It Seems Like There Might Be Another Typo

2.0 Literature Review

This section reviews current literature regarding the relationship between tax avoidance and CSR and how this can relate to the risk management theory and stakeholder theory, but first, I will provide definitions of tax avoidance and CSR. My focus on this literature review was on peer-reviewed work using Nottingham Trent University’s University’s library one search, google scholar, and other online portals.

2.1 Defining corporate social responsibility (CSR) and tax avoidance

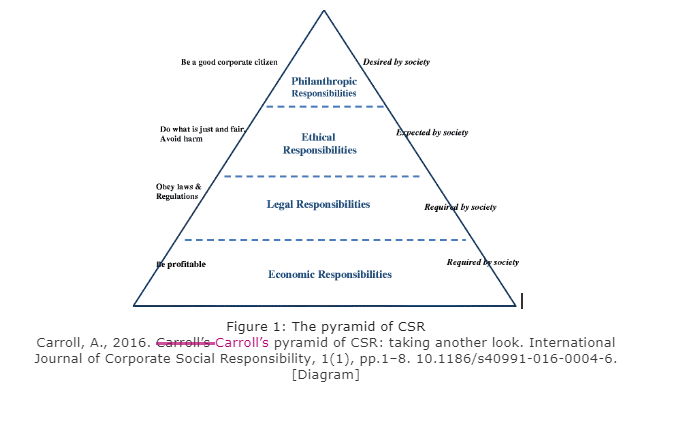

CSR draws its justifications from the principles of ethical performance among companies. Many people have different perceptions of what CSR is. Economist Milton Friedman (1970) gave a comprehensive view of what social responsibility was. Friedman argued that the social responsibility of a firm was directed on toward making a profit. Anything else, such as environmental issues and social welfare, was for the government to get involved with. However, this kind of thinking became less prominent following Carroll’s Carroll’s (2016) proposed pyramid of CSR. Figure 1 shows the different components of CSR and their importance. The base for the pyramid is focused around the economic responsibilities to the firm, followed by the legal duties, ethical responsibilities, and at the top is discretionary responsibilities. This differs with Friedman’s Friedman’s school of thought because, in Carroll’s Carroll’s pyramid, a firm’s firm’s obligations are not solely focused around making a profit, but instead focused on having other commitments, such as legal responsibilities and ethical responsibilities.

There are a lot ofmany speculations among researchers about the definition of tax avoidance, as most people tend to confuse it with tax evasion (Angell 1938). Although both ““do break the spirit of the law” ” (Strater 2016, P.7), their characteristics differ slightly. It is agreed by most that tax avoidance is a legitimate way to lower your taxes, whereas tax evasion is an illegal way to reduce taxes. ““The classical distinction between tax avoidance and tax evasion is that tax evasion is present only if the taxpayer provides intentionally inaccurate or incomplete information to the tax authorities to reduce the tax burden” ” (Blaufus et al. 2019, p. 279). Stephenson and Vracheva (2015, P.6) define tax avoidance as ”” (1) payment of less tax that might be required by a reasonable interpretation of a country’s country’s laws; (2) amount of tax on profits declared in a country other than where they were earned; or (3) payments made somewhat later than the profits benefits were received.” .” On the other hand, Hanlon and Heitzman (2010) define tax avoidance purely as the reduction in taxes. When I talk about tax avoidance, I will be using Hanlon and Heitzman’s Heitzman’s definition during my research as it is the most recognised recognized definition with other researchers in this field, and when I think of tax avoidance, this is the definition that comes to mind (Im, Kim and Ko 2017; Jeongho and Chaechang 2017; Strater 2016). Multinational companies can use multiple strategies to avoid tax. One way they can do this is by shifting profits to a country with lower tax jurisdictions through the use of transfer pricing. ““Transfer pricing refers to the setting of intra-firm prices for goods and services that are transmitted across national boundaries. As both the buyer and the seller are controlled by the multinational corporation (MNC) , it has control over the price that is set; if the buyer operates within a higher tax jurisdiction, then a higher transfer price will result in lower taxable profits and a lower overall tax liability for the MNC” ” (West 2016, p. 1144). Corporate tax is based on taxable profit, and companies can put their profits benefits in low tax countries. For example, Amazon pays little tax in the UK because all UK sales made are documented through the UK branch of a Luxembourg-based company, Amazon EU Sarl (Worrall 2018). Amazon takes advantage of the low tax rates in Luxembourg, which allows them to pay less tax on profits made in the UK.

2.1 Tax avoidance and CSR

Lanis and Richardson (2012) revealed a negative correlation between CSR and the level of tax aggressiveness. They define tax aggressiveness as ““the downward management of taxable income through tax planning activities” ” (p.86). They found that the higher the level of CSR activities the firms took part in, the lower the level of tax aggressiveness. The study used financial data collected from the Australian financial markets and CSR data collected from individual companies. However, the author does not give a precise guideline/scale on how they measured and evaluated the CSR initiatives to determine whether a company CSR activity could be deemed as best, average, or below average. Therefore more research could be conducted to come to a more thorough conclusion. Following on from their 2012 study, further research analysis was performed, which enabled them to researchcome to a more effective beneficial conclusionoutcome. Their new study found that a higher level of CSR performance resulted in a less likelihood of tax avoidance, especially when firms partook in community relations and diversity. Although both of their studies reached the same conclusion, in their new study they used the Kinder, Lydenbery and Domini (KLD) database to gather their CSR data. This database gives a better indication of the strengths and concerns of CSR activities. ““The KLD STATS database includes over 90 indicators in seven stakeholder or social issue areas, including: community relations, corporate governance, diversity, employee relations, environment, human rights, and issues related to firm’s firm’s products and core business” ” (Lanis and Richardson 2015, p. 440). This database provides strengths and concern ratings for each company. CSR strengths ““relate to issues that are more in a firm’s firm’s control” ” and CSR concerns ““involve external parties such as the government in the case of legal issues” ” (Alikaj et al. 2017, p. 5). The 2015 study also utilised utilized a more direct measure of tax avoidance from the KLD database in an attempt to overcome their 2012 study’s study’s limitations. Their limitations included using CSR reports and annual reports to determine a proxy for CSR activity, and this has shown to be a poor proxy for CSR activity by other researchers. (reference other researchers). Hoi, Wu, and Zang (2013) evaluated the association between tax avoidance and irresponsible CSR activities. ““Irresponsible CSR activities include corporate actions that are widely regarded as damaging to corporate governance, employee relations, communities, public health, human rights, diversity, and the environment” ” (P. 2026). This differs from responsible CSR activities that affect the firm’s firm’s stakeholders. They used different measures to capture aggressive tax avoidance and found that the more a firm engages with irresponsible CSR activities, the less likely the firm partakes in aggressive tax avoidance. In contrast to this study, Davis et al. (2016) suggested that firms that act in a socially responsible manner and value CSR initiatives pay low taxes. They established that the more a company was involved with CSR initiatives, the higher the probability the company would avoid taxes. This contradicts the empirical studies which revealed a negative relationship between CSR and tax avoidance (Lanis and Richardson, 2013; 2015; Hoi et al. 2013). Hoi et al. (2013) and Davis et al. (2016) both arrive at contradicting conclusions even though the data derived in both studies is from

the same KLD and Compustat sources. However, although they both used the same databases, there are three main differences to their studies that could have caused this irregularity. Firstly, Hoi et al. (2013) used the Thomson Reuters Ownership database as well as the KLD database to retrieve their CSR ratings, whereas Davis et al. (2016) used the KLD database alone. This meant that Hoi et al. (2013) gathered more data on CSR, which increased the reliability of the ratings. Secondly, the sample size of Hoi et al. (2013) involved 8888 more firm firm-year observations than Davis et al. (2016). Finally, both studies used a different proxy to measure tax avoidance. Davis et al. (2016) used the five five-year cash effective tax rate, whereas Hoi et al. (2013) used two difference different measures; the discretionary book-tax difference and the permanent book-tax difference. This could been the cause of their conflicting results. Higgins, Omer, and Phillips (2015) revealed that companies that operate in tax havens participate in socially responsible activities, which is reinforced by Huseynov and Klamm (2012), who stated that companies that identified themselves as responsible in terms of providing social initiatives, engaged in tax avoidance. Huseynov and Klamm (2012) discovered that the lower a firm engages participates in CSR, the higher the tax avoidance it partakes in. They separated strengths and concerns of the following CSR categories; corporate governance, community, and diversity. They found that firms with concerns interests of those CSR categories had a lower effective tax rate, which was inconsistent with Davis et al. (2016), who found the opposite. However, Davis et al. (2016) excluded the corporate governance category and used a five five-year effective tax rate, which could have been the cause of this indifference. Hypothesis 1: The more a firm engages in CSR, the less likely it will partake in tax avoidance.

2.2 Risk management and stakeholder theory

The risk management theory of CSR ““argues that firms purposely increase their CSR activities to hedge against any reputational risks that might arise from aggressive tax avoidance practices” ” (Col and Patel 2008, P. 1034), linking CSR with tax avoidance. The risk management theory of CSR states that firms that come under scrutiny from the public about avoiding taxes, partake in CSR activities to try and lessen the negative aftermath. ““This is consistent with the major transformation of Starbuck’s Starbuck’s CSR agenda by CEO Howard Schuitz and his team that is geared toward putting people, community, and environment first” ” (Col and Patel 2008, P. 1036). This was put in place just after the scrutiny from avoiding tax came about. Col and Patel (2008) found that firms increase CSR activities after opening up tax haven affiliates. This is in line with the risk management theory in trying to counteract the scrutiny from the public by opening up a tax haven. Moreover, this study uses proxies for variables, such as; values, internal capabilities, or unobservable CEO characteristics. These variables are used by a firm to set its CSR plan and also to choose the tax avoidance practice it will use. Therefore, by using proxies, it can bias the coefficient estimates which can affect the reliability of the study. Thus, I don’t don’t take these results to be very accurate. In conjunction with the risk management theory, Hoi Wu and Zang (2013) argued that tax avoidance could impose a significant risk to firms, therefore, initiating CSR activities could hedge against these risks imposed. Hasan et al. (2017) implied that the basis of discovering a negative link between CSR and tax avoidance, arose when companies participate in CSR to lessen the negative public perception of their participation in tax avoidance. ““Leading companies such as Starbucks and Amazon have recently come under scrutiny for such activity and have experienced a consumer backlash due to their aggressive tax avoidance activity” ” (Col and Patel 2008, P. 1033). Regarding the tempering effect of CSR, Salihu et al. (2013) established that the reduction in stockholder value after a bad public image is lesser in companies that participate in CSR compared to those that do not engage in it. Such evidence recommends that some companies tactically use CSR to establish a more favourable status among different shareholders and decrease the likelihood of a punitive image. Hypothesis 2: Firms that get involved with tax avoidance are more likely to adopt CSR initiatives to hedge against the risks imposed by avoiding tax. In contrary to the risk management theory, the stakeholder theory states that ““the economic and social purpose of this corporation is to create and distribute increased wealth and value to all its primary stakeholder groups, without favouring one group to the expense of others” ” (Huang et al. 2017, P.45). Stakeholders include government, customers, suppliers and employees. The stakeholder theory predicts a negative relationship between CSR ratings and the probability of inversion. A corporate tax inversion is where a company relocates its operation to another country, therefore reducing their tax. For example, ““Burger King Corporation’s Corporation’s recent expatriation to Canada has elicited a huge public outcry and political backlash” ” (Huang et al. 2017, P. 43). Other studies mentioned earlier also concur with the stakeholder theory (Lanis and Richardson 2012;2015 and Huang et al. 2017). Huang et al. (2017) examined the relation between CSR and corporate expatriation. They found that firms with higher CSR performance were less likely to expatriate. Their findings disagreed with Lanis and Richardson (2015), who show that more factors of CSR other than diversity

are involved with tax avoidance. Huang et al.’s ’s (2017) results indicated that corporate governance, diversity, and employee relation components of CSR are negatively related to the likelihood of inversions, while the environment component is positively associated with the probability of inversions. Their overall findings, therefore, are in line with the stakeholder theory. However, flaws in their study remain. The sample size used in the study is relatively small, which questions the accuracy of the studysurvey. Furthermore, the CSR index scores were used by MSCI, which only provides approximate results, so more accurate CSR measures may provide us with stronger more reliable results. Hypothesis 3: Firms with high levels of CSR performance are less likely to expatriate compared to firms with low levels of CSR performance. My literature review shows conflicting results. Some researchers (Lanis and Richardson 2015, Hoi, Wu, and Zang 2013) found that the more a firm engages in CSR activities, the less likely it will participate in tax avoidance. Other researchers (Col and Patel 2008, Hasan et al. 2017, and Salihu et al. 2013) found that the more a firm partakes in tax avoidance activities, the more likely there is to be evidence of CSR activities, likely possibly in an effort to hedge against a negative public image. There is minimal research on firms that participate in tax avoidance alone. Therefore, I will conduct my own research to understand this further.

3.1 Quantitative versus qualitative research

There are two methods of research; Qualitative and quantitative. ““Quantitative research allows data to be collected that focuses on precise and objective measurements that use numerical and statistical analysis to support or refuse refute a hypothesis” ” (Campbell 2014, P.3). On the other hand qualitative data is a method that generates non-numerical data (Saunders et al. 2019). Methods of qualitative research include; focus groups, interviews, observational methods and document analysis (Saunders et al, 2015). Antieno (2009) expresses that qualitative data can break down data into a more simple way without destroying the context or complexity. ““A researcher that selects a qualitative research method collects open-ended, emerging data that is then used to develop themes” ” (Campbell 2014, P.3). However, for a qualitative research design to be credible and useful, it has to be executed in the right way. ExampleFor example, for a questionnaire to be successful and provide reliable results, ; the information has to be well structured and provide information relevant to the study (Sofaer 2002). In order tTo explore the relationship between tax avoidance and CSR, I will be combining qualitative and quantitative research methods. From my literature review, I identified a major significant gap in the literature. None of the existing studies I reviewed utilised utilized qualitative data and instead focused on quantitative data. Therefore I will be using both methods to collect data.

3.2 primary research and secondary research

Primary research requires the researcher to collect their own data through self-conducted methods, which include questionnaires and interviews. Secondary research involves the researcher delving into information that has already been gathered from other researchers (Saunders et al. 2019). Secondary research is usually where an investigation will begin, so it can give an idea of what information already exists about the topic at hand, and primary research can help fill in any subsequent gaps that the researcher was not able to find during the secondary research. (McCrocklin 2018). During my researchinvestigation, I will be collecting secondary data. This is because there is already a lot of existing literature that can lead to descriptive detailed insights into my study. Using secondary data resources will be beneficial, majorly because it allows me to save on time and resources needed for me to establish a conclusion.

For my study, I will be using a case study to establish if there is a relationship between CSR and tax avoidance. Cooper (2018, p.124) argues that ““rather than aiming to provide statistical representativeness, case study research enables a detailed, in in-depth view of the phenomenon being studied to be established.” .” Case studies also enables the researcher to explore how developments change over time. After exploring many possible industries and unique companies, I decided to choose Starbucks. I wanted to choose an industry where they operate internationally to ensure that tax information is available in different countries. I wanted to choose a company where their its image is important essential, along with their its reputation. This can ensure that there is an acceptable level of CSR reporting that exists now and also over the past couple of years. There is a lot of information and case studies on Starbucks, t. Therefore I wanted to choose an industry where I can build on the case studies that already exist. For the reasons above, I will be investigating Starbucks. I will begin my investigation by collecting all of Starbuck’s annual reports and corporate sustainability reports in the past ten years. I will be using ten years as my time period because Starbucks reportedly stopped paying UK tax for a while after 2009. In additionBesides, I will gather a range of policy documents published by Starbucks for the same time period. I will then go on to analyse these documents. In effect, I will collect everything that may be of relevance in with respect to CSR and tax avoidance of Starbucks. A popular simplified tax planning strategy includes transfer pricing (Sugathan and Rejie, 2015). Transfer pricing involves shifting profits to countries that have lower tax jurisdictions. Corporations can do this by shifting changing profits amongst their subsidiaries. Countries with lower tax jurisdictions are known as tax havens and have been used as an indicator of tax avoidance by other researchers (Campbell and Helleloid 2016; Col and Patel 2019). The basis of my research will involve investigating the degree to which Starbucks shift profits amongst their its subsidiaries. I will focus on how they shift profits and also their incentives for doing so. To test my hypothesis, I will look at the trends in the past 10 ten years to see whether or not Starbucks partake in tax avoidance, and if their CSR activities increase over the years as well as their tax avoidance strategies, or whether they stay the same or even decrease. I will also look at newspaper articles and media coverage to see what the public thinks and if they avoid tax, whether or not they have gotten a bad reputation from it, and if so,, if they adopted various CSR initiatives to hedge against that bad public image. (REWORD TO MAKE IT SOUND MORE ACADEMIC)

References:

- Angell, M.B., 1938. Tax Evasion and Tax Avoidance. Columbia Law Review, 38(1), 80–97. Atieno, O.P., 2009. Problems of Education in the 21st Century. An Analysis of the Strengths and Limitations of Qualitative and Quantitative Research Paradigms. [online], 13, 13-18. Available at:

- Campbell, K., Helleloid, D., 2016. Starbucks: Social responsibility and tax avoidance [online]. Journal of Accounting Education, 37, 38–60. Available at:

- Campbell, S., 2014. What is qualitative research? Clinical laboratory science: journal of the American Society for Medical Technology [online], 27(1), p.3. Available at:

- Chung, J., Cho, C., 2018. Current Trends within Social and Environmental Accounting Research: A Literature Review [Online], Accounting Perspectives, 17(2), 207–239. Available at:

- Col, B. and Patel, S., 2019. Going to haven? Corporate social responsibility and tax avoidance. Journal of Business Ethics [online], 154(4), 1033-1050. Available at:

- Cooper, M., 2018. What drives the tax avoidance strategies adopted by US MNEs? [online]. Ph.D. thesis, University of Reading. Available at:

- Davis, A.K., Guenther, D.A., Krull, ,L.K. and Williams, B.M., 2015. Do socially responsible firms pay more taxes? The accounting review [online], 91(1), 47-68. Available at

- Goh, B.W., Lee, J., Lim, C.Y. and Shevlin, T., 2016. The effect of corporate tax avoidance on the cost of equity. The Accounting Review [online], 91(6), 1647-1670. Available at:

- Pratiwi, I., Djakman, C., 2017. The Role of Corporate Political Connections in the Relation of CSR and Tax Avoidance: Evidence from Indonesia. Review of Integrative Business and Economics Research [online], 6,

- Salihu, I.A., Sheikh Obid, S.N. and Annuar, H.A., 2013. Measures of corporate tax avoidance: empirical evidence from an emerging economy. International Journal of Business & Society [online]. Available at:

- Saunders, M., Lewis, Philip, Thornhill, Adrian, 2015. Research methods for business students [eBook]. 7th ed. New York: Pearson Education. Available at: NTU Library [Accessed 13 February 2020]. Sikka, P., 2010, December. Smoke and mirrors: Corporate social responsibility and tax avoidance. In Accounting Forum, 34 (3), 153-168. Elsevier.

- Sofaer, S., 2002. Qualitative research methods. International Journal for Quality in Health Care, 14(4), 329–336. Stephenson, D. and Vracheva, V., 2015. Corporate Social Responsibility and Tax Avoidance: A Literature Review and Directions for Future Research. Journal of social science research network (SSRN) [online], (November). Available at:

Looking for further insights on Interconnected Safety Challenges? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts