Risk Factors in Fintech Business Operations

1. Introduction

Fintech is being emerged as new financial industry that combines the technology with financial service for improving the quality of financial services to both individual and commercial clients. This type of companies consider a wide range tech-based solutions like e-finance, social networking services, and other innovations that would provide the best and creative services to clients. In this regard, big data analytics, artificial intelligence and other e-commerce financial technologies are being emerged as great disruptors in restructuring the financial service practices (Tang, Ooi and Chong, 2020). In the context of contemporary business environment, the Fintech companies offer wide range of payment and loan services with consideration of economic sharing, regulations, policies and information technology. However, several unique services of Fintech firms such as financial consultancy, crowed funding, virtual currencies and cyber securities along with digital innovation are incorporated several challenges and risk factors for modern financial system. It includes the easy access of finance, non-compliance of all legal guidelines, unavailability of appropriate regulatory environment, and many more that may leave the adverse impact on the sustainability of different financial institutions (Ryu, 2018). Therefore, this report is going to evaluate different risk factors associated with Fintech Business operations because the Fintech companies have incurred different disruption within the role, structure and competitive environment for financial institutions. If you need assistance with a finance dissertation help, then reach out to us for our valuable guidance.

1.2 Study Aim and Objectives

The aim of the current study is To Assess Different types of New Risks Does Fintech Create for the Modern Financial Institution.

As pert the study aim, research followed the below mention objectives to meet study goals:

To evaluate the contemporary trends in the context of Fintech firms.

To identify new types of risks influenced by Fintech firms for existing financial institution.

1.3 Research Questions

For managing the data collection process with reference to study objectives, researcher is going to consider below mentioned research questions:

What are the contemporary trends in the context of Fintech firms?

How does Fintech industry influence the risk for existing financial institution?

1.4 Rationale of the Study

The present study is focused to assess different types of new risks does Fintech create for the modern financial institution. The main reason behind consideration of this area of investigation was that there have been several studies performed on the framework of financial institutions along with their operations but the present study is tried to present a distinct approach associated with finance sector (Ng and Kwok, 2017). This is because Fintech companies consider a variety of digital tools and technologies to facilitate the best experiences to clients in terms of payment solutions and easy access of finance so as the increased popularity of Fintech companies with consideration of some innovative tools may influence a variety of risk factors to different financial institution. This investigation would provide a great support to financial regulators and other financial institution in developing a variety of policy and strategic to manage the disruption related risk factors aligned with the operations of Fintect.

2. Literature Review

2.1 Introduction

In the context of contemporary studies, the section of literature review assists researcher for assessing in-depth understanding about the area of investigation. This section covers a detailed assessment of a variety of secondary data that has been extracted from online books, journals, findings of past studies, views of different scholars, and internet-based articles (Ryu, 2018). As per the study goals, this section covers detailed evaluation of contemporary trends in Fitech industry along with risks crated by Fintech industry for the different financial institutions.

2.2 Contemporary trends in Fintech Industry

Saleem (2021) stated that Fintech is also considered as the ‘financial technology’ in which companies establish a combination of different technologies like software, algorithms, compute and mobile-based tools with reference a variety of financial service. This industry enables the user to carry out a variety of financial transaction such as deposit checking. fund transfer, credit facilities, bills payment and others. Fintech companies have developed a variety of tech-based solutions that are widely used by bank, finance firms, lenders, e-commerce websites and many more (Romānova and Kudinska, 2016). Moreover, the investigation of Wang, Liu and Luo (2021) determined that Fintech industry has incorporated several disruption in the context of role of financial institutions along with their structure for managing the market environment. Moreover, the post-crisis regulatory frameworks have influenced companies for managing the significant adjustment in the business model of different kinds of financial institutions. In this regard, the technology plays a critical role in the strategic planning and resource management that also influences the quality of financial services. Therefore, the popularity of Fintech companies has been enhanced in significant manner (Suprun, Petrishina and Vasylchuk, 2020). Due to availability of the high quality of service, Fintech industry has recorded the huge growth and it has attracted the huge investment within the financial sector. In this context, over €2.7 billion was being invested within European fintech during the first quarter of 2018. In similar way, the total value of investment in US FinTechs was being raised to $12.4 billion in funding. The assessment of UK market trends has determined the country has over 1,600 FinTech firms and total number of fintech companies would become doubled by 2030 in UK. Therefore, the preference of fintech firms has been enhanced in significant manage different kinds of financial services (Top 5 risks for FinTech businesses, 2019). Moreover, Li and et.al. (2020) argued that different technology-led financial services firms are paying a significant attention for increasing transparency along with efficiency of financial transactions. It also plays a critical role in reducing costs of financial services as well as providing the most vulnerable access to a wide range of the financial products. These companies have found a significant success in order to provide consumers and businesses unique services with consideration of the innovative tools and products through they are able to manage and control their money. The fintech industry offers a combination of various services such as app-based banking, online lending and financial services, investment platforms, trading platforms along with the AI-led wealth management (Hill, 2018). Varga (2017) argued that FinTech businesses have a unique combination of exposures influenced by technology that are not contemplated by the traditional financial institutions products and services.

2.3 Risks created by Fintech industry for financial institutions

The investigation of Kagan (2020) determined that the financial industry is working under different regulations but financial institutions in different countries do not have appropriate control over the internet-based transactions. Therefore, several have been addressed associated with the business operations of Fintech such as moral hazard, loan defaults, along with the information asymmetry. In this regard, Bunea, Kogan and Stolin (2016) stated that the inappropriate professional liability is being emerged as the most critical issue that could be aligned with the business practices of Fintech companies. It includes the negligent advice and failing in facilitation of appropriate client services for different financial products and services. In the context of contemporary business trends, Fintech companies offer a variety of new and unique products. However, the selection of an appropriate distribution model also affects the quality of services and compliance of legal guidelines. Moreover, the Fintech companies are highly dependent on the third party contractor that influences the liability of risk due to negligence of third party contractors within the service rendering process (Petrushenko and But, 2018). On the other hand, the investigation of Lee and Shin (2018) determined that the technology plays an important role in the context of Fintech companies. The consideration of new technologies, new products and new distribution are incorporating new wealth opportunities. Moreover, it also influences the new regulatory exposure of different financial regulatory authorities and financial institutions. Moreover, Fintech companies identify the some loophole in the existing the financial structure to facilitate the best experience to customers. Therefore, the financial regulators has to update their regulations for ensuring the safety and protection of Fintech companies from unethical trade practices.

As per the research of Ng and Kwok (2017), it has found that the theft of funds has been emerged as the crucial risk factor aligned with the Fintech financial transactions. This is because the majority of the Fintech companies are managing the high frequency of fund movement. In this regards, the high volume of payments, higher number of transactions and customer accounts influence companies for consideration of latest technologies. But, the increased usage of technology would enhance the vulnerability of financial transactions to theft. These thefts are conducted by cyber criminals and external parties that are not involved in the financial transactions (Tang, Ooi and Chong, 2020). In this regards, Ryu (2018) argued that Fintech companies have been emerged as the prime target for cyber criminals. Therefore, Network security, data breaches or even a denial-of-service attack as well as damage and rectification costs following these incidents would be emerged as key area of concern for FinTech companies along with financial institutions. In the context of contemporary business environment, cyber crimes are being emerged as the most critical problem for both Fin-tech companies along with financial institutions. Therefore, government agencies have to update their policies related to cyber crimes and other issues. Saleem (2021) stated the existing banking firms and other traditional financial institutions are enhancing their dependence over the business operations of Fintech companies that are highly dependent on technologies. Therefore, the technological failure has been addressed as an important risk factor that is faced by the financial institutions and clients (Ryu, 2018). The heavy reliance of technology infrastructure could enhance the risks in which customers are unable to access a variety of services that resulting lost in income or lost customers. Therefore, optimum utilisation of a variety of tech-based solutions has been emerged as the most critical tasks for Fintech companies (Romānova and Kudinska, 2016).

Apat from that, the research of Wang, Liu and Luo (2021) determined that Fintech firms are having a variety of digital payment and other services that also influence the easy access to finance that may increase the chances of defaults. The high number of loan defaults influences the regulatory authorities to manage different guidelines for controlling the loan defaults. Moreover, the Fintech firms are managing their practices with banks and different financial institution so as the easy access to finance for people may increase the chances of the number of defaulters that could enhance the sustainability related risk factors for different finance and banking firms (Suprun, Petrishina and Vasylchuk, 2020). In similar way, Li and et.al. (2020) argued that Fintech has gained a significant success to manage the requirements of customers with consideration of different tech-based solutions. Therefore, the increased the popularity of Fintech companies increases the competition level for the different financial institutions. This thing influences sustainability risk for those finance institutions that are offering traditional services because the customers are transforming to new companies that are offering the highend and unique services (Petrushenko and But, 2018). Moreover, the investigation of Kagan (2020) determined that merger of technology and industry has incorporated several challenges for traditional financial institutions because the FinTechs aren’t likely to find all of their exposures that could be covered within a single policy. On the other hand, the traditional financial institutions policies are not covering the liability arising from the failure of technology, failure influenced by the sub-contractor liability or IP infringement (Hill, 2018). On the other hand, the technology policies aren’t likely to cover different exposures from the provision of financial services products or advice and are unlikely to offer the D&O cover that is expected by the majority of the financial organizations.

2.4 Summary

As per the above assessment, the section of literature review determines the Fintech companies has recorded a significant growth and popularity due to emergence of digital technologies along with incorporation of tech-based solutions so as consumer finds the high quality financial services. However, this section determines the Fintech industry incorporates a variety of challenges and risks factors existing financial institutions such as cyber security, movement of customers, and others.

3. Research Methodology

3.1 Research Philosophy

In the context of contemporary studies, there are mainly two types of research philosophy considered by different researchers with reference to nature and goals of investigation i.e. positivism and interpretivism. As per the study goals, researcher adopted the interpretivism research philosophy because that the interpretivism research philosophy would be found very effective to evaluate the different areas associated with human interest. It has found very effective to manage the qualitative data in an efficient manner (Daniel, Kumar and Omar, 2018). On the other hand, positivism is mainly considered for carrying the quantitative investigation based on different facts and figures.

3.2 Research Approach

In the present investigation, researcher identified two possible options of the research approaches i.e. inductive and deductive but the researcher applied the inductive approach because it offers logical thinking process that is associated with specific observations to create the broader generalisations and theories. On the other hand, the deductive approach was not found reliable for managing the qualitative investigation because it would provide better support for testing existing theories and approaches (Devi, 2017). It influences the researcher for the researcher for narrowing down the investigation towards the more specific hypotheses.

3.3 Research Design

As per the nature of current research, the researcher followed the exploratory research design because the exploratory research design offers the high level of flexibility to bring new innovation and ideas and it would assist the researcher for assessing a significant understanding about different research issues (Dźwigoł, 2018). On the other hand, descriptive research provides the better result for assessing the relationship among different variables.

3.4 Data collection

As per the requirement of current investigation, researcher adopted the both primary and secondary sources of information. The primary data collection was mainly performed by questionnaire-based survey (Fletcher, 2017). On the other hand, the collection of secondary data was mainly carried out through books, online journals, internet articles, and others.

3.5 Sampling and Sample Size

In the current study, researcher needs the expert knowledge of financial professional professionals to meet the study goals in an efficient manner. Therefore, the purposive sampling approach was being adopted researcher to gain useful information about the area of investigation. With consideration of purposive sampling, researcher considered a sample of 20 financial analysts as the target respondents for filling questionnaire.

3.6 Data analysis

In the context of qualitative investigation, researcher adopted the thematic analysis to evaluate different responses in the primary data collection (Flick, 2015). In this process, researcher developed different themes with reference questionnaire and research objectives. However, the statistical analysis was not found suitable in the case of current investigation.

4. Findings and Discussion

4.1 Thematic analysis

In the evaluation of the primary data, the concept of thematic analysis has been addressed as the most reliable tool to assess different responses of participants. In this context of present investigation, researcher created different themes with reference to research questions and questions that were asked in the questionnaire. In the current investigation, researcher considered the responses of 20 financial analyst of different finance companies that are evaluated with consideration of thematic analysis.

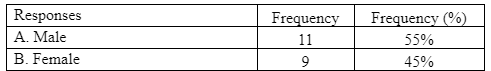

The above table presents responses of participants about the gender in which 55% of participants were make and 45% of participants were female that shows that researcher has tried to maintain the equality in the data collection process.

Theme 2: The popularity of Fintech companies have been enhanced in significant manner.

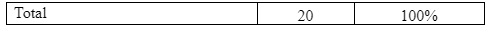

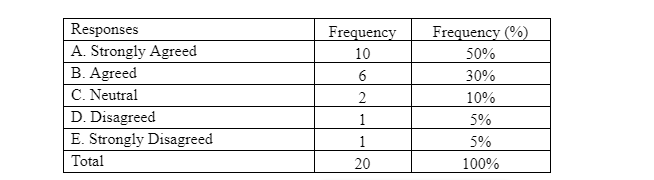

The above table presents the responses of participants when they were asked about the increment in the popularity of Fintech companies in which the majority of participants were accepted that the popularity of Fintech firms have been enhanced in significant manner because the 85% of participants were considered the option of strongly agreed and agreed. However, only 2 participants were opposed the argument by selecting the options of disagreed and strongly disagreed. Therefore, it can be stated that the fintech companies are being emerged as a critical disruptor in the context of finance sector.

Theme 3: Tech-based unique or innovative services are emerged as key driver of the popularity of Fintech Industry.

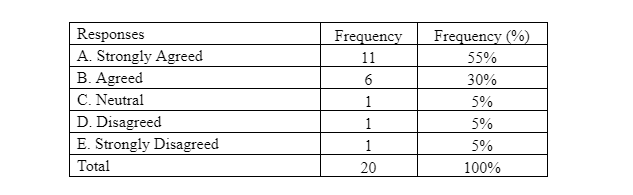

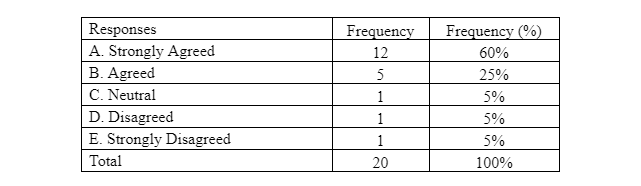

As per the above responses, it can be stated that technology plays a critical role in the development and growth of Fintech industry. This is because 60% of participants were selected the option of strongly agreed and 25% of participants were considered the option of agreed. Overall, it can stated that different technologies like artificial intelligence, mobile-based tools and others are leaving a significant implication on the improving the efficiency of tech-based financial services.

Theme 4: The increased popularity of Fintech industry incorporates several risk factors for financial institutions?

When the participants were asked about the influence of risk factors for financial institutions due to the increased popularity of Fintech industry then the majority of participants were provided by their positive responses by selecting the option of Strongly Agreed and Agreed. In this context, total 80% of participants presented the positive responses.

Theme 5: Different risk factors identified that are associated with the business operation of Fintech firms for financial institutions.

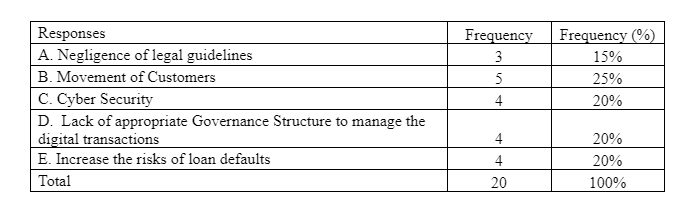

In the context of current study, the above table presents the responses of financial analysts when they were asked about the most critical risk factor for financial institutions influenced by the the business operation of Fintech firms in which researcher was found mix responses because the 15% of participants were selected the option of Negligence of legal guidelines, 25% of analyst were considered the option of Movement of Customers, 20% participants were selected the option of Cyber Security, 20% of respondents were preferred the Lack of appropriate Governance Structure to manage the digital transactions and remaining 20% of participants were selected the option of Increase the risks of loan defaults as the key risk factors for financial institutions. Therefore, the fintech industry stimulates a verity of risks for traditional financial service providers, regulators and banking authorities.

4.2 Discussion

In the context of current study, researcher has tried to Assess Different types of New Risks Does Fintech Create for the Modern Financial Institution. Therefore, researcher considered both primary and secondary sources of information to assess the useful information about the subject matter. In the primary data collection data, researcher found that the popularity of Fintech companies has been enhanced in significant because these companies are offering a wide range of tech-based services to manage the payments, fund transfer, credit and many more. In this regards, the technology plays a critical role that include internet, artificial intelligence and others. These findings are also supported by the investigation of Bunea, Kogan and Stolin (2016) that determined that companies working in the Fintech industry has incorporated several disruption in facilitation of a variety of financial along with their structure for managing the market environment. Fintech industry has recorded the huge growth and it also attracted the huge investment due to availability of the high quality of service. The fintech industry offers a combination of various services such as app-based banking, online lending and financial services, investment platforms along with the trading platforms that have been recorded as key growth drivers.

In the context of primary data collection, researcher identified multiple risk factors associated with fintech services that may leave adverse impact on the efficiency and sustainability of traditional financial institutions such as Negligence of legal guidelines, Movement of Customers to Fintech services, Cyber Security related challenges, Lack of appropriate Governance Structure to manage the digital transaction and Increase the risks of loan defaults. In the context of present investigation, the evaluation of secondary data also determines similar outcomes as compared to findings of primary data collection. In this context, Lee and Shin (2018) stated that the increased usage of technology in dealing with a variety of financial transactions would enhance the vulnerability of financial transactions form different security related threats. These threats are conducted by different cyber criminals and external parties. However, Wang, Liu and Luo (2021) argued that the high number of loan defaults associated with Fintech companies influences the regulatory authorities for managing different guidelines for controlling the loan defaults and it could increase the chance of risk factors. In addition to that, Ng and Kwok (2017) asserted that the efficiency of the Fintech companies is highly dependent on the different kinds of third party contractors and service providers that influences the liability of risk due to negligence of third party contractors within the service rendering process. All these factors influence different types of risks for the financial regulators.

5. Summary of Key Findings

In the present study, researcher has tried to Assess Different types of New Risks Does Fintech Create for the Modern Financial Institutions. The first research question is What are the contemporary trends in the context of Fintech firms? so as the comparison of primary and secondary research findings concludes that Fintech companies have recorded a significant growth by influencing an appropriate combination of financial services with technology. Therefore, customers get high quality, innovative and creative services from the Fintech companies. This thing influences customers to move their financial transactions from the traditional financial service providers to Fintech companies. Therefore, this industry has gained a significant in attracting the investment from various other financing firms. The second research question is How does Fintech industry influence the risk for existing financial institution? in which comparison of primary and secondary research findings concludes the similar outcomes such as inefficiency of existing financial institutional framework in relation to requirements of Fintech industry, movement of customers, cyber crimes, increase level of frauds in different types of financial transitions, negligence of legal compliance and many more. In addition to that, the existing financial institutions or regulatory authorities would also find the increment in the risk factors that are associated with credit risk management, loan defaults and others. Overall, it can be stated that Fintech industry has reported huge disruption in the financial service sector in all over the world.

6. Recommendations

As per the findings of current study, the government agencies and financial regulators should update their digital safety guidelines on regular manner for controlling criminal activities that are mainly focused to Fintech industry. Moreover, the Fintech industry would record a significant growth in near future due to increased usage of mobile technologies and other tools so as traditional financial institutions should establish the collaborative working system with Fintech companies for lowering different risk factors along with enhancement in the organisational sustainability.

7. Research Limitations

In the context of current study, several limitations may limit the usefulness of study findings. First of all, researcher focused on the qualitative data with primary research so as researcher was not able to determine the correlation among different variables. Secondly, this investigation mainly paid extra attention on the risk factors aligned with Fintech industry but it did not cover the positive elements so as users only gets the information of different risk factors.

Reference

- Bunea, S., Kogan, B., and Stolin, D. (2016). Banks Versus FinTech: At Last, it's Official. Journal of Financial Transformation, 44, 122-131.

- Daniel, B., Kumar, V., and Omar, N. (2018). Postgraduate conception of research methodology: implications for learning and teaching. International Journal of Research and Method in Education, 41(2), 220-236.

- Devi, P. S. (2017). Research methodology: A handbook for beginners. Notion Press.

- Dźwigoł, H. (2018). Scientific research methodology in management sciences. Фінансово-кредитна діяльність: проблеми теорії та практики, (2), 424-437.

- Fletcher, A. J. (2017). Applying critical realism in qualitative research: methodology meets method. International journal of social research methodology, 20(2), 181-194.

- Flick, U. (2015). Introducing research methodology: A beginner's guide to doing a research project.

- Hill, J. (2018). Fintech and the remaking of financial institutions. Academic Press.

- Kagan, J. (2020). Financial technology–fintech. Datum pristupa dokumentu, 13(6), 2020-2025.

- Lee, I., and Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business horizons, 61(1), 35-46.

- Li, J., Li, J., Zhu, X., Yao, Y., and Casu, B. (2020). Risk spillovers between FinTech and traditional financial institutions: Evidence from the US. International Review of Financial Analysis, 71, 101544.

- Ng, A. W., and Kwok, B. K. (2017). Emergence of Fintech and cybersecurity in a global financial centre: Strategic approach by a regulator. Journal of Financial Regulation and Compliance.

- Petrushenko, Y., Kozarezenko, L., Glinska-Newes, A., Tokarenko, M., and But, M. (2018). The opportunities of engaging FinTech companies into the system of cross-border money transfers in Ukraine. Investment Management & Financial Innovations, 15(4), 332-344.

- Pollari, I. (2016). The rise of Fintech opportunities and challenges. Jassa, (3), 15-21.

- Romānova, I., and Kudinska, M. (2016). Banking and Fintech: a challenge or opportunity?. In Contemporary issues in finance: Current challenges from across Europe. Emerald Group Publishing Limited.

- Ryu, H. S. (2018). What makes users willing or hesitant to use Fintech?: the moderating effect of user type. Industrial Management & Data Systems.

- Ryu, H. S. (2018, January). Understanding benefit and risk framework of fintech adoption: Comparison of early adopters and late adopters. In Proceedings of the 51st Hawaii International Conference on System Sciences.

- Saleem, A. (2021). Fintech Revolution, Perceived Risks and Fintech Adoption: Evidence from Financial Industry. Educational Research (IJMCER), 3(3), 191-205.

- Suprun, A., Petrishina, T., and Vasylchuk, I. (2020). Competition and cooperation between fintech companies and traditional financial institutions. In E3S Web of Conferences (Vol. 166, p. 13028). EDP Sciences.

- Tang, K. L., Ooi, C. K., and Chong, J. B. (2020). Perceived Risk Factors Affect Intention To Use FinTech. Journal of Accounting and Finance in Emerging Economies, 6(2), 453-463.

- Top 5 risks for FinTech businesses. (2019). [Online]. Accessed through: https://www.cfcunderwriting.com/en-gb/resources/articles/2019/11/top-5-risks-for-fintech-businesses . [Accessed on 8th Nov. 2021].

- Varga, D. (2017). Fintech, the new era of financial services. Vezetéstudomány-Budapest Management Review, 48(11), 22-32.

- Wang, R., Liu, J., and Luo, H. (2021). Fintech development and bank risk taking in China. The European Journal of Finance, 27(4-5), 397-418.

Continue your journey with our comprehensive guide to A Study on the Banking Industry in Australia and New Zealand.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts