Automated Systems in Insurance Sector

Introduction

The orientation of the concerned project development report has been formulated on the aim of demonstration of a particular process implementation within a working environment. To this effect, the selection of the automated and computerised office work systems management has been undertaken within the sector of the global Insurance industry. The project development report has been constituted to perform the identification of the work imperatives. These imperatives are necessary to be fulfilled through adopting of proper technology for modernisation of working processes of the offices of insurance organisations. The purpose of such an endeavour has been the effective promotion of the service delivery mechanisms which could enhance the service delivery within the selected industry. This purpose could be further explained to be the endeavour, on part of organisational working processes, for the attainment of the objectives related to maximisation of both profits and work process management efficacy. Such an objective is equally applicable within the differential and leading insurance organisations on the global scenario. The project study report would be formulated as an empirical design through a structured approach to explore the specific impact of adoption of automated and computerised work management systems in the insurance sector to further the service quality. The project development is also formulated to achieve the profitability and efficacy of greater dividend generation in the sector under consideration. The structure of the project development would constitute a gradual approach involving several phases of development of the entire study project.

Project background

According to Albrecher et al (2019), various insurance organisations on the global scale such as AXA, Berkshire Hathway, Allianz SE, Prudential PLC and others had been utilising Punch Cards, Magnetic Reflective Cards and other similar equipments for the office tasks such as commission release to the agents, premium billing and sending of various premium notifications to the policy holders and printing of policies and receipts as well as default notifications, even during the early part of the 21st Century. In this context, Bohnert, Fritzsche and Gregor (2019) have observed that, in terms of effectively managing the long term contract based functionalities involving the policy holders and various other intermediaries such as the Development Officers and insurance agents, the institution of latest computerised work processes within the front end offices and even at the back offices has acquired extensive significance and priority. Thus, Colladon (2015) has suggested that the undertaking of a concerted effort based project implementation to ensure that any selected, global insurance organisation could be equipped exclusively with the latest computer hardware and software suits for the automation of the information processing and other office works, would be off extensive relevance and pertinence. Furthermore, this could be further elaborated from the perspective that the expansion of the responsibilities of the insurance organisations in the current hyper competitive global scenario, in the manner of preparation of multiple financial and administrative statements such as commission bills, premium income statements formulated on the basis of data filled by the individual Divisional Offices and branches of the concerned insurance organisation and various similar accounting statements, has made it imperative for the organisational office work management mechanisms to be transmuted from a manual to a completely digitised and Information Technology based computerised format.

Continue your journey with our comprehensive guide to Systems Management.

Project Context

As per the research of Buonfiglio et al (2017), the commercial significance of the computerised work system management within the Insurance industries could be realised from a utilitarian perspective. This could be especially acknowledged in the format of implementation of greater effective physical control on the entirety of data management mechanisms so as to improve the existing mechanisms of both security and operational efficacies. This also concerns the time management imperatives which dictate the incredible pace of business process in the current global scenario. The benefits to be derived from such a project performance could be understood to be the prevention of data theft and other formats of economic crimes, unintended shortcomings, blunders and shortfalls in work management. As have been opined by Boddy, McCalman and Buchanan (2018) the institution of cutting edge IT applications in tandem with the latest automated computing equipment, could generate accurate and instantaneous solutions to the existing insurance office work related contingencies concerning processing, managing and storage of data. The objective is always maximisation of the profits earned. This involves operational efficacy management which could be only performed through a gradual and definitive shift from the manual to the information management based operational process. The application of the computerisation project to institute IT assisted work processes within the front and back offices of such insurance companies is thus critical concerning this context. According to DiRienzo (2015) the current context of insurance sector based corporate operations management is fundamentally directed by the application of information technology based applications. The causality has been the increasing significance of multiplicity of deliverables which IT based applications could furnish as support tools to the insurance organisations so that multifunctioning and multitasking abilities could be fostered within the office based work processes of such organisations. According to Frey and Osborne (2017), some involved tools and support systems are automated workstations, executive work-systems, storages and analytical, screening and management applications for electronic mails, management informatics and decision support systems. These could assist in the signing the proposals, managing the application procedures, reception of quotes and negotiation of the terms of policies.

According to Friesen (2017), the context of the project portfolio could further be explained to be the attempted fulfilment of the modernisation necessities of different organisations where, the existing workforce personnel of insurers stationed at the home office could be supported through automated tools of information processing, storage and communication functionalities. According to Rosemann and vomBrocke (2015), most of the insurance products are primarily sold through the Internet in the current scenario. This consistently reduces the transaction cost and required time duration and also contributes to the improvement of the service quality of the customers. Furthermore, the increasing numbers of insurance organisations has further necessitated the improvement of service quality by different insurance organisations to better serve the market segments which are in existence. Apart from this, product specific information provisioning to the identified market segments through the different information channels of the Internet could be effective in terms of preserving the customer bases of the insurance sector operators. Furthermore, Gunjan and Khatravath (2016) have highlighted a pertinent observation. This has been the fact that utilisation of completely computerised information management processes in the Insurance sector has been exerting the influence on the customers in the measure of assisting them through making information available online which could be accessed relatively effortlessly. This benefit, concerning multiple insurance agencies and their product offerings, enables the customers to comparatively evaluate the best suitable insurance policies for them prior to the formulation of their decisions. Such observations, according to Anderson (2016), are reflective of the aspect that utilisation of consistent technological improvements to perform the business operations of the insurance business functionalities has become the need of the hour and this is only performable through institution of IT applications and complete computerisation of all of the manual and semi-manual work processes within the corporate offices of different insurance companies. Thus, Incze et al (2016) have stated that the corresponding project portfolio has been an attempt to develop impeccable service performance in the insurance sector. This is inclusive of functionalities such as collecting the necessary data regarding various market ratings, underwriting the policies and policy document development within a particular insurance organisation.

Trans-disciplinary theoretical models analysis

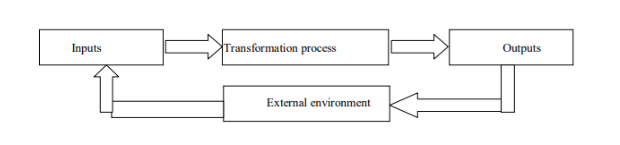

The research of Hespanha (2018) has outlined that Systems Theory could be considered to be the trans-disciplinary theoretical model which could be effective in terms of suggesting the evolutional approach through which transformation of specific functionality based operational management mechanisms could be explained. To this effect, this theoretical construct is considered to be capable to clarify the role and significance of the specific components of any hierarchical and complicated organisational structure such as an insurance organisation. Furthermore, Lamberton, Brigo and Hoy (2017) have opined that the spiralling competition between different insurance operatives within the insurance sector has outlined the necessity to call for the enhancement of the digital software based operations within the working structures so as to cope with the competitive contingencies in the current markets. In this context, Kerzner (2017) has delineated that the constructive approaches of Systems Theory emphasises on consistently aligning the insurance office subsystems with each other so that the incremental development of the complicated subsystems could be effectively coordinated. This process involves accurately transmuting the informational inputs into service outputs. In this context, Innovation (2019) has categorised that the interdependencies of such operational subsystems could effectively amplify the glitches made in any of the subsystems. This contributes to the occurrence of untoward consequences in a collective manner within the working architecture of insurance sector operators.

According to McCall et al (2017), the components of the Systems Theory could be utilised, in the form of systems boundary management and direction of the flow of information, to improve the computerisation of the office based working processes of the insurance sector operators. Eling and Lehmann (2018) have determined that the error elimination possibility through computerised, automated data processing and output generation abilities, could be utilised in the forms of the systems boundary component of the theory. This could be explained as the process of entering accounting and records based data in the primary computerised systems so that the subsequent operational subsystems could be prepare the accounting reports and associated outputs accordingly. This could minimise the possibility of repetition of the posting of similar data sets on multiple occasions since manual services would be transformed into computerised ones. According to Tanner et al (2017), the project profile has been served by the Systems Theory through outlining the reliability aspects associated with the computerised work systems in the insurance organisational offices which could be ensured through the data flow based component of the theoretical construct under consideration. This is achieved through the utilisation of the well-adapted capability of computerised systems to perform repetitions in terms of identical operations. Thus, the flow of inputs and transmutation of them into systems output through management of the operational environment could be achieved. The core consideration is to ensure greater accuracy and reliability aspects which are inherent to the computerised accounting and data processing measures in comparison to manual systems utilisation. Furthermore, the research of Moore, Piwek and Roper (2018) has suggested that the external operational environment influences the operational efficacy of any insurance organisation concerning the differential inputs which such companies are subjected to from the global insurance industrial structure, the society and the economic demeanour of the concurrent age. This realisation brings into effect the significance of the combination of the two components of the Systems Theory, namely the Synergy and Flexible as well as Inflexible systems, in terms of application of the same in the front and back office based operations in the insurance agencies. The effective combination of these components of the Systems Theory could only be achieved through the achievement of the most optimised speed of information management and data updating mechanisms. According to Härting, Reichstein and Sochacki (2019), these are achievable through completely computerised accounting and information processing systems since only minimal time would be required to update and process the existing inputs into outputs. For an instance, when front office operations such as reinsurance or investment related operations such as term loans are managed, through computerised accounting systems, the information pertaining to the insurance accounts and related financial statements (term loan trading account related information) could be updated instantaneously and autonomously.

According to Myers et al (2018), the perceptual model, demonstrated above, is reflective of the methodical manner to transmute various inputs into service outputs by the insurance agencies through computerised, automated functioning. The transformation process related segment of the trans-disciplinal theoretical construct under consideration is formulated through planning, staffing, organising and controlling of differential functionalities of insurance operations based office work. The input segment specifies the components such as capital, communication, people and technical information management skills of the insurance organisational human resources so as to better utilise the systems boundaries and information flow based work processes. VanderLinden et al (2018) have averred that the output segment is indicative of the involvement of a range of stakeholders in the insurance sector based organisations such as insurance service subscribers, employees, service equipment suppliers and existing government administrative structures. According to Weiss (2015), the ubiquitous measure of multifarious outputs, the insurance trading operations, could involve the components such as the claims payment related analysis of information and formulation of subsequent reports, existing policy parameter related outputs, insurance scheme formulation, financial accounts management, term payments accounting, stakeholder management, billing and renewal notifications, MIS claims assessment, audits of reinsurance accounts and much more. Computerisation of the insurance industrial office working structures is thus critical concerning the management of such vast array of functionality related data. According to Busque et al (2017), the Systems Theory, thus, provides the proverbial guidance manual on which the entire rationale of the concerned project portfolio could be based regarding the computerisation of the insurance industry based data management operations. According to Rosemann and vomBrocke (2015), gradual elimination of the conventional information management process tools such as document based mailing rooms, file repository stores and manual data entry mechanisms which have been so far utilised as the office work components through which the organisational external environments have been controlled and managed, is palpable given the financial dividends which computerised working environments could yield in the forms of reduced operational costs and curtailment of required time frames.

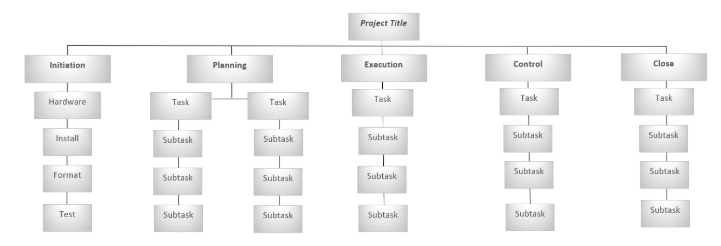

Preparation of project plan

This had been essential to ensure the orientation of the entire project portfolio. According to Fulton and Gavazzi (2017), the basic components on which the project plan was formulated had been the project scope, goals, deliverables and resource requirements framework for the project completion. Concerning the purpose of task and deliverables visualisation, the utilisation of a work Breakdown structure had been undertaken at this stage. The underscoring rational had been the element of manageability which could be derived from such a hierarchical diffusion of the complete project scope. The emphasis had been on the effective delineation of the project objectives, provisioning of services and the combination of resource based and operational approaches in maintaining the deliverable timelines. According to Busque et al (2017), this process highlighted the scheduling aspect to determine the timeline for the culmination of the insurance office based work process computerisation project.

The formulated task breakdown structure had been indicative of the existence of columns where the task and subtask based assignments could be delineated and the resource dependencies could be outlined. According to Kakabadse and Bank (2018) to better outline the components and parameters of the overall project, the, plan based work structure involved multiplicity of factors as the following:

1: Numbers of tasks consisting of numerical enlistment of project deliverables.

2: Description of tasks with details of the deliverables concerning the specific parameters of the subtasks as well.

3: Dependency elaboration involving the outlining of the tasks which could not be commenced till the previous tasks or subtasks could not be completed. This enumerated the linkages between the individual tasks in a sequential manner.

4: Delegation of resources with particular emphasis on the enlistment of the equipment, personnel and materials which could be necessary

5: Status of the tasks/subtasks so that effective tracking of the progression status could be performed.

6: Estimated cost ranges so that required financial commitments could be outlined in tandem with the deliverables.

Project evaluation criteria formulation

The project operational department was entrusted with the development of project evaluation criteria. This involved the considerations of the actual situations associated with the project and the available timeframe. The primary considerations could be outlined as the maintenance of the schedule, quality preservation, cost management and satisfaction of the stakeholders. The project objectives were formulated on the basis of the evaluation criteria concerning the relevance, effectiveness, efficiency, impact and sustainability. These factors, in a cumulative manner, were considered to provide the basis on which the validation of the project could be ascertained.

According to Nicoletti (2016), the factor of Relevance outlined the inclusion of the information about project background, beneficiaries, stakeholders and strategies employed within the project development plan. Renuka and Dinesh (2018) have stated that the factor of Efficiency has been inclusive of cost-benefit considerations, cost-effectiveness and quality management of the computerisation project. Schimel (2016) has outlined that the factor of Impact indicates the expected and unexpected influences of the culmination of the concerned project. This could also be considered to be the factor to analyse the project strategy relevance in terms of the framework of applications. Furthermore, the Sustainability aspect is indicative of the extent to which the project purpose could be maintained after the project could be completed and the other elements which could either contribute or inhibit in the complete computerisation of the offices of the hypothetical insurance organisation.

Project planning phases

Project implementation

Step 1

This involved the identification of the software functional requirements for the purpose of both technological and archival management objectives. According to Scardovi (2017), the primary archival information analysis functionalities could be understood to be the following:

1:Registration of multiple applications of general insurance such the financial claims, the MIS and term loan based information, audit performance outcomes of investment accounts and co-insurance operations.

2: Classification of information and filling of the associated data.

3: Retention of the key strands of information and data and disposal of the rest through auto deletion.

4: Ensuring security measures such as access granted to only the users, recovery mechanisms and back-up systems.

5: Sharing, search and retrieval of the information.

6: Reports and statistics elaboration.

According to Schmidt et al (2017), the primary technological functionalities concerning computerisation performed in the project have been the following:

1: Systems of application platforms.

2: Management based e-mail applications.

3: Formatting applications.

4: Authenticity management and records evaluations services.

5: Records and data transfer systems.

6: Singular sign-in services.

Step 2

Selection of operational software

According to Shukla and Nerlekar (2019), to this effect, the project phase selected the current software suits for the purpose of documentation and records management systems (DRMS). The selected assortment of software is as the following:

1: Oracle content management

2: SharePoint

3:KnowledgeTree

4:Folium

5: Nuxeo

6: Alfresco

7: GroupWise

8: ProteusPA

9: ProtocolloASP

10: Folium

A group of software had been installed and tests were performed. This included the open-source software such as Alfresco and KnowledgeTree. One proprietary software, GroupWise, had been utilised for the management of e-mail. In this context, the compilation of a checklist was undertaken to evaluate the functional requirements. This had been a specific requirement to for the purpose of installation and tests of the computer systems.

Step 3

1: Resetting of the numbers of application protocols.

2: Testing of management of the internal scheme of records classification.

3: Testing of retention of records and sequential protocols of file disposal.

4: Evaluation of the digital folder retention capacities.

Step 4

The insurance front office working systems where modified in terms of the offering of the Application Service Provider (ASP) systems. This involved the utilisation of the in-house server so that records transaction could be facilitated.

Step 5

The final determination of insurance records and input management software involved installation of only two formats of software (KnowledgeTree and Alfresco). These software suits are commercially available as open source technologies. Additional technical support costs and necessary hardware had been determined as well. Furthermore, the block diagram system of the data flow graph was utilised to highlight the insurance tasks related information flow involving the sources and destinations

The office hardware components are represented as rectangles with the ovals indicating the operational modules of digitisation. This consisted of the application of high level designs so that overall operational details could be represented to the working personnel of the insurance office under consideration. Issues related to safety ensuring, verification of the outcomes of instillations and testing of installed operational modules were addressed in the due course. This process involved the conversion of analog based service inputs the ADC systems so that the analog inputs could be successfully transmuted to digital versions. ADC drivers and timer hardware became instrumental in this context. The alphanumeric positional inputs are represented through such hardware and associated software suits as fixed-point numbers within the installed computers.

Project business case evaluation

Finally, the evaluation of the development of embedded systems was performed through well-defined procedures. This was vital in terms of the developmental phase based efficacy evaluation so that no haphazard production of deliverables could remain. The final objective had been the satisfaction of the outlined objectives in terms of systems stability, accuracy and input/output relationships. The criteria which had been utilised, had been dual in terms of categorisation of the components of the entire system. According to Kerzner (2017), the Quantitative category involved the dynamic and static efficiency based considerations such as the speed through which the input of data in the insurance organisational central office could be processed and compartmentalised and the requirements of memory and storage management. This category also involved the accuracy measures of the outcomes. On the other hand, according to Voutilainen and Koskinen (2019) the Qualitative criteria was centred on the software maintenance operational prospects. There had been three aspects to such a consideration. The initial had been the measure of debugging and correctional troubleshooting of the entire systems software operating mechanisms. The second had been the verification correctness of the system. The final one had been the maintenance of the installed systems through addition of further features as per the necessity could arise.

Skills Developed

According to Williams (2019), from the utilitarian perspective, multifaceted skill sets could be developed through the entire research project performance. The most significant of such developed skill sets are as the following:

1: Advancement of skill sets concerning identification of project requirements and management of the efforts in this context.

2: Project operations process execution capabilities.

3: Proper management of project basics.

4: Project progression specifics development

5: Conceptualisation of the project management plan.

6: Stakeholders identification.

7: Project scope management.

Reference List

- Albrecher, H., Bommier, A., Filipović, D., Koch-Medina, P., Loisel, S. and Schmeiser, H., 2019. Insurance: models, digitalization, and data science. European Actuarial Journal, pp.1-12.

- Boddy, D., McCalman, J. and Buchanan, D.A., 2018. The new management challenge: information systems for improved performance. Routledge.

- Bohnert, A., Fritzsche, A. and Gregor, S., 2019. Digital agendas in the insurance industry: the importance of comprehensive approaches. The Geneva Papers on Risk and Insurance-Issues and Practice, 44(1), pp.1-19.

- Buonfiglio, J., Thomas, L.U.N.A. and Chase, P., Good Moon Running LLC, 2017. Automated modeling and insurance recommendation method and system.

- Busque, K.J., Amigo, A.J., Borden, R.M., Peak, D.F. and Walters, E.J., Hartford Fire Insurance Co, 2017. Insurance processing system and method using mobile devices for proof of ownership.

- DiRienzo, A.L., Integrated Claims Systems LLC, 2015. Methods for processing insurance transactions.

- Eling, M. and Lehmann, M., 2018. The impact of digitalization on the insurance value chain and the insurability of risks. The Geneva Papers on Risk and Insurance-Issues and Practice, 43(3), pp.359-396.

- Frey, C.B. and Osborne, M.A., 2017. The future of employment: How susceptible are jobs to computerisation?. Technological forecasting and social change, 114, pp.254-280.

- Friesen, S.T., 2017. Techniques for centrally managing a credentialing life cycle for hospitals, providers, insurance payers, contract management, and claims data processing organizations.

- Gunjan, A. and Khatravath, S., Wipro Ltd, 2016. Method and device for determining potential risk of an insurance claim on an insurer.

- Härting, R.C., Reichstein, C. and Sochacki, R., 2019. Potential Benefits of Digital Business Models and Its Processes in the Financial and Insurance Industry. In Intelligent Decision Technologies 2019 (pp. 205-216). Springer, Singapore.

- Hussain, K. and Prieto, E., 2016. Big data in the finance and insurance sectors. In New Horizons for a Data-Driven Economy (pp. 209-223). Springer, Cham.

- Incze, E.G., Leach, P.W., Nelson, K.L., Phidd, M.G. and Williams, M.J., Aetna Inc, 2016. Method of providing personal engagement in recovery and return to work for individuals on disability insurance.

- Kerzner, H., 2017. Project management: a systems approach to planning, scheduling, and controlling. John Wiley & Sons.

- Lamberton, C., Brigo, D. and Hoy, D., 2017. Impact of Robotics, RPA and AI on the insurance industry: challenges and opportunities. Journal of Financial Perspectives, 4(1).

- McCall, T.A., Bryant, W.D., Riney, J.W. and Gay, C.E., State Farm Mutual Automobile Insurance Co, 2017. Method for using electronic metadata to verify insurance claims.

- Mishra, D. and Rabi, N., 2019. Changing Contours of Risk Management in a Digitized Financial Space: The Future Started Yesterday. Available at SSRN 3407153.

- Moore, P., Piwek, L. and Roper, I., 2018. The quantified workplace: A study in self-tracking, agility and change management. In Self-Tracking (pp. 93-110). Palgrave Macmillan, Cham.

- Myers, J., Boyer, B., Hunt, D., Turrentine, D., Ingrum, L.J., Olander, E., Blakney, N.M. and Williams, A.C., State Farm Mutual Automobile Insurance Co, 2018. Systems and methods for analyzing insurance claims associated with long-term care insurance.

- Peak, D.F., Amigo, A.J., Borden, R.M., Busque, K.J. and Walters, E.J., Hartford Fire Insurance Co, 2017. System and method for geocoded insurance processing using mobile devices.

- Richardson, L., 2017. Sharing as a postwork style: digital work and the co-working office. Cambridge journal of regions, economy and society, 10(2), pp.297-310.

- Rosemann, M. and vomBrocke, J., 2015. The six core elements of business process management. In Handbook on business process management 1 (pp. 105-122).Springer, Berlin, Heidelberg.

- Schimel, N., 2016. Digital risk: a strategic challenge and a growth opportunity for insurers. Financial Stability Review, (20), pp.25-36.

- Schmidt, R., Möhring, M., Bär, F. and Zimmermann, A., 2017, June. The Impact of Digitization on Information System Design-An Explorative Case Study of Digitization in the Insurance Business. In International Conference on Business Information Systems (pp. 137-149). Springer, Cham.

- Shukla, A. and Nerlekar, D., 2019. Impact of digitization transformation on financial markets. MET Management Retrospect, 3(01).

- Stauber, C.E., Cavalier, R.M. and Awad, G.J., Fc Advisors LLC, 2017. Insurance data management platform.

- Tan, R.R., Aviso, K.B., Promentilla, M.A.B., Yu, K.D.S. and Santos, J.R., 2019. Input–Output Optimization Models for Supply Chains.In Input-Output Models for Sustainable Industrial Systems (pp. 75-89).Springer, Singapore.

- Tanner Jr, T.C., Alstad, C.E., Smith, W.B., Gosnell, D.K. and Harrison, V.C., PokitDokInc, 2017. System and method for dynamic healthcare insurance claims decision support.

- VanderLinden, S.L., Millie, S.M., Anderson, N. and Chishti, S., 2018. The INSURTECH Book: The Insurance Technology Handbook for Investors, Entrepreneurs and FinTech Visionaries. John Wiley & Sons.

- Weiss, S.G., 2015. System and Method for Storing Health Information and Adjudicating Insurance Claims.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts