of organisation’s size of an organisation on the corporate finance: A study on banking industry within Australia and New Zealand.”. As per the study goals, researcher has adopted the quantitative research methodology in which the firm’s size has been measured with reference to different independent variables such as revenue, profitability, market value of equity, and total assets. However, the leverage or debt capital has considered the dependent variable. In this regard, the application of regression analysis and correlation concludes the acceptance of alternative hypothesis that states that Firm’s size has a direct impact on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand. If you are seeking finance dissertation help, making you understand the relationship between firm size and corporate finance is crucial for your research.

Chapter 1: Introduction

1.1 Overview of Study Topic

The firm size plays a critical role in dealing with various long and short term corporate finance operations that may have direct influence the long term business efficiency and sustainability. The size of firm is aligned with nature of business, scale of business operations, market value, total assets employed by an organisation, and other. The size of firm is significantly aligned with the efficiency of corporate financing operations. The corporate finance refers to combination of different activities and transactions that are aligned with raising the capital of business entity for the creation, development, expansion and acquisition of businesses (Dang and Yang, 2018). It leaves the direct impact on the efficiency of the decision making process that result a variety of financial or monetary implications. It support companies in establishing an appropriate balance between capital market trends and decision making process in different companies. In the context of contemporary business environment, it supports companies in making appropriate corporate decision for ensuring the maximised shareholder’s value. The expansion of business operation in overseas market due to globalisation, has influenced the importance and role of corporate finance in every industry (Nakatani, 2019).

With consideration of size and type of organisations, the management of every company is looking to streamlines their corporate financing related operations for assessing an optimum level of wealth distribution along with the generation of appropriate return on investment. It influences managers for managing different factors in investment and financing decisions that include planning of finances, raising funds, investing operations, and monitoring. Apart from that, corporate finance decisions in different companies are being influenced by several factors such size of firm, market conditions, cost of capital, and many more (Coles, Lemmon and Meschke, 2012). These factors are having direct influence the efficiency and profitability of companies because the corporate finance decisions control the cost of capital along with solvency risk. For maximising the efficiency of business operations along with the generating the high value of returns, the concept of corporate finance assists companies in carrying out detailed comparison of different investment alternatives so as an organisation would be able to select most appropriate investment solution (Eka, 2018). In this context, companies consider different sources of finance or capital to meet the long and short business goals with consideration of cost of capital, risk factors, impact on shareholders’ returns, and others. Therefore, managers have to consider a variety of measures while taking the corporate finance related decisions such as firm size, market value, and others. In this regard, companies with equity share capital have to evaluate dividend decision in the assessment of shareholder’s returns with reference to time duration and amount of investment (Hashmi and Akhtar, 2018). In addition to that, advanced corporate finance related operations covers the development of a wide range of financial strategies and execution of different business policies to manage the corporate planning and resource management.

As a result of change in the market conditions, companies are facing several challenges in their business environment that may have direct impact on the long term business goals and sustainability of managerial operations. In this context, the approach of corporate finance has been addressed the subpart of finance and it supports companies in dealing with sources of finance, promoting the capital restructuring, supporting the accounting practices, and enhancing the effectiveness of investment decisions (Swastika, 2013). Therefore, the role of corporate finance has been enhanced to manage high quality capital investment and financing decisions because this tool pays extra attention on the maximisation of shareholder value with the help of long and short term financial planning along with execution of different business strategies. It covers all critical elements initiated with capital investment to tax consideration that influences the overall profitability and efficiency of management operation to deal with various market opportunities and threats (González and González, 2012). In addition to that, the leverage is being termed as the most important element of corporate finance so as companies use different policies to manage the investment debt capital that maximises the profit and minimises the cost of capital with the optimum utilisation of different tools of investment. Moreover, the firm size plays a most critical role in influencing the different corporate finance related operations because the vision and objectives of companies are significantly influenced by size and nature of companies along with the market trends (Lumapow and Tumiwa, 2017).

For managing the financing operations with reference to various market opportunities and threats, companies apply different tools and strategies of corporate financial operations such as capital budgeting, capital financing and, and assessment of return on capital. The approach of investment and capital budgeting covers a systematic planning in which companies consider different types of long-term capital assets to assess highest-adjusted returns. This assessment supports managers for deciding whether or not they need to consider the particular investment proposal (Amihud and Mendelson, 2012). Therefore, the management considers a variety of financing accounting tools such as evaluation of total investment of company in new assets or capital expenditure, assessment of future cash flows, cost of capital and many more so as an appropriate comparison of different investment proposals would select the top management in selection of the most profitable investment options. The selection of investment options is also carried with reference to existing size of firm, nature of business, revenue generation capabilities of existing business operations and others. Moreover, the corporate finance operations have been found very effective for performing the financial modelling to estimate the economic impact of an investment opportunity by evaluating the internal rate of return, net present value and others elements of different elements (Ibhagui and Olokoyo, 2018). These factors also influence the financing decisions of companies because the high rate of return could influence the management to select costly or high risky sources of debt finance.

Continue your journey with our comprehensive guide to Risk Factors in Fintech Business Operations.

In addition to that, the capital financing is being termed as the core activity of corporate finance in which management takes a variety of decisions such as the selection of the most optimally finance for the capital investments with consideration of the business’ equity, debt, or a mix of both. Long-term funding for major capital expenditures or investments is mainly obtained by selling company stocks or issuing debt securities with the help of investment banks. In this context, size of firm has been addressed as key element that determines an organisation’s capabilities to raise the funds for various long and short term business requirements (Kurshev and Strebulaev, 2015). In this context, the corporate financing operations help management for managing an appropriate balance in the two sources of funding. This is because the consideration of too much debt may increase the risk of default in repayment or solvency risk, while the increased dependence on the equity capital may dilute earnings and value for original investors. Overall, manager working in the corporate finance professionals are always focusing to optimize the company’s capital structure by lowering its Weighted Average Cost of Capital (WACC) with reference to existing business capabilities and size (Pattiruhu and PAAIS, 2020).

1.2 Purpose of Investigation

In the context of contemporary business environment, the size of a firm plays an important role in evaluating the efficiency of business operations and relationship of the management that enjoys by an organisation within and outside its operating or business environment because the operational capabilities of companies are having direct impact on the long term sustainability of company (Kim, Lin and Chen, 2016). Therefore, a large firm is having a significant influence over its various internal and external stakeholders. In addition to that, the growing influences of different kinds of conglomerates along with the multinational corporations within the global economy have enhanced the importance of size within the corporate environment. By refocusing on the importance of size towards the corporate discourse, the economic growth of an organisation is aligned with the size of existing organizations. In this context, the size of firm also encourages long and short term business finance and investment decision that are aligned with corporate finance related operations (García-Meca, López-Iturriaga and Tejerina-Gaite, 2017). In this context, several past studies have examined the implications of organizational/firm size on different kinds of outcomes that are aligned with the different fields of organizational management that include executive compensation, innovation and development in companies, application of organizational change, change in the functional complexity, hiring practices, and corporate social responsibility. However, this investigation is aimed to present a distinct approach by assessing the relationship between firm size and corporate finance (Siahaan, 2014). In the context of corporate finance, several factors are identified that are having huge implications on the efficiency of the business operations and long term business sustainability such as capital structure, financial policy and investment strategy, selection of dividend policy, assessment of the leverage position, expansion rate in the form of merger and acquisition. Therefore, the purpose of current study is aligned to deal with contemporary business challenges in financing operations so as researcher has focused to assess the relationship between the firm’s size and leverage (Doğan, 2013). The main reason behind consideration of leverage as an important element of corporate finance was that leverage or usages of debt capital in companies affects the solvency risk, cost of capital, earnings, and firm’s value. Moreover, it plays a critical role in future business decisions related to capital structure, expansion of business with debt capital, identification of new sources of finance, assessment of cost of capital, and many more. In this regard, the firm’s size is being termed as key area of concern in making the financing or fund raising decisions through debt capital.

1.3 Research Problem

In the context of contemporary business environment, various global and domestic factors have incorporated several challenges for the banking industry in Australia that may have adverse impact on the sustainability of banking firms. The evaluation of the contemporary trends in the banking sector New Zealand and Australia has determined that banks in Australia operates with high value of leverage capital as compared to other countries (Rao, Tilt and Lester, 2012). In this regard, different factors such as organisational size, business policies, expansion decisions, and others have influenced the requirements of funds among banking firms. However, the increase in the borrowing cost in New Zealand and Australia influences the cost of funds. Moreover, the reliance of the big banks on foreign sources for their wholesale funding has been reduced but it still accounts for more than half of total wholesale funding of banking firm. In addition to that, the size of banking firms is having direct influence over the capital structure because the larger companies are having more capabilities to raise capital from the different sources of finance and it also influence the leverage value of companies (Dang and Yang, 2018). However, the easy access of debt capital also influences companies having small size to assess more funds but small companies are facing some issues in mobilisation of extra debt capital to profitable investment opportunities that could influence the solvency risk. In this regard, the size of companies determines their companies to mobile debt capital in profitable investment options. Therefore, the current study has tried to assess the influence the firm’s size on the corporate financing operations. The rationale behind consideration of area of current investigation was that past studies have paid extra attention on the firm’s size, business profitability and capital structure. However, the present investigation has focused to fill the gap identified the past studies by determining the influence of firm’s size over the corporate finance with consideration of leverage position of banking firms.

1.4 Significance of Study

In the context of current investigation, researcher has tried to evaluate the impact of organisation’s size of an organisation on the corporate finance with reference to the banking industry within Australia and New Zealand. For determining the firm size, different studies have determined different measures such as total revenue, total assets, market value of equity capital, profitability and others; these variables are acted as the independent variable, whereas corporate finance refers with leverage of company that would be acted as dependent variable (Nakatani, 2019). Therefore, findings of current study will be found very useful to lending institutions and management banking firm. This is because the current investigation would examine the significant impact of different measures of firm’s size over the leverage position so as this information assists the management of banking and other investment in managing a variety decisions related to corporate finance. It supports companies in maintaining an appropriate balance between organisational capabilities and the amount of debt capital in capital structure that may influence the overall business profitability and lowering the risk to investors (Coles, Lemmon and Meschke, 2012). In addition to that, research findings would be found very useful to manager for developing appropriate strategic plan with consideration of long and short term investment projects that may leave positive impact on the firm’s size along with the revenue generation capabilities of different companies.

1.5 Research Aim and Objectives

Aim

The aim of current study is “To evaluate the impact of organisation’s size of an organisation on the corporate finance: A study on banking industry within Australia and New Zealand.”

Objectives

As per the study aim, researcher considered below mentioned objective to achieve the study goals in an efficient manner:

To evaluate different elements that determines the firm’s size.

To examine key aspects of corporate finance related operations in different companies

To investigate the role of corporate finance in capital structure decisions

To assess the impact of revenue on the financial leverage of banks operating within the banking sector of Australia and New Zealand

To evaluate the impact of total assets on the financial leverage of banking firm operating within the banking sector of Australia and New Zealand

To assess influence of market value of equity on the financial leverage of banking companies that operating within the banking sector of Australia and New Zealand

To identify the impact of profitability on the financial leverage of banking companies that operating within the banking sector of Australia and New Zealand

1.6 Research Question

For supporting the data collection process to meet the study objectives, researcher questions assist researcher in consideration of different types of variables to assess the key areas of a systematic assessment. In the context of present investigation, research questions are listed below:

- What are different elements that are used to evaluate the firm’s size?

- What are the most critical elements that are considered by manager in dealing with the corporate finance related operations?

- How does corporate finance influence the capital structure decisions of different companies?

- How does the revenue influence the financial leverage of banking companies related to the banking sector of Australia and New Zealand?

- What is the significant relationship between total assets and the financial leverage of banking firm working in the banking sector of Australia and New Zealand?

- What is the significant relationship between the market value of equity and financial leverage of banking companies that operating within the banking sector of Australia and New Zealand?

- How does the profitability affect the financial leverage of banking companies associated with the banking sector Australia and New Zealand?

1.5 Overview of Research Methodology and Report Structure

Research Methodology and Research hypothesis

With reference to nature of current study, researcher examines a variety of information to generate the useful findings in relation to study goals with the help of quantitative research methodology in which researcher uses a variety of secondary data associated with the financial performance of different banking firms. In this context, researcher applies different statistical tools to evaluate the relationship among different variables (Hashmi and Akhtar, 2018). For the application of research methodology, the hypothesis development is being termed as the most critical aspect of a systematic investigation. This is because hypothesis is worked as pre-framed outcomes or assumptions that could be examined or tested for attainment of study goals in an efficient manner. In the context of present investigation, hypothesis is determined below:

H0: There is not significant impact of the firm’s size on the financial leverage of banking firms associated with the banking sector of Australia and New Zealand.

H1: There is significant impact of the firm’s size on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand.

With reference nature of data and study objectives, researcher has adopted linear regression model for assessing the relationship between the independent and independent variables.

Methodology 1

DV- Leverage

IV1- Total Revenue

H02: There is not significant impact of the Total Revenue on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand.

H2: There is significant impact of the Total Revenue on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand

Methodology 2

DV- Leverage

IV2- Total Assets

H03: There is not significant impact of the Total Assets on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand.

H3: There is significant impact of the Total Assets on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand

Methodology 3

DV- Leverage

IV3- Market Value of Equity Capital

H04: There is not significant impact of the Market Value of Equity Capital on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand.

H4: There is significant impact of the Market Value of Equity Capital on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand

Methodology 4

DV- Leverage

IV4- Net Income

H04: There is not significant impact of the Net Income on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand.

H4: There is significant impact of the Net Income on the financial leverage of banking firm associated with the banking sector of Australia and New Zealand.

Structure of Report

As per the nature of investigation, this report contains the five different sections that covers different elements i.e. introduction, literature review, research methodology, results and summary of finding, and conclusion and recommendation. The section is termed as Introduction that provides a brief overview of whole investigation because it contains the background, research problem, significance of research, aim and objective, and report structure. This part determines critical variables and elements that are considered by as key areas of investigation. The second section is termed as the Literature Review. In this part, researcher carries out a detailed assessment of different theories and approaches aligned with firm’s size, capital structure, corporate finance and others for assessing the in-depth understanding about the subject the areas of investigation (Swastika, 2013). In this context, researcher considers different secondary sources of information such as findings of past studies, articles of different scholars, online book and other sources. The next section is known as Research Methodology that determines a comparison and evaluation of different research tools and tactics to select an appropriate combination of different research approaches for the selection of the most appropriate research methodology. As per the nature of current investigation, the researcher has considered the secondary sources of information along with various other approaches aligned with quantitative research methodology (González and González, 2012). The fourth section is termed as Results and Summary of findings in which researcher presents the findings of linear regression and descriptive statistics to test the hypothesis for determining the implications of firm’s size on the leverage position of banking firms related to Australia and New Zealand. The last section of this report presents the Conclusion and Recommendation that covers findings of current investigation with reference to study objectives. In this section, researcher offers some recommendations through which companies banking companies could influence the efficiency of business operations with reference to firm size and leverage.

Chapter 2: Literature Review

2.1 Introduction

The section of literature review seems a great tool through which an investigator would be able to assess an in-depth understanding about key areas of investigation. In this context of present investigation, researcher has focused to evaluate the impact of organisation’s size of an organisation on the corporate finance with reference to banking industry within Australia and New Zealand (Lumapow and Tumiwa, 2017). In this regards, researcher considered a variety of sources of secondary data such as online journals and books to assess the findings of past studies and views of different scholars to support the statistical analysis. Moreover, this section also examines different reports and online articles to evaluate different variables of capital structure such as firm’s size, sales and leverage. With reference to study objectives, this part carries out detailed evaluation of different theories associated with firm’s size and corporate finance (Amihud and Mendelson, 2012). This section determines the relationship among different critical variables that are used to meet study objective such as total sales, total assets, leverage, profitability, and market value of company that are playing a critical in influencing the efficiency of business operations.

2.2 Firm Size and its Measures

Ibhagui and Olokoyo (2018) stated that the firm’s size determines the scale or volume of operations turned out by a single firm. The study of the size of a business is being termed as an important corporate planning and financial decision making. It may have direct impact on the long term efficiency and sustainability along with fund raising capabilities. In the context of firm’s size, Kurshev and Strebulaev (2015) determined the amount of capital invested is being termed as an important measure of firm size. However, companies face some issues in assessing the accurate data about the capitalisation that may have direct impact on the efficiency of capital financing decisions. Apart from that the capital invested has been emerged as important indicator of capital. It assists manager in selection of an appropriate capital structure with reference to distinct business requirements. Furthermore, Pattiruhu (2020) stated that the value of total assets is being termed as an important indicator of firm’s size because this value presents an organisation’s investment within the current and non-current assets that are having direct impact on the operational capabilities of companies. The value of assets assists manager in evaluating the overall value of total investment that has been made by an organisation in different business operations to handle long and short term business requirements (Lumapow and Tumiwa, 2017). Therefore, total assets value has been perceived as an important indicator that provides accurate information about the level of capital expenditure. In this regard, Amihud and Mendelson (2012) argued that total assets also determines the combination of availability of working capital and investment in fixed assets that may have significant influence over the long term financing and investment decisions.

Moreover, the investigation of Kurshev and Strebulaev (2015) addressed that total monetary value of an organisation’s sales or total revenue presents the efficiency of business operations and capital investment made by an organisation so as the value of total revenue can be presented as the firm’s size that may have direct impact on the efficiency of business operations along with the long term organisational sustainability. In the context of corporate finance operations, the value of company’s revenue is being termed as an important element that influences financing decisions in different companies (Dang, Li and Yang, 2018). Hashmi and Naz (2020) argued that the monetary value of all the products of an organisation is also assisted the management in evaluating the overall value of firm. This is because the business entity the increase in value of product during the economic boom influences the overall value of company because the market value of different products and services may have direct impact on the efficiency of business operations along with firm value. In addition to that, the volume of output is being termed as the most appropriate in assessing the overall size of an organisation (Nakatani, 2019). Therefore, the production quantity is being termed as an important indicator firm’s size. The volume of production determines the production capacity of plant that is used to determine the firm’s size.

As per the study of Siahaan (2014), it found that the size of the firm is being termed as one of the most decisive factors in achieving the maximum efficiency within different business operations. In the context of contemporary business environment, the large-scale production is being considered as the most important approach for bringing the high level of economic results because it would support companies in lowering the productions costs and increasing the overall profitability of an organisation. Therefore, there has been a tendency among companies in which they are tried to increase the size of the industrial or production units for achieving the goals of the mass production along with the bulk sales in different markets (Hashmi and Akhtar, 2018). Therefore, organisation capacity has been addressed as an important indicator of firm size. In this regard, Humphery-Jenner and Powell (2014) stated that firms of different sizes have been adopted different measure and identifying new approaches for expanding their business resources and business potential with reference to different market challenges and opportunities. However, all types of organisation are not able to operate with an equal efficiency (Drempetic, Klein and Zwergel, 2020). Therefore, different economists stated that the problem of size must be viewed from the point of costs in relation with the expected returns with consideration of total value of investment made by an organisation. The investigation of Lumapow and Tumiwa (2017) determined that there has been a generally accepted norm is identified in the context of modern economic analysis in which the expansion of the business has been perceived as key driver for lowering the overall production cost. Therefore, all firms are always focusing for expanding their scale of operations through companies would be able to spread the business expenditure over larger output. However, Ibhagui and Olokoyo (2018) argued that growth in the business operation or expansion of business capabilities must be aligned with reference to business profitability because the management should have to ensure to manage the business expansion in such manner with consideration of the adverse effect on its profitability. This is because the high level of business expansion and growth beyond a particular limit may increase the chances of the decreasing returns per unit on the investment as result of the managerial along other financial strains that is also called as the model limit (MALIK and et.al., 2021).

The research of Arnegger and Vetter (2014) determined several factors that are having a significant influence over the size of an organisation and it may have a significant influence over the financing decisions of an organisation. In this context, the Nature of Industry is being termed as the most critical element of in the business planning that may have a significant impact on size of an organisation because manufacturing industries are having a large infrastructure and size as compared to companies that are operating in the trading and service industry. This is because manufacturing industries are involved in the production of the heavy machinery, producing a variety of goods over a large scale, making higher capital investments that influence the size of an organisation so as the nature of industry plays a critical role in influencing the size of an organisation (Arnegger, Pull and Vetter, 2014). However, Harisa, Mohamad and Meutia (2019) argued that the Nature of Products has addressed the most critical element that influences the firm’s size. This is because when the product portfolio of a company seems less standardized then the size of the firm is often found the small when the product is standardized, complex, along with durable that may change the perception of people and it could also indicate the larger size of an organisation. In addition to that, the total value of capital employed has been identified as key indicator of the firm’s size because when the total value capital employed is high and the firm can use it for supporting the business expansion whereas small companies also contain the low value of investment in the form of capital employed (Kurshev and Strebulaev, 2015). In addition to that, Ali, Khurshid and Mahmood (2015) argued that the size of the market plays an important role in influencing the size of an organisation if the size of the market seems large for the particular product and service then an organisation would find extra opportunities for the business expansion and identification of new sources of finance. In similar way, the Quality of management is being termed as an important element that influences the firm’s size. In this regard, the competence along with the integrity of management has direct impact over the size of a business unit. It plays a critical role in managing the business expansion decision and handling the long term financial planning (Olawale, Ilo and Lawal, 2017). Moreover, if the management follows an appropriate competence for managing the complex tasks of modern business that are mainly managed by the large business organisations then the efficiency of the management has direct impact over the efficiency and size of the business operations.

As per the investigation of Olawale, Ilo, and Lawal (2017), the Signaling Theory found effective in evaluating different measures of firm’s size and other related variables. In this regards, the signaling theory states that there is information asymmetry or information mismatch between internal organisational structure with external users of financial statements that are termed as the stakeholders of the business entity. In this context, signaling theory determines that why companies are paying the huge attention for providing the financial statement information to external parties that include government agencies, investors and lenders (Mule, Mukras and Nzioka, 2015). This is because the disclosure of information incorporated by organisation within the financial statements assists the investors and potential lender for making an appropriate analysis of financial to manage their investment in within an organisation so as people can change their views about the company's financial performance. Coles and Li (2019) argued that the disclosure of information carried out by company managers can give signals to users of financial statements so that accurate information is very important in the process of making investment decisions or providing loans by external parties and other stakeholder. With consideration of different theoretical aspect of signaling theory, it has been perceived that the user of the financial statement would be able to assess the accurate information about the capital structure, size and profitability that would reduce the problem associated with the information asymmetry (Wei, Xu and Zeng, 2017). The investigation of Dang, Ngo and Hoang (2019), the assessment of size of an organisation can be carried out with consideration of debt-to-equity-ratio because it supports different stakeholders in assessing the quality of an organisation’s capital. In this context, the addition of more debt by companies within the company's capital structure can be considered as an appropriate signal of higher expected future cash flows. This is because the company could provide appropriate commitments lenders for meeting interest payments with reference to distinct requirements of the debt holders and managing the remaining cash flow in a more efficient manner (Tunyi, 2019). Lerner and Seru (2017) stated that investors perceive the debt issuance as a better signal as compared to the issuance of ordinary shares for raising funds because the issuance of share by an organisation could be emerged as overvalued solution for investors. In this regard, the greater the size of an organisation will give an appropriate signal that shows that financial performance is improving systematically at a reliable growth rate (Mitton, 2020). Moreover, Signaling theory also explains that the size plays a critical role in influencing the perception of stakeholders because it enhances an organisation’s capabilities for attaining different types of financing requirements.

2.3 Assessment of corporate finance and finance leverage

Erel, Jang and Weisbach (2020) asserted that the corporate finance is being termed as the subfield of finance that is dealing with different financing operations such as assessment of sources of funds, capital structuring, and application of a variety of investment decisions. It provides a great support in maximization of the shareholder’s value with consideration of the long and short-term financial planning along with the implementation of various business strategies. Corporate finance activities are being executed from a range from capital investment operations to manage the tax considerations (Lawrenz and Oberndorfer, 2018). The financing operations of an organisation are significantly influenced by several critical elements such as cost of capital, availability of finance, requirements of funds.

For attainment of distinct financing needs, companies raise financial capital by issuing the debt securities or by selling common stocks. In this context, financial leverage is being termed as the most critical to meet the financing needs of an organisation (Vithessonthi and Tongurai, 2015). The investigation of Dewally and Shao (2014) determined that financial leverage is being extent to which fixed-income securities along with the preferred stock that are used by companies in dealing with the capital structure. Financial leverage has been valued with consideration of different interest tax shield with reference to income tax law. Moreover, the usage of financial leverage is also valued with consideration of total value of the assets that are purchased with consideration of the debt capital and it would offer the higher return with reference to total cost of financing (Gabaix, Landier and Sauvagnat, 2014). The research of Shen, Firth and Poon (2016) determined that the application of financial leverage may increase the company’s profits. Moreover, the leverage decisions are aligned with the usage of debt for undertaking an investment or acquisition of new projects. The result has focused to multiply the potential returns from a variety of investment options. At the same time, leverage would be found very effective for multiplying the potential downside risk when an investment would not attain the desirable objectives (Silva, 2019). In the context of contemporary business operations, when a property or investment is termed as the "highly leveraged’ that shows the high value of debt capital in relation to equity capital of an organisation.

Błach (2020) argued that the concept of leverage is also being used by both investors and management of different companies. Investors consider the leverage for assessing a significant increase in the company’s returns that can be aligned with the investments of an organisation. They lever their investments by using various instruments, including options, futures, and margin accounts. Companies are also using the leverage to achieve the financing needs for the acquisition of a variety of assets because companies use debt financing to manage a significant investment in the business operations instead of the application of share capital to raise capital (Butt, 2016). This thing plays a critical role for increasing the shareholder value. Hatem (2014) argued that a company’s capital structure is a crucial tool that can use to maximize the value of the business. It determines an appropriate structure that can be emerged as an important combination of long-term and short-term debt along with the preferred equity. The ratio between a firm’s liabilities along with its equity values has been found very effective for determining the value of risk factor in capital financing with reference balance between the debt and equity capital. In addition to that, a company that is highly dependent on the debt capital is being considered as an aggressive capital structure that contains the more risk for stakeholders (Raza and Karim, 2016). Moreover, this risk plays a critical role in the strategic planning for managing different risk factors.

As per the research of Garicano, Lelarge and Van Reenen (2016), it determined that the financial leverage is having a significant influence over the level along with the variability of the organisation’s after tax earnings that may have direct impact on the firm's overall risk and return. The concept of the operating leverage is significantly depending on the fixed operating costs and it may have direct influence over the higher operating risk of the firm. Baltacı and Ayaydın (2014) argued that high operating leverage is good when the sales are rising but it could be termed as a risky tool when companies are addressing the downfall in the sale volume. Bhagat and Bolton (2019) stated that the total assets along with the sale turnover are commonly considered as substitutes for determining the size of organisation. With the help of debt capital, larger companies are not only enjoying a higher turnover with the help of increased profit generation capabilities and but also it is also generating the higher income to stakeholders. This is because large companies are having the better access to capital markets and it would support manager in lowering the total cost of borrowing. In addition to that, large firms are more likely to handle short term debt along with the working capital requirements to manage their working capitals in more efficient manner as compared to the small firms (Nawaiseh, Boa and El-shohnah, 2015). In addition to that, most of the large firms are also enjoying the economies of scale that would support companies in minimizing their costs and increment in the profitability of the business operations.

2.4 Evaluation of different elements that influence the capital structure and corporate financing operations

As per the research of Ehrhardt and Brigham, 2016), it has addressed a firm’s capital structure can be evaluated as the proportion of the debt-to-equity. With reference to contemporary business environment, companies consider different sources of finance that can be categorised in the form of debt and equity capital that are used to manage a variety of financial needs such as expansion of the business, managing the capital expenditures, acquisitions of assets and inventories, and managing various short term or long-term investments. Vo and Nguyen (2014) stated that tradeoffs firms have to determine the requirements and usage of debt or equity to deal with different finance operations, and managers should have to maintain an appropriate balance in the two types of capital sources for assessing the optimal capital structure. For optimizing the capital structure in an organisation, a firm can consider either more debt or equity with consideration of different elements of cost of capital (Setiadharma and Machali, 2017). In the context of capital structure planning, the new capital that’s acquired by an organisation may be used for managing the investment in new assets or organisation may also consider the funds for managing the repurchase of the debt/equity that’s currently outstanding in the form of recapitalization.

On the other hand, the research of Frijns, Dodd and Cimerova (2016) determined that the minimisation of cost of capital has been perceived as the most critical task for the corporate financing operations. In addition to that, a sound capital structure of any business enterprise has found highly effective for maximising the shareholders’ wealth by paying extra attention on the minimisation of the overall cost of capital. In this regard, companies pay huge attention on debt capital or leverage to meet distinct financing requirements. In the context of contemporary business environment, companies are focusing to adopt the long-term debt capital within the capital structure so as they would be able to achieve the cost control objectives (Frijns, Dodd and Cimerova, 2016). In the context of larger firm, companies find more operational capabilities to manage the large proportion of debt capital within the overall capital structure of an organisation. This is because the cost of debt capital is lower than the cost of equity or preference share capital so as companies could manage tax benefits that may have substantial implications on funding operation. Moreover, the research of Ibhagui and Olokoyo (2018) determined that that the capital structure assists manager in managing the solvency risk or liquidity position. This is because the liquidity management has been perceived as an important determinant of the corporate financing decisions. In this regard, Kurshev and Strebulaev (2015) argued that a sound capital structure never allows an organisation for increasing the debt capital in high value because the emergence of poor economic condition of business may influences distribution of solvency in which the solvency would be disturbed for the compulsory payment of interest to the debt-supplier. By managing the risk of solvency, the firm size has been perceived as an important variable to determine the efficiency of financing practices (Pattiruhu, 2020).

2.5 Key variables consider in corporate financing operations

In this context of different studies, there have been different variables identified which are playing a critical role in supporting the corporate financing operations. In this regards, Ibhagui and Olokoyo (2018) stated that the capital budgeting is being termed as the most critical variable of corporate financing operations. This approach is used by investor when an organisation is planning for the long-term investment for different business objectives such as replacement of old machinery, acquisition of new machines and equipment, managing the investment in new plants, development of new products, establishing research and development operations and others. In this context, the concept of capital budgeting has been found very useful to evaluate the worth of funding of cash through the capital structure of an organisation within different investment options (Lumapow and Tumiwa, 2017). Amihud and Mendelson (2012) stated that concept of capital budgeting assists managers in evaluating the cost of capital for different investment proposal, value of return, appropriateness of different sources of finance, payback period and many more. Therefore, it is considered as the most appropriate in profit estimation through investment planning and resource management. Moreover, it assists managers in determining the requirements of funds to meet of funding requirements of different investment projects (Kurshev and Strebulaev, 2015).

The investigation of Hashmi and Naz (2020) determined that the primary target of every organisation to maximise the shareholder’s value with optimum investment and profit planning. In this context, the selections of capital structure and managing the solvency risk have been termed as key elements of strategic decision making process. Siahaan (2014) stated that financial management has the major goal of increasing the shareholder value. In this regard, the corporate finance managers are focused to maintain the balance between the investments in different types of projects that would support companies for increasing the firm’s profitability as well as sustainability. In addition to that, the regular payment of dividend is also considered as an important tool that is used by companies to maximise the value of shareholders. In this context, companies have to pay huge attention on the efficiency of capital structure, sources of finance, cost of capital and returns to maintain the stable business growth at minimal cost (Nakatani, 2019). Furthermore, the investigation of Humphery-Jenner and Powell (2014) determined that companies have a variety of resources and surplus cash through which managers manage the business expansion by investing the additional resources within different investment proposals. In this context, the corporate financing operations assist managers for conducting the proper analysis of capital structure and cost of debt financing for determining the appropriate allocation of the firm’s capital resources and cash surplus that could enhance the business profitability and dividend payment capabilities (Drempetic, Klein and Zwergel, 2020).

The investigation of Lumapow and Tumiwa (2017) was focused to evaluate the relationship between the return on investment and corporate financing practices in which researcher found that every organisation should have to pay a significant attention on the returns on investment in the financial planning and selection of sources of capital. In the of corporate finance theory, an organisation has to manage a significant investment in different assets for yielding an appropriation of the value to organisation. In addition to that, the return on investment is being termed as an appropriate approach for measuring the returns earned with reference to total value of invested capital. Therefore, return on investment is being termed as key driver of corporate financing operations because it will assist manager in evaluating the profit generation capabilities of an investment proposal along with its role to enhance the overall value of business entity (Arnegger, Pull and Vetter, 2014).

In similar way, the research of Ibhagui and Olokoyo (2018) was aimed to evaluate the corporate financing operations to manage the merger and acquisition in which researcher found the leveraged buyout (LBO) as the most critical concept of capital structure planning. It plays a critical role in stimulating the lending decisions among companies in which LBO can be applied in different forms such as Management Buy-in, Management Buy-out, Secondary Buyout and tertiary buyout. Overall, these elements have been found very effective to support the financial planning and investment management practices. However, Arnegger and Vetter (2014) stated that the assessment of leveraged buyout (LBO) has been found a very difficult task for performing the merger and acquisition in the small companies. Apart from that, it seems a great tool to support the investment planning with consideration of debt capital. Moreover, it would enhance of corporate financing operations with reference to contemporary trends in the business environment.

The research of Harisa, Mohamad and Meutia (2019) perceived the growth stock as an important variable of corporate financing operations and it plays a critical role in financial and investment planning. A growth stock has been termed as those stocks that generate positive cash flow and its revenue are increasing in more rapidly as compared to industry average. In the context of financial planning and resource management, the growth stock plays a critical role in enhancing the effectiveness of corporate financing operations with reference to long and short terms strategic goals (Kurshev and Strebulaev, 2015). Furthermore, Ali, Khurshid and Mahmood (2015) stated that the growth stock seems a great to estimate the future business profitability along with average rate of returns. It may leave substantial implications over the investment flow and resource management. Apart from that, the investigation of Coles and Li (2019) determined that efficient-market hypothesis has been termed as an important aspect of corporate financing practices. This is because the efficient market hypothesis determines that the financial markets are efficient in terms of information flow. It determines three types of hypothesis such as weak, semi-strong and strong that would support the management in investment management and selection of sources of finance to meet the long and short term strategic requirements in an efficient manner (Mule, Mukras and Nzioka, 2015). In this regard, scholar further stated that the ‘weak form’ determines that that the prices on traded assets are being termed as important reflection of all types of past publicly available information about the organisation. Moreover, ‘semi-strong form’ reflects that all types of publicly available information of companies and new information may influence the instant change in the prices of stocks. The ‘Strong form’ presents the instant reflection in the prices even the occurrence of the hidden information. Therefore, the term efficient market hypothesis may leave substantial implication on the long term financial planning and resource management (Wei, Xu and Zeng, 2017).

2.6 Theoretical assessment of corporate financing operations

The investigation of Arnold (2012) determined a systematic comparison of different theories based on the linkages between capital structure and the firm’s strategy that are playing a critical role in the corporate financing operations. In this context, researcher found two classes of models which pay extra attention on the structure of capital in which different determinants of the firm’s organisation along with the industrial strategy are having a significant influence over the corporate financing decisions. In this context, the first model evaluates the relationship between capital structure of an organisation along with its growth strategy on the market for goods and services that are having a significant influence over the efficiency of the corporate financing decisions (Gong, 2020). In the context of the second model, investigator presented the usage of the relationship between capital structure along with the different characteristics of inputs as well as the outputs within the production process. However, Agrawal and Matsa (2013) argued that the grounded approach influences the debt over strategic variables and it encourages the managers for developing appropriate relationships between suppliers as well as consumers. In the context of production operation, key strategic variables include price, quantity and others. In the context of corporate financing operation, the business strategy of the firm is being established in such manner that may influence the attitude of competitors along with effectiveness of corporate financing decisions.

Moreover, Demirci, Huang and Sialm (2019) stated that the capital structure affects the appropriateness of the business strategy along with the performance of any business for attainment of the market equilibrium. With consideration of different characteristics of the production process, the capital structure or corporate financing decisions may have significant influence over the availability of a particular product or service and it also affects the bargaining process between managers and suppliers. In this regard, the investigation of Vo (2019) determined that the oligopolies are tempted companies for taking on more debt as compared to monopolies within highly competitive market trends. Scholar further identified that the debt tends to be long term in the corporate financing practices. Further assessment of different theories of corporate finance assisted researcher for assessing different tactics of the collusion that influences the reduction of debt along with the debt capacities that may be aligned with the elasticity of demand. In the context of a theoretical standpoint, Ting and Azizan (2016) evaluated the models based on organisational along with the industrial considerations that disclosed the highly interesting findings about the selection of the capital structure and corporate financing operations. These models have been found very effective in describing the links between capital structure and characteristics of corporate financing operations that are mainly influenced by the market demand and competition level in particular sector or industry. In this regards, the different theories that are linking an organisation’s capital structure and factor-product markets have incorporated or determined the new dimensions in the research and a systematic evaluation has found the increased the role of the non-financial stakeholders in designing different types of corporate finance structure (Dwenger and Steiner, 2014). These elements are playing an important in corporate financing decision in different types of industrial organisation along with their firms’ strategic management. Moreover, Saeed, Belghitar and Clark (2015) highlighted the existence of mutual influences that are identified between production factors along with the corporate financial decisions in which industrial concentration and competition policy are being termed as the most critical component of financing decisions to influence the organisational sustainability.

The research of Harjoto (2017) was focused to conduct theoretical research in the field of corporate financing operations and found that companies have recorded several conflicts of interest not only between with internal stakeholders but also between outside agents that may have a significant influence over the management decisions about the long term financial planning and investment management. Norden and van Kampen (2013) argued that only a few of the theoretical formulations have been empirically examined different theories of corporate finances. Moreover, direct testing of different theories has been found difficult task because it has found a very difficult task for establishing the relationship among different variables. For example, the assessment of changes in the area of competition that were being influenced by a firm’s financing decisions. Moreover, different studies presented different assumptions related to the time duration, scope and conesquences of macroeconomic shocks that cannot be anticipated by market participants in an appropriate manner (Chen, Sensini and Vazquez, 2021). In this regard, Hamrouni, Boussaada and Toumi (2019) analysed the sensitivity of sales or revenue increases with reference to the changes in leverage value of different industries and concluded that the financial structure may have a significant influence over the firm’s performance in the context of the product markets because the selection of financing methods affect the firms’ competitive capacity within the highly competitive market trends. Moreover, different theories based on the relationships between firms’ capital structure along with the market for corporate control have determined a significant influence of the capital structure over the takeover activity within the financial planning and expansion decisions. Kalantonis, Kallandranis and Sotiropoulos (2021) stated that the incumbent managers can manipulate a public bid in the context of corporate financing operations that may have direct impact on the probability of success while performing business takeover bid that is mainly influenced by the equity stake that hold by an organisation. To the extent that the top management of the acquiring firm and of the target firm have maintained different competences so as the value of the firm is dependent on the level of resistance by the incumbent manager in response to different attempts of takeover (Chen, Sensini and Vazquez, 2021). Therefore, corporate financing operations are being influenced by several factors.

2.7 Contemporary trends in banking sector and recent changes in banking industry of Australia and New Zealand that influence corporate finance related decision

As per the investigation of Lumapow and Tumiwa (2017), there have been several changes identified in banking market capacity along with its structure with reference to change in market conditions and government regulation. In this regard, financial and other crisis reported the huge implications on the strong growth rate among companies or banking firms that are associated with the banking sector in different advanced economies. In this regard, several capacity metrics point or performance indicators have reported huge shrink in the wealth and operational capabilities of banking sectors during the crisis Therefore, banking firms have incorporated various adjustments to manage their market position so as companies have restructured the business operations (U-Din, Tripe and Kabir, 2017). For example, reduction in business volumes or change in the capital structure rather than assessing exit from the particular market.

Murray (2017) argued that the banking sectors have reported a significant expansion and growth in countries that were being less affected by the crisis, that include mainly emerging market economies (EMEs). Therefore, concentration within the banking systems has influenced several changes in the business model that also affects the corporate financing operations. In this context, the research of Ruming and Baker (2021) determined that the shifting in the bank business models has been considered as the most important element that influences financing decisions among banking firms in all over the word. This is because banking firms related to advanced economy have a tendency in order to reorient their business away from the complex business operations and organisational procedures, towards the less capital-intensive activities that cover different aspects of commercial banking operations. This approach leaves the huge implications on the banks’ asset portfolios along with several other factors that include revenue mix along with the increased reliance on customer’s deposit (Mayes, 2015). In this context, the Large banking firms associated with the European and US markets have also become more selective and paid extra attention on their international banking practices so as the banking sector companies related to the large EMEs addressed less negative consequences of the financial crisis even these organisation have expanded internationally. Moreover, Boxall, Bainbridge and Frenkel (2018) determined that the evaluation of different trends in bank performance in different countries has recorded a significant decline within the bank’s profitability and business model. In this regard, the lower value of leverage determined by regulatory reforms was being termed as key element of the decline in the business profitability. Moreover, many advanced economy banks are facing several issues related to revenues and cost management so as these companies have already taken several measures for cutting the business expenditure including the legacy costs associated with past investment decisions, along with change in the capital structure that may have direct impact on the firm size and corporate financing operations (Murray, 2017).

Willis, Carryer and Henderson (2017) stated that the main findings associated with the post-crisis are aligned with the structural change in banking operations along with capital structure through which banking firms would be able to assess the stability in the three critical area of the banking sector i.e. Bank resilience and risk-taking; assessment of the market sentiment and future bank profitability; and evaluation of the system-wide effects. In the context of first element, banking firms in all over the world have considered different variables to increase their resilience to manage a variety future risks that include substantially building up capital along with the establishment of appropriate liquidity buffers (Airehrour, Vasudevan Nair and Madanian, 2018). Hatem (2014) argued that the increased use of stress testing and other approaches by banking firms and other financial institution since the crisis has been found a great approach for assessing the greater resilience on a forward-looking basis so as companies would be able to regulate the credit flows in good as well as bad times. In addition, banking firms within the advanced economy have transformed their capital structure by shifting towards the more stable source of finance and managing their investment towards the safer as well as the less complex assets and other investment tools (Butt, 2016). In this context, some of these adjustments are also being influenced by some cyclical factors that include the accommodative monetary policy and other economic drivers. In this regard, different statistics determined that banking firms have considerably strengthened their risk management policies as well as internal control operations to enhance the effectiveness of business model along with corporate financing decisions. However, these changes would not provide an appropriate support to evaluate the market uncertainties in near future. Apart from that, the investigation of Błach (2020) found that assessment of the market sentiment and future bank profitability play a critical role in influencing the efficiency of the banking operations and corporate strategies. Despite of an appropriate recovery identified within different types of the marketbased indicators, the sentiments of equity investors towards larger institutions in recent years were remained sceptical towards some banks with low profitability (Silva, 2019).

Shen, Firth and Poon (2016) examined different simulations analysis that were being carried out by the Working Group and addressed that some institutions should have to adopt and implement further cost-cutting along with different kinds of the structural adjustments with reference to domestic business trends and future risk factor. In this context, the element of system-wide effect is having a significant implication on the operational and financial capabilities of banking firms (Gabaix, Landier and Sauvagnat, 2014). For assessing the implications of a variety of the structural changes, the assessment system-wide stability is essential because it must be harder in the case of individual banks would find different complex interactions that may have direct impact on the leverage and assets portfolio of banking firms.

The research of Dewally and Shao (2014) determined that banking authorities have adopted a number of changes that are consistent with the objectives of public authorities aligned with the other reform process. First of all, banks have been more focused on geographical element in their international strategy and tend to intermediate more of their international claims locally. Second, direct connections between banking organisations through a variety of companies that are involved in the lending and derivatives operations have been declined (Vithessonthi and Tongurai, 2015). Third, some European banking systems that are having relatively high capacity has incorporated several changes in their operations along with the banking system that also influences the progress with consolidation. Fourth, the implications of the less business model diversity have been raised in the form of the repositioning of many banking organisation towards commercial banking and also transformed the business operations to maximise the efficiency of business operations and it played a critical role in influencing the banking firms for shifting towards more stable funding sources such as deposits. Lawrenz and Oberndorfer (2018) argued that a range of other reforms in banking firms has also enhanced systemic stability with consideration of several modifications in banking operations in which size of banking companies also influence the management in establishment of an appropriate relationship in different source of finance and capital in which the size of an organisation has also considered as critical factor that determines an organisation’s capabilities for raising the leverage (Erel, Jang and Weisbach, 2020).

The investigation of Mitton (2020) determined that the Basel III reforms have been adopted in Australia and different regulations of these reforms are being executed as per the schedule that are playing a critical role in strengthening a prudential regime that is already tighter as compared to the global minimum standards. These reforms have been found very effective for encouraging the banking firms for putting the greater emphasis on the assessment of the cost of capital along with the liquidity in different business operation. In this regard, the Tier 1 capital ratios for the banking companies have been increased by 50% since 2006 in which the most of capital is being termed as the CET1 capital. These regulatory changes have been found very effective to manage several changes in the corporate financing operations. Lerner and Seru (2017) stated that the change in capital structure or corporate financing operation in banking system would be emerged as important element in the reduction in risk-taking operations. In this context, Banks are selling some of their higher risk assets that were failed j to provide in sufficient rates of return. For lowering the financial risks, Australian banks have reduced their international banking activities that are aligned with the United Kingdom and Asia, where banks were not gained appropriate returns and banks were not able to met banks' cost of capital. Apart from that, corporate financing decisions have influenced banking firm for the expansion of their exposure towards the mortgage lending that could reduce the requirements of capital because different collateral are being used to protect the these types of loans. In addition to that, the investigation of Tunyi (2019) determined that the majority of top banking firm have also diversified their business operations towards the life insurance along with the wealth management operations. These diversifications of the business operations were played a critical role in implementing several changes in capital rules because the banking firm would require the more capital for supporting the intra-group investments. Therefore, the management of banking should have to pay extra attention on the corporate finance and leverage management related decisions (Dang, Ngo and Hoang, 2019). This is because it has been anticipated that different investments aligned with diversified business operations may be failed to deliver the anticipated benefits that are influenced by the cross-selling, and an appreciation of the non-financial risks.

The research of Wei, Xu and Zeng (2017) determined that the introduction of liquidity regulations with consideration of the Liquidity Coverage Ratio (LCR) along with the Net Stable Funding Ratio (NSFR) has influenced the requirements of a substantial rise in the banks' liquid asset holdings that is increased to 20% as compared to 15% pre-crises rate that influences the requirements of funds among banking companies so as companies have to consider several factors in selection of appropriate sources of corporate finance such as size of organisation, profitability, market share and existing capital structure. Therefore, banking firms are paying huge attention on the High Quality Liquid Assets (HQLA) like government securities along with the government bonds different financing requirements of banking firms. Coles and Li (2019) argued that different liquidity regulations have been contributed to influence the reduction in liquidity along with the maturity transformation. It may have direct impact on the corporate finance and leverage of bank. In addition to that, Mule, Mukras and Nzioka (2015) argued that the change in capital structure level substantial change in the composition of banks' liabilities. For managing the efficiency of business operation, banking companies in Australia region have significantly reduced the usage of the short-term debt, while increasing their use of domestic deposits. By applying transfer pricing across in the context of the whole business operations, banks are now seeking to ensure that all lending decisions are significantly aligned with the liquidity of deposits or maturity transformation. As per the research of Olawale, Ilo, and Lawal (2017), it has found that the regulatory changes along with optimum recognition of bank’s financial risks as well as returns have restricted the growth banking organisation in term’s profitability since 2014. In addition to that, the divestment of different types of wealth management business operations has been the reduced total profits so as companies are paying extra attention on corporate financing decisions (Olawale, Ilo and Lawal, 2017).

Therefore, banking firms are paying extra attention on the profitability of the business operations by focusing on return on assets (ROA) but financial crisis leaved negative impact on the organisational profitability (Ali, Khurshid and Mahmood, 2015). Two important contributors have been the increased holdings of (safer but lower yielding) HQLA and a more general decline in risk-taking and hence reward. The fall in profitability has been even larger when it is measured by return on equity (ROE) as a result of the increase in bank’s equity outstanding. Moreover, the decline in profitability does not equate related to the costs of financial intermediation for customers. Therefore, the spread between lending rates along with the funding costs leaves significant impact on efficiency of corporate finance (Kurshev and Strebulaev, 2015). In this regard, the higher costs to customers and lower profits profit margin in banking firms reflect the different implications of tighter prudential regulation.

2.8 Revenue and firm’s size

Tunyi (2019) stated that revenue presents the total amount of money a company brings in consideration of sales of a variety of products and services. In the context of contemporary business environment, revenue is being termed as an important indicator of an organisation’s capabilities for generation of revenue along with the efficiency of business operations. It may have a significant influence over the profit generation capabilities. The investigation of Lerner and Seru (2017) determined that revenue also has critical psychological implications over the both internal and external stakeholders for an individual’s business. Moreover, employees would be able to feel more confident with their employer and have found a sense of security and stability in their jobs. It plays a critical role in influencing the firm’s size. In addition to that, strong revenue production offers employees this feeling of comfort and also influences the perception of other stakeholders that may have a significant impact on the business planning and decision making. It may have a significant impact on the strategic planning and financing decisions of companies (Lumapow and Tumiwa, 2017). Kurshev and Strebulaev (2015) argued that the amount of revenue is being termed as the most important tool to business partners, suppliers, community members along with the other stakeholders for determining the efficiency of business operations and effectiveness of corporate planning and decision making. The high value of revenue offers more confidence to stakeholders for making more risks decisions to support the business operations along with decision making process. As per the research of Pattiruhu (2020), it has found that the revenue plays a critical role in influencing the flow of funds within the business operations that influences the availability of working capital to manage the financing requirements. Therefore, the revenue plays a critical role in influencing the corporate financing operations along with the capital structure.

The study of Dang, Li and Yang (2018) was focused to evaluate revenue trends in the banking sector. In this regard, the retail banking has been perceived as key driver of revenue and it plays a critical role in influencing the flow of funds that may have a significant influence over the corporate financing decision. However, Hashmi and Akhtar (2018) argued that wholesale banking which is the second highest revenue generating segment and it typically accounts for 15% to 40% of the revenue generated by banks in modern times all over the world refers to a special banking operation which is also known by the name of investment banking. The major services provided by banks under this Wholesale banking includes trading and sales, corporate lending, mergers and acquisitions and many more. These services are playing a critical in estimation of the organisation’s capabilities along with the firm’s size (Hashmi and Akhtar, 2018). This is because the bigger firms have more capabilities to generate the high value of revenue margin. Therefore, the revenue plays a critical role in evaluating the firm’s size.

On the other hand, Dang, Li and Yang (2018) argued that revenue of an organisation cannot present the firm’s size in an appropriate manner because several factors affect the revenue generation capabilities some of these variables can be controlled by an organisation or some of these factors cannot be controlled by a firm in an efficient manner. In this context, the economic growth of a country has been addressed as the key driver higher revenue because the high rate of economic growth encourages the market demand of different products and services so as companies would find several opportunities to generate the extra sales or revenue with reference to change in the economic conditions of country. In this context, the revenue of an organisation is influenced by different market drivers and companies would not find any significant influence of the business strategies over its revenue generation. Furthermore, the nature of goods or services may have direct influence over the strategic planning along with their market demand. In some cases, companies are generating higher revenue even after low capital investment (Sardo and Serrasqueiro, 2017). For example, IT sector. However, some companies are generating the low revenue even after the higher capital investment. Therefore, Shah (2012) stated that revenue cannot be considered as an important element for determining the firm’s size in an appropriate manner. This is because the sales of an organisation may be fluctuated with reference to different internal and external factors that may have direct impact on the long term business sustainability. Therefore, the consideration of revenue as the firm’s size would not be suitable in all types of companies.

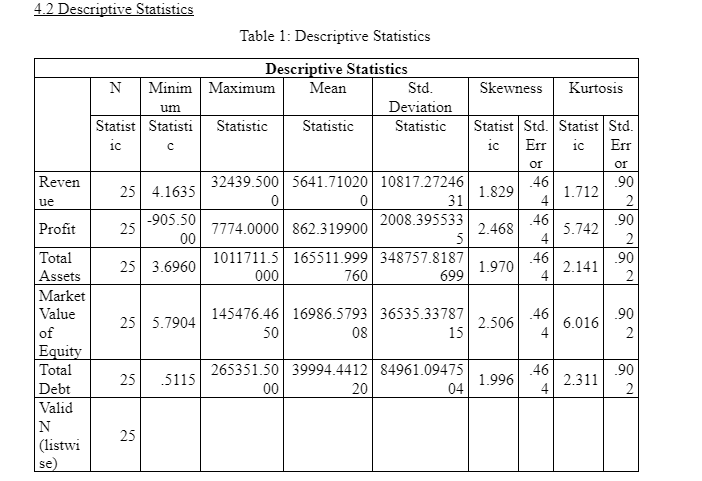

2.9 Profitability and firm’s size